Future of Crypto Exchanges 2025: AI, DeFi & Web3 Evolution

The future of crypto exchanges is rapidly evolving through artificial intelligence integration, cross-chain interoperability, and regulatory-driven innovation transforming how traders interact with digital assets. Leading platforms like Binance, Coinbase, and emerging Web3-native exchanges are developing AI-powered trading tools, gasless transactions, and seamless DeFi integration.

Exchange evolution accelerates through technological breakthroughs including zero-knowledge proofs, layer-2 scaling solutions, and tokenized real-world assets integration. The SEC’s Project Crypto initiative and global regulatory frameworks are driving institutional adoption while enabling innovative features like on-chain custody and programmable payments.

The cryptocurrency exchange market reached $2.96 trillion in total market capitalization with 560 million global users by 2025. Crypto exchanges are transforming from simple trading platforms into comprehensive financial ecosystems offering staking, lending, NFT marketplaces, and AI-driven investment services.

This comprehensive analysis examines exchange innovation trends, technological disruptions, regulatory impacts, and business model evolution shaping the next decade. You will discover how AI automation, cross-chain trading, DeFi integration, and institutional adoption are revolutionizing cryptocurrency trading infrastructure.

Table of Contents

- AI Revolution in Crypto Trading

- Cross-Chain Trading Infrastructure

- DeFi Integration with Traditional Exchanges

- Web3 and Self-Custody Evolution

- Regulatory-Driven Innovation

- Institutional Platform Development

- Zero-Fee and Gasless Trading

- Tokenized Assets and RWA Integration

- Exchange Super-Apps and Ecosystems

- Layer-2 and Scaling Solutions

- Security and Privacy Innovations

- Mobile-First and Accessibility

- Predictions for 2025-2030

- FAQs

- Prepare for the Future

AI Revolution in Crypto Trading

Artificial intelligence is transforming crypto exchanges into intelligent trading platforms that analyze market data, execute automated strategies, and provide personalized investment recommendations. AI-powered trading bots processed over $500 billion in trading volume across major exchanges in 2024, demonstrating institutional-grade automation accessibility.

Modern AI integration encompasses predictive analytics, sentiment analysis, risk management, and automated execution systems. Exchanges implement machine learning algorithms analyzing social media trends, news sentiment, technical indicators, and market microstructure to generate trading signals with millisecond response times.

AI-driven trading features include:

- Algorithmic trading bots: Automated strategies executing trades based on predefined parameters

- Sentiment analysis: Real-time social media and news sentiment integration

- Risk management: AI-powered portfolio optimization and loss prevention

- Market prediction: Machine learning models forecasting price movements

- Personalized recommendations: Customized trading suggestions based on user behavior

- Fraud detection: Advanced algorithms identifying suspicious activities and preventing losses

Automated Trading and Smart Order Routing

AI-powered smart order routing optimizes trade execution by analyzing liquidity across multiple venues, reducing slippage and improving fill rates. Advanced algorithms fragment large orders across different order book levels while minimizing market impact and execution costs.

Smart routing systems consider factors including bid-ask spreads, order book depth, historical volatility, and network congestion when determining optimal execution paths. These systems dynamically adjust trading strategies based on real-time market conditions and user preferences.

Smart routing benefits:

- Improved execution prices: Optimal routing reduces average execution costs by 15-30%

- Reduced slippage: Large order fragmentation minimizes price impact

- Latency optimization: Millisecond execution speeds through algorithmic processing

- Multi-venue liquidity: Access to deeper liquidity pools across exchanges

- Risk mitigation: Automated systems prevent common trading errors and losses

Predictive Analytics and Market Intelligence

Machine learning models process vast amounts of market data to identify trading opportunities and predict price movements with increasing accuracy. These systems analyze on-chain data, order flow, social sentiment, and macroeconomic factors to generate actionable insights.

Advanced analytics platforms integrate technical analysis, fundamental research, and alternative data sources creating comprehensive market intelligence. Professional traders access institutional-grade research tools previously available only to hedge funds and proprietary trading firms.

Analytics capabilities:

- Price prediction models: Machine learning algorithms forecasting short and long-term movements

- Volatility forecasting: Advanced models predicting market volatility and risk metrics

- Correlation analysis: Cross-asset relationships and portfolio diversification insights

- Flow analysis: Order flow and whale movement tracking for market timing

- Alternative data: Social media sentiment, search trends, and news impact analysis

Cross-Chain Trading Infrastructure

Cross-chain interoperability enables seamless trading across multiple blockchain networks without requiring separate exchange accounts or manual token bridging. This infrastructure eliminates friction while providing access to diverse ecosystems including Ethereum, Solana, Polygon, and Binance Smart Chain.

Cross-chain protocols implement atomic swaps, bridge technologies, and unified liquidity pools enabling instant asset conversion across different networks. Users trade Ethereum-based tokens against Solana assets or access Polygon DeFi opportunities without leaving their primary exchange interface.

Cross-chain capabilities include:

- Multi-chain wallet integration: Single interface managing assets across multiple blockchains

- Atomic cross-chain swaps: Trustless trading between different blockchain networks

- Unified order books: Aggregated liquidity across multiple chains and protocols

- Bridge integration: Seamless asset transfers between different blockchain ecosystems

- Gas optimization: Automatic selection of lowest-cost networks for transactions

Interoperability Protocols and Standards

Emerging interoperability standards enable exchanges to connect with multiple blockchain networks through standardized APIs and communication protocols. These frameworks reduce development complexity while expanding asset availability and trading opportunities.

Major protocols including Cosmos IBC, Polkadot’s parachain architecture, and Layer Zero’s omnichain solutions provide technical infrastructure for cross-chain exchange integration. These systems maintain security while enabling unprecedented connectivity between previously isolated networks.

Key interoperability features:

- Standardized APIs: Consistent interfaces across different blockchain networks

- Security preservation: Cross-chain transactions maintaining individual network security

- Scalability improvement: Load distribution across multiple network infrastructures

- Asset expansion: Access to thousands of tokens across different ecosystems

- Innovation acceleration: Rapid integration of new blockchain networks and protocols

Unified Liquidity and Order Management

Cross-chain liquidity aggregation creates deeper order books and improved price discovery by combining trading volumes from multiple blockchain networks. This unified approach reduces arbitrage opportunities while providing better execution for large trades.

Sophisticated order management systems route trades across different chains based on liquidity availability, execution costs, and user preferences. These systems automatically balance inventory across networks while minimizing cross-chain transaction costs and settlement times.

DeFi Integration with Traditional Exchanges

Centralized exchanges are integrating decentralized finance protocols to offer yield farming, liquidity provision, and advanced DeFi strategies within familiar trading interfaces. This hybrid approach combines centralized convenience with decentralized innovation and ownership principles.

Major exchanges including Binance and Coinbase now offer integrated DeFi services including automated market making, lending protocols, and yield optimization strategies. Users access complex DeFi opportunities without managing multiple protocols or understanding technical implementation details.

DeFi integration features:

- Yield farming automation: One-click access to high-yield DeFi opportunities

- Liquidity provision: Simplified participation in automated market makers

- Lending and borrowing: Integrated access to decentralized lending protocols

- Derivatives trading: Complex DeFi derivatives within centralized interfaces

- Governance participation: Automated voting and governance token management

- Risk management: Professional-grade tools for DeFi position monitoring

Automated Market Making and Liquidity Provision

Exchanges are implementing automated market making features that allow users to provide liquidity and earn fees without understanding complex DeFi mechanics. These systems abstract technical complexity while providing institutional-grade yields and risk management.

Integrated AMM functionality enables users to deploy capital across multiple liquidity pools automatically, with intelligent rebalancing and yield optimization. Professional tools provide impermanent loss protection and dynamic fee adjustment based on market conditions.

AMM integration benefits:

- Simplified participation: One-click liquidity provision across multiple protocols

- Yield optimization: Automated strategies maximizing returns while managing risk

- Impermanent loss protection: Advanced hedging strategies reducing principal risk

- Professional analytics: Real-time monitoring and performance attribution

- Tax optimization: Integrated reporting for complex DeFi transactions

Decentralized Exchