Margin Trading: Complete Guide for 2025

Updated on August 31, 2025 • Reading time: 14–18 minutes

Risk Notice: Margin trading uses borrowed funds and can lead to rapid losses, including liquidation. This article is education only, not financial advice.

What Is Margin Trading?

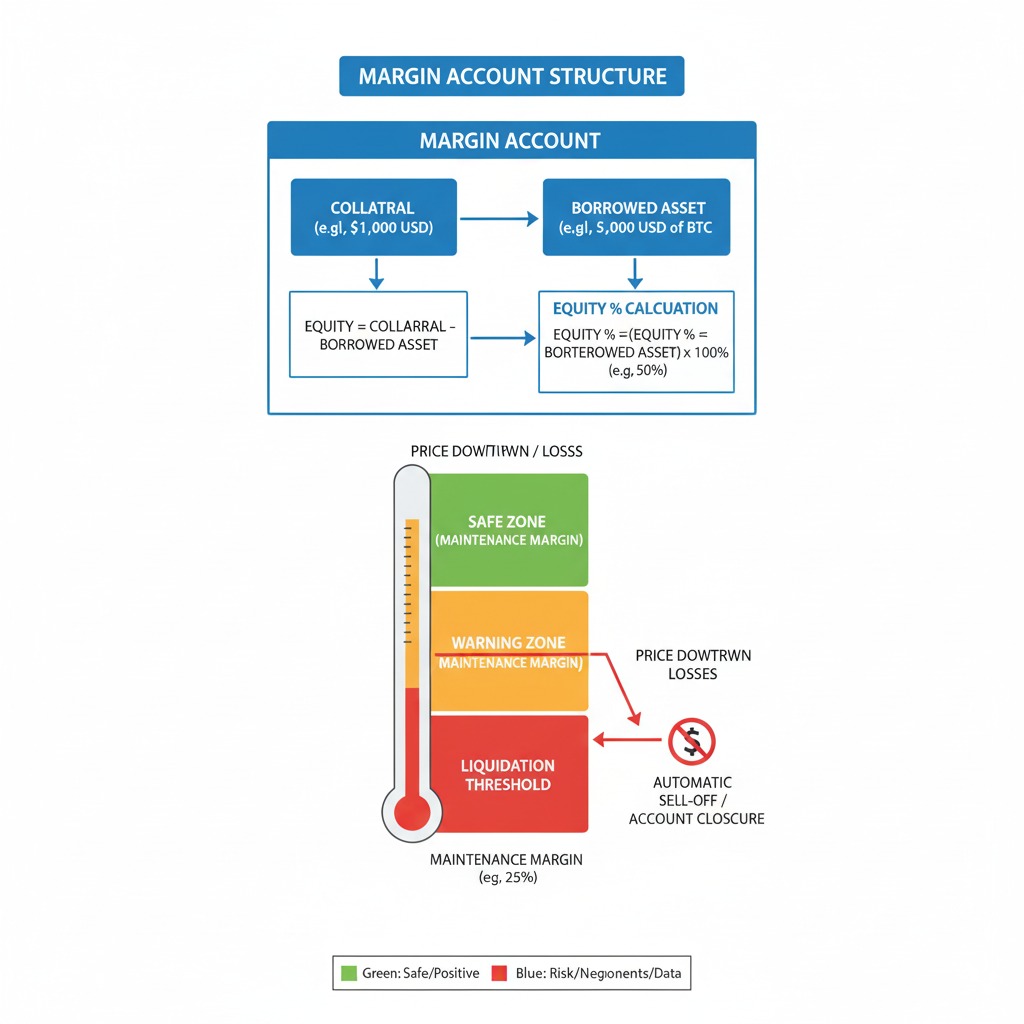

Margin trading allows you to borrow funds from an exchange to increase position size beyond your cash balance. You pay interest on borrowed assets and face margin calls and liquidation if equity falls below maintenance levels.

Unlike spot trading, margin adds borrowing costs and collateral requirements. Unlike futures trading, margin uses borrow/interest instead of funding rates on perpetual contracts.

How Margin Trading Works (Step by Step)

- Enable margin account on the exchange and complete required agreements.

- Transfer collateral (e.g., USDT, BTC) into the margin wallet.

- Borrow the asset or quote you need (based on pair and direction you intend to trade).

- Open position via limit/market orders. Your equity % moves with price.

- Monitor health: if equity approaches maintenance margin, reduce risk or add collateral.

- Repay loan + interest when closing the position.

Key Metrics

- Leverage: effective exposure ÷ equity; higher leverage increases liquidation risk.

- Maintenance margin: minimum equity to avoid liquidation.

- Equity %: (Assets − Liabilities) ÷ Assets; falling equity % triggers margin calls.

