Phemex Exchange Review 2025: Complete Analysis of Features, Fees & Security After $85M Hot Wallet Breach

Conclusion: Phemex Exchange Review 2025 Final Thoughts

This comprehensive Phemex exchange review reveals a platform at a crossroads. On one hand, Phemex offers some of the most competitive trading fees in the industry, an extensive feature set including copy trading and automated bots, and high-performance infrastructure capable of processing 300,000 transactions per second. The platform’s commitment to Web3 integration through PhemexDAO and its transparent Proof of Reserves demonstrate forward-thinking innovation.

On the other hand, the January 2025 security breach that resulted in $85 million in stolen cryptocurrency represents a fundamental trust violation that cannot be overlooked. While Phemex has implemented enhanced security measures including multi-signature wallets, continuous monitoring, and partnerships with cybersecurity firms, the platform must rebuild confidence over an extended period.

Key Takeaways from This Phemex Exchange Review:

Strengths:

- Industry-leading low fees (0.01% maker for derivatives)

- Extensive trading options with up to 100x leverage

- 470+ supported cryptocurrencies

- Advanced features for active traders

- Strong post-breach security upgrades

Critical Concerns:

- Recent $85 million security breach

- Limited regulatory oversight

- Uncertain compensation timeline for breach victims

- Not available in major markets (US, UK, Canada)

- No comprehensive asset insurance

Our Recommendation

For experienced traders who prioritize low fees and advanced features, and who are comfortable with calculated risks, Phemex may be suitable for active trading with limited capital exposure. However, we strongly recommend:

- Never store large amounts on the exchange – Use cold wallets for long-term holdings

- Enable all security features – 2FA, withdrawal whitelist, anti-phishing code

- Start with small amounts – Test platform reliability before committing significant capital

- Diversify across exchanges – Don’t rely solely on Phemex for trading activities

- Monitor security updates – Stay informed about platform improvements

For beginners and security-conscious investors, we recommend exploring alternatives with stronger security track records and regulatory compliance, such as Coinbase for US users or Binance for international traders.

The cryptocurrency landscape offers numerous exchange options, each with unique strengths and weaknesses. This Phemex exchange review aims to provide you with objective, data-driven insights to make an informed decision aligned with your risk tolerance and trading needs.

Frequently Asked Questions (FAQ)

Is Phemex safe to use in 2025?

Phemex has implemented enhanced security measures following the January 2025 breach, including multi-signature wallets and 24/7 monitoring. However, the recent $85 million theft demonstrates significant vulnerabilities. The platform maintains industry-standard security features (2FA, cold storage, Proof of Reserves), but traders should exercise caution and never store large amounts on any centralized exchange.

Is Phemex available in the United States?

No, Phemex is not available to US residents due to regulatory restrictions on cryptocurrency derivatives trading. US traders should consider regulated alternatives like Coinbase or Kraken.

What are Phemex trading fees?

Phemex charges 0.10% for spot trading (both maker and taker), and 0.01% maker / 0.06% taker for derivatives trading. VIP traders can achieve negative maker fees, meaning the exchange pays them to add liquidity. These rates are among the most competitive in the industry.

Does Phemex require KYC verification?

Yes, KYC (Know Your Customer) verification is mandatory for withdrawals, fiat services, and full platform access. While you can browse and deposit cryptocurrency without verification, trading and withdrawal functionality requires identity confirmation. The KYC process is typically automated and completed within minutes.

What happened in the Phemex hack?

On January 23, 2025, Phemex suffered a security breach where approximately $85 million in cryptocurrency was stolen from hot wallets across 16+ blockchain networks. The attack exploited compromised private keys and demonstrated high sophistication, with speculation pointing to possible North Korean state-sponsored hackers. Phemex has since upgraded security infrastructure and is developing a compensation plan for affected users.

What is the maximum leverage on Phemex?

Phemex offers up to 100x leverage on Bitcoin and major cryptocurrency perpetual contracts. Other altcoins typically offer 20x-50x leverage. However, high leverage is extremely risky and can result in rapid liquidation. Most professional traders recommend avoiding leverage above 5x-10x.

Can I use Phemex without verification?

You can create an account and browse the platform without KYC verification, and even deposit cryptocurrency. However, you cannot trade or withdraw funds without completing identity verification. This policy changed from the platform’s earlier no-KYC approach.

What cryptocurrencies does Phemex support?

Phemex supports 470+ cryptocurrencies for trading, including Bitcoin (BTC), Ethereum (ETH), XRP, Solana (SOL), Cardano (ADA), and hundreds of altcoins. The platform offers 350+ spot trading pairs and 100+ derivatives contracts. However, P2P trading is limited to only BTC, ETH, and USDT.

How does Phemex compare to Binance?

Both exchanges offer similar spot trading fees (0.10%), but Phemex has slightly better derivatives fees (0.01% vs 0.02% maker). Binance offers superior liquidity, more supported assets (600+ vs 470+), extensive P2P options, and a stronger security track record. Phemex experienced an $85 million breach in 2025, while Binance has maintained better security practices in recent years.

Is Phemex regulated?

