7 Step Guide to Getting Started with How to trade options on Deribit

Published: December 21, 2022 | Category: Education

An option trading screen can be a little overwhelming for newer option traders. However, most of this is simply due to the sheer amount of information on display. Unlike with futures trading, the data for dozens of similar options is usually displayed on the page at the same time. Once you know where to look and click though, trading options becomes much simpler.

This step-by-step guide is aimed at breaking down the initial barrier of information overload. We will use a simple example to illustrate how to:

In this guide, we will cover the essential steps of How to trade options on Deribit to help you navigate the platform with ease.

- Navigate to the option page on Deribit

- Locate an option

- Open the order form for an option

- Trade an option

- View open option positions

And if after this guide you still aren’t sure how to place an option order, there are additional resources to help, including a test version of the site where you can test things out completely free without risking any real funds.

By following this comprehensive guide on How to trade options on Deribit, you’ll be well-equipped to start trading confidently.

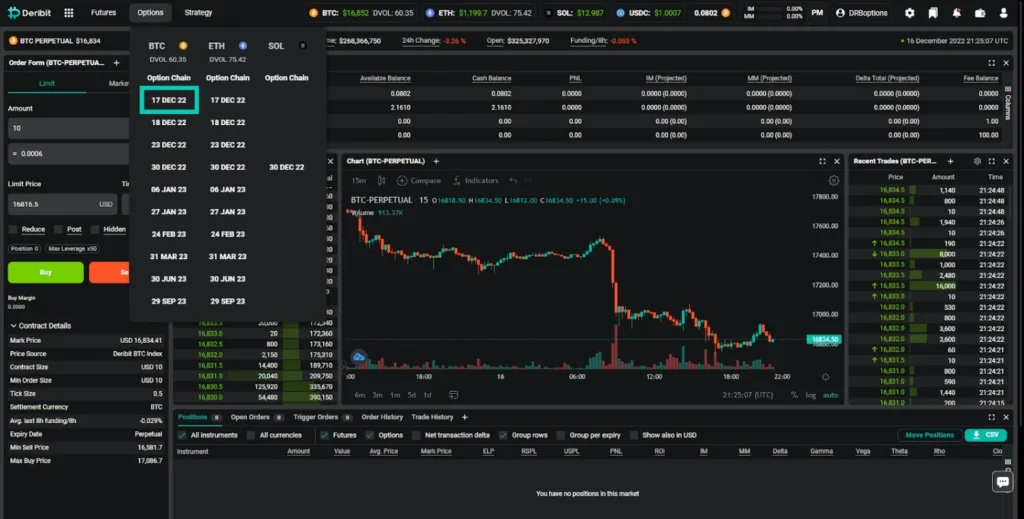

Step 1: Navigate to the Options Page

Once logged in to the Deribit website, navigate to the options page.

Go to Options in the top menu, then click on either Option Chain or a specific expiration date for the desired currency.

For example, if we want to look specifically at the BTC options that expire on 17th December 2022, we click here on 17 DEC 22 in the BTC column.

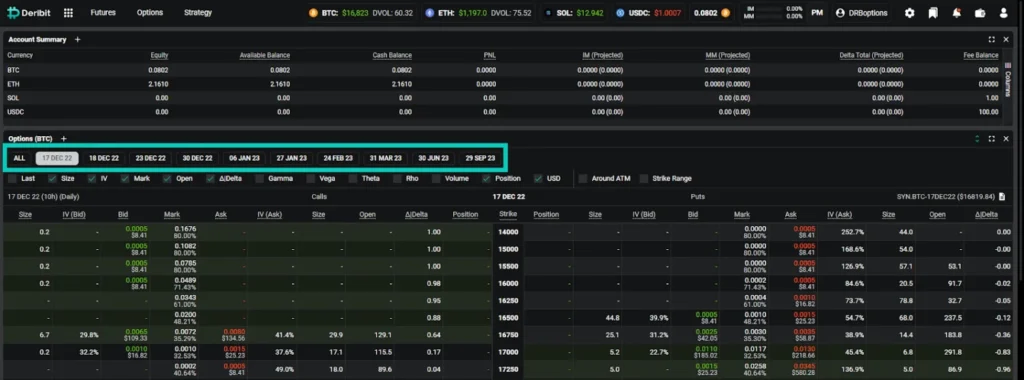

Understanding the Option Page

On the Option Page it is possible to show the entire option chain, or only show an individual expiry. This can be changed by selecting the desired view at the top of the chain.

Definition: The ‘option chain’ is a list of all available options for a particular asset, usually grouped by expiry date.

Step 2: Find the Option You Want to Trade

Options are displayed with the strike prices down the centre column, with call options to the left of this, and put options to the right of this.

Tip: If you are new to options and would like more information on the different types of option, and much more, check out the free Deribit option course.

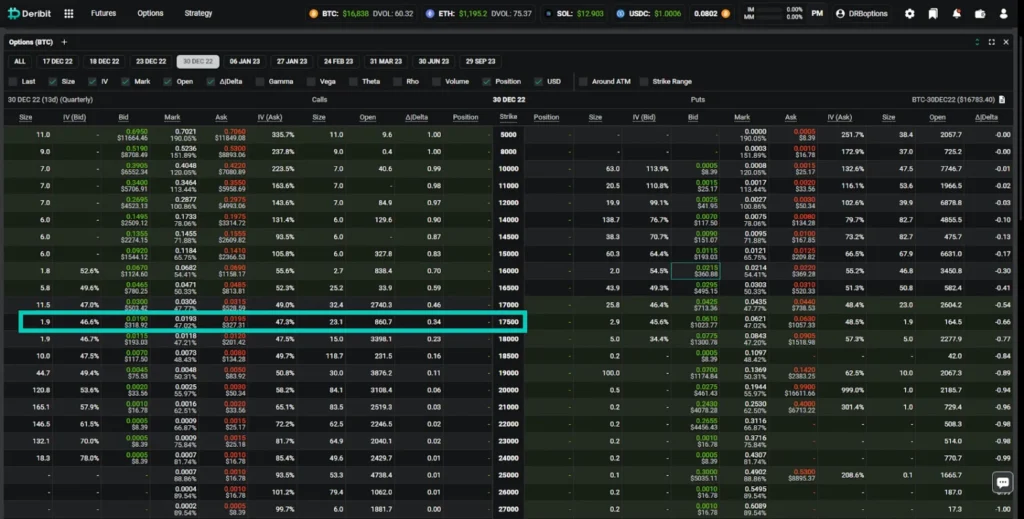

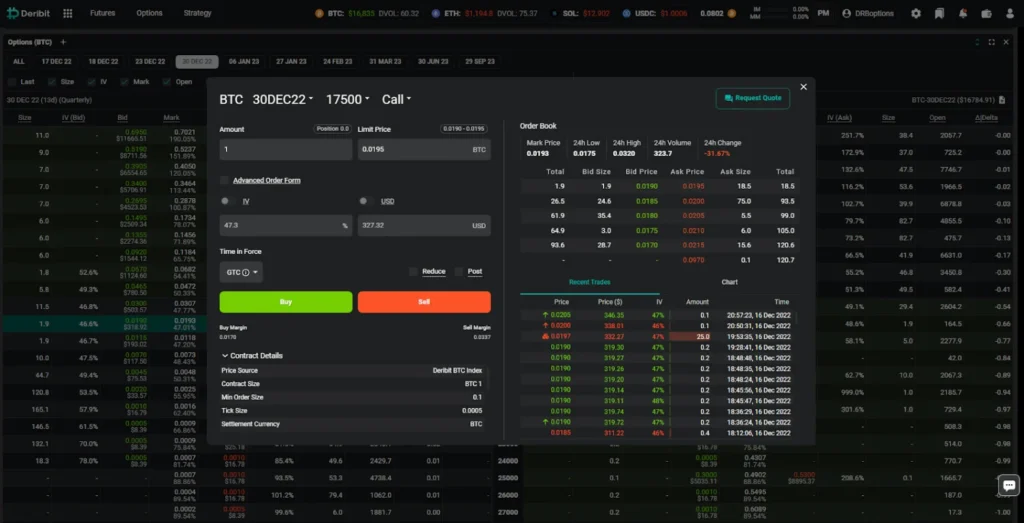

Example: Trading a Call Option

If we want to trade the $17,500 call option that expires on 30th December, we:

- Select the 30 DEC 22 expiry at the top of the option chain

- Find 17500 in the centre column

- Look left to the call option details

Remember: Call options are on the left, and put options are on the right.

