Spot Trading: Complete 2025 Crypto Trading Guide

Spot trading represents the most fundamental and widely adopted method of cryptocurrency trading, involving the immediate purchase and sale of digital assets at current market prices for instant settlement. This straightforward trading approach allows traders to gain direct ownership of cryptocurrencies without the complexity of derivatives, margin requirements, or expiration dates that characterize other trading methods.

Unlike futures, margin, or derivatives trading, spot trading provides immediate asset ownership with transparent pricing based on real-time supply and demand dynamics. The simplicity and direct nature of spot trading make it the preferred entry point for beginners while remaining essential for experienced traders implementing various investment strategies from short-term scalping to long-term holding.

This comprehensive guide explores everything you need to know about spot trading, from basic mechanics and order types to advanced strategies and risk management. You will discover how spot trading works, its advantages and limitations, trading strategies for different market conditions, and how to choose the right platform for your trading objectives.

What Is Spot Trading in Cryptocurrency?

Spot trading in cryptocurrency refers to the buying and selling of digital assets at their current market prices for immediate delivery and settlement. The term “spot” indicates that transactions occur “on the spot” at prevailing market rates without delay or future obligations.

Core Spot Trading Mechanics

Spot trading operates on the principle of immediate exchange, where buyers and sellers meet at current market prices to complete transactions instantly.

Immediate Settlement: When you execute a spot trade, ownership of the cryptocurrency transfers immediately to your account. There are no contracts, no expiration dates, and no future obligations—just direct asset exchange at current market values.

Real Asset Ownership: Unlike derivatives trading where you hold contracts representing underlying assets, spot trading provides actual cryptocurrency ownership. You can withdraw, transfer, stake, or use your cryptocurrencies immediately after purchase.

Market Price Execution: Spot trades execute at current market prices determined by real-time supply and demand dynamics across the exchange’s order book.

Spot Trading vs Other Trading Methods

Understanding how spot trading differs from other cryptocurrency trading methods helps clarify its unique characteristics and applications.

Spot vs Futures Trading: Futures involve contracts to buy or sell assets at predetermined prices on future dates, while spot trading provides immediate ownership at current prices without expiration dates.

Spot vs Margin Trading: Margin trading allows borrowing funds to amplify positions with leverage, while spot trading uses only available account balance without borrowed capital or liquidation risks.

Spot vs Options Trading: Options provide rights (not obligations) to buy or sell at specific prices, while spot trading involves immediate purchase or sale obligations at current market prices.

How Spot Trading Works: Step-by-Step Process

The spot trading process involves several straightforward steps that remain consistent across different cryptocurrency exchanges and platforms.

Getting Started with Spot Trading

Beginning your spot trading journey requires platform selection, account setup, and understanding basic trading mechanics.

Exchange Selection: Choose a reputable cryptocurrency exchange that supports spot trading with good liquidity, competitive fees, and strong security measures. Popular options include Binance, Coinbase, Bybit, and OKX.

Account Creation: Register an account by providing basic information and completing identity verification (KYC) as required by regulatory compliance standards.

Funding Your Account: Deposit fiat currency (USD, EUR) via bank transfer, credit card, or other payment methods, or transfer cryptocurrencies from external wallets.

Executing Spot Trades

Once your account is funded, you can begin executing spot trades through the exchange’s trading interface.