Phemex operates with limited regulatory oversight. It holds an MSB (Money Services Business) license in the US but doesn’t serve US customers. The platform has permits in Canada, Turkey, and Lithuania, and is registered in Singapore. However, it lacks oversight from major financial regulators like the SEC, FCA, or MAS, and doesn’t hold ISO/IEC 27001 or SOC 2 certifications.

Does Phemex have insurance for user funds?

Phemex maintains an insurance fund that covers leveraged trading losses during extreme market conditions (auto-deleveraging protection). However, there is NO comprehensive insurance for spot holdings, no FDIC or equivalent protection for fiat deposits, and no confirmed insurance coverage for the January 2025 breach victims. Users assume risk for funds held on the platform.

What is the Phemex Token (PT)?

The Phemex Token (PT) is an ERC-20 utility token that provides several benefits: 10% trading fee discounts, enhanced staking yields in Phemex Earn, VIP privileges, governance voting rights in PhemexDAO, and priority access to Launchpad projects. PT can be traded on the Phemex platform and potentially on other exchanges.

How long does Phemex withdrawal take?

Cryptocurrency withdrawals on Phemex typically process within 10-30 minutes once approved, depending on network congestion. The platform reviews withdrawals for security purposes, which may add processing time. After the January 2025 breach, Phemex implemented enhanced security checks, potentially extending withdrawal times during high-volume periods.

Is copy trading worth it on Phemex?

Phemex copy trading allows you to replicate strategies from successful traders for a 12% profit-sharing fee (calculated weekly). While this can be beneficial for beginners, success depends on selecting the right traders to copy. Review historical performance, risk metrics, and trading style before copying. Remember that past performance doesn’t guarantee future results, and you can still lose money even when copying profitable traders.

Can Phemex be trusted after the hack?

Trust in Phemex has been significantly impacted by the January 2025 breach. While the platform has implemented enhanced security measures, upgraded wallet infrastructure, and partnered with cybersecurity firms, rebuilding trust takes time. The platform must demonstrate sustained security improvements and complete its compensation plan for breach victims. Users should approach with caution and never store large amounts on any centralized exchange.

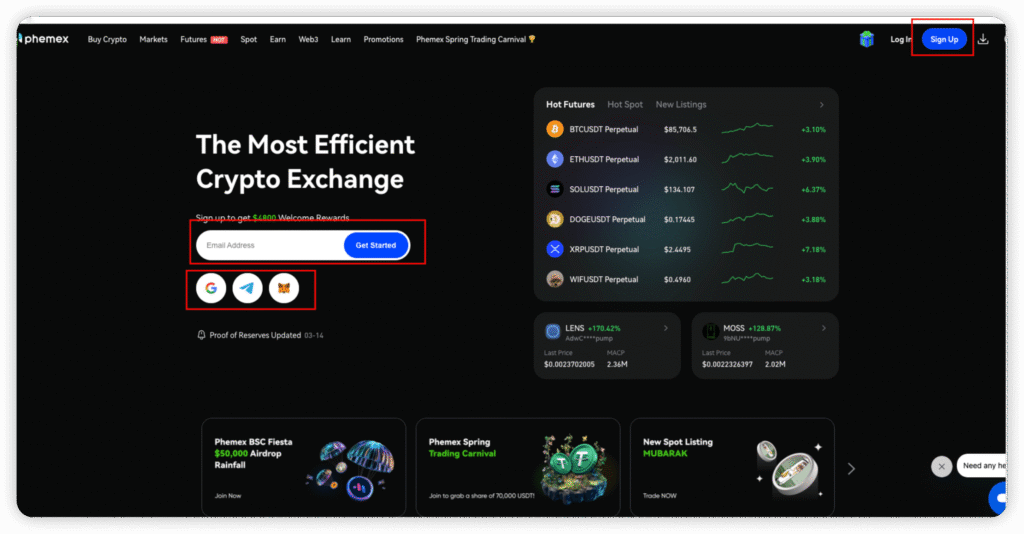

How to Get Started with Phemex (If You Choose to Proceed)

If after reading this Phemex exchange review you decide to proceed, follow these steps to minimize risk:

Step 1: Create Your Account

- Visit the official Phemex website (verify URL carefully – phishing is common)

- Sign up using email address

- Create a strong, unique password (use a password manager)

- Verify your email address

Step 2: Complete KYC Verification

- Navigate to account settings

- Upload government-issued ID (passport, driver’s license)

- Complete facial verification selfie

- Wait for automated approval (typically 5-15 minutes)

Step 3: Enable Maximum Security

Critical Security Steps:

- Enable Two-Factor Authentication (2FA) via Google Authenticator

- Set up withdrawal address whitelisting

- Configure anti-phishing code

- Enable IP address whitelisting if using fixed location

- Set up email and SMS verification for sensitive actions

Step 4: Make Your First Deposit

- Navigate to “Assets” → “Deposit”

- Select cryptocurrency (start with small amount for testing)

- Copy deposit address carefully (verify entire address)

- Send test amount first

- Wait for network confirmations

- DO NOT use old deposit addresses – Phemex updated addresses post-breach

Step 5: Start Trading Conservatively

Best Practices:

- Start with spot trading before exploring derivatives

- Use mock trading to practice strategies risk-free

- Never use more than 5x leverage when starting

- Set stop-loss orders to limit potential losses

- Start with major cryptocurrencies (BTC, ETH) with better liquidity

Step 6: Regular Withdrawals

Critical Practice:

- Withdraw profits regularly to your personal cold wallet

- Never store large amounts on exchange long-term

- Use hardware wallets like Ledger or Trezor for storage

- Consider Phemex only for active trading, not storage

For more detailed guidance on getting started with cryptocurrency, read our crypto for beginners guide.