Step 3: Open the Order Form for the Chosen Option

To open the order form for a particular option, click twice on that option in the option chain.

For more details on the Order Form functionality, you may refer to the Deribit documentation.https://www.deribit.com/?reg=17768.2670https://www.deribit.com/?reg=17768.2670

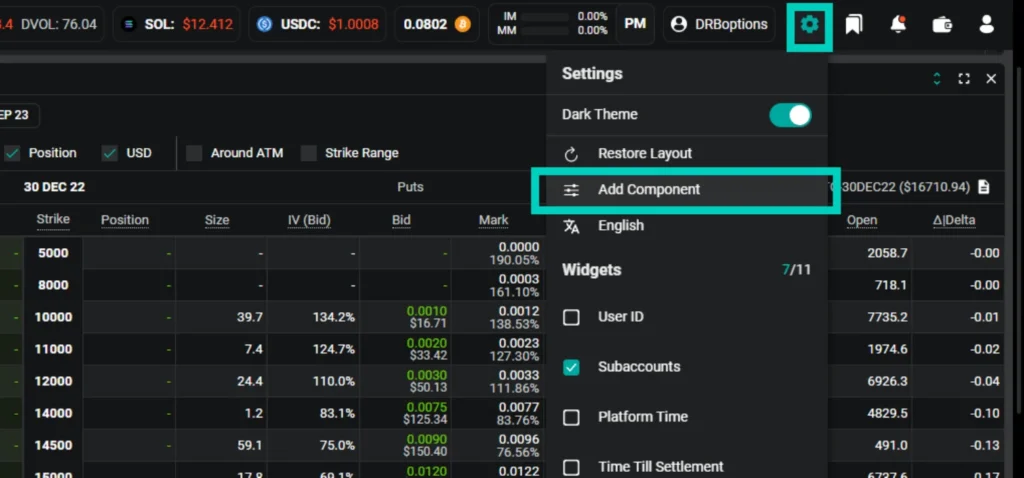

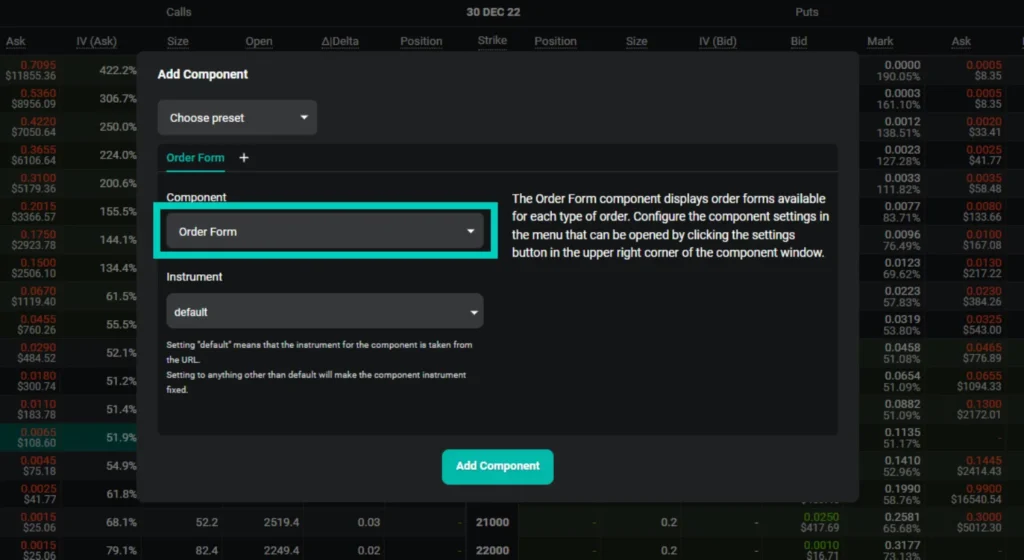

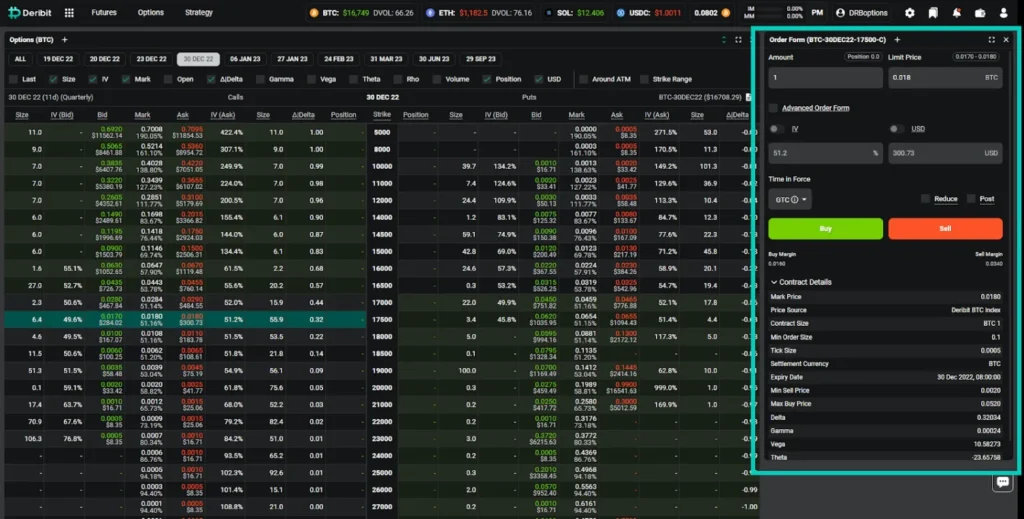

Step 3.b: Alternative Setup (Optional)

If you would prefer to have the order form always shown on the page for whichever option is selected, this can be done by adding the Order Form component to your layout.

To do this:

- Go to the cogwheel menu at the top of the page

- Click Add Component