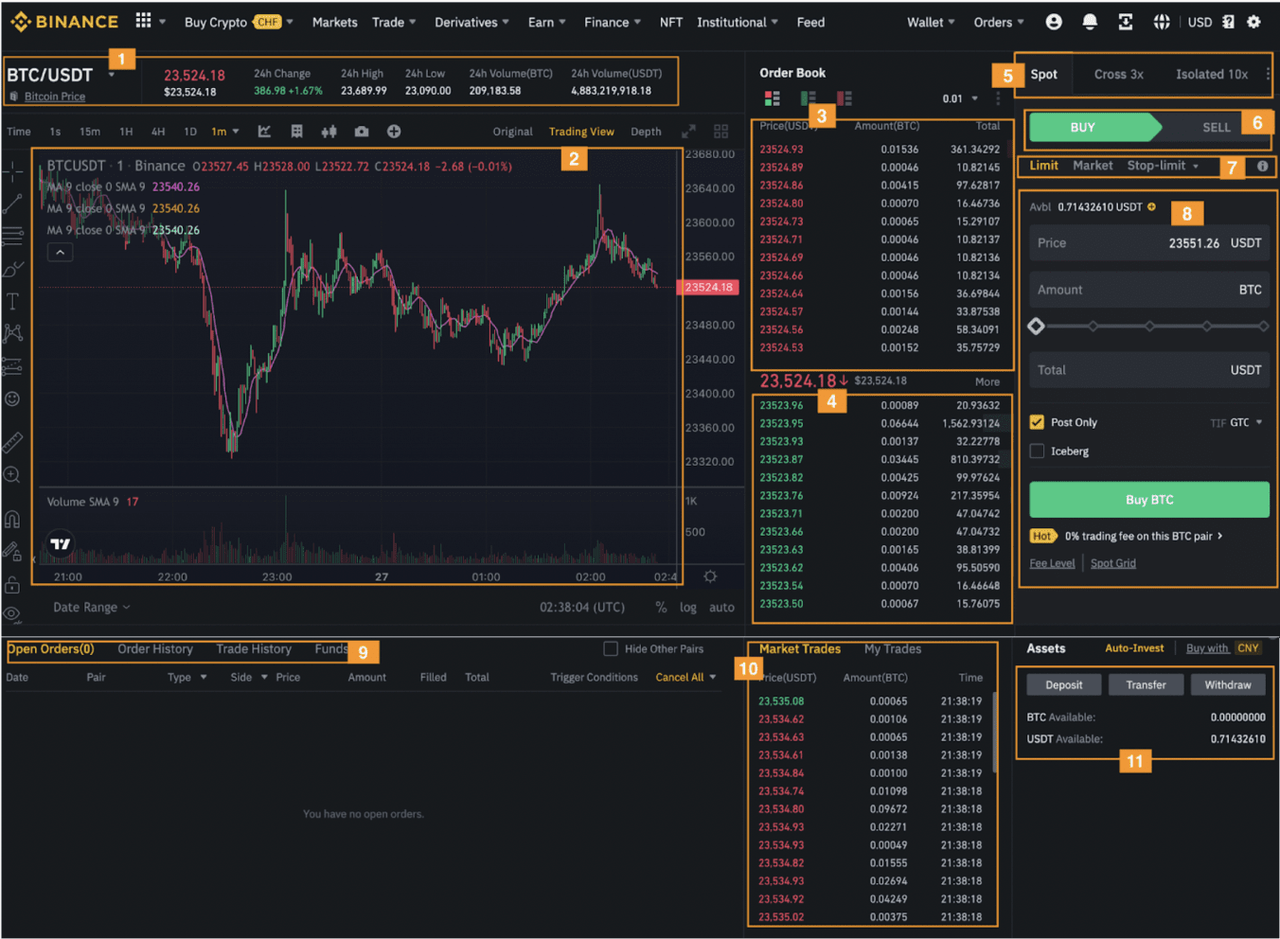

Trading Pair Selection: Choose your desired trading pair (e.g., BTC/USDT, ETH/USD) representing the cryptocurrency you want to buy or sell against your base currency.

Order Placement: Enter your trade details including the amount you want to buy or sell, select your order type (market or limit), and review trade parameters before submission.

Trade Execution: Upon order submission, the exchange matches your order with corresponding buyers or sellers from the order book, completing the transaction instantly for market orders or when price conditions are met for limit orders.

Asset Transfer: After successful execution, purchased cryptocurrencies appear in your exchange wallet, ready for withdrawal to personal wallets or further trading.

Understanding Trading Pairs and Market Dynamics

Trading pairs form the foundation of spot trading, representing the relationship between different cryptocurrencies and their relative values.

