What Is Deribit? Complete Beginner’s Guide to Crypto Derivatives (2025)

Introduction

Deribit is the world’s leading cryptocurrency derivatives exchange, commanding over 80% of the global crypto options market and processing billions in daily trading volume across Bitcoin and Ethereum futures, options, and perpetual contracts.

The crypto derivatives market has exploded to over $2 trillion in daily trading volume, yet most retail traders remain confined to basic spot trading. According to CoinGecko’s 2024 Derivatives Report, traders utilizing derivatives strategies generated 340% higher returns compared to spot-only traders through leverage optimization and hedging strategies.

Founded in 2016, Deribit pioneered institutional-grade crypto derivatives for retail traders, offering leverage up to 50x on futures and sophisticated options strategies previously available only to Wall Street professionals. The platform serves over 400,000 active traders across 150+ countries with deep liquidity, advanced order types, and industry-leading security protocols.

Key Benefits of Trading on Deribit:

- Market-Leading Liquidity: Tightest bid-ask spreads in crypto options with minimal slippage on large orders

- Leverage Up to 50x: Maximize capital efficiency and trading potential

- No KYC Required: Start trading immediately with only email verification (withdrawal limits apply)

- Advanced Risk Management: Portfolio margin, partial liquidations, and auto-deleveraging protection

- Institutional Security: 95% cold storage, multi-signature wallets, zero security breaches since inception

What Is This Deribit Trading Guide About?

Before exploring Deribit’s platform, understanding cryptocurrency derivatives is essential for maximizing trading potential.

Crypto derivatives are financial contracts whose value derives from underlying cryptocurrency assets like Bitcoin or Ethereum. Unlike spot trading where you purchase and own actual cryptocurrency, derivatives enable speculation on price movements without holding the asset itself.

Three Main Types of Crypto Derivatives:

Futures Contracts lock in predetermined prices to buy or sell cryptocurrency at specific future dates. Traders use futures for directional speculation with leverage or hedging existing spot positions against adverse price movements. Quarterly and bi-quarterly expirations provide flexibility for short-term and medium-term strategies.

Options Contracts grant the right—but not the obligation—to buy (call options) or sell (put options) cryptocurrency at predetermined strike prices before expiration dates. Options provide asymmetric risk profiles enabling portfolio protection, income generation through premium collection, and complex multi-leg strategies impossible with spot or futures trading.

Perpetual Swaps function like futures contracts without expiration dates, utilizing funding rate mechanisms to anchor contract prices to spot markets. Perpetual contracts have become the most popular derivative instrument, representing 70% of crypto derivatives volume due to their simplicity and indefinite holding periods.

Why Trade Derivatives Instead of Spot?

Capital Efficiency Through Leverage: Control $50,000 worth of Bitcoin with only $5,000 margin using 10x leverage. This multiplies both potential profits and losses proportionally, enabling significant returns on high-conviction trades.

Advanced Hedging Strategies: Protect long-term crypto holdings during bear markets by shorting futures contracts, maintaining exposure while offsetting downside risk. Options strategies like protective puts provide insurance-like protection with defined costs.

Income Generation Opportunities: Sell covered calls on existing holdings to collect premium income during sideways markets. Advanced traders utilize iron condors, butterflies, and calendar spreads to profit from volatility patterns.

Shorting Capability: Profit from declining markets through short positions impossible in spot-only trading. Derivatives provide true market neutrality and bidirectional trading opportunities.

What Is Deribit Exchange?

Deribit stands as the undisputed leader in cryptocurrency derivatives trading, processing over $5 billion in daily trading volume and maintaining over 80% market share in crypto options markets.

Founded in 2016 by John Jansen (CEO) and Marius Jachtmans (CTO), both former ABN AMRO investment banking professionals, Deribit pioneered retail access to sophisticated derivatives instruments previously available only to institutional traders. The Amsterdam-headquartered exchange operates under Panama’s regulatory framework, balancing legal clarity with user privacy.

What Sets Deribit Apart From Competitors:

Pure Derivatives Focus: Unlike exchanges offering both spot and derivatives markets, Deribit exclusively specializes in derivatives trading. This focused approach enables platform optimization for advanced trading strategies, superior execution quality, and features specifically designed for derivatives traders.

Unmatched Options Market Depth: Deribit dominates crypto options with 80%+ market share, providing hundreds of strike prices across multiple expiration dates from daily to quarterly cycles. This liquidity depth ensures minimal slippage even on large institutional orders, attracting professional market makers and traders demanding execution quality.

Industry-Leading Leverage: Deribit offers up to 50x leverage on futures and perpetual contracts, with 20x leverage available on options positions. Advanced portfolio margining reduces capital requirements for hedged strategies, maximizing capital efficiency for sophisticated traders.

Institutional-Grade Security: The platform maintains a flawless security record since inception—a rarity in crypto exchange history. With 95% of user funds stored in cold storage multi-signature wallets and robust insurance fund protection, Deribit prioritizes asset safety above all else.

No KYC Trading Access: Begin trading immediately with only email verification. Deposit cryptocurrency and execute trades within minutes without identity document submission. KYC becomes necessary only for enhanced withdrawal limits and institutional features.

Advanced Trading Infrastructure: Deribit’s proprietary matching engine processes over 1 million transactions per second with microsecond latency. Real-time margin calculations, instant order execution, and 99.9%+ uptime ensure professional-grade trading experience.

Deribit’s Market Position in 2025:

According to The Block’s 2024 Derivatives Report, Deribit maintains:

- 82% market share in Bitcoin options trading

- 78% market share in Ethereum options trading

- Top 5 global ranking for Bitcoin futures volume

- Over 400,000 active trader accounts

- $15+ billion in average monthly trading volume

Why Trade Derivatives on Deribit?

Understanding Deribit’s specific advantages helps traders maximize platform benefits and optimize trading strategies.

Unparalleled Liquidity Depth

Options Market Dominance: Deribit’s 80%+ options market share creates self-reinforcing liquidity advantages. Professional market makers concentrate operations on Deribit, creating tight bid-ask spreads and minimal slippage unavailable on competing platforms.

Futures Competitive Positioning: While Binance and Bybit lead perpetual futures volume, Deribit ranks consistently in the top five exchanges for Bitcoin and Ethereum futures. The platform’s liquidity proves sufficient for retail and institutional position sizes without meaningful market impact.

Real-World Liquidity Example: A $100,000 Bitcoin call option purchase on Deribit typically executes within 0.1% of mid-market price. The same order on smaller exchanges often experiences 2-5% slippage, representing thousands in additional costs.

Advanced Trading Features

Portfolio Margin System: After completing KYC verification, access portfolio margining that calculates risk across all positions simultaneously. Hedged strategies require significantly less margin compared to individual position margining, freeing capital for additional opportunities.

Sophisticated Order Types: Beyond basic market and limit orders, Deribit supports:

- Stop-loss and take-profit orders for automated risk management

- Trailing stops that lock in profits while maintaining upside exposure

- Conditional orders executing based on index price triggers

- Block trades for large institutional orders with minimal market impact

- Combo orders executing complex multi-leg option strategies simultaneously

Greeks Display and Analysis: Every option position displays real-time Greeks (delta, gamma, theta, vega, rho), enabling sophisticated risk management and strategy optimization. Understanding how positions respond to price changes, time decay, and volatility shifts separates successful options traders from those who struggle.

Cost-Effective Fee Structure

Deribit implements maker-taker fee structures rewarding liquidity providers:

Futures and Perpetuals:

- Makers: -0.025% to -0.05% (receive rebates)

- Takers: 0.05% to 0.075%

Options:

- Makers: -0.04% (receive rebates)

- Takers: 0.04%

Volume-Based Discounts: Monthly trading volume determines fee tiers, with top-tier traders earning maximum rebates. This structure makes Deribit cost-competitive even compared to spot trading on other exchanges.

Risk Management Infrastructure

Partial Liquidation System: Unlike competitors liquidating entire positions, Deribit employs partial liquidation reducing only the minimum position size necessary to restore adequate margin. This prevents total account liquidation from temporary volatility spikes.

Insurance Fund Protection: A well-capitalized insurance fund absorbs losses exceeding trader margins, preventing auto-deleveraging of profitable traders during extreme market conditions.

Advanced Mark Pricing: The mark price determining liquidations uses moving averages rather than last traded prices, preventing manipulation and cascading liquidations from flash crashes.

Real-Time Risk Monitoring: Position panels display exact liquidation prices, margin utilization, and available equity. Margin calculator tools enable pre-trade risk assessment before position entry.

Ready to experience the world’s leading crypto derivatives platform? Create your free Deribit account here and start trading Bitcoin and Ethereum futures and options with industry-leading liquidity.

How Deribit Works: Platform Architecture

Understanding Deribit’s technical infrastructure enables confident trading and prevents costly mistakes.

Core Trading Engine

High-Performance Matching System: Deribit’s proprietary trading engine processes over 1 million transactions per second using cutting-edge low-latency technology. Order execution occurs in microseconds, ensuring traders never miss profitable opportunities due to platform delays.

Index Price Calculation: The Deribit Index serves as the foundation for all derivatives pricing. The platform aggregates spot prices from major exchanges including Coinbase, Bitstamp, Kraken, Gemini, and itBit, weighted by volume. This multi-source approach prevents manipulation and ensures fair position marking.

Mark Price Methodology: The mark price determines liquidation points and unrealized profit/loss calculations. Unlike simply using the last traded price, Deribit’s mark pricing employs sophisticated algorithms incorporating index price, funding rates, and time to expiration. This approach prevents liquidations from temporary order book irregularities.

Margin and Liquidation Systems

Initial and Maintenance Margin: Initial margin represents the minimum capital required to open positions. For example, 10x leverage requires 10% initial margin ($1,000 for a $10,000 position). Maintenance margin is typically 50% of initial margin—the level triggering liquidation if crossed.

Cross Margin vs. Isolated Margin:

- Cross Margin: Uses entire account balance to support all positions, preventing individual position liquidations but risking total account loss

- Isolated Margin: Allocates specific capital to each position, limiting losses to allocated amounts but increasing liquidation risk

Liquidation Process: When account equity falls below maintenance margin, the liquidation engine activates:

- Position is partially reduced to restore adequate margin

- If market conditions prevent partial liquidation, full position closure occurs

- Remaining losses beyond bankruptcy price are absorbed by the insurance fund

- In extreme cases, auto-deleveraging may affect opposing positions

Auto-Deleveraging (ADL) System: During extreme volatility when liquidations cannot execute at bankruptcy prices, Deribit automatically reduces profitable opposing positions to cover losses. Understanding ADL priority prevents unexpected position closures.

Settlement Mechanisms

Futures Settlement: Bitcoin and Ethereum futures settle to the Deribit Index price at 08:00 UTC on expiration dates. Quarterly futures (March, June, September, December) and bi-quarterly futures provide multiple timeframe options.

Options Settlement: European-style options settle to underlying futures contracts at 08:00 UTC on expiration. Only in-the-money options execute automatically, while out-of-money options expire worthless.

Perpetual Funding Rates: Perpetual contracts employ funding rate mechanisms every eight hours (00:00, 08:00, 16:00 UTC) to anchor contract prices to spot markets. Positive funding requires longs to pay shorts; negative funding reverses this flow.

Platform Availability and Reliability

Deribit operates 24/7/365 with scheduled maintenance windows announced minimum 24 hours in advance. The platform maintains 99.9%+ uptime, ensuring traders can manage positions whenever market conditions demand action.

For comprehensive analysis of Deribit’s competitive advantages, fee structures, and security measures, explore our detailed Deribit Exchange Review.

Getting Started: Setting Up Your Deribit Account

Beginning your derivatives trading journey on Deribit requires only minutes. Follow this comprehensive setup process:

Step 1: Account Registration

Navigate to Deribit’s registration page and complete the simple signup form:

Required Information:

- Valid email address

- Strong password (minimum 8 characters with uppercase, lowercase, numbers, symbols)

- Agreement to Terms of Service and Privacy Policy

Email Verification: Check your inbox for the verification email and click the confirmation link. This activates your account for immediate trading access.

No KYC Required: Unlike most exchanges, Deribit enables trading immediately without identity verification. Start depositing and trading within minutes of registration.

Step 2: Enable Security Features

Two-Factor Authentication (2FA): Immediately enable Google Authenticator or another authenticator app to protect your account. Navigate to Account Settings → Security → Two-Factor Authentication and follow the setup instructions.

Security Best Practices:

- Use unique, strong passwords never shared across platforms

- Enable withdrawal whitelist restricting withdrawals to pre-approved addresses

- Consider hardware security keys (YubiKey, Titan) for maximum protection

- Never share 2FA codes or recovery phrases with anyone

- Be cautious of phishing attempts mimicking official Deribit communications

Step 3: Deposit Cryptocurrency

Deribit accepts Bitcoin, Ethereum, and USDC deposits. The platform operates exclusively with cryptocurrency—no fiat deposits are possible.

Deposit Process:

- Navigate to Account → Deposit from the main dashboard

- Select cryptocurrency (BTC, ETH, or USDC)

- Copy the generated deposit address or scan QR code

- Send cryptocurrency from your wallet or another exchange

- Wait for required network confirmations (1 for BTC, 12 for ETH)

Important Deposit Notes:

- Double-check the selected cryptocurrency matches what you’re sending

- Sending incorrect cryptocurrency results in permanent loss

- Network fees are paid by the sender—Deribit charges zero deposit fees

- Deposits typically appear within 15-60 minutes depending on network congestion

Step 4: Familiarize Yourself With the Interface

Main Dashboard Components:

Order Book Panel: Displays real-time buy and sell orders with prices and quantities. Green represents bids (buyers), red represents asks (sellers). The spread between highest bid and lowest ask indicates market liquidity.

Trading Chart: Interactive price charts with technical indicators, drawing tools, and multiple timeframe analysis. Customize layouts to match your trading methodology.

Position Panel: Shows all open positions with entry prices, current profit/loss, margin used, and exact liquidation prices. Monitor this constantly to manage risk.

Order Entry Panel: Place market orders (execute immediately at current prices) or limit orders (execute only at specified prices or better). Advanced order types including stop-loss, take-profit, and trailing stops are available.

Account Balance: Displays available equity, used margin, and unrealized profit/loss across all positions.

Step 5: Practice on Testnet

Deribit Testnet mirrors the live exchange with simulated funds, enabling risk-free practice before committing real capital.

Accessing Testnet:

- Visit test.deribit.com

- Register using the same process as live accounts

- Receive virtual Bitcoin and Ethereum for practice trading

- Test all features, strategies, and order types without financial risk

Recommended Practice Duration: Spend minimum one week on testnet familiarizing yourself with interface mechanics, margin calculations, and liquidation dynamics before live trading.

Step 6: Complete KYC Verification (Optional)

While unnecessary for basic trading, KYC verification unlocks enhanced features:

KYC Benefits:

- Higher withdrawal limits (unlimited after verification)

- Access to portfolio margining for reduced capital requirements

- Institutional features including block trades

- Priority customer support

- Eligibility for trading competitions and promotions

Verification Process:

- Navigate to Account → Verification

- Select individual or corporate account type

- Upload government-issued photo ID (passport, driver’s license, national ID)

- Provide proof of address (utility bill, bank statement) dated within 90 days

- Complete liveness check via webcam or mobile device

- Wait 24-48 hours for verification approval

Trading Products Available on Deribit

Deribit specializes in derivatives across Bitcoin and Ethereum with multiple product types optimized for different trading strategies.

Bitcoin and Ethereum Futures

Perpetual Contracts: Never-expiring futures contracts anchored to spot prices through funding rate mechanisms. These have become the most popular derivative instrument due to simplicity and indefinite holding periods.

Quarterly Futures: Fixed expiration dates on the last Friday of March, June, September, and December at 08:00 UTC. These contracts trade at premiums or discounts to spot based on market sentiment and interest rate expectations.

Bi-Quarterly Futures: Six-month expiration cycles providing medium-term trading opportunities.