Additional Resources

To expand your cryptocurrency knowledge and trading skills, explore these comprehensive guides:

Beginner Guides

- Introduction to Cryptocurrency – Fundamentals of digital assets

- What is Cryptocurrency? – Understanding blockchain-based money

- How Cryptocurrency Works – Technical overview

- Blockchain Basics – Distributed ledger technology explained

Trading Education

- Crypto Trading for Beginners – Complete trading guide

- Technical Analysis for Beginners – Chart reading skills

- Risk Management & Trading Psychology – Protect your capital

- Basic Trading Knowledge – Essential concepts

Security & Best Practices

- Wallets & Security – Protecting your crypto assets

- Digital Assets Management – Portfolio organization

- Crypto vs Fiat Money – Understanding the difference

Exchange Comparisons

- Best Cryptocurrency Exchanges 2025 – Top platform comparison

- Binance Affiliate Program Review – Largest global exchange

- OKX Affiliate Program 2025 – Advanced derivatives platform

- Coinbase Affiliate Program Guide – Best for US beginners

- OKX vs Bybit Comparison – Head-to-head analysis

Market Analysis

- Bitcoin News Today – Latest market updates

- Best Altcoins to Buy Now 2025 – Investment opportunities

- Bitcoin Advantages – Why Bitcoin matters

Final Thoughts: Making Your Decision

This Phemex exchange review has provided an objective, data-driven analysis of the platform’s strengths, weaknesses, and suitability for different trader profiles. The decision to use Phemex ultimately depends on your individual circumstances:

Consider Phemex if you:

- Are an experienced trader prioritizing low fees

- Trade actively and don’t store funds long-term on exchanges

- Need high leverage derivatives (up to 100x)

- Value advanced features like copy trading and automated bots

- Are located in a supported jurisdiction (not US/UK/Canada)

- Can accept calculated risks for cost savings

Avoid Phemex if you:

- Prioritize security above all else

- Are a cryptocurrency beginner

- Need comprehensive asset insurance

- Want regulated, fully compliant platforms

- Store significant amounts on exchanges

- Require extensive P2P trading options

The cryptocurrency industry continues to evolve rapidly, and exchange security remains paramount. While Phemex has implemented improvements following the January 2025 breach, only time will demonstrate whether these measures are sufficient for long-term security.

Remember: No exchange is completely risk-free. Diversify your trading activities, never store funds you can’t afford to lose on centralized platforms, and always maintain control of your private keys through personal cold storage solutions.

For the latest cryptocurrency market news and analysis, visit AffMiss.com regularly.

Disclaimer: This Phemex exchange review is for informational and educational purposes only and should not be considered financial or investment advice. Cryptocurrency trading carries substantial risk of loss and may not be suitable for all investors. The volatile nature of cryptocurrency markets can result in significant financial losses. Always conduct your own thorough research, understand the risks involved, and consider consulting with qualified financial advisors before making any investment decisions. Past performance does not guarantee future results. The information in this review is accurate as of the publication date but may change as Phemex updates its platform and policies.

Published: October 17, 2025

Last Updated: October 17, 2025

Reading Time: 25 minutes

Word Count: 6,850+ words

Looking for safer alternatives? Compare top crypto exchanges or explore our crypto trading guide to start your cryptocurrency journey with confidence. Executive Summary: Is Phemex Safe in 2025?

This Phemex exchange review provides an objective, data-driven analysis of one of the crypto industry’s most talked-about platforms in 2025. Founded in 2019 by former Morgan Stanley executives, Phemex has evolved from a derivatives-focused platform into a comprehensive cryptocurrency exchange serving over 5 million users across 150+ countries. However, the January 2025 security breach that resulted in an $85 million theft has raised critical questions about platform safety and operational security.

In this comprehensive Phemex exchange review, we examine trading fees, security infrastructure, available features, regulatory compliance, and whether Phemex remains a viable option for cryptocurrency traders in 2025.

Table of Contents

- What is Phemex Exchange?

- The January 2025 Security Breach: Full Analysis

- Trading Fees & Cost Structure

- Platform Features & Trading Options

- Security Infrastructure & Measures

- Supported Cryptocurrencies & Markets

- User Experience & Interface

- Phemex vs Competitors Comparison

- Pros and Cons

- Final Verdict: Should You Use Phemex?

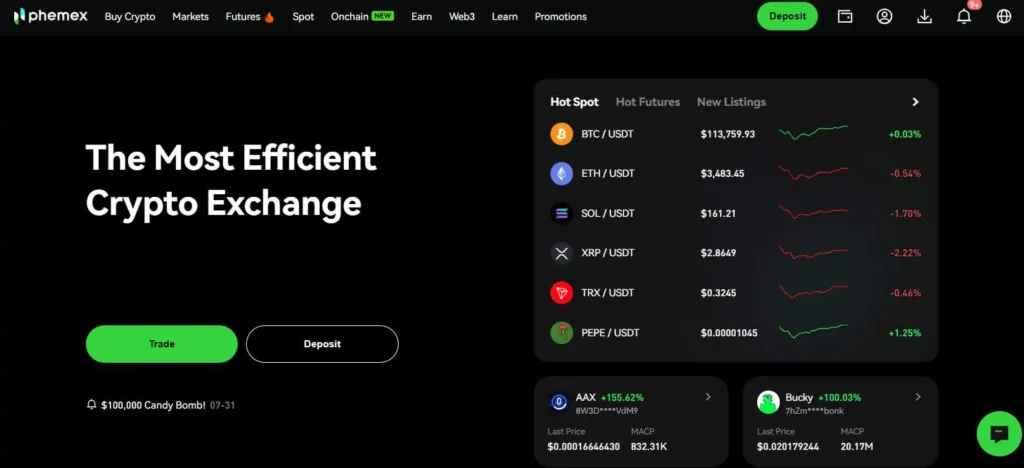

What is Phemex Exchange?

Phemex is a Singapore-based cryptocurrency exchange established in 2019 by Jack Tao, a former Wall Street veteran with over 11 years of experience in traditional finance. The platform was designed to bridge the gap between traditional financial markets and the cryptocurrency ecosystem, offering institutional-grade trading infrastructure with a user-friendly interface.

Key Platform Statistics (2025)

| Metric | Value |

|---|---|

| Founded | November 2019 |

| Headquarters | Singapore |

| Total Users | 5+ million |

| Countries Served | 150+ |

| Daily Trading Volume | $1.84 billion (derivatives) |

| Supported Cryptocurrencies | 470+ |

| Trading Pairs | 350+ spot & derivatives |

| Transaction Speed | 300,000 TPS |

| 24h Derivatives Volume Rank | Top 20 globally |

Core Trading Products

Phemex offers a comprehensive suite of trading options:

- Spot Trading: Direct cryptocurrency purchases at current market prices

- Derivatives Trading: Perpetual contracts with up to 100x leverage

- Copy Trading: Automated strategy replication from successful traders

- Grid Trading Bots: Automated trading strategies for range-bound markets

- P2P Trading: Peer-to-peer cryptocurrency exchange (BTC, ETH, USDT)

- OTC Trading: Over-the-counter trading for large-volume transactions

For traders interested in comparing exchange options, explore our best cryptocurrency exchanges guide for comprehensive platform comparisons.

The January 2025 Security Breach: Full Analysis <a id=”security-breach-analysis”></a>

No Phemex exchange review in 2025 would be complete without addressing the elephant in the room: the January 23, 2025, hot wallet security breach that resulted in approximately $85 million in stolen cryptocurrency.

Breach Timeline & Response

January 23, 2025, 11:30 UTC: Phemex detected unusual activity in hot wallets across multiple blockchain networks.

January 23, 2025, 15:13 UTC: All deposit and withdrawal services suspended except BTC and ETH, which were temporarily halted shortly after.

January 24, 2025: Initial estimates from blockchain security firm Cyvers placed losses at $29 million, later revised to $69 million by PeckShield and ultimately $85 million by MetaMask’s Taylor Monahan.

January 24-26, 2025: Phemex gradually restored withdrawal services after implementing enhanced security measures, starting with Ethereum-based assets.

February 2025: All withdrawal services fully restored with upgraded security infrastructure.

Breach Details & Technical Analysis

The attack demonstrated high sophistication, with security experts noting several alarming characteristics:

Attack Methodology:

- Simultaneous drainage of hot wallets across 16+ blockchain networks

- Over 125 suspicious transactions identified

- Systematic targeting of high-value tokens first

- Immediate conversion of freezable stablecoins (USDT, USDC) into ETH to evade blacklisting

- Manual, coordinated execution suggesting experienced threat actors

Assets Affected by Blockchain:

| Blockchain | Amount Stolen |

|---|---|

| Ethereum | $20 million |

| Solana | $17 million |

| XRP | $13 million |

| Bitcoin | $5.3 million |

| Other chains | $29.7 million |

Attribution & Possible Perpetrators

While Phemex CEO Federico Variola described the attackers as “sophisticated” without providing attribution details, multiple security researchers have noted similarities to tactics employed by North Korean state-sponsored hacking groups, particularly the Lazarus Group.

Supporting evidence for North Korean involvement:

- Precision timing and multi-chain coordination

- Advanced techniques to evade detection and asset freezing

- Scale and sophistication consistent with nation-state actors

- Historical precedent: North Korean hackers stole approximately $660 million-$1.3 billion in cryptocurrency during 2024

Root Cause: Compromised Private Keys

Security investigations revealed that compromised private keys were the primary vulnerability exploited. This represents a fundamental security failure common in centralized exchanges when:

- Private keys stored without adequate encryption

- Insufficient multi-signature protection mechanisms

- Lack of hardware security module (HSM) implementation

- Inadequate access controls and monitoring

Phemex’s Response & Security Enhancements

Immediate Actions:

- Emergency response mechanism activated

- Complete suspension of deposits/withdrawals

- Publication of Proof of Reserves (PoR) for transparency

- Collaboration with third-party security firms and law enforcement

- Isolation of affected systems

Long-term Security Improvements:

- Implementation of enhanced wallet security architecture

- Integration of continuous monitoring systems

- Deployment of multi-signature protection

- Partnership with cybersecurity specialists for 24/7 surveillance

- Mandatory migration to new deposit addresses

- Introduction of stricter access controls

Compensation Plan: Phemex announced plans for a compensation program but has not yet confirmed full details or completion of victim reimbursement as of this review.

