Deribit: The Top Exchange for Professional Traders in Bitcoin and Ethereum Derivatives Trading

Estimated reading time: 7 minutes

Key Takeaways

- Deribit Exchange is a leading crypto derivatives platform for BTC, ETH, and SOL options/futures.

- Offers up to 100x leverage, extremely deep liquidity, and advanced trading tools.

- No spot trading—entirely focused on derivatives products.

- 99% of funds are stored in cold wallets for enhanced security.

- Competitive fees, affording rebates for market makers.

- Popular among institutional, professional, and high-frequency traders.

- Strong affiliate program for content creators and marketers.

Table of Contents

- What is Deribit?

- Understanding Derivatives: Options and Futures

- Pros and Cons of Trading on Deribit

- Fee Structure Breakdown

- Comparing Deribit with Other Exchanges

- Tailoring Strategies for Different Audiences

- Conclusion

- FAQ

What is Deribit?

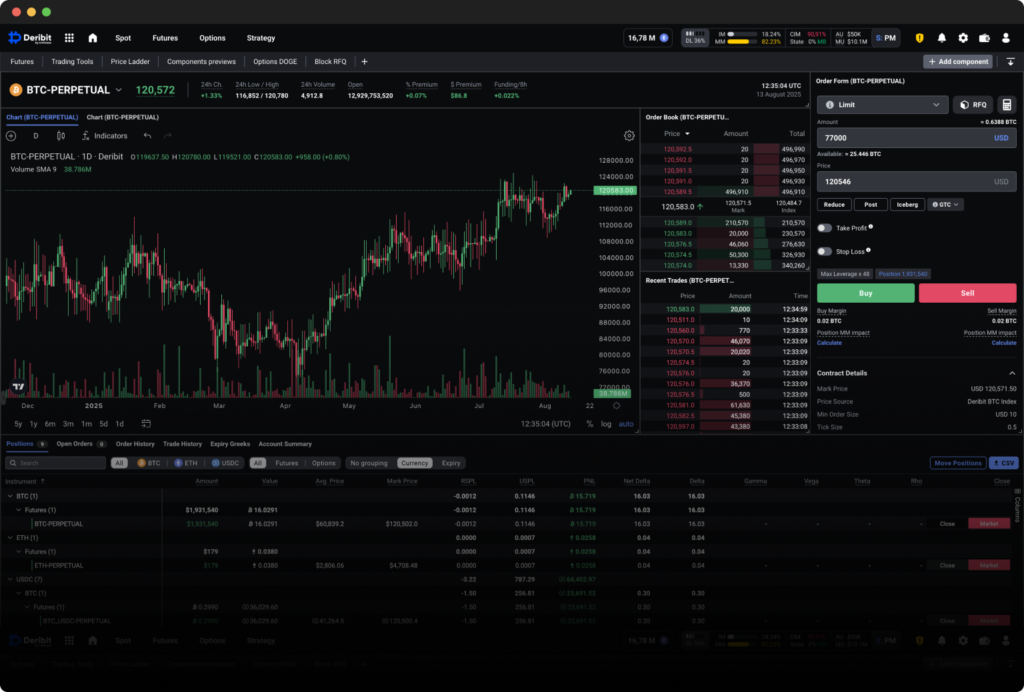

Established in 2016, Deribit Exchange has established itself as a go-to exchange for cryptocurrency derivatives, specializing in options and futures trading for BTC and ETH, with more recent additions such as SOL. Unlike many other exchanges, Deribit does not offer spot (real asset) trading, focusing solely on derivatives. Its robust platform, deep liquidity, and competitive fee structure make it a favorite among professional traders. Learn more.

Key Features:

- High Leverage Opportunities: Traders can leverage their positions by up to 100x on BTC futures.