Futures Specifications:

- Leverage: Up to 50x on perpetuals and quarterly futures

- Contract Size: 1 BTC or 1 ETH

- Tick Size: $0.50 for BTC, $0.05 for ETH

- Settlement: Cash-settled to Deribit Index price

- Funding: Every 8 hours for perpetuals (00:00, 08:00, 16:00 UTC)

Options Contracts

Deribit’s strongest competitive advantage lies in options markets, offering unmatched liquidity and strike price selection.

Available Expirations:

- Daily options (expiring next business day)

- Weekly options (Friday expirations)

- Monthly options (last Friday of each month)

- Quarterly options (March, June, September, December)

Strike Price Coverage: Hundreds of strike prices ranging from deep out-of-the-money to deep in-the-money, enabling precise strategy implementation. New strikes are added automatically as prices move to ensure adequate coverage.

Option Types:

- Call Options: Right to buy cryptocurrency at strike price

- Put Options: Right to sell cryptocurrency at strike price

- European Style: Exercise only at expiration (not before)

Options Specifications:

- Leverage: Up to 20x

- Contract Size: 1 BTC or 1 ETH per contract

- Settlement: To underlying futures contracts at 08:00 UTC

- Exercise: Automatic for in-the-money options at expiration

- Pricing: Black-Scholes model with volatility smile adjustments

Greeks Display: Every option position shows real-time Greeks:

- Delta: Sensitivity to price changes (-1 to +1)

- Gamma: Rate of delta change

- Theta: Time decay per day

- Vega: Sensitivity to volatility changes

- Rho: Sensitivity to interest rate changes

Volatility Index (DVOL)

Deribit’s proprietary volatility index measures 30-day implied volatility derived from Bitcoin and Ethereum options markets, similar to VIX for traditional markets.

DVOL Usage:

- Gauge market sentiment and expectations

- Time volatility-based options strategies

- Identify extreme fear or complacency

- Compare historical volatility to implied volatility

DVOL Interpretation:

- Below 40: Low volatility, complacency

- 40-80: Normal market conditions

- 80-120: Elevated volatility

- Above 120: Extreme volatility, potential panic

Index Products

Deribit BTC Index: Aggregates Bitcoin spot prices from Bitstamp, Coinbase, Kraken, Gemini, and itBit weighted by volume. Serves as settlement price for all Bitcoin derivatives.

Deribit ETH Index: Aggregates Ethereum spot prices from the same exchanges weighted by volume. Serves as settlement price for all Ethereum derivatives.

Index prices update continuously in real-time, ensuring fair marking of positions and preventing manipulation from single exchange irregularities.

Understanding Leverage and Margin on Deribit

Leverage amplifies both profits and losses. Mastering margin management separates successful derivatives traders from those facing repeated liquidations.

Margin Fundamentals

Initial Margin: The minimum capital required to open positions. Deribit calculates initial margin as:

Initial Margin = Position Value ÷ Leverage

Example: A $50,000 Bitcoin position with 10x leverage requires $5,000 initial margin (10% of position value).

Maintenance Margin: The minimum equity required to keep positions open. When account equity falls below maintenance margin, liquidation triggers. Deribit uses 50% of initial margin as the maintenance threshold.

Example: The $50,000 position above requires $2,500 maintenance margin (5% of position value, or 50% of initial margin).

Available Equity: Your total account balance plus unrealized profit/loss across all positions. This determines buying power and liquidation risk.

Leverage Selection Strategy

Conservative Approach (2-5x Leverage):

- Wider liquidation buffers withstand normal market volatility

- Lower stress and better sleep during volatile periods

- Suitable for longer-term directional trades

- Recommended for beginners learning margin mechanics

Moderate Approach (5-15x Leverage):

- Balance between capital efficiency and risk management

- Appropriate for experienced traders with proven strategies

- Requires active monitoring and risk management

- Suitable for short to medium-term trades

Aggressive Approach (15-50x Leverage):

- Maximum capital efficiency but minimal room for error

- Only appropriate for highly skilled traders with excellent risk management

- Requires constant monitoring and quick decision-making

- Best for very short-term trades and scalping strategies

Cross Margin vs. Isolated Margin

Cross Margin Mode:

Advantages:

- Uses entire account balance to support all positions

- Prevents liquidation of individual positions from normal volatility

- Simplified margin management across multiple positions

- Better capital efficiency for diversified portfolios

Disadvantages:

- Single bad trade can liquidate entire account

- Losses from one position affect margin availability for others

- Less control over position-level risk containment

When to Use Cross Margin:

- Diversified portfolios with multiple hedged positions

- When you want maximum liquidation protection for all positions

- Experienced traders comfortable with portfolio-level risk management

Isolated Margin Mode:

Advantages:

- Limits losses to allocated margin for each position

- Protects account from total liquidation due to single position

- Greater control over position-level risk

- Enables testing new strategies with limited capital at risk

Disadvantages:

- Higher liquidation risk for individual positions

- Less capital efficient requiring more margin per position

- More complex margin management across multiple positions

When to Use Isolated Margin:

- Testing new strategies with limited risk capital

- High-risk, high-reward trades where you want to limit downside

- Positions where you accept liquidation as acceptable outcome

- When learning derivatives trading

Portfolio Margin (KYC Required)

After completing identity verification, access portfolio margining calculating risk across all positions simultaneously using advanced modeling.

Portfolio Margin Benefits:

- Significantly reduced margin requirements for hedged strategies

- Long call + short call spreads require minimal margin

- Long futures + short futures across expirations optimized

- More capital available for additional trading opportunities

Portfolio Margin Example:

Standard Margining:

- Long 1 BTC call ($50,000 strike): $5,000 margin

- Short 1 BTC call ($55,000 strike): $3,000 margin

- Total Margin Required: $8,000

Portfolio Margining:

- Combined position recognized as call spread

- Maximum Risk: $5,000 (difference between strikes)

- Total Margin Required: $5,500 (saving $2,500)

Portfolio margining becomes increasingly valuable for complex multi-leg strategies, freeing capital for additional positions.

Monitoring Liquidation Risk

Liquidation Price Calculation: Deribit displays exact liquidation prices for every position in your position panel. Monitor these constantly and take action before approaching liquidation levels.

Risk Management Actions:

- Add margin by depositing additional cryptocurrency

- Reduce position size by partially closing positions

- Place hedge orders offsetting directional risk

- Convert cross margin to isolated margin to protect account balance

- Close unprofitable positions before losses escalate

Margin Call Warnings: Deribit sends email notifications when your account approaches maintenance margin levels. Never ignore these warnings—take immediate action to reduce risk.

Risk Management for Derivatives Trading

Derivatives trading demands disciplined risk management. Even experienced traders face liquidation without proper safeguards.

Position Sizing Rules

The 1-2% Rule: Never allocate more than 1-2% of total trading capital to any single position. This ensures that even a series of losses won’t destroy your account.

Position Sizing Formula:

Position Size = (Account Balance × Risk Percentage) ÷ Distance to Stop-Loss

Example: With a $50,000 account and 2% risk rule:

- Maximum risk per trade: $1,000 (2% of $50,000)

- If stop-loss is 5% from entry: Position size = $1,000 ÷ 5% = $20,000

- With 10x leverage: Only $2,000 margin used (4% of account)

Stop-Loss Implementation

Types of Stop-Loss Orders:

Standard Stop-Loss: Automatically closes positions when prices reach predetermined levels. Place stops beyond key technical levels to avoid premature exits while protecting against catastrophic losses.

Trailing Stop-Loss: Automatically adjusts stop levels as trades move favorably, locking in profits while maintaining upside exposure. Particularly effective for trending markets.

Time-Based Stops: Close positions after predetermined time periods regardless of profit/loss, preventing overexposure to time decay (theta) in options positions.

Stop-Loss Best Practices:

- Place stops based on technical analysis, not arbitrary percentages

- Account for normal market volatility when setting stop distances

- Never remove stops hoping for recovery—this destroys accounts

- Use mental stops only if you can execute discipline consistently

- Consider volatility-adjusted stops using Average True Range (ATR)

Take-Profit Strategies

Fixed Target Profits: Set predetermined profit targets based on risk-reward ratios (minimum 1:2 risk-reward recommended).