Common Trading Pair Types

Cryptocurrency exchanges offer various trading pair categories to accommodate different trading strategies and preferences.

Crypto-to-Crypto Pairs: Direct trading between different cryptocurrencies (e.g., BTC/ETH, ADA/SOL) without involving fiat currencies, popular for portfolio rebalancing and arbitrage opportunities.

Crypto-to-Fiat Pairs: Trading cryptocurrencies against traditional currencies (e.g., BTC/USD, ETH/EUR) enables direct conversion between digital and traditional assets.

Crypto-to-Stablecoin Pairs: Pairing cryptocurrencies with stablecoins (e.g., BTC/USDT, ETH/USDC) provides price stability and serves as a bridge between different cryptocurrencies and fiat currencies.

Market Dynamics and Price Discovery

Spot prices reflect real-time market conditions through continuous interaction between buyers and sellers.

Supply and Demand: Prices increase when buying demand exceeds selling pressure and decrease when selling pressure overwhelms buying interest.

Order Book Depth: The number and size of buy and sell orders at different price levels determine market liquidity and potential price movement impacts.

Market Liquidity: High liquidity markets feature tight bid-ask spreads and minimal price slippage, while low liquidity markets may experience wider spreads and more significant price impacts from large orders.

Order Types in Spot Trading

Different order types provide traders with varying levels of control over trade execution, pricing, and timing to match specific trading strategies.

Market Orders: Immediate Execution

Market orders prioritize speed over price precision, executing immediately at the best available market price.

Instant Execution: Market orders complete within seconds by accepting the current best bid (for sellers) or ask (for buyers) prices from the order book.

Price Uncertainty: While market orders guarantee execution, the final execution price may differ slightly from displayed prices due to market movement during order processing.

Best Use Cases: Market orders work best when immediate execution is more important than achieving specific prices, such as during breaking news events or when entering/exiting positions quickly.

Limit Orders: Price Control

Limit orders allow traders to specify exact prices at which they’re willing to buy or sell, providing greater control over trade execution.

Price Specification: Set buy limit orders below current market prices to purchase at desired levels, or sell limit orders above market prices to achieve target profit levels.

Execution Conditions: Limit orders only execute when market prices reach or exceed specified limits, potentially resulting in partial fills or no execution if markets don’t reach target prices.

Strategic Applications: Use limit orders for dollar-cost averaging strategies, profit-taking at predetermined levels, or accumulating positions during market corrections.

Stop-Loss Orders: Risk Management

Stop-loss orders help limit losses by automatically triggering market orders when prices move against positions.

Automatic Triggering: When cryptocurrency prices reach predetermined stop levels, stop-loss orders convert to market orders for immediate execution.

Risk Limitation: Stop-loss orders help prevent large losses during adverse market movements, particularly important in volatile cryptocurrency markets.

Stop-Limit Orders: Combine stop triggers with limit order execution to provide price protection while avoiding potential slippage from pure market order execution.

Advantages of Spot Trading

Spot trading offers numerous benefits that make it attractive for traders across different experience levels and investment strategies.

Simplicity and Accessibility

The straightforward nature of spot trading makes it an ideal starting point for cryptocurrency market participation.

Easy Learning Curve: Spot trading involves simple buy-low, sell-high concepts without complex contract specifications, margin calculations, or expiration date management.

Direct Ownership: Immediate asset ownership provides clear understanding of what you own and its current value without derivative complexity or counterparty risks.

Beginner-Friendly: New traders can start with small amounts to learn market dynamics and trading mechanics without sophisticated knowledge of leveraged products.

Full Asset Control

Spot trading provides complete control over purchased cryptocurrencies with various utilization options.

Withdrawal Freedom: Transfer cryptocurrencies to personal wallets for enhanced security, self-custody, or participation in decentralized finance protocols.

Staking Opportunities: Use owned cryptocurrencies for staking to earn passive rewards while maintaining long-term positions.