- Interest accrual: borrowing cost that compounds over time.

Cross vs. Isolated Margin

Cross margin shares equity across open positions; liquidation on one can impact the rest. Isolated margin confines risk to a single position with a fixed collateral amount. Beginners typically prefer isolated to keep failures contained.

| Aspect | Cross Margin | Isolated Margin |

|---|---|---|

| Collateral Pool | Shared across positions | Assigned to one position |

| Risk Containment | Lower (chain reaction) | Higher (ring-fenced) |

| Active Management | Requires constant monitoring | More predictable risk budget |

| Use Case | Advanced hedges, portfolio margin | Learning, strategy testing, strict risk caps |

Pros and Cons

Pros

- Capital efficiency: amplify position size with the same equity.

- Flexible direction: borrow asset/quote to go long or short pairs.

- Hedging: protect spot holdings during downtrends with tactical shorts.

Cons

- Interest cost: borrowing adds ongoing cost that reduces net returns.

- Liquidation risk: rapid moves can wipe equity when over-leveraged.

- Complexity: requires strict sizing, invalidation, and discipline.

Best Exchanges for Margin Trading

Prioritize deep liquidity, clear borrow/interest rules, strong risk engines, and security controls. Explore in-depth platform overviews:

- Binance Exchange Review — Start: Binance (ref)

- Bybit Exchange Features — Join: Bybit (ref)

- OKX Exchange Benefits — Join: OKX (ref)

- KuCoin — KuCoin (ref)

- Gate.io — Gate.io (ref)

- MEXC — MEXC (ref)

- Bitget — Bitget (ref)

- BingX — BingX (ref)

- WhiteBIT — WhiteBIT (ref)

See the cluster hub: Trading Features on Exchanges and related: Spot Trading, Futures Trading, Copy Trading.

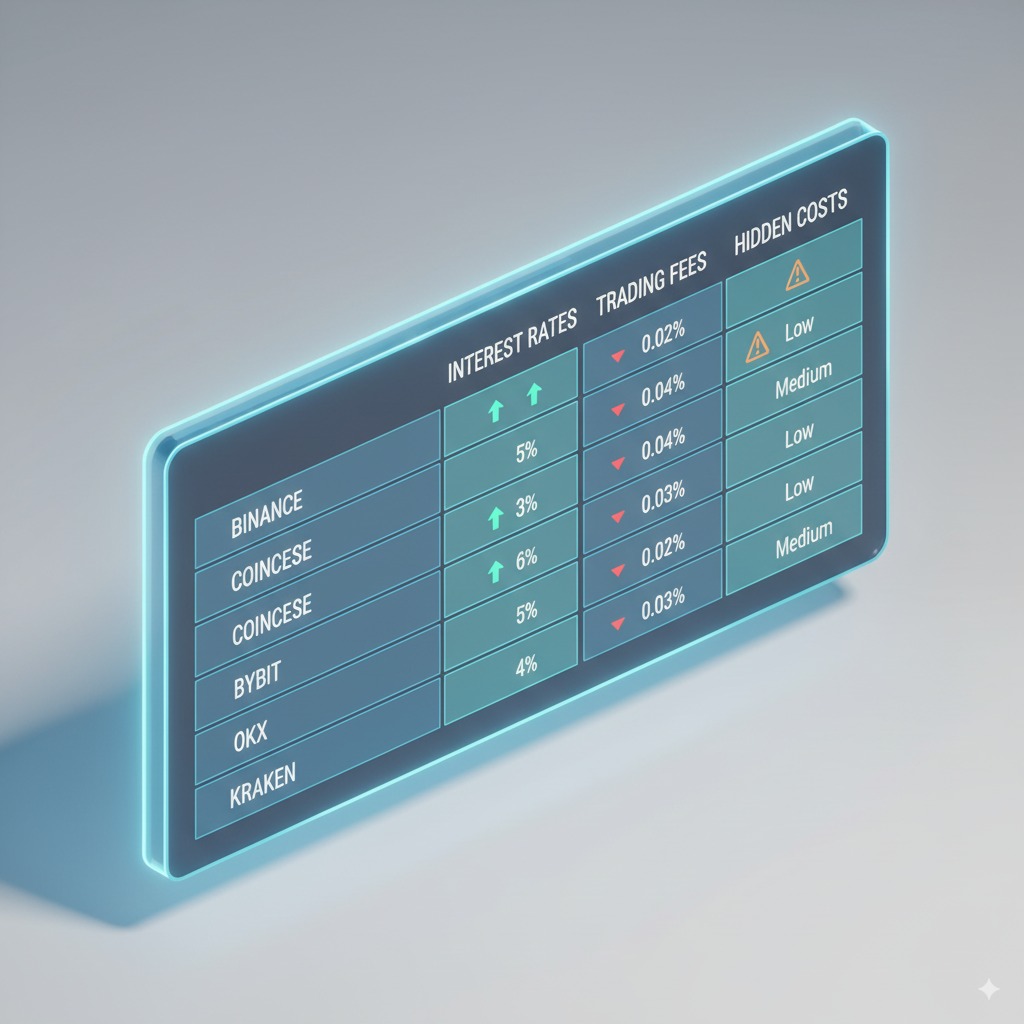

Fees: Trading, Interest, and Hidden Costs

Margin costs include trading fees (maker/taker), borrow interest on assets, and withdrawal/network fees. Some platforms offer VIP tiers or fee discounts (e.g., token holdings, volume).

| Exchange | Borrow Type | Interest Basis | Trading Fees (range) | Notes |

|---|---|---|---|---|

| Binance | Asset borrow per pair | Variable by asset/tier | Varies by tier | High liquidity; flexible repayment |

| Bybit | Unified or isolated borrow | Variable by asset/tier | Varies by tier | Portfolio margin options |

| OKX | Borrow via margin account | Variable by asset/tier | Varies by tier | Robust risk engine; cross-collateral |

Tip: Interest accrues continuously; long holds can become expensive. If the thesis changes or borrow cost rises, reduce size or exit proactively.

Core Strategies and Risk Controls

Position Sizing and Invalidation

Risk a small, fixed percentage of equity per trade (e.g., 0.5%–1%) and define invalidation before entry.

Position Size = (Equity × %Risk) / (Entry − Invalidation)Breakout/Retest Longs

- Wait for level reclaim and retest with tight invalidation.

- Prefer isolated margin to cap loss if the breakout fails.

- Avoid chasing; let price come to your level.

Mean-Reversion Shorts

- Fade extended moves into resistance with defined stop.

- Size down when volatility rises; interest still accrues.

- Manage adds cautiously; never average down blindly.

Hedging Spot Holdings

- Borrow asset to short when risk signals trigger (e.g., breakdowns).

- Hedge size reflects desired protection (partial vs. full); maintain a plan to lift the hedge.

- Track borrow availability/interest before holding overnight.

Risk Guardrails

- Prefer isolated margin until consistently profitable.

- Always use hard stops; never widen stops after entry.

- Set a max daily loss and stop trading when hit.

- Avoid correlated positions that amplify the same risk.

Common Risks and Mistakes

- Over-leverage: small moves can trigger liquidation cascades.

- No plan: entries without invalidation or take-profit logic.

- Ignoring interest: long holds bleed through borrow costs.

- Cross contagion: one bad trade drains the whole account.

- Revenge trading: emotional escalation after a loss.

Margin vs. Spot vs. Futures vs. Copy Trading

| Feature | Margin | Spot | Futures | Copy Trading |

|---|---|---|---|---|

| Leverage | Yes (via borrow) | No | Yes (contract leverage) | Indirect |

| Cost Model | Interest on borrowed assets | Trading + withdrawal fees | Trading fees + funding (perps) | Fees + leader fees (varies) |

| Liquidation | Equity below maintenance | None | Risk engine per contract | Depends on leader decisions |

| Complexity | Medium–High | Low | High | Low–Medium |

Learn basics first with Spot Trading, then compare with Futures Trading before choosing an approach.

Security, Compliance, and Availability

Choose platforms with strong custody and risk controls, and check derivative availability in your region. Use 2FA, anti-phishing codes, withdrawal allowlists, and device/security hygiene.

Related reads: Trading Features on Exchanges, Binance Review, Bybit Features, OKX Benefits.

Getting Started Safely

- Enable and secure margin: 2FA, allowlists, alerts on equity %.

- Fund collateral and test a small isolated position first.

- Define plan: setup, invalidation, % risk, max daily loss.

- Journal entries/exits and emotions; iterate weekly.

- Scale slowly after 20–30 logged trades with consistency.

Quick access:

- Binance (ref): Start on Binance

- Bybit (ref): Start on Bybit

- OKX (ref): Start on OKX

FAQs

Is Margin Trading Good for Beginners?

Short answer: It is risky. Beginners should master spot first, then start with tiny, isolated positions and hard stops.

Cross or Isolated — Which Should I Use?

Most learners choose isolated to ring-fence risk per position. Cross suits advanced hedging with rigorous monitoring.

How Much Leverage Is Reasonable?

Use the minimum leverage to express your edge. Many consistent traders focus on sizing and invalidation over high leverage.

Do I Pay Interest on Margin?

Yes. Borrowed assets accrue interest. Long holds can become expensive; include borrow cost in your PnL planning.

What Triggers Liquidation?

Liquidation occurs when equity falls below maintenance margin. Manage size, set hard stops, and avoid correlated bets.