Scaling Out: Close portions of profitable positions at multiple targets:

- Take 33% profit at 1:1 risk-reward

- Take 33% profit at 1:2 risk-reward

- Let 34% run with trailing stop for extended moves

Resistance-Based Targets: Place take-profit orders at key resistance levels, support levels, or round numbers where profit-taking typically occurs.

Hedging Strategies

Futures Hedging: If holding long-term Bitcoin spot holdings, short Bitcoin futures during bear markets to offset losses while maintaining long-term exposure.

Options Hedging:

- Protective Puts: Purchase put options providing downside insurance for spot holdings

- Covered Calls: Sell call options against spot holdings to generate income

- Collars: Combine protective puts (bought) with covered calls (sold) for defined risk at reduced cost

Cross-Exchange Hedging: Maintain spot positions on one exchange while shorting futures on Deribit to capture basis spreads and protect portfolio value.

Volatility Management

DVOL Monitoring: Check Deribit’s Volatility Index before entering positions:

- Reduce position sizes during high volatility (DVOL > 80)

- Consider selling premium during elevated volatility

- Be cautious of purchasing options during volatility spikes

- Increase position sizes during low volatility (DVOL < 40)

Position Sizing Adjustments:

- Cut position sizes by 50% when volatility exceeds normal ranges

- Tighten stop-losses during unstable markets

- Avoid overleveraging during volatility contractions (calm before storm)

Funding Rate Awareness (Perpetuals)

Funding Rate Impact: Perpetual contracts charge funding rates every 8 hours. Extended positions in high-funding environments erode profits significantly.

Funding Rate Strategy:

- Monitor funding rates before entering perpetual positions

- Avoid long positions during sustained positive funding (longs pay shorts)

- Consider shorting during extreme positive funding (potential reversal signal)

- Close positions before funding payment if rates are extreme

- Switch to quarterly futures to avoid funding costs for longer-term trades

Historical Funding Analysis: Extreme funding rates often precede reversals. When funding exceeds 0.10% per 8 hours (0.30%+ daily), markets are overcrowded and vulnerable to corrections.

Diversification Principles

Product Diversification: Don’t concentrate exclusively in one product type:

- Combine perpetuals, futures, and options

- Mix long and short positions based on market conditions

- Use different strategies across different timeframes

Temporal Diversification: Avoid concentrating all positions in single expiration dates:

- Spread options across multiple expirations

- Mix short-term and long-term positions

- Stagger entries across multiple days to reduce timing risk

Strategy Diversification: Employ multiple trading approaches:

- Directional trades for trending markets

- Volatility trades for range-bound markets

- Arbitrage opportunities between products

- Premium selling strategies during high volatility

Advanced Trading Features on Deribit

Professional traders leverage Deribit’s sophisticated tools to maximize edge and trading efficiency.

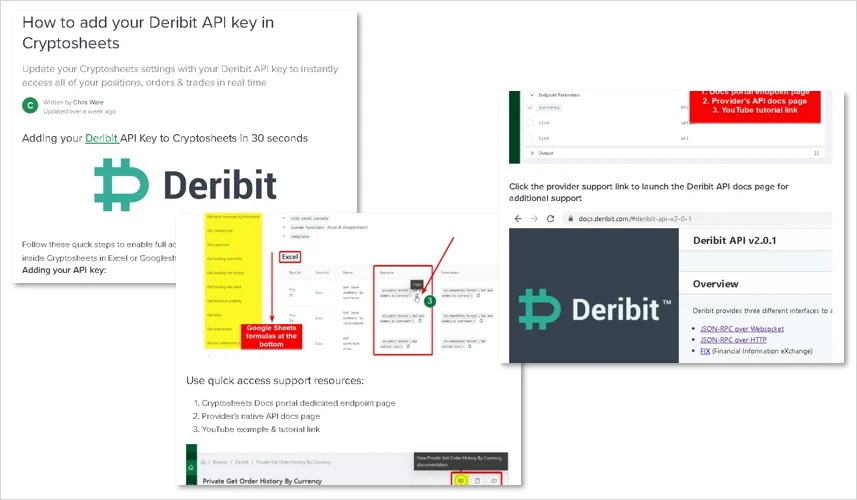

API Access for Algorithmic Trading

Deribit provides comprehensive APIs enabling automated trading, custom integrations, and portfolio management systems.

API Types:

- RESTful API: For account management, historical data, and non-time-sensitive operations

- WebSocket API: Real-time market data, order execution, and position updates

- FIX API: Industry-standard protocol for institutional algorithmic trading

API Use Cases:

- Automated trading bot execution

- Custom charting and analysis tools

- Portfolio risk management systems

- Multi-exchange arbitrage strategies

- Market-making algorithms

- Backtesting and strategy development

Getting Started with APIs:

- Generate API keys from Account Settings → API

- Set appropriate permissions (read-only, trading, withdrawal)

- Implement IP address whitelisting for security

- Start with testnet API for development and testing

- Review comprehensive documentation at docs.deribit.com

Block Trades for Institutional Orders

Block trades enable large orders to execute off-order-book without market impact, preserving anonymity and avoiding slippage.

Block Trade Process:

- Negotiate prices with counterparty privately

- Both parties submit block trade request simultaneously

- Exchange verifies both requests match

- Trade executes immediately at agreed price

- Transaction reported publicly after completion

Block Trade Benefits:

- No market impact from large orders

- Guaranteed execution at negotiated prices

- Anonymity of position sizes

- Suitable for institutional-size trades

Minimum Block Sizes:

- Bitcoin Options: 20 BTC notional

- Ethereum Options: 200 ETH notional

- Futures: 50 BTC or 500 ETH notional

Combo Orders for Complex Strategies

Execute multi-leg option strategies atomically in single transactions, guaranteeing execution at specified prices.

Supported Combo Strategies:

- Vertical spreads (call spreads, put spreads)

- Horizontal spreads (calendar spreads, diagonal spreads)

- Iron condors and butterflies

- Straddles and strangles

- Ratio spreads and backspreads

Combo Order Advantages:

- Guaranteed execution of all legs simultaneously

- Eliminate leg risk from partial fills

- Better pricing through market-maker competition

- Simplified order management

- Automatic Greeks calculations for combined position

Advanced Order Types

Trailing Stop Orders: Automatically adjust stop levels as prices move favorably:

- Set trailing distance as percentage or absolute value

- Stop follows prices at fixed distance during favorable moves

- Locks in profits while maintaining upside exposure

- Particularly effective in trending markets

Conditional Orders: Execute only when specified conditions are met:

- Index price triggers (execute when BTC index crosses $60,000)

- Mark price triggers (based on liquidation price calculations)

- Last price triggers (based on recent trade prices)

- Combine multiple conditions with AND/OR logic

Iceberg Orders: Display only partial order size to market while keeping full order active:

- Hide large position accumulation from market

- Reduce market impact from substantial orders

- Typical usage: Display 10% of total order size

- Useful for building positions without moving markets

Fees and Costs on Deribit

Understanding Deribit’s comprehensive fee structure enables cost optimization and profitability maximization.

Trading Fee Schedule

Futures and Perpetuals:

| Volume Tier (30-day) | Maker Fee | Taker Fee |

|---|---|---|

| < $10M | -0.025% | 0.075% |

| $10M – $50M | -0.030% | 0.070% |

| $50M – $200M | -0.035% | 0.065% |

| $200M – $500M | -0.040% | 0.060% |

| $500M+ | -0.050% | 0.050% |

Options:

| Volume Tier (30-day) | Maker Fee | Taker Fee |

|---|---|---|

| < $10M | -0.04% | 0.04% |

| $10M – $50M | -0.04% | 0.04% |

| $50M+ | -0.04% | 0.03% |

Maker vs. Taker Explanation:

- Makers: Add liquidity by placing limit orders in the order book (earn rebates)

- Takers: Remove liquidity by executing against existing orders (pay fees)

Additional Fees

Settlement Fees:

- Futures Expiration: 0.00% (maker) / 0.015% (taker)

- Options Exercise: No additional fee beyond standard trading commission

Delivery Fees: No additional charges for physical delivery (all Deribit products are cash-settled).

