The Complete Guide: How to Trade Options Like a Pro on Deribit (2025 Edition)

Quick Start: Ready to begin options trading? Open your Deribit account now and get instant access to the world’s most liquid crypto options market with up to 100x leverage!

What You’ll Learn in This Guide

Learning how to trade options can transform your trading strategy and unlock new profit opportunities in both rising and falling markets. This comprehensive guide will take you from beginner to confident options trader using Deribit – the world’s leading cryptocurrency derivatives platform.

In the next 10 minutes, you’ll discover:

- ✅ The exact 4-step process to start options trading

- ✅ Why Deribit dominates the crypto options market

- ✅ Professional strategies used by successful traders

- ✅ Risk management techniques that protect your capital

- ✅ Real trading examples with profit calculations

Why Options Trading is Your Gateway to Advanced Profits

Before diving into how to trade options, let’s understand why options are considered the “Swiss Army knife” of trading:

🎯 Profit in Any Market Direction

- Make money when prices go up, down, or sideways

- Limited risk with unlimited profit potential

- Perfect for hedging your existing crypto portfolio

💰 Capital Efficiency

- Control large positions with small capital

- Generate income through premium collection

- Leverage market volatility to your advantage

📈 Professional Edge

- Access the same tools used by Wall Street pros

- Advanced strategies for sophisticated traders

- Multiple income streams from one platform

Success Story: “I started with $1,000 on Deribit and generated $450 in premium income in my first month just by selling covered calls on my Bitcoin holdings.” – Alex M., Professional Trader

🚀 Start Your Options Journey on Deribit Today

The 4-Step Blueprint: How to Trade Options on Deribit

Step 1: Set Up Your Professional Trading Account

Why Deribit is the #1 Choice for Options Trading

When learning how to trade options, your platform choice can make or break your success. Here’s why over 500,000 traders trust Deribit:

🏆 Market Leadership

- 85% market share in crypto options trading

- $2B+ daily trading volume

- Deepest liquidity = tightest spreads

🔒 Bank-Level Security

- 99% of funds stored in cold wallets

- $50M insurance fund protecting traders

- SOC 2 Type II certified security

⚡ Lightning-Fast Execution

- Sub-millisecond order matching

- Advanced order types (Stop-Loss, Take-Profit, Trailing Stop)

- Professional-grade mobile app

💡 Pro Tip: Complete your KYC verification during account setup to unlock higher withdrawal limits and advanced features.

👉 Open Your Deribit Account (2 Minutes Setup)

Account Setup Checklist:

- ✅ Create account with strong password

- ✅ Enable 2FA security

- ✅ Complete KYC verification

- ✅ Make your first deposit (minimum $10)

- ✅ Familiarize yourself with the interface

Step 2: Master Your Options Strategy

Determine Your Trading Objective

Before you learn how to trade options, clarity on your goals is essential:

🎯 Speculation (High Risk, High Reward)

- Predict Bitcoin/Ethereum price direction

- Target: 50-200% returns in weeks

- Capital required: $100-1,000 per trade

💼 Income Generation (Moderate Risk, Steady Returns)

- Sell options to collect premium

- Target: 5-15% monthly returns

- Capital required: $1,000+ for optimal strategies

🛡️ Portfolio Hedging (Low Risk, Protection Focus)

- Protect existing crypto holdings

- Target: Insurance against major drops

- Capital required: 1-3% of portfolio value

Understanding the Two Types of Options

📈 Call Options: Your Bullish Bet

- When to buy: Expecting price to rise above strike price

- Maximum loss: Premium paid (limited)

- Maximum profit: Unlimited upside potential

- Example: Buy BTC $50,000 call for $500 premium when BTC is at $48,000

📉 Put Options: Your Bearish Strategy

- When to buy: Expecting price to fall below strike price

- Maximum loss: Premium paid (limited)

- Maximum profit: Strike price minus premium

- Example: Buy BTC $45,000 put for $300 premium when BTC is at $48,000

Beginner’s Mistake: Don’t buy options expiring in less than 7 days unless you’re an experienced trader. Time decay works against you rapidly!