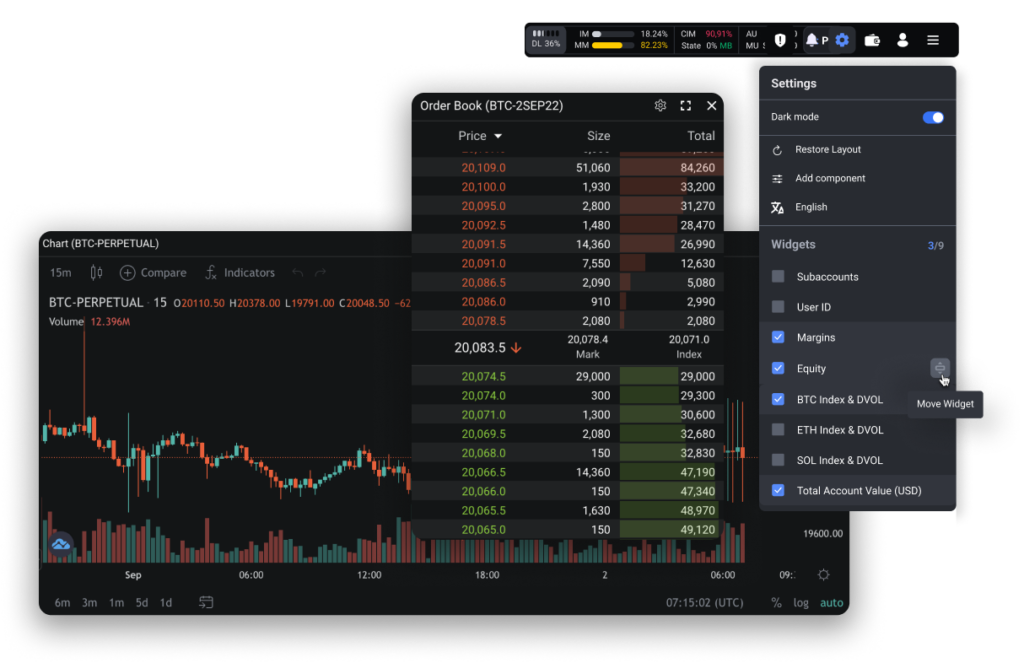

- Advanced Trading Tools: Deribit offers a customizable interface, analytics tools, and a demo mode for users to practice without risk.

- Security: The exchange claims to keep 99% of user funds in cold storage, minimizing the risk of hacks.

Understanding Derivatives: Options and Futures

If you’re new to the concept of derivatives, it’s helpful to see how various exchanges structure and offer these products. Detailed comparisons, including spot vs. derivatives and margin trading, can be found at this overview of trading features on exchanges, which explains how options, futures, margin, and complex trading features work across leading crypto exchanges.

Options Trading

Options contracts grant the buyer the right (but not the obligation) to buy or sell an asset at a predetermined price and expiration date. On Deribit, you can trade options for BTC, ETH, and SOL. This flexibility allows traders to hedge risks effectively or leverage potential price movements.

Futures Trading

Futures contracts obligate traders to buy or sell the underlying asset at a specified price within a specific timeframe. Deribit’s futures trading is equipped with high liquidity and the ability to utilize significant leverage. For a comprehensive breakdown of how crypto futures trading operates—including perpetuals and risk management for leveraged products—see: crypto futures trading explained.

Perpetual Contracts

Perpetual futures mimic traditional futures but do not have an expiration date, allowing traders to hold positions indefinitely, provided they meet margin requirements.

Pros and Cons of Trading on Deribit

Pros

- High Liquidity: Deribit is among the most liquid platforms for crypto options, enabling efficient trades.

- Competitive Fees: Fees generally range from a maker rebate of up to -0.02% to taker fees of about 0.05%.

- Speed and Stability: With sub-millisecond latency, Deribit’s infrastructure is designed for speed, catering to the demands of professional traders.

- Robust Security: 99% of funds in cold storage lowers risk exposure significantly.

- 24/7 Customer Support: Users can access support at any time, making it ideal for global traders.

If understanding crypto exchange fee structures is important to your overall profitability, compare makers, takers, and other platform costs here: crypto exchange fees.

Cons

- High Leverage Risks: While leverage can magnify profits, it also increases the risk of rapid liquidations, particularly in volatile markets.

- Limited Asset Range: Primarily focused on BTC, ETH, and SOL; investors looking for a more diverse array of altcoins might be disappointed.