Funding Rate Costs (Perpetuals): Not technically fees but costs paid between traders:

- Calculated every 8 hours (00:00, 08:00, 16:00 UTC)

- Based on premium between perpetual and spot prices

- Range typically -0.05% to +0.05% per period

- Extreme funding can reach 0.10%+ during strong trends

Deposit and Withdrawal Fees

Deposit Fees: Zero across all supported cryptocurrencies (Bitcoin, Ethereum, USDC). Network transaction fees paid by sender.

Withdrawal Fees:

- Bitcoin: 0.0001 BTC (adjusts based on network congestion)

- Ethereum: 0.003 ETH (adjusts based on gas prices)

- USDC: $3 USDC

Withdrawal Limits:

- Unverified Accounts: 10 BTC or equivalent per day

- KYC-Verified Accounts: Unlimited withdrawals

Liquidation Fees

When positions are force-liquidated, additional fees apply:

- Liquidation Fee: 0.075% of liquidated position value

- Insurance Fund Contribution: Varies based on market conditions

Avoiding Liquidation Fees: Manage positions proactively to avoid liquidations. The 0.075% fee plus losses from liquidation price execution make liquidations extremely costly.

Fee Optimization Strategies

Become a Maker: Place limit orders instead of market orders whenever possible. Not only avoid taker fees, but earn rebates. The difference between -0.025% (maker) and 0.075% (taker) equals 0.10% savings per trade—significant over thousands of trades.

Volume Tier Advancement: Increase trading volume to access better fee tiers. At $10M monthly volume, maker rebates increase to -0.030% while taker fees decrease to 0.070%.

Options Fee Advantage: Options have lower fees than futures (0.04% vs 0.075% for takers). When appropriate, use options instead of futures for position expression.

Block Trades: For large institutional orders, negotiate block trades with zero additional fees beyond standard maker/taker rates.

Security and Fund Safety

Deribit prioritizes security through multiple protective layers, maintaining a perfect security record since 2016 inception.

Cold Storage Security

95% Cold Storage: Deribit stores 95% of user funds in offline, air-gapped cold storage wallets distributed across multiple physical locations worldwide.

Multi-Signature Wallets: Cold storage wallets require multiple authorized signatures for fund movement, preventing single-point-of-failure or internal theft.

Geographic Distribution: Cold storage is distributed across multiple jurisdictions in bank vaults and secure storage facilities, protecting against localized physical threats.

Hot Wallet Minimization: Only 5% of funds remain in hot wallets for daily operational needs, minimizing potential losses from any security breach.

Withdrawal Security Protocols

Mandatory Delays: Withdrawals implement mandatory processing delays providing time for security review and fraud prevention.

IP Address Whitelist: Enable IP whitelist restrictions limiting withdrawals to approved IP addresses only.

Withdrawal Address Whitelist: Pre-approve withdrawal addresses requiring separate authentication, preventing unauthorized destinations even if accounts are compromised.

Two-Factor Authentication: Mandatory 2FA for all withdrawal requests provides additional security layer beyond password authentication.

Email Confirmations: Every withdrawal triggers confirmation emails with cancellation links, enabling rapid response to unauthorized activity.

Insurance Fund Protection

Deribit maintains a well-capitalized insurance fund protecting users from counterparty risk and extreme market events.

Insurance Fund Purpose:

- Absorbs losses from liquidations exceeding bankruptcy prices

- Prevents socialized losses affecting profitable traders

- Provides buffer during extreme volatility and market gaps

- Eliminates systemic risk from trader defaults

Fund Transparency: Insurance fund balance published publicly on Deribit’s website, updated in real-time. As of Q1 2025, the fund contains over $100M equivalent.

Auto-Deleveraging (ADL): Only when insurance fund is insufficient does ADL trigger, automatically reducing profitable opposing positions. ADL priority displays in the position panel, enabling proactive risk management.

Platform Security Measures

DDoS Protection: Enterprise-grade DDoS mitigation ensures platform availability during attacks, preventing denial of service during critical trading periods.

Regular Security Audits: Independent security firms conduct regular penetration testing and vulnerability assessments, identifying potential weaknesses before exploitation.

Bug Bounty Program: Deribit rewards security researchers discovering platform vulnerabilities, creating incentives for responsible disclosure.

Employee Security Training: All Deribit employees undergo mandatory security training and background checks, reducing internal threat vectors.

Incident Response Team: 24/7 security monitoring team responds immediately to suspicious activity, potential breaches, or security incidents.

Legal and Regulatory Framework

Panama Registration: Deribit operates under Panama’s legal framework, balancing regulatory compliance with user privacy protection.

Dutch Operations: Company headquarters in Amsterdam, Netherlands provides additional regulatory oversight and consumer protection.

License Compliance: Deribit maintains necessary licenses and registrations for legal operation in primary markets, though not available in some jurisdictions including United States.

Terms of Service: Comprehensive user agreements outline rights, responsibilities, and dispute resolution procedures, providing legal clarity for all parties.

Common Mistakes to Avoid

New derivatives traders repeatedly make these errors. Learning from others’ mistakes prevents costly lessons.

Overleveraging (The #1 Account Killer)

The Mistake: Using maximum available leverage (50x) from the start, leaving zero room for market volatility or analysis errors.

The Reality: Even experienced traders rarely use leverage above 10x except for very short-term scalping. Beginners should start with 2-3x maximum leverage.

The Solution:

- Start with 2-3x leverage until consistently profitable

- Gradually increase leverage only after demonstrating profitability

- Remember: High leverage doesn’t increase profits, it increases liquidation risk

- Calculate liquidation prices before every trade

- Maintain minimum 50% cushion between entry and liquidation

Real Example: A trader enters a $10,000 Bitcoin position with 50x leverage ($200 margin). A mere 2% adverse move liquidates the entire position. With 5x leverage, the same position survives a 20% move—critical difference.

Ignoring Funding Rates

The Mistake: Holding perpetual contracts for weeks while paying 0.05% funding every 8 hours, accumulating 0.15% daily costs that erode profits.

The Reality: Funding costs compound rapidly. At 0.05% per 8-hour period, you pay 0.15% daily or 4.5% monthly—potentially exceeding any profits from the trade.

The Solution:

- Check funding rates before entering perpetual positions

- Avoid holding positions during sustained extreme funding

- Consider quarterly futures for longer-term positions (no funding costs)

- Close positions before funding periods during extreme rates

- Use funding rate extremes as contrary indicators (market overcrowded)

Real Example: A trader holds a long perpetual Bitcoin position for 30 days during positive funding averaging 0.05% per 8-hour period. Total funding cost: 4.5% of position value. If Bitcoin only rises 3%, the trade is actually unprofitable after funding.

Poor Entry Timing (FOMO Trading)

The Mistake: Entering positions after significant moves from fear of missing out (FOMO), buying tops, or selling bottoms.

The Reality: Chasing price movements consistently produces losses. Markets correct after extended moves, liquidating late entrants who bought at extremes.

The Solution:

- Wait for pullbacks to support levels before entering long positions

- Wait for rallies to resistance before entering short positions

- Use limit orders at predetermined levels instead of market orders

- Never chase breakouts without confirmation

- Set price alerts and wait patiently for optimal entries

Real Example: Bitcoin rallies from $50,000 to $58,000 in three days. FOMO trader enters long at $58,000 with 10x leverage. Bitcoin corrects to $55,000, resulting in liquidation. Patient trader waits for pullback to $54,000 support and enters with better risk-reward.

Neglecting Liquidation Prices

The Mistake: Opening positions without knowing exact liquidation prices or maintaining adequate buffer margin.

The Reality: Liquidations occur at the worst possible times, typically at local extremes before reversals. Once liquidated, you cannot participate in recovery.