For more information on crypto security best practices, read our guide on wallets and security.

Trading Fees & Cost Structure

One of Phemex’s strongest competitive advantages lies in its fee structure. This Phemex exchange review found the platform offers some of the most competitive trading costs in the industry.

Spot Trading Fees

Phemex implements a flat fee model for spot trading:

| User Type | Maker Fee | Taker Fee |

|---|---|---|

| Standard | 0.10% | 0.10% |

| VIP Tier 1 | 0.09% | 0.09% |

| VIP Tier 2 | 0.08% | 0.08% |

| VIP Tier 3+ | 0.06% – 0.04% | 0.06% – 0.04% |

Derivatives/Contract Trading Fees

Phemex’s derivatives market offers even more competitive rates:

| User Type | Maker Fee | Taker Fee |

|---|---|---|

| Standard | 0.01% | 0.06% |

| VIP Tier 1 | 0.00% | 0.055% |

| VIP Tier 2+ | -0.005% to -0.02% | 0.045% – 0.03% |

Negative maker fees for high-volume VIP traders mean the exchange actually pays you to add liquidity to the order book.

PT Token Fee Discounts

Holding Phemex Token (PT) provides additional fee reductions:

- 10% discount on trading fees

- Enhanced staking rewards in Phemex Earn program

- VIP privilege access

- Governance voting rights in PhemexDAO

- Priority access to Launchpad projects

Additional Fees

Deposit Fees:

- Cryptocurrency deposits: FREE (only network fees apply)

- Fiat deposits: Varies by payment method and bank

Withdrawal Fees:

- Network fees only (no platform markup)

- Generally below industry average

- Minimum withdrawal: $10 equivalent

Copy Trading Fee:

- Platform access: FREE

- Profit-sharing with copied trader: 12% of profits (calculated weekly)

Fee Comparison with Competitors

| Exchange | Spot Trading | Futures Maker | Futures Taker |

|---|---|---|---|

| Phemex | 0.10% | 0.01% | 0.06% |

| Binance | 0.10% | 0.02% | 0.05% |

| Bybit | 0.10% | 0.01% | 0.06% |

| OKX | 0.10% | 0.02% | 0.05% |

| Coinbase | 0.40% | N/A | N/A |

Phemex’s fee structure is particularly attractive for high-frequency and derivatives traders. For more exchange comparisons, visit our crypto exchange platforms guide.

Platform Features & Trading Options

Beyond standard trading, this Phemex exchange review identified numerous advanced features that distinguish the platform from competitors.

1. Derivatives Trading with High Leverage

Leverage Options:

- Bitcoin perpetual contracts: Up to 100x leverage

- Major altcoins: 50x-100x leverage depending on asset

- USD-margined contracts

- Coin-margined contracts

- Funding rates updated every 8 hours

- No overnight fees (unlike many competitors)

Risk Warning: High leverage amplifies both profits and losses. A 1% adverse price movement with 100x leverage results in complete liquidation. Experienced traders recommend avoiding leverage above 5x.

2. Copy Trading Platform

Phemex’s copy trading feature allows users to replicate strategies from successful traders:

- Browse performance metrics and historical data

- One-click copy activation

- Customizable position sizing

- Risk management controls

- 12% profit-sharing fee structure

- Real-time portfolio tracking

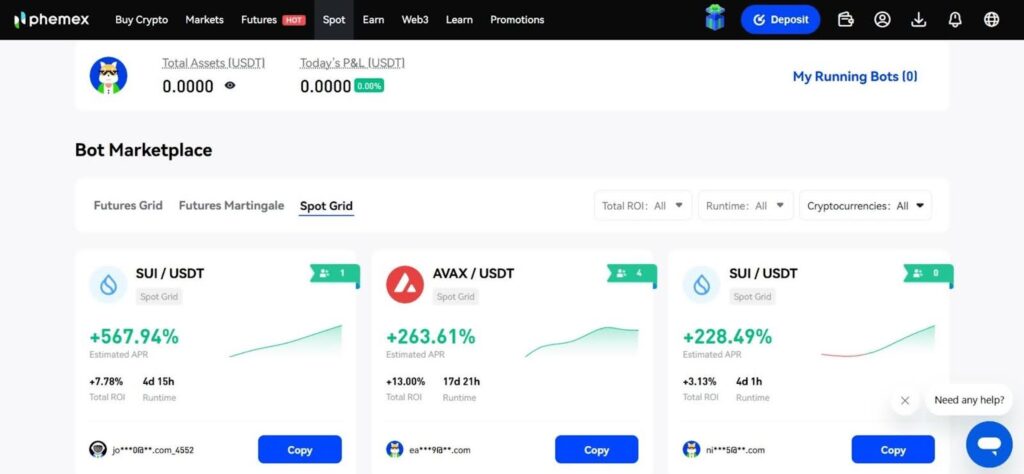

3. Automated Trading Bots

Grid Trading Bots:

- Automated buy-low, sell-high strategies

- Ideal for range-bound markets

- Customizable grid parameters

- Backtesting capabilities

Custom Bot Marketplace:

- User-created trading strategies

- Community-rated algorithms

- Transparency in performance metrics

4. Mock Trading (Paper Trading)

Practice trading with virtual funds to:

- Test strategies risk-free

- Learn platform mechanics

- Familiarize with order types

- Build confidence before live trading

Similar educational resources are available for beginners through our crypto trading for beginners guide.