- Select the Order Form component from the dropdown menu

- Click Add Component

The component can then be positioned in the layout according to personal preference, making your trading workflow more efficient.

Step 4: Enter the Order Details

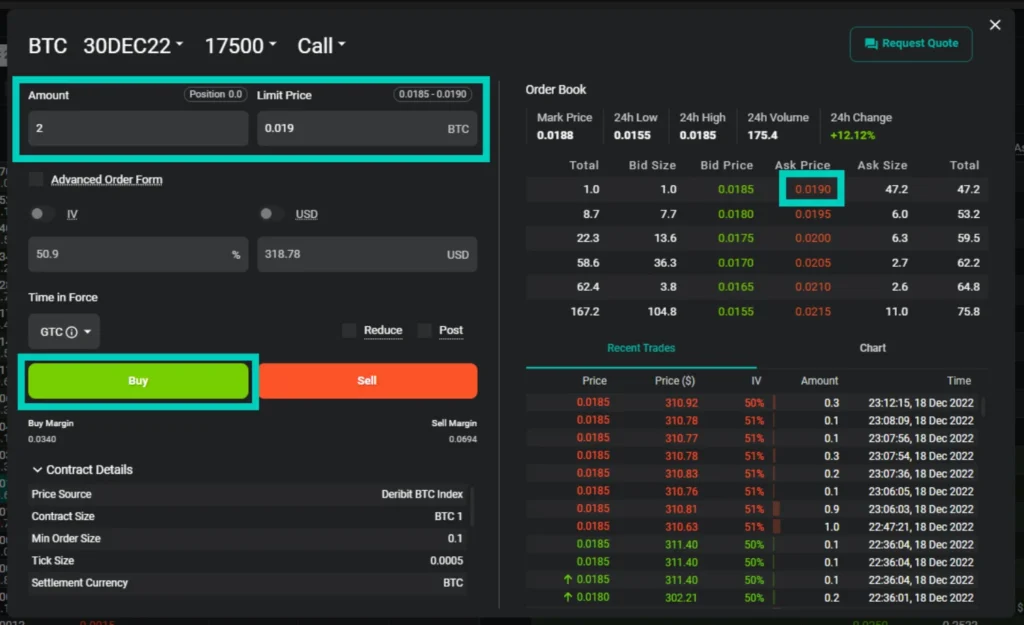

For example, we have chosen the option BTC-30DEC22-17500-C. This is a Bitcoin option that:

- Expires on 30th December 2022

- Has a strike price of $17,500

- Is a call option

Placing Your Order

If we want to buy two of these call options for a price of 0.019 each, we:

- Enter an Amount of 2

- Set a limit price of 0.019 BTC

In the order book on the right, we can see an existing order to sell this option at a price of 0.019, so our order to buy at 0.019 would execute immediately.