Utility Access: Utilize cryptocurrencies for their intended purposes, including payments, smart contract interactions, NFT purchases, or gaming applications.

Lower Risk Profile

Compared to leveraged trading methods, spot trading presents more manageable risk characteristics.

Limited Loss Exposure: Maximum potential loss is limited to your initial investment without liquidation risks or margin call obligations.

No Leverage Risks: Absence of borrowed funds eliminates risks of amplified losses, forced liquidation, or owing money beyond initial investment amounts.

Transparent Pricing: Spot prices reflect actual market values without funding rate complications or derivative premium/discount considerations.

Disadvantages and Limitations of Spot Trading

While spot trading offers many advantages, it also presents certain limitations that traders should understand.

Capital Requirements

Spot trading requires sufficient capital to take meaningful positions without leverage amplification.

Full Capital Commitment: Each trade requires complete purchase amount upfront, potentially limiting position sizes for smaller accounts.

Limited Profit Amplification: Without leverage, profit potential is directly proportional to capital invested and percentage price movements.

Market Volatility Exposure

Direct ownership means full exposure to cryptocurrency price volatility without hedging mechanisms.

Price Risk: Cryptocurrencies experience significant price swings that can result in substantial losses during adverse market conditions.

No Short Selling: Traditional spot trading doesn’t allow profiting from declining prices without first owning the assets to sell.

Emotional Trading Risk: Direct ownership can lead to emotional decision-making during volatile periods, potentially resulting in poor timing of entries and exits.

Spot Trading Strategies for Different Goals

Various trading strategies can be implemented through spot trading to achieve different investment objectives and time horizons.

Buy and Hold Strategy

Long-term investment approach focusing on cryptocurrency appreciation over extended periods.

Long-Term Perspective: Purchase cryptocurrencies with strong fundamental prospects and hold them through market cycles to capture long-term growth trends.

Dollar-Cost Averaging: Make regular purchases regardless of price to reduce average cost basis over time and minimize timing risk impacts.

Portfolio Diversification: Spread investments across multiple cryptocurrencies to reduce concentration risk and capture growth from different blockchain ecosystems.

Day Trading Approach

Short-term strategy attempting to profit from intraday price movements through frequent buying and selling.

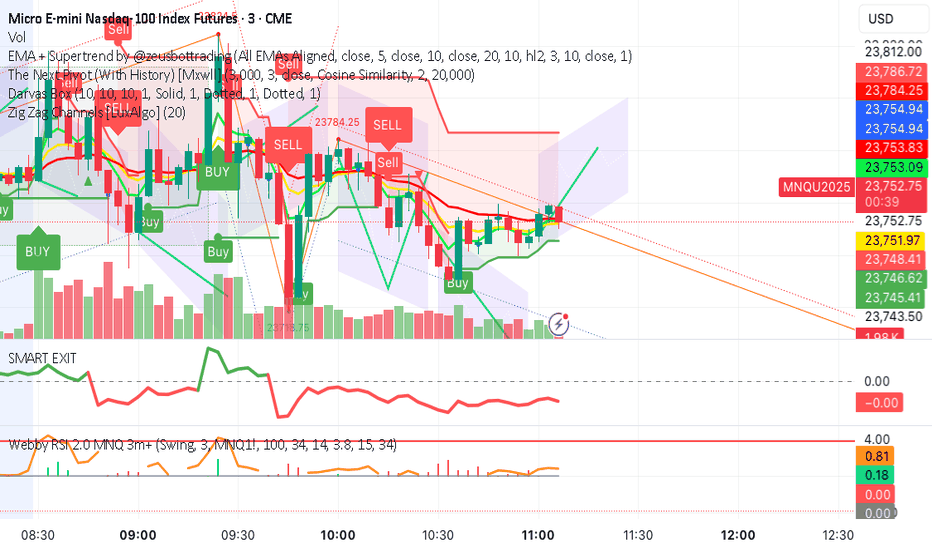

Technical Analysis Focus: Use chart patterns, technical indicators, and volume analysis to identify short-term price movement opportunities.