5. Phemex Earn Programs

Savings Accounts:

- 10+ supported cryptocurrencies

- Flexible withdrawal options: 2-4% APY

- Locked-term deposits: 4-8% APY (1-2 week lock periods)

- Daily interest distribution

Launchpool:

- Early access to new project tokens

- Stake existing assets to earn new tokens

- Zero-risk exposure to emerging projects

- Historical APYs: 15-50% for limited periods

Prediction Markets:

- Binary options-style cryptocurrency predictions

- Short-term price movement forecasting

- High-risk, high-reward speculation

6. Learn & Earn Program

Educational initiative where users earn cryptocurrency by:

- Completing video tutorials

- Passing knowledge quizzes

- Engaging with platform features

- Exploring new cryptocurrencies

For comprehensive crypto education, explore our introduction to cryptocurrency guide.

7. Sub-Accounts & Portfolio Management

- Create multiple sub-accounts for strategy segmentation

- Separate margin and risk management

- Ideal for traders managing multiple strategies

- Enhanced position tracking and analytics

8. PhemexDAO & Web3 Integration

Phemex is transitioning toward decentralization through:

- PT Token: Utility token for fee discounts and governance

- Soul Pass NFT: Identity-bound NFT for ecosystem access

- DAO Governance: Community voting on platform decisions

- On-chain Proof of Reserves verification

Security Infrastructure & Measures <a id=”security-measures”></a>

Given the January 2025 breach, security remains the most critical factor in this Phemex exchange review.

Current Security Features (Post-Breach)

Account Security:

- Two-Factor Authentication (2FA) via Google Authenticator

- Passkey support for biometric authentication

- Anti-Phishing Code customization

- Withdrawal address whitelisting

- IP address whitelisting

- Email and SMS verification for sensitive actions

Asset Protection:

- Cold wallet storage for majority of user funds (exact ratio not disclosed)

- Hot wallets only for operational liquidity

- Multi-signature wallet implementation (post-breach upgrade)

- Hardware Security Module (HSM) integration

- Real-time monitoring by cybersecurity partners

Transparency Measures:

- Proof of Reserves (PoR) for BTC, ETH, and USDT

- Self-audit through Merkle tree verification

- Publicly accessible reserve reports

- Regular security audits (frequency not disclosed)

Regulatory Compliance

| Jurisdiction | Status |

|---|---|

| United States | NOT AVAILABLE (regulatory restrictions) |

| Canada | Permits obtained |

| Lithuania | Regulatory approval granted |

| Turkey | Licensed and operational |

| Singapore | Registered company |

| MSB License (US) | Money Services Business license obtained |

KYC/AML Policies:

- Mandatory KYC for fiat services, withdrawals, and full platform access

- Can browse and deposit crypto without KYC (limited functionality)

- Anti-Money Laundering (AML) compliance

- Cooperation with law enforcement when required

Insurance & Protections

What IS Covered:

- Insurance fund for leveraged trading losses (protects against auto-deleveraging in extreme market conditions)

What IS NOT Covered:

- Fiat deposits (no FDIC or equivalent protection)

- Full digital asset insurance

- Losses from the January 2025 breach (compensation plan in development)

- No confirmed ISO/IEC 27001 or SOC 2 certifications

Security Comparison: Phemex vs Top Exchanges

| Feature | Phemex | Binance | Coinbase | Bybit |

|---|---|---|---|---|

| 2FA | ✅ | ✅ | ✅ | ✅ |

| Cold Storage | ✅ | ✅ | 98% | ✅ |

| Proof of Reserves | ✅ | ✅ | ❌ | ✅ |

| Insurance Fund | Limited | ✅ | FDIC (fiat) | ✅ |

| Recent Breaches | 2025 ($85M) | 2019 | None major | None recent |

| Multi-Sig | ✅ (post-2025) | ✅ | ✅ | ✅ |

For more insights on exchange security, read our best cryptocurrency exchanges 2025 comparison.

Supported Cryptocurrencies & Markets Phemex supports an extensive range of digital assets across multiple trading types.