Step 5: Send the Order

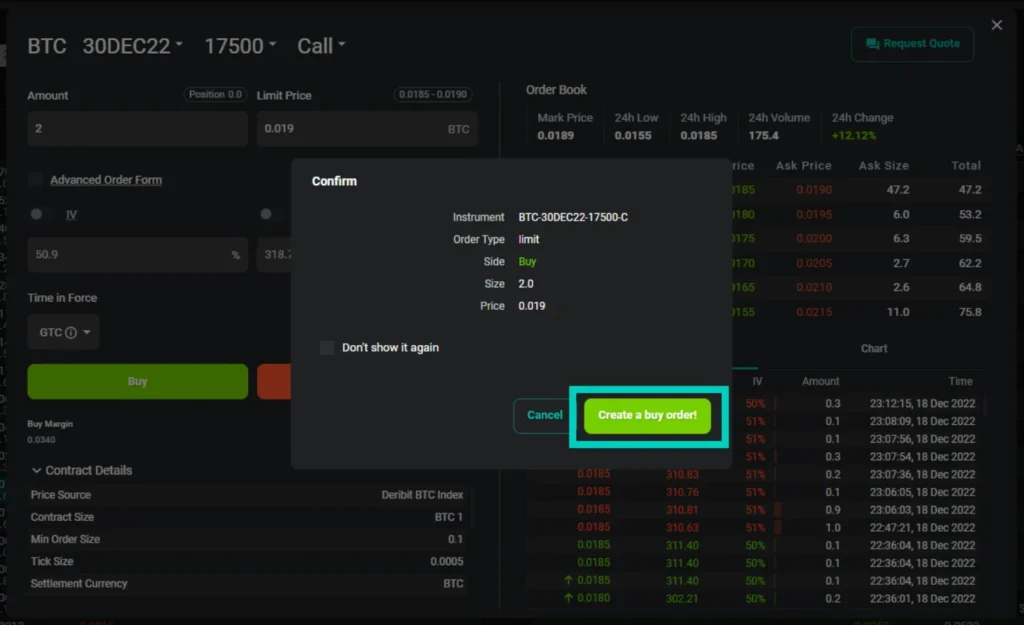

To place the order, click the Buy button. This will bring up the confirmation screen where the order details can be checked.

Confirming Your Order

The Size is shown as 2, and the Price is shown as 0.019. This price is per unit though. The total price paid would be the Size multiplied by the Price, which in this case is 0.038 BTC.

Once the details have been confirmed, click Create a buy order to send the order into the market.

Tip: The Deribit test site is an excellent place to practice placing orders first, without risking any real funds. The test site is free but requires a separate account and can be found at test.deribit.com.