- US Regulations: Deribit does not offer services to users in the United States due to regulatory restrictions.

For a deeper discussion on regulatory issues and security best practices on crypto exchanges, see: crypto exchange security.

Fee Structure Breakdown

| Fee Type | Structure | Comments |

|---|---|---|

| Maker Fees | Up to -0.02% | Rebates for providing liquidity |

| Taker Fees | 0.05% for futures and options | Direct charges when taking liquidity |

| Deposit Fees | None | Network fees still apply |

| Withdrawal Fees | None | Network fees for transferring assets |

| Liquidation Fees | Proprietary risk management | Slightly complex liquidation process |

Comparing Deribit with Other Exchanges

| Platform | Products | Fee Structure | Asset Range | Leverage | Unique Features |

|---|---|---|---|---|---|

| Deribit | Options, Futures, Perpetuals | Maker rebates, 0.05% taker | BTC, ETH, SOL | Up to 100x (BTC) | Best liquidity for options |

| BitMEX | Futures, Perpetuals | Similar to Deribit | Broader asset range | Up to 100x | Established reputation |

| OKX | Spot, Futures, Options | Discounted for volume | Broad (100+) | Up to 125x | Volume tiers and spot trading |

| Binance | Spot, Futures, Options | Tiered discounts | Extremely broad | Up to 125x | Largest trading volume |

If you’re interested in exploring derivatives-focused competing platforms, check out Bybit, which is also renowned for high liquidity and advanced tools.

For a full exchange comparison across spot, futures, and derivatives, see: Top Crypto Exchanges 2025 Comparison.

Tailoring Strategies for Different Audiences

For Beginners

Starting in crypto trading can be overwhelming. Deribit offers a demo/testnet feature that allows new traders to practice without financial risk. It’s essential for beginners to familiarize themselves with the platform’s interface and understand the difference between derivatives and spot trading. For a foundational starting point to crypto trading as a beginner, visit: crypto trading for beginners.

For Futures Traders

Traders focusing on futures should consider the leverage offered and the competitive fee structure. Keeping track of their margins and using risk management tools is also crucial. Deribit’s advanced trading tools can help optimize strategies effectively.

For Affiliate Marketers & Content Creators

Deribit offers an attractive affiliate program, allowing marketers to earn commissions on the trading fees generated by referred customers. Promoting Deribit as a top choice for derivatives trading can be a lucrative venture, especially among institutional clients and professional traders. If you’re considering earning as a Deribit affiliate or comparing it to other major programs, see our detailed guide: Deribit affiliate program guide.

Conclusion

Deribit represents a blend of innovation, reliability, and strategic trading opportunities that cater to different traders, from novice to professional levels. While the platform shines in its offerings for BTC and ETH derivatives, it is essential for traders to weigh the potential risks against the benefits of high-leverage trading. The exchange’s dedication to security, advanced tools, and 24/7 support makes it a formidable player in the cryptocurrency derivatives arena.

Whether you’re starting your trading journey or seeking to amplify your trading strategies, Deribit is undoubtedly worth considering.

FAQ

- What is Deribit?

Deribit is a specialized crypto derivatives exchange focusing on BTC, ETH, and SOL options and futures trading, offering deep liquidity and advanced features for professional traders.

- Does Deribit offer spot trading?

No, Deribit does not offer spot trading. It is a derivatives-only platform focused exclusively on options, futures, and perpetual contracts.

- Is Deribit safe to use?

Deribit keeps 99% of its user funds in cold storage and implements multiple layers of security to protect against hacks and unauthorized withdrawals.

- Can US users trade on Deribit?

No, due to regulatory restrictions, US users are not permitted to register or trade on Deribit.

- How do Deribit’s fees compare to other platforms?

Deribit offers competitive fees with rebates for market makers and 0.05% taker fees, generally on par or better than other derivatives exchanges.

- What assets can I trade on Deribit?

Currently, Bitcoin (BTC), Ethereum (ETH), and Solana (SOL) products are supported.

- Is there a Deribit affiliate program?

Yes, Deribit offers an affiliate program with commission on trading fees. Details and comparisons are in our affiliate program guide.