High-Activity Requirements: Monitor markets continuously throughout trading sessions to identify and act on brief profit opportunities.

Risk Management Discipline: Implement strict stop-loss orders and position sizing rules to limit losses from unsuccessful trades.

Swing Trading Strategy

Medium-term approach capturing price swings over days to weeks through market cycle analysis.

Trend Following: Identify and follow established price trends while avoiding market noise and minor fluctuations.

Support and Resistance: Use key price levels to time entries and exits based on expected price reactions at significant technical levels.

Fundamental Analysis Integration: Combine technical analysis with fundamental developments to identify swing trading opportunities aligned with longer-term trends.

Risk Management in Spot Trading

Effective risk management protects capital and enables sustainable trading success across different market conditions.

Position Sizing Strategies

Proper position sizing prevents excessive losses from individual trades while maintaining portfolio balance.

Percentage-Based Sizing: Limit individual trades to specific percentages of total portfolio value (commonly 1-5%) to prevent single-trade disasters.

Risk-Reward Analysis: Evaluate potential profit relative to potential loss before entering positions, targeting ratios of at least 2:1 or 3:1.

Diversification Principles: Spread investments across different cryptocurrencies, sectors, and strategies to reduce correlation risk and improve overall portfolio stability.

Stop-Loss Implementation

Strategic use of stop-loss orders limits downside exposure while allowing upside participation.

Technical Stop Levels: Place stop-loss orders below key support levels or at predetermined percentage losses to exit positions when technical conditions deteriorate.

Trailing Stops: Use trailing stop orders to lock in profits as positions move favorably while providing downside protection if trends reverse.

Position Scaling: Reduce position sizes as losses accumulate to preserve capital for future opportunities.

Market Analysis and Research

Thorough analysis improves trading decisions and reduces unnecessary risk exposure.

Fundamental Research: Study cryptocurrency projects, development progress, adoption metrics, and competitive positioning to make informed investment decisions.

Technical Analysis: Use price charts, volume patterns, and technical indicators to identify optimal entry and exit points.

News and Sentiment Monitoring: Stay informed about regulatory developments, partnership announcements, and market sentiment shifts that could impact prices.

Choosing the Right Spot Trading Platform

Platform selection significantly impacts trading experience, costs, and available features for spot trading activities.

Key Selection Criteria

Several factors determine which cryptocurrency exchange best suits your spot trading needs.

Security Standards: Prioritize exchanges with strong security records, cold storage practices, insurance coverage, and regulatory compliance.

Trading Fees: Compare maker-taker fee structures, volume discounts, and additional costs like withdrawal fees to minimize trading expenses.

Available Assets: Ensure the platform supports cryptocurrencies you want to trade with sufficient liquidity for smooth execution.

User Interface: Choose platforms with intuitive interfaces matching your experience level and trading style preferences.

Platform Comparison

Leading cryptocurrency exchanges offer different advantages for spot trading activities.

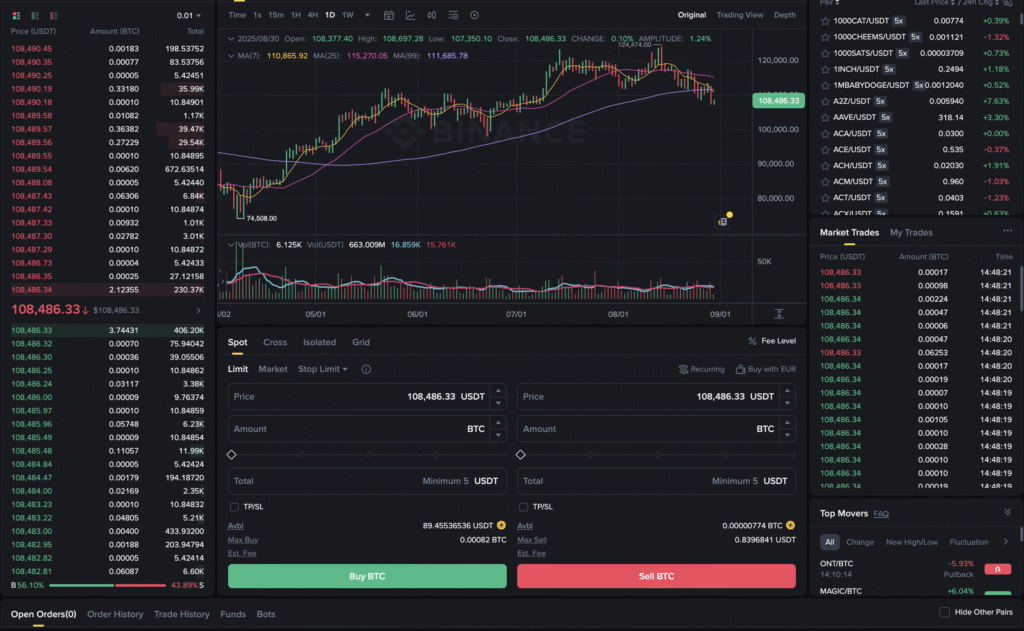

Binance: Largest global exchange with over 600 cryptocurrencies, competitive fees starting at 0.1%, and comprehensive trading tools including advanced order types.

Coinbase: User-friendly platform prioritizing simplicity and regulatory compliance, ideal for beginners with higher fees but better customer support.

Bybit: Strong focus on derivatives but offers competitive spot trading with low fees and advanced features for experienced traders.

OKX: Comprehensive platform combining spot trading with Web3 features, offering good balance of tools and accessibility.

Advanced Spot Trading Techniques

Experienced traders can implement sophisticated strategies to enhance spot trading effectiveness and profitability.

Arbitrage Opportunities

Price differences between exchanges or trading pairs create profit opportunities for alert traders.

Exchange Arbitrage: Buy cryptocurrencies on exchanges with lower prices and sell on exchanges with higher prices, profiting from price discrepancies.

Triangular Arbitrage: Exploit price inefficiencies between three different cryptocurrency pairs to generate profits through circular trading.

Cross-Border Arbitrage: Take advantage of regional price differences due to local market conditions, regulations, or liquidity variations.

Portfolio Rebalancing

Systematic approach to maintaining desired asset allocation as market values change over time.

Threshold Rebalancing: Rebalance portfolios when asset allocations deviate beyond predetermined percentages from target weights.

Time-Based Rebalancing: Adjust portfolio compositions at regular intervals regardless of current allocations to maintain strategic positions.

Opportunistic Rebalancing: Combine systematic rebalancing with tactical adjustments based on market conditions and opportunities.

Market Making Strategies

Provide liquidity to markets by placing both buy and sell orders around current prices to profit from bid-ask spreads.

Grid Trading: Place multiple buy and sell orders at regular price intervals to profit from normal market fluctuations.

Mean Reversion: Trade against short-term price movements expecting prices to return to average levels over time.

Tax Implications of Spot Trading

Understanding tax obligations helps ensure compliance and optimize after-tax returns from spot trading activities.

Taxable Events

Most jurisdictions treat cryptocurrency trades as taxable events requiring reporting and potential tax payments.

Crypto-to-Fiat Sales: Converting cryptocurrencies to traditional currencies typically triggers capital gains or losses based on purchase and sale prices.

Crypto-to-Crypto Trades: Many tax authorities treat cryptocurrency exchanges as taxable events even without fiat currency involvement.

Record Keeping: Maintain detailed records of all transactions including dates, amounts, prices, and counterparties for accurate tax reporting.

Tax Optimization Strategies

Legal methods to minimize tax obligations while maintaining trading flexibility.

Long-Term Holding: Hold cryptocurrencies for over one year (in many jurisdictions) to qualify for preferential long-term capital gains tax rates.

Tax-Loss Harvesting: Realize losses to offset gains and reduce overall tax obligations while maintaining desired portfolio exposures.