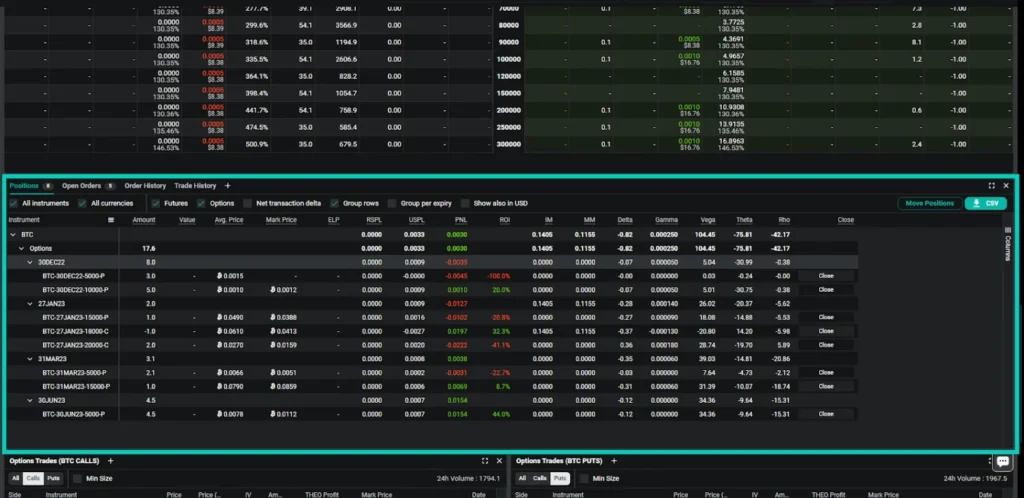

Step 6: Viewing Open Positions

All open positions can be viewed in the positions table on your Deribit dashboard.

This table displays:

- Active options positions

- Current profit/loss

- Position size

- Strike price and expiration

- Greeks (Delta, Gamma, Theta, Vega)

Monitoring your positions regularly is essential for effective risk management.

Step 7: Closing Positions

Options can be held to expiry. When held to expiry, any profit or loss will be paid automatically as soon as they expire.

Note: Options on Deribit are cash settled rather than physically settled. This means you receive the profit in BTC or ETH rather than the underlying asset itself.

Closing Positions Early

Alternatively, option positions can be closed early, before they expire. This can be done by either:

Method 1: Using the close button in the positions table

Method 2: Executing an opposing order in the same option

Examples:

- If a trader is long 2 contracts of Option A, this position would be closed by selling 2 contracts of Option A (reducing the position to zero)

- If a trader is short 5 contracts of Option B, this position would be closed by buying 5 contracts of Option B (reducing the position to zero)

Ready to Start Trading Options on Deribit?

Now that you understand the complete process of trading options on Deribit—from navigating the platform to placing orders and managing positions—you’re ready to begin your options trading journey.

Key Takeaways

✅ Options are organized in chains with calls on the left and puts on the right ✅ Double-click any option to open its order form ✅ Always verify order details before confirming ✅ Practice on the testnet before risking real funds ✅ Monitor positions regularly and understand when to close them

Next Steps

Start small: Begin with minimal position sizes to familiarize yourself with the platform mechanics and options behavior.

Use the testnet: Practice extensively on test.deribit.com with simulated funds before trading with real capital.

Continue learning: Explore Deribit’s free option course to deepen your understanding of options strategies and risk management.

Apply risk management: Never trade with funds you cannot afford to lose, and always understand your maximum risk before entering any position.

Begin Your Options Trading Journey Today

Deribit offers the most liquid cryptocurrency options market globally, with institutional-grade tools and competitive fees. Whether you’re hedging existing positions or implementing sophisticated trading strategies, Deribit provides the infrastructure you need.

Open Your Free Deribit Account Now →

Benefits of getting started:

- Access to the world’s leading crypto options platform

- Deep liquidity for efficient execution

- Competitive maker rebates and volume discounts

- Professional-grade trading tools and analytics

- Robust security with 95%+ cold storage

- Free testnet for risk-free practice

Don’t let the initial complexity hold you back. With this step-by-step guide and Deribit’s testnet environment, you can master options trading at your own pace without financial risk. Start your journey today and unlock the full potential of cryptocurrency derivatives.

Create Your Account & Start Trading →

Disclaimer: Options trading involves substantial risk and is not suitable for all investors. This guide is educational content and does not constitute financial advice. Always conduct thorough research and consider consulting with financial professionals before trading derivatives. Practice on the testnet before risking real funds.

Useful Resources for Learning More

Deribit Options Course: Comprehensive free course covering options fundamentals, strategies, and platform-specific features

Deribit Testnet: test.deribit.com – Practice trading with simulated funds in a complete replica of the live platform

Deribit Documentation: Official guides covering all platform features, order types, and advanced functionality

Community Support: Active Telegram community and social media channels for questions and discussions

Continue building your options trading expertise with these valuable resources, and remember that consistent practice and continuous learning are keys to long-term success in derivatives markets.