📊 Explore Live Options Prices on Deribit

Step 3: Select the Perfect Option Contract

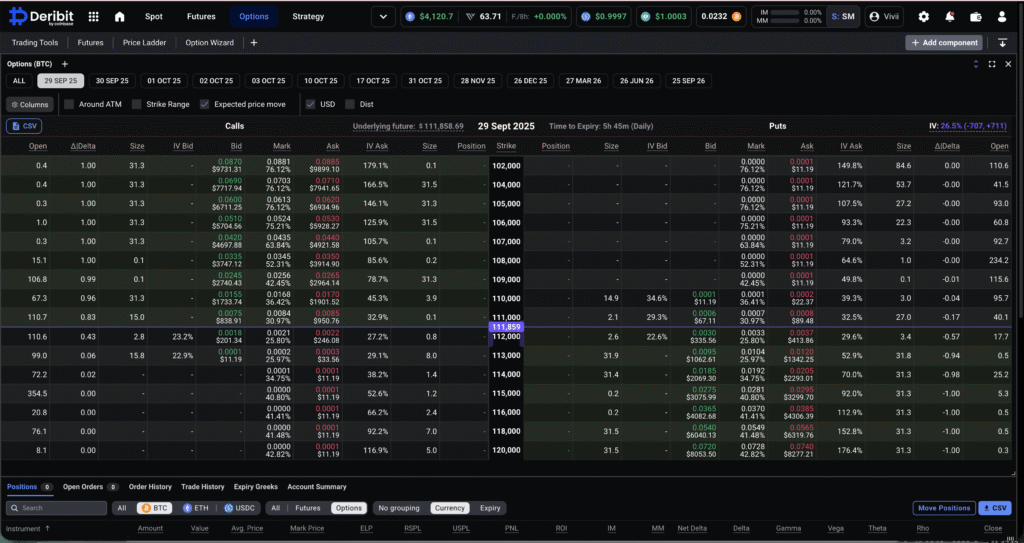

Navigate Deribit’s Options Chain Like a Pro

The options chain is your command center. Here’s what each column means:

📅 Expiration Dates

- Weekly options: High-risk, high-reward short-term plays

- Monthly options: Balanced approach for most strategies

- Quarterly options: Long-term positioning with lower time decay

💰 Strike Prices

- In-The-Money (ITM): Higher probability, higher premium

- At-The-Money (ATM): Balanced risk-reward, most liquid

- Out-The-Money (OTM): Lower cost, higher potential returns

📊 Key Metrics to Watch

- Volume: Aim for options with 50+ daily volume

- Open Interest: Higher = more liquid = better fills

- Bid-Ask Spread: Tighter spreads save you money

Strike Price Selection Strategy

For Beginners: Start with ATM or slightly ITM options

- Higher success probability

- More predictable profit/loss

- Better liquidity for easy exit

For Advanced Traders: Consider OTM options for higher leverage

- Lower entry cost

- Higher percentage returns

- Requires precise timing

Optimal Expiration Timing

🎯 Quick Profits (1-2 weeks)

- Use weekly options

- Target major news events

- Higher risk, faster results

⚖️ Balanced Approach (1 month)

- Most popular choice

- Good balance of time and premium

- Suitable for most strategies

🏗️ Position Building (3 months)

- Lower time decay pressure

- Perfect for covered calls

- Better for swing trading

🎯 Find Your Perfect Option on Deribit

Step 4: Execute and Manage Your Trades Like a Pro

Order Types That Give You the Edge

⚡ Market Orders

- When to use: Urgent execution needed

- Pros: Immediate fill guaranteed

- Cons: May get unfavorable price in volatile markets

🎯 Limit Orders

- When to use: Specific price targeting

- Pros: Control your entry/exit price

- Cons: Risk of missing the move

🛡️ Stop-Loss Orders

- When to use: Automatic risk management

- Pros: Protects against major losses

- Cons: May trigger on temporary spikes

📈 Take-Profit Orders

- When to use: Lock in profits automatically

- Pros: Removes emotion from profit-taking

- Cons: May miss bigger moves

Position Monitoring Essentials

Track Your Greeks (Advanced)

- Delta: Price sensitivity (0.5 = moves $0.50 per $1 underlying move)

- Gamma: Delta acceleration

- Theta: Daily time decay (your enemy when buying options)

- Vega: Volatility sensitivity

Daily Monitoring Checklist

- ✅ Check P&L and portfolio exposure

- ✅ Monitor news affecting your underlying assets

- ✅ Review upcoming expiration dates

- ✅ Adjust stop-losses if needed

- ✅ Look for profit-taking opportunities

Exit Strategy Framework

💰 Taking Profits

- Take 50% profit at 25% time to expiration

- Take 80% profit if achieved in first 1/3 of trade duration

- Never let a winning trade turn into a loser

⛔ Cutting Losses

- Set stop-loss at 50% of premium paid

- Exit immediately if your thesis changes

- Don’t hold worthless options hoping for miracles

🔥 Start Trading Options on Deribit Now

Advanced Options Strategies That Generate Consistent Profits

The Income Generator: Covered Call Strategy

Perfect for: Bitcoin/Ethereum holders wanting extra income

How it works:

- Hold 1 BTC in your portfolio

- Sell 1 BTC call option above current price

- Collect premium income immediately

- Keep premium if BTC stays below strike price

Example Trade:

- BTC Price: $48,000

- Sell BTC $52,000 call expiring in 30 days

- Premium collected: $800

- Result: If BTC stays below $52,000, keep $800 profit

Monthly Income Potential: 3-8% of your Bitcoin holdings

The Portfolio Protector: Protective Put Strategy

Perfect for: Large crypto holders wanting downside protection

How it works:

- Hold your crypto portfolio

- Buy put options as insurance

- Limit your maximum loss

- Keep unlimited upside potential

Example Trade:

- Hold 1 BTC worth $48,000

- Buy BTC $45,000 put for $600 premium

- Maximum loss: $3,600 ($48,000 – $45,000 + $600 premium)

- Protection: 92.5% of portfolio value protected

The Volatility Harvester: Iron Condor Strategy

Perfect for: Sideways market conditions

How it works:

- Sell ATM call and put options

- Buy OTM call and put options

- Profit when price stays within range

- Limited risk, steady income

Profit Zone: When Bitcoin trades between your sold strikes

💼 Implement These Strategies on Deribit

Risk Management: The Secret to Long-Term Success

The 5 Golden Rules of Options Trading

1. Never Risk More Than 2% Per Trade

- Start with $1,000? Risk maximum $20 per trade

- This allows for 50 consecutive losses before account wipeout

- Compound your profits, not your losses

2. Diversify Your Expiration Dates

- Don’t put all options in same expiry week

- Mix weekly, monthly, and quarterly options

- Reduces timing risk significantly

3. Use Stop-Losses Religiously

- Set stop-loss BEFORE entering trade

- Stick to your plan regardless of emotions

- Better to take small loss than large one

4. Track Your Win Rate

- Successful options traders win 60-70% of trades

- Focus on risk-reward ratio, not just win rate

- One big winner can offset several small losses

5. Keep a Trading Journal

- Record every trade with reasoning

- Review weekly to identify patterns

- Learn from both wins and losses

Position Sizing for Different Account Sizes

📊 $1,000 Account

- Maximum risk per trade: $20

- Recommended strategies: Single option purchases

- Focus: Learning and capital preservation

📊 $5,000 Account

- Maximum risk per trade: $100

- Recommended strategies: Simple spreads, covered calls

- Focus: Consistent income generation

📊 $10,000+ Account

- Maximum risk per trade: $200+

- Recommended strategies: Advanced spreads, portfolio hedging

- Focus: Professional trading techniques

🎯 Size Your Positions Correctly on Deribit

Why Deribit Dominates the Crypto Options Market

Unmatched Liquidity Advantage

📈 Trading Volume Statistics

- Daily options volume: $2.5B+

- Market maker presence: 24/7

- Average spread: 0.1-0.3% (industry leading)

🔄 Easy Entry and Exit

- Buy/sell large positions without moving market

- No slippage on standard trade sizes

- Instant execution during all market hours

Professional Trading Tools

📊 Advanced Charting

- TradingView integration

- 50+ technical indicators

- Custom strategy backtesting

🤖 API Trading

- REST and WebSocket APIs

- Perfect for algorithmic trading

- Sub-millisecond latency

📱 Mobile Excellence

- Full-featured mobile app

- Trade on the go

- Real-time portfolio monitoring

Competitive Fee Structure

🏷️ Trading Fees

- Makers: 0.02% (get paid for providing liquidity)

- Takers: 0.05% (among lowest in industry)

- Volume discounts available

💰 No Hidden Costs

- Free deposits and withdrawals

- No account maintenance fees

- Transparent fee structure

💎 Experience Deribit’s Premium Platform

Real Trading Examples: From Theory to Profit

Example 1: Bitcoin Bullish Call Option

Market Setup:

- BTC Price: $48,000

- Expectation: Rise to $55,000 in 30 days

- Strategy: Buy Call Option

Trade Details:

- Buy BTC $50,000 Call

- Premium paid: $800

- Expiration: 30 days

Profit Scenarios:

- BTC at $52,000: Profit = $1,200 (150% return)

- BTC at $55,000: Profit = $4,200 (525% return)

- BTC at $58,000: Profit = $7,200 (900% return)

Maximum Loss: $800 (if BTC below $50,000 at expiration)

Example 2: Ethereum Income Strategy

Market Setup:

- ETH Holdings: 10 ETH at $3,000 each

- Strategy: Covered Call for income

Trade Details:

- Sell 10 ETH $3,200 Calls

- Premium collected: $500 per contract = $5,000 total

- Monthly income: 16.7% annualized

Results:

- If ETH below $3,200: Keep $5,000 premium

- If ETH above $3,200: Sell ETH at profit + keep premium

Example 3: Portfolio Protection

Market Setup:

- Portfolio value: $50,000 in crypto

- Concern: Major market correction

- Strategy: Portfolio hedge

Trade Details:

- Buy Bitcoin $45,000 Puts

- Cost: $1,500 (3% of portfolio)

- Protection: 85% of portfolio value

Insurance Benefit:

- Market drops 30%: Portfolio loss limited to 15%

- Market rises: Only lose $1,500 premium

- Peace of mind: Priceless

🚀 Execute Your First Profitable Trade on Deribit

Your Options Trading Success Timeline

Week 1-2: Foundation Building

- ✅ Open and fund Deribit account

- ✅ Complete platform tutorial

- ✅ Practice with small positions ($20-50)

- ✅ Focus on learning interface

Week 3-4: Strategy Implementation

- ✅ Choose your primary strategy (income vs speculation)

- ✅ Start with ATM options for practice

- ✅ Keep detailed trading journal

- ✅ Risk only 1% per trade initially

Month 2-3: Skill Development

- ✅ Try different expiration dates

- ✅ Experiment with spreads strategies

- ✅ Increase position sizes gradually

- ✅ Develop personal trading rules

Month 4+: Advanced Techniques

- ✅ Portfolio hedging strategies

- ✅ Multi-leg combinations

- ✅ Volatility trading

- ✅ Consistent profitability

Frequently Asked Questions

Q: How much money do I need to start options trading? A: You can start with as little as $100 on Deribit, but $1,000 gives you better flexibility and risk management options.

Q: Are options riskier than spot trading? A: Options can be less risky when used properly. Buying options limits your loss to the premium paid, unlike spot trading where losses can be unlimited.

Q: How do I know when to sell my options? A: Set profit targets (50-100% gains) and stop-losses (50% of premium) before entering trades. Stick to your plan regardless of emotions.

Q: Can I trade options 24/7? A: Yes! Deribit operates 24/7, allowing you to trade crypto options around the clock, unlike traditional stock options.

Q: What’s the difference between American and European style options? A: Deribit uses European-style options, which can only be exercised at expiration, making them simpler for beginners.

Take Action: Your Options Trading Journey Starts Now

You now have the complete blueprint for how to trade options successfully. The strategies, risk management techniques, and platform knowledge you’ve gained are worth thousands of dollars in trading education.

But knowledge without action is worthless.

Your Next Steps:

- 🚀 Open your Deribit account (takes 2 minutes)

- 💰 Make your first deposit (start with $100-1,000)

- 📚 Practice with small positions (risk only $20-50 initially)

- 📊 Choose your first strategy (covered calls for income or protective puts for hedging)

- 📈 Execute your first trade and begin your profitable options journey

🎁 Special Bonus for New Traders: Start trading today and get access to:

- ✅ $50,000 practice account

- ✅ Advanced options calculator

- ✅ 24/7 customer support

- ✅ Professional trading tools

- ✅ Mobile app for trading anywhere

⏰ Don’t Wait – Markets Never Sleep

Every day you delay is another day of missed profit opportunities. Professional traders are already using these strategies to generate consistent income while you’re still reading about it.

🔥 JOIN 500,000+ SUCCESSFUL TRADERS ON DERIBIT

💭 Remember: The best time to plant a tree was 20 years ago. The second best time is now. Your options trading success story begins with a single click.

⚠️ Risk Disclaimer: Options trading involves substantial risk and is not suitable for all investors. Past performance does not guarantee future results. Only trade with money you can afford to lose. This content is for educational purposes only and does not constitute financial advice. Always do your own research and consider consulting with a financial advisor.

🏆 Start Your Profitable Options Trading Journey Today: Click Here to Open Your Deribit Account