Professional Consultation: Work with tax professionals familiar with cryptocurrency regulations in your jurisdiction to ensure compliance and optimization.

Common Spot Trading Mistakes to Avoid

Learning from common errors helps improve trading outcomes and avoid unnecessary losses.

Emotional Trading Errors

Psychological factors often lead to poor trading decisions and suboptimal outcomes.

FOMO Trading: Avoid making impulsive purchases during price rallies without proper analysis or risk management.

Panic Selling: Resist selling positions during temporary market downturns without considering long-term fundamentals or strategic objectives.

Overconfidence: Don’t increase position sizes or take excessive risks after successful trades without maintaining discipline.

Technical Mistakes

Operational errors can result in unexpected losses or missed opportunities.

Order Type Confusion: Understand different order types and their implications before placing trades to avoid unintended execution.

Fee Negligence: Consider trading fees and withdrawal costs in profit calculations to maintain realistic return expectations.

Security Lapses: Use proper security measures including two-factor authentication and secure password practices to protect accounts.

Future of Spot Trading

The spot trading landscape continues evolving with technological advances and regulatory developments shaping its future direction.

Technological Improvements

Innovation drives enhanced trading experiences and new opportunities for spot traders.

Faster Settlement: Blockchain improvements and layer-2 solutions enable near-instantaneous settlement with reduced costs.

Enhanced Security: Advanced security measures including multi-signature wallets and insurance products provide better asset protection.

Improved Interfaces: Better user interfaces and mobile applications make spot trading more accessible to broader audiences.

Regulatory Evolution

Clearer regulations provide better framework for spot trading activities and investor protection.

Compliance Standards: Standardized regulatory frameworks improve investor confidence and institutional participation.

Consumer Protection: Enhanced consumer protection measures reduce fraud risks and improve market integrity.

Tax Clarity: Clearer tax guidance helps traders understand obligations and optimize strategies within legal boundaries.

Getting Started: Your First Spot Trade

Practical guidance for executing your first spot trade safely and effectively.

Preparation Steps

Proper preparation increases chances of successful trading outcomes and positive learning experiences.

Education First: Learn basic cryptocurrency concepts, trading terminology, and platform functionality before risking capital.

Start Small: Begin with small amounts you can afford to lose while learning market dynamics and platform operations.

Practice Account: Use demo accounts or paper trading features to practice without financial risk before live trading.

Execution Checklist

Follow systematic approach to ensure proper trade execution and risk management.

Market Research: Analyze chosen cryptocurrency’s fundamentals, technical outlook, and current market conditions.

Risk Assessment: Determine position size based on risk tolerance and portfolio management principles.

Order Placement: Choose appropriate order type based on market conditions and trading objectives.

Monitoring Plan: Establish plans for monitoring positions and taking profits or cutting losses as needed.

Conclusion

Spot trading represents the foundation of cryptocurrency trading, offering direct asset ownership with transparent pricing and immediate settlement. Its simplicity makes it ideal for beginners while remaining essential for experienced traders implementing various investment strategies.

The key to successful spot trading lies in understanding market dynamics, implementing proper risk management, choosing appropriate platforms, and maintaining discipline in strategy execution. While spot trading offers lower risk compared to leveraged alternatives, it still requires careful analysis, strategic planning, and emotional control to achieve consistent success.

As the cryptocurrency market continues maturing with better regulation, improved technology, and increased institutional participation, spot trading will likely remain the primary method for most participants to access digital asset opportunities. Whether pursuing long-term investment goals or short-term trading profits, mastering spot trading fundamentals provides the foundation for cryptocurrency market success.

Ready to start spot trading? Learn more about choosing the right platform and developing comprehensive strategies in our complete crypto exchange guide to begin your cryptocurrency trading journey with confidence and knowledge.

Risk Disclaimer: Cryptocurrency trading involves significant risk and may result in substantial losses. Past performance does not guarantee future results. Only trade with funds you can afford to lose and conduct thorough research before making investment decisions.