The Solution:

- Know exact liquidation prices before entering every position

- Maintain minimum 50% buffer between entry and liquidation

- Add margin proactively when approaching liquidation levels

- Use price alerts warning when approaching liquidation

- Close or reduce positions rather than facing liquidation

Real Example: Trader enters long Bitcoin at $55,000 with 20x leverage, liquidation at $52,250 (5% drop). Bitcoin briefly wicks to $52,000 during normal volatility, liquidating the position. Bitcoin then rallies to $58,000, but trader captured none of the move due to premature liquidation.

Emotional Trading After Losses

The Mistake: Immediately entering new trades after losses to “get back to even,” often with increased position sizes (revenge trading).

The Reality: Emotional trading compounds losses. The best traders take breaks after drawdowns to reset psychologically before resuming trading.

The Solution:

- Implement “stop trading” rules after consecutive losses (3 losses = stop for day)

- Take minimum 24-hour breaks after significant drawdowns

- Review trades objectively before resuming trading

- Never increase position sizes after losses

- Accept that losses are normal part of trading

Real Example: Trader loses $2,000 on a Bitcoin long position. Immediately enters another long position with $4,000 (doubling down to recover faster). That position also loses, creating $6,000 total loss. Taking a break and resetting would have prevented the additional $4,000 loss.

Misunderstanding Options Greeks

The Mistake: Purchasing options without understanding time decay (theta) or volatility impact (vega), resulting in losses even when directionally correct.

The Reality: Options are complex instruments affected by time decay, volatility changes, and price movements simultaneously. Being directionally correct isn’t sufficient for profitability.

The Solution:

- Study options Greeks before trading options

- Understand theta decay accelerates as expiration approaches

- Recognize vega impact—volatility decreases hurt long options

- Use options calculators to model trades before execution

- Consider selling premium during high volatility instead of buying

- Match option expirations to expected move timeframe

Real Example: Trader purchases Bitcoin call options expiring in 2 days, expecting rally. Bitcoin does rally 3%, but options lose value due to theta decay and implied volatility decrease. Trader experiences loss despite correct directional prediction.

Inadequate Testing of Strategies

The Mistake: Implementing untested strategies with real money during volatile market conditions.

The Reality: Volatile markets expose strategy weaknesses quickly. Testing in calm conditions doesn’t prepare strategies for stress testing.

The Solution:

- Backtest strategies using historical data before live implementation

- Paper trade minimum 30 days before risking capital

- Start with small position sizes even after testing

- Expect different results in live trading due to execution and emotions

- Adjust strategies based on live performance data

Real Example: Trader develops options selling strategy during low volatility period. Strategy appears profitable in backtesting. Implements full size during volatility spike, immediately facing large losses from gamma risk not apparent during testing.

Deribit vs. Competitors

Understanding Deribit’s competitive positioning helps traders select optimal platforms for specific strategies.

Deribit vs. Binance Futures

Binance Advantages:

- Significantly deeper perpetual futures liquidity

- Hundreds of altcoin futures contracts

- Integrated spot trading for seamless portfolio management

- Lower learning curve for beginners

- SAFU fund provides additional security layer

Deribit Advantages:

- 10x deeper options liquidity (80% market share)

- More sophisticated options trading tools and Greeks display

- No KYC required for basic trading

- Better derivatives-focused interface without spot trading distractions

- Professional traders prefer Deribit for advanced strategies

Conclusion: Use Binance for perpetual futures and altcoin exposure. Use Deribit for options trading and sophisticated derivatives strategies.

Deribit vs. Bybit

Bybit Advantages:

- More competitive maker-taker fees for high-volume traders

- Better Asian market support and liquidity during Asian hours

- More aggressive bonus and promotional programs

- Copy trading features for strategy replication

- Dual Price system for liquidation protection

Deribit Advantages:

- Vastly superior options markets (Bybit options essentially non-existent)

- Longer operating history with proven security record

- Better portfolio margining calculations

- More sophisticated order types and API functionality

- Professional institutional client base

Conclusion: Use Bybit for perpetual futures with competitive fees. Use Deribit for any options trading or advanced derivatives strategies.

Deribit vs. OKX

OKX Advantages:

- Comprehensive crypto ecosystem including spot, derivatives, and DeFi

- Better for traders wanting single platform for all crypto activities

- Stronger altcoin derivatives offerings

- Better mobile app experience

- Web3 wallet integration

Deribit Advantages:

- Significantly deeper Bitcoin and Ethereum options liquidity

- Pure derivatives focus without distraction

- Better options pricing and tighter spreads

- More advanced options analytics and tools

- Preferred platform for professional options traders

Conclusion: Use OKX for diversified crypto trading across spot and derivatives. Use Deribit for serious options trading requiring maximum liquidity.

Deribit vs. CME Bitcoin Futures

CME Advantages:

- Full regulatory oversight and institutional legitimacy

- CFTC-regulated providing legal clarity

- Accessible through traditional brokerage accounts

- Cash-settled to regulated reference rates

- Suitable for institutional investors requiring regulated venues

Deribit Advantages:

- Leverage up to 50x (vs 2x at CME)

- 24/7 trading (vs limited CME hours)

- Crypto-native settlement (vs cash settlement)

- Much deeper options markets

- Lower capital requirements

- No KYC for basic access

Conclusion: Use CME for institutional-grade regulated exposure. Use Deribit for leveraged trading, options strategies, and 24/7 access.

Deribit vs. FTX (Historical Context)

FTX’s collapse in November 2022 eliminated Deribit’s primary competitor and demonstrated the critical importance of security and proper risk management.

Deribit’s Response to FTX Collapse:

- Processed record withdrawal volumes flawlessly

- Proved security infrastructure and cold storage effectiveness

- Absorbed massive liquidity migration from FTX refugees

- Market share increased from 60% to 80%+ in options markets

- Demonstrated operational excellence during industry stress

Lessons for Traders:

- Exchange security and financial stability matter more than features

- Avoid platforms offering unrealistic yields or bonus programs

- Prefer exchanges with proven operational track records

- Diversify holdings across multiple platforms when possible

- Monitor exchange proof-of-reserves and financial disclosures

Tax Considerations for Derivatives Trading

Cryptocurrency derivatives trigger tax obligations in most jurisdictions requiring careful record-keeping and compliance.

Taxable Events in Derivatives Trading

Realized Gains and Losses: Every position closure creates taxable events. Profitable trades generate taxable income; losing trades create deductible losses (subject to limitations).

Funding Rate Payments: Perpetual contract funding payments may be taxable depending on jurisdiction. Consult tax professionals about proper treatment of periodic funding rate settlements.

Options Premiums: Selling options creates immediate income recognition. Purchasing options creates basis for future gain/loss calculation upon sale or expiration.

Settlement Events: Futures and options settlements constitute taxable events even without explicit sell orders. Cash settlements generate reportable gains or losses.

Tax Calculation Methodologies

FIFO (First In, First Out): Assumes earliest purchased positions are sold first. This is the default method in most jurisdictions.

LIFO (Last In, First Out): Assumes most recently purchased positions are sold first. May be beneficial in certain scenarios but not accepted in all jurisdictions.

Specific Identification: Allows selecting exact positions being closed, optimizing tax outcomes. Requires meticulous record-keeping and explicit position identification.

Averaging: Some jurisdictions allow averaging cost basis across similar positions. Check local tax code for availability and requirements.

Record Keeping Requirements

Essential Records to Maintain:

- Complete trade history with dates, times, prices, and quantities

- Funding rate payments and receipts for perpetual contracts

- Liquidation events with final prices and losses

- Deposit and withdrawal transactions with dates and amounts

- Fee payments across all transaction types

- Options exercise and assignment records

Automated Solutions:

- CryptoTrader.Tax – Specialized crypto tax software

- Koinly – Comprehensive crypto accounting platform

- TokenTax – Professional crypto tax preparation

- Deribit’s native export functionality for complete trade histories

International Tax Variations

United States:

- Short-term capital gains (held < 1 year) taxed as ordinary income (up to 37%)

- Long-term capital gains (held > 1 year) taxed at reduced rates (0%, 15%, 20%)

- Wash sale rules may apply preventing loss harvesting

- Form 8949 and Schedule D required for reporting

- Professional traders may qualify for trader tax status with enhanced deductions

European Union:

- Capital gains tax rates vary dramatically by country (0% to 50%+)

- Some countries exempt crypto profits under certain thresholds

- VAT generally not applicable to cryptocurrency trading

- Reporting requirements vary by member state

- Consider residency carefully for tax optimization

United Kingdom:

- Capital Gains Tax applies with £3,000 annual exemption (2024/25)

- Rates of 10% or 20% depending on total income

- Share pooling rules apply to identical assets

- Detailed records required for HMRC compliance

- Specific reporting requirements for derivatives

Asia-Pacific Variations:

- Singapore: Generally tax-free if not trading business

- Hong Kong: Usually tax-free unless systematic trading business

- Australia: CGT applies with 50% discount for > 12 months

- Japan: Up to 55% combined national and local taxes

- South Korea: 20% tax on profits > 2.5M KRW

Tax Optimization Strategies (Legal)

Tax-Loss Harvesting: Realize losses before year-end to offset gains, reducing tax liability. Be aware of wash sale rules potentially disallowing losses if repurchasing within 30 days (jurisdiction-dependent).

Long-Term Holding: When possible, hold positions over one year to qualify for lower long-term capital gains rates in applicable jurisdictions.

Geographic Arbitrage: Some traders structure operations in tax-favorable jurisdictions, though this requires actual residency and proper structuring with professional legal and tax advice.

Entity Structuring: Professional traders may benefit from corporate structures enabling business expense deductions and different tax treatment. Requires significant trading volume to justify complexity and costs.

Retirement Account Trading: In some jurisdictions (e.g., US), trading crypto derivatives in self-directed IRAs or 401(k)s defers taxes until retirement withdrawals, though availability and restrictions vary.

Professional Guidance Recommendations

When to Consult Tax Professionals:

- Trading volume exceeds $50,000 annually

- Using complex options strategies with unclear tax treatment

- Operating across multiple countries or changing tax residency

- Considering entity structuring for tax optimization

- Facing audits or tax authority inquiries

- Earning substantial income (> $100,000) from derivatives trading

Selecting Tax Professionals:

- Prioritize professionals with cryptocurrency expertise

- Verify experience with derivatives trading taxation

- Confirm knowledge of your specific jurisdiction

- Request references from other crypto traders

- Understand fee structures before engagement

Derivatives trading generates substantial tax complexity. Investing in proper accounting and professional guidance prevents costly errors, penalties, and interest charges from tax authorities.

Is Deribit Right for You?

Determining whether Deribit fits your trading needs requires honest self-assessment across multiple dimensions.

You Should Use Deribit If:

You Want to Trade Options: Deribit is essentially mandatory for serious crypto options trading. The 80%+ market share means unmatched liquidity, tightest spreads, and best execution quality unavailable anywhere else.

You Need Maximum Leverage: With leverage up to 50x on futures and 20x on options, Deribit provides maximum capital efficiency for skilled traders confident in their strategies and risk management.

You Value Privacy and Fast Access: No KYC requirement for basic trading enables immediate access with only email verification. Start trading within minutes of registration.

You’re a Professional or Institutional Trader: Advanced features including API access, portfolio margining, block trades, and combo orders cater specifically to professional trading operations.

You Require Deep Liquidity: Deribit’s dominant market share ensures consistent execution quality even for large position sizes without significant market impact or slippage.

You Want Focus Without Distractions: Pure derivatives platform without spot trading, NFT marketplaces, or other features enables concentrated focus on derivatives strategies.

Consider Alternatives If:

You’re an Absolute Beginner: Derivatives trading is complex and risky. If you’ve never traded cryptocurrency before, start with spot trading on beginner-friendly platforms like Coinbase or Binance before attempting derivatives.

You Want Spot and Derivatives Integration: Platforms like Binance and OKX offer seamless integration between spot and derivatives trading, enabling easier portfolio management and cross-product strategies.

You Need Altcoin Derivatives: Deribit focuses exclusively on Bitcoin and Ethereum. If you want to trade altcoin futures or options, consider Binance, Bybit, or OKX offering dozens of altcoin derivatives.

You Require Extensive Educational Resources: Deribit provides basic tutorials but isn’t as education-focused as some competitors. Beginners may prefer platforms with comprehensive learning academies and guided tutorials.

You Prefer 24/7 Customer Support: While Deribit offers support, response times and availability may not match some competitors. If immediate support is critical, consider platforms with more extensive customer service teams.

You Want Regulated Exposure: US and some other jurisdictions prohibit Deribit access. If you require CFTC or FCA-regulated platforms, consider CME or regulated alternatives in your jurisdiction.

Skill Level Requirements

Minimum Requirements for Futures/Perpetuals:

- Solid understanding of leverage and margin mechanics

- Experience with technical analysis and chart reading

- Disciplined risk management and stop-loss implementation

- Comfortable with position sizing calculations

- Ability to remain emotionally neutral during losses

Minimum Requirements for Options:

- Everything above, plus:

- Understanding of options Greeks (delta, gamma, theta, vega)

- Knowledge of volatility impact on options pricing

- Familiarity with various options strategies (spreads, straddles, etc.)

- Ability to analyze risk-reward profiles across complex positions

- Understanding of time decay and expiration mechanics

Recommended Preparation:

- Minimum 6 months cryptocurrency trading experience

- Completion of options education courses or reading

- Practice on Deribit testnet for minimum 2 weeks

- Start with small positions (under $500) initially

- Gradually scale position sizes as proficiency develops

Capital Requirements

Absolute Minimum: You can technically start trading with $100-$200, though this severely limits position diversity and risk management flexibility.

Realistic Minimum: $1,000-$2,500 provides adequate capital for multiple small positions, proper risk management (1-2% per trade), and room for inevitable losses during learning phase.

Comfortable Trading: $5,000-$10,000 enables diversified strategies across multiple positions, adequate risk buffer, and psychological comfort preventing emotional decision-making from every fluctuation.

Professional Level: $25,000+ supports professional trading with portfolio margin, multiple simultaneous strategies, and ability to capture institutional-size opportunities requiring larger capital commitments.

Getting Started: Your Action Plan

Ready to begin derivatives trading on Deribit? Follow this comprehensive implementation roadmap for optimal success:

Phase 1: Education and Preparation (Week 1-2)

Day 1-3: Derivatives Fundamentals

- Study futures, perpetuals, and options mechanics

- Understand leverage, margin, and liquidation dynamics

- Learn risk management principles and position sizing

- Complete Deribit’s introductory tutorials

- Watch educational videos on YouTube from reputable traders

Day 4-7: Platform Familiarization

- Create testnet account for risk-free practice

- Navigate interface and locate all key features

- Place demo trades across futures and options

- Practice using different order types

- Test various leverage levels and observe liquidation impacts

Week 2: Strategy Development

- Develop written trading plan with entry/exit criteria

- Define position sizing rules and risk parameters

- Establish stop-loss and take-profit methodologies

- Document which strategies you’ll use initially

- Set realistic profit targets and acceptable loss limits

Phase 2: Live Account Setup (Week 3)

Security Configuration:

- Register live Deribit account

- Enable Google Authenticator 2FA immediately

- Configure withdrawal whitelist

- Set up withdrawal address whitelist

- Document all security credentials securely

Initial Deposit:

- Start with comfortable amount you can afford to lose completely

- Recommended: $1,000-$2,500 for meaningful learning

- Use Bitcoin or Ethereum for lowest deposit costs

- Wait for full network confirmations before trading

- Verify deposit appears correctly in account balance

Phase 3: Conservative Initial Trading (Week 3-8)

First Month Goals:

- Focus on learning, not profits

- Start with 2-3x leverage maximum

- Limit position sizes to 1% of capital per trade

- Trade only Bitcoin or Ethereum (avoid overcomplication)

- Use perpetuals or quarterly futures (avoid options initially)

Daily Trading Routine:

- Review overnight market developments

- Check technical analysis across multiple timeframes

- Identify 1-2 high-probability setups

- Calculate position sizes and liquidation prices

- Execute trades with predetermined stop-losses

- Monitor positions but avoid overtrading

- Journal every trade with reasoning and outcome

Weekly Review Process:

- Calculate win rate and average risk-reward

- Identify patterns in winning and losing trades

- Adjust strategies based on performance data

- Review risk management adherence

- Set goals for following week

Phase 4: Strategy Expansion (Month 2-3)

Gradual Complexity Increase:

- Introduce options trading with small positions

- Start with simple strategies (covered calls, protective puts)

- Test different leverage levels (still staying under 10x)

- Experiment with various order types

- Implement more sophisticated technical analysis

Risk Management Evolution:

- Increase position sizes gradually to 2% per trade

- Add portfolio-level stop-loss rules (daily/weekly loss limits)

- Implement correlation-based position limits

- Test hedging strategies using multiple products

- Develop position scaling methodology

Phase 5: Advanced Implementation (Month 4+)

Professional Development:

- Complete KYC for portfolio margining access

- Implement API integration if technically skilled

- Test complex multi-leg options strategies

- Increase position sizes to 3-5% for highest-conviction trades

- Develop multiple uncorrelated strategies

Community Engagement:

- Join Deribit Telegram channels for market insights

- Follow professional traders sharing ideas

- Participate in trading competitions

- Network with other derivatives traders

- Consider mentorship from experienced traders

Phase 6: Continuous Improvement

Ongoing Education:

- Study advanced options strategies (iron condors, butterflies)

- Learn volatility trading and DVOL analysis

- Master arbitrage opportunities between products

- Understand market microstructure and order flow

- Read professional trading books and resources

Performance Optimization:

- Track detailed metrics beyond simple P&L

- Analyze execution quality and slippage

- Optimize fee payments through maker/taker balance

- Test new strategies on small positions first

- Continuously refine edge through data analysis

Risk Management Refinement:

- Update risk parameters based on account growth

- Adjust position sizes as capital increases

- Implement advanced portfolio risk metrics (VaR, Sharpe)

- Develop disaster recovery protocols

- Maintain emotional discipline through inevitable drawdowns

Conclusion

Deribit represents the apex of cryptocurrency derivatives trading, combining institutional-grade infrastructure with retail accessibility. The platform’s unmatched options market depth, advanced trading features, and proven security record make it the definitive choice for serious derivatives traders.

Success in derivatives trading demands far more than platform selection. The leverage amplifying potential profits also magnifies losses with equal intensity. Profitable derivatives trading requires disciplined risk management, comprehensive education, emotional control, and realistic expectations developed through months and years of experience.

The derivatives market offers opportunities impossible in spot trading—from leveraged directional speculation to sophisticated hedging strategies to income generation through premium selling. These advantages come with commensurate risks that destroy undisciplined traders attempting to profit without proper preparation.

Deribit provides the tools, liquidity, and infrastructure. Your education, risk management, and psychological discipline determine outcomes. Start conservatively, scale gradually, and prioritize long-term survival over short-term profits.

The majority of derivatives traders lose money. Those who succeed distinguish themselves through disciplined risk management, continuous learning, emotional control, and realistic expectations. Which category will you join?

Open your Deribit account now and begin your derivatives trading journey on the world’s leading crypto options and futures platform.

Frequently Asked Questions

Q1: Is Deribit safe for derivatives trading in 2025?

Deribit maintains the strongest security record among major crypto derivatives exchanges with zero security breaches since 2016 inception. The platform stores 95% of user funds in cold storage multi-signature wallets distributed across multiple geographic locations. The insurance fund contains over $100M protecting users from counterparty risk. However, no exchange guarantees absolute safety—never store funds longer than necessary and withdraw regularly to personal wallets.

Q2: Can US citizens use Deribit?

No, Deribit does not accept customers from the United States, United Kingdom, Quebec (Canada), and several other restricted jurisdictions due to regulatory considerations. US traders should consider CFTC-regulated alternatives like CME for regulated Bitcoin and Ethereum futures exposure. Using VPNs to bypass geographic restrictions violates Terms of Service and may result in account closure and fund seizure.

Q3: What is the minimum deposit required to start trading on Deribit?

Deribit has no official minimum deposit requirement. You can deposit any amount and begin trading immediately. However, practical minimums depend on position sizes and margin requirements. For meaningful futures trading with proper risk management, consider $1,000-$2,500 minimum. For options trading, $2,500-$5,000 enables adequate diversification across strikes and expirations while maintaining risk management discipline.

Q4: How does Deribit’s leverage compare to competitors?

Deribit offers up to 50x leverage on Bitcoin and Ethereum futures and perpetuals, matching Binance and Bybit. Options leverage reaches 20x, significantly higher than most competitors. However, maximum leverage shouldn’t be used by retail traders—even professionals rarely exceed 10x except for very short-term scalping. Start with 2-3x leverage and increase gradually only after demonstrating consistent profitability.

Q5: What fees does Deribit charge for derivatives trading?

Deribit employs maker-taker fee structures. Futures takers pay 0.075% while makers receive -0.025% rebates. Options have lower fees with takers paying 0.04% and makers receiving -0.04% rebates. Volume-based discounts reduce fees further for high-volume traders. Settlement fees apply at futures expiration (0.015% for takers). Funding rates on perpetuals range typically -0.05% to +0.05% per 8-hour period. Liquidations incur additional 0.075% fees.

Q6: Can I trade on Deribit without KYC verification?

Yes, Deribit enables immediate trading with only email verification—no identity documents required for basic access. This provides privacy and rapid onboarding unavailable on most competitors. However, unverified accounts face withdrawal limits (10 BTC daily equivalent). KYC verification removes withdrawal limits, enables portfolio margining, unlocks institutional features, and provides priority support. Most serious traders complete verification eventually.

Q7: What’s the difference between Deribit’s futures and perpetual contracts?

Futures contracts have fixed expiration dates (quarterly and bi-quarterly) and settle to index prices at 08:00 UTC on expiration. They trade at premiums or discounts to spot based on market sentiment. Perpetual contracts never expire and employ funding rate mechanisms every 8 hours to anchor prices to spot markets. Perpetuals are simpler for beginners and don’t require rolling positions. Futures avoid funding costs for longer-term positions and enable specific expiration-based strategies.

Q8: How do I avoid liquidation on Deribit?

Liquidation prevention requires multiple strategies: (1) Use conservative leverage (2-5x maximum for beginners), (2) Know exact liquidation prices before every trade, (3) Maintain 50%+ buffer between entry and liquidation, (4) Add margin proactively when approaching liquidation levels, (5) Use stop-losses to close positions before liquidation, (6) Reduce position sizes during high volatility, and (7) Never commit entire account to single positions. Position management separates successful traders from those facing repeated liquidations.

Q9: What options strategies work best on Deribit?

Beginners should start with simple directional strategies: buying calls when bullish, buying puts when bearish, or protective puts for spot hedging. Intermediate traders profit from selling covered calls on spot holdings or cash-secured puts during high volatility. Advanced traders implement spreads (verticals, calendars, diagonals), iron condors, and butterflies leveraging Deribit’s exceptional liquidity. Match strategy complexity to your options knowledge—complex strategies require deep understanding of Greeks and risk profiles.

Q10: How does Deribit’s insurance fund protect traders?

The insurance fund absorbs losses from liquidations exceeding bankruptcy prices, preventing socialized losses across profitable traders. When positions liquidate, the liquidation engine attempts to close at bankruptcy price (where trader equity = $0). If market gaps prevent this, losses are absorbed by the insurance fund rather than affecting other users. Only when the insurance fund is insufficient does auto-deleveraging (ADL) reduce profitable opposing positions. The fund currently contains over $100M, providing substantial protection during extreme market conditions.

Disclaimer: Cryptocurrency derivatives trading involves substantial risk of loss and is not suitable for all investors. Leverage amplifies both potential profits and losses. Past performance does not guarantee future results. Never trade with funds you cannot afford to lose completely. This guide provides educational information only and does not constitute financial, investment, or trading advice. Conduct thorough research, understand the risks, and consult licensed financial advisors before trading derivatives. Deribit is not available in all jurisdictions including the United States. Ensure compliance with local laws and regulations before accessing the platform.