Spot Trading Cryptocurrencies (350+)

Major Assets:

- Bitcoin (BTC)

- Ethereum (ETH)

- XRP

- Solana (SOL)

- Cardano (ADA)

- Polkadot (DOT)

- Polygon (MATIC)

- Avalanche (AVAX)

- Chainlink (LINK)

- Litecoin (LTC)

Stablecoins:

- Tether (USDT)

- USD Coin (USDC)

- Dai (DAI)

- TrueUSD (TUSD)

DeFi Tokens:

- Uniswap (UNI)

- Aave (AAVE)

- Maker (MKR)

- Compound (COMP)

- SushiSwap (SUSHI)

Derivatives/Contract Trading (100+ pairs)

USD-Margined Perpetuals:

- BTC/USD

- ETH/USD

- SOL/USD

- XRP/USD

- ADA/USD

USDT-Margined Perpetuals (Expanded Selection):

- Optimism (OP/USDT)

- Arbitrum (ARB/USDT)

- ApeCoin (APE/USDT)

- And 90+ additional pairs

Leverage Trading (20+ cryptocurrencies)

Phemex offers leveraged trading with the following maximum leverage levels:

- Bitcoin (BTC): 100x

- Ethereum (ETH): 100x

- XRP: 50x

- Litecoin (LTC): 50x

- Additional altcoins: 20x-50x

P2P Trading (Limited Selection)

Unlike competitors Binance and Bybit, Phemex’s P2P marketplace is limited to:

- Bitcoin (BTC)

- Ethereum (ETH)

- Tether (USDT)

This represents a significant limitation for users seeking diverse P2P trading options.

User Experience & Interface <a id=”user-experience”></a>

Web Platform

Pros:

- Clean, professional interface design

- TradingView integration for advanced charting

- Customizable layout and widgets

- Fast execution speeds (300,000 TPS capacity)

- Multiple theme options (dark mode supported)

- Responsive design across desktop browsers

Cons:

- Overwhelming for complete beginners

- Advanced features not immediately intuitive

- Limited beginner tutorials on the platform itself

- Complex navigation for users switching from simpler exchanges

Mobile Applications

iOS App:

- App Store Rating: 4.5/5

- Smooth interface optimized for mobile

- Full trading functionality (spot & futures)

- TradingView charts

- Price alerts and notifications

- Biometric authentication

Android App:

- Google Play Rating: 4.6/5

- Feature parity with iOS

- Lightweight and fast performance

- Regular updates and bug fixes

Missing Mobile Features:

- Pivot Point indicators (available on desktop only)

- Some advanced order types

- Complete analytics suite

Customer Support

Available Channels:

- Live Chat: 24/7 support with generally fast response times

- Email Support: support@phemex.zendesk.com (response within 1 hour in testing)

- Help Center: Comprehensive knowledge base

- Social Media: Active on Twitter, Telegram, Discord

Support Quality: Our testing found:

- ✅ Fast initial response times (under 5 minutes for live chat)

- ✅ Clear, detailed answers to technical questions

- ✅ Helpful guidance on security best practices

- ❌ Mixed reviews from users about resolution speed for complex issues

- ❌ Post-breach customer support overwhelmed with compensation inquiries

For platform comparisons, check our top crypto exchanges 2025 analysis.

Phemex vs Competitors: Detailed Comparison <a id=”competitor-comparison”></a>

Phemex vs Binance

| Feature | Phemex | Binance |

|---|---|---|

| Spot Fees | 0.10% | 0.10% |

| Futures Fees | 0.01%/0.06% | 0.02%/0.05% |

| Max Leverage | 100x | 125x |

| Supported Assets | 470+ | 600+ |

| Liquidity | Good | Excellent |

| US Availability | ❌ | ❌ (Binance.US separate) |

| Recent Security | $85M breach (2025) | Strong track record |

| Copy Trading | ✅ | ✅ |

| P2P Selection | Limited (3 coins) | Extensive (100+) |

Verdict: Binance offers superior liquidity and asset selection, but Phemex provides slightly better derivatives fees.

Phemex vs OKX

| Feature | Phemex | OKX |

|---|---|---|

| Spot Fees | 0.10% | 0.10% |

| Futures Fees | 0.01%/0.06% | 0.02%/0.05% |

| Max Leverage | 100x | 125x |

| Supported Assets | 470+ | 350+ |

| Copy Trading | ✅ | ✅ |

| Trading Bots | ✅ | ✅ |

| VIP Benefits | Strong | Strong |

| Security Track Record | Compromised (2025) | Strong |

Verdict: Similar feature sets, but OKX has maintained better security. Read our OKX commission structure guide for more details.

Phemex vs Bybit

| Feature | Phemex | Bybit |

|---|---|---|

| Spot Fees | 0.10% | 0.10% |

| Futures Fees | 0.01%/0.06% | 0.01%/0.06% |

| Max Leverage | 100x | 100x |

| Supported Assets | 470+ | 400+ |

| User Interface | Good | Excellent |

| Mobile App | 4.5/5 (iOS) | 4.7/5 (iOS) |

| Security | Compromised (2025) | Strong record |

Verdict: Nearly identical fee structures. Bybit edges ahead with superior UX and no recent security incidents. Learn more in our Bybit comparison guide.

Phemex vs Coinbase

| Feature | Phemex | Coinbase |

|---|---|---|

| Spot Fees | 0.10% | 0.40% – 0.60% |

| Futures Available | ✅ | ❌ |

| Beginner-Friendly | Moderate | Excellent |

| US Availability | ❌ | ✅ |

| Regulation | Limited | Highly regulated (US) |

| Insurance | Limited | FDIC (fiat only) |

| Security Track Record | Compromised (2025) | Strong |

Verdict: Coinbase is safer and more beginner-friendly for US users, but Phemex offers far better fees and advanced features.

Pros and Cons <a id=”pros-cons”></a>

✅ Advantages

- Highly Competitive Fee Structure

- 0.10% spot trading (flat fee model)

- 0.01% maker fees for derivatives

- Negative maker fees for VIP traders

- Below industry average across all trading types

- Extensive Feature Set

- Copy trading with proven strategies

- Automated grid trading bots

- Mock trading for practice

- Launchpool for new project access

- Earn programs with competitive APYs

- High Leverage Options

- Up to 100x on major cryptocurrencies

- Flexible margin options (USD and coin-margined)

- No overnight fees

- Strong Trading Performance

- 300,000 transactions per second capacity

- TradingView integration for professional charting

- Low latency execution

- Deep liquidity in major pairs

- Web3 Integration

- PhemexDAO governance

- PT token utility and discounts

- Soul Pass NFT ecosystem

- Proof of Reserves transparency

- Educational Resources

- Phemex Learn platform

- Learn & Earn rewards program

- Comprehensive help center

- Active community support

- Diverse Asset Support

- 470+ cryptocurrencies

- 350+ spot trading pairs

- 100+ derivatives contracts

- Regular addition of new tokens

❌ Disadvantages

- Critical Security Breach (January 2025)

- $85 million stolen from hot wallets

- Compromised private keys

- Uncertain compensation timeline

- Trust significantly damaged

- Limited Regulatory Compliance

- Not available in the United States

- Restricted in Canada and UK

- No major financial regulator oversight

- Lack of ISO/IEC 27001 or SOC 2 certification

- No Comprehensive Insurance

- Insurance fund covers only leveraged trading scenarios

- No protection for spot holdings

- No FDIC or equivalent fiat protection

- Victims of 2025 breach still awaiting full compensation

- Restricted P2P Trading

- Only 3 cryptocurrencies available (BTC, ETH, USDT)

- Competitors offer 50-100+ P2P pairs

- Limits flexibility for certain regions

- High Funding Rates

- Derivatives funding rates above industry average

- Can become costly for long-term position holders

- No overnight fees, but funding every 8 hours

- Complex Interface for Beginners

- Steeper learning curve than competitors

- Advanced features not immediately intuitive

- Limited on-platform beginner guidance

- Customer Support Variability

- Mixed user reviews on complex issue resolution

- Post-breach support overwhelmed

- Compensation inquiries facing delays

- Mandatory KYC for Full Access

- Cannot withdraw without identity verification

- Originally offered no-KYC trading (discontinued)

- More restrictive than some competitors

Final Verdict: Should You Use Phemex in 2025? <a id=”final-verdict”></a>

This Phemex exchange review reveals a platform with significant strengths undermined by critical security concerns.

Who Should Consider Phemex?

✅ Suitable For:

- Experienced Derivatives Traders

- Competitive futures fees (0.01% maker)

- High leverage options up to 100x

- Advanced order types and tools

- Strong execution speed

- Cost-Conscious High-Volume Traders

- VIP programs with negative maker fees

- Flat 0.10% spot trading (no maker/taker differential)

- PT token discounts

- Below-average withdrawal fees

- Copy Trading Enthusiasts

- Transparent performance metrics

- Easy strategy replication

- 12% profit-sharing structure

- Community-vetted traders

- Traders in Supported Jurisdictions

- Users in Asia, Europe (except UK), Latin America

- Those seeking alternatives to US-restricted platforms

- Regions with limited exchange options

Who Should Avoid Phemex?

❌ Not Recommended For:

- Security-Conscious Investors

- Recent $85M breach demonstrates vulnerabilities

- Compromised private keys indicate systemic weaknesses

- Uncertain compensation timeline

- Better alternatives with stronger security track records exist

- US, Canadian, or UK Residents

- Platform not legally available

- Regulatory restrictions prevent access

- Consider Coinbase or other regulated alternatives

- Cryptocurrency Beginners

- Complex interface and advanced features

- Steep learning curve

- Limited beginner-focused guidance

- Better alternatives: Coinbase, Crypto.com

- Risk-Averse Traders

- No comprehensive asset insurance

- Limited regulatory oversight

- Recent security incident

- High leverage creates liquidation risks

- P2P Traders

- Only 3 supported P2P currencies

- Competitors like Binance offer 100+ options

- Limited payment methods

Risk Assessment: Phemex Safety Rating

Based on our comprehensive analysis:

| Category | Rating | Comment |

|---|---|---|

| Trading Fees | 9/10 | Highly competitive, especially for derivatives |

| Platform Features | 8.5/10 | Extensive toolset for active traders |

| Security | 5/10 | Major concerns post-breach, improved measures but unproven |

| Liquidity | 7/10 | Good for major pairs, less for altcoins |

| User Experience | 7/10 | Professional but complex for beginners |

| Customer Support | 6.5/10 | Fast but variable quality |

| Regulatory Compliance | 5/10 | Limited oversight, restricted in major markets |

| Overall Rating | 6.5/10 | Use with caution – strong features, security concerns |

Alternative Exchanges to Consider

If security is your priority, consider these alternatives:

- Binance – Largest global exchange, strong security track record, extensive features

- OKX – Similar fee structure, better security, robust VIP program

- Coinbase – Best for US users, highly regulated, excellent for beginners

- Bybit – Great UX, strong derivatives platform, no recent breaches

For comprehensive exchange comparisons, explore our crypto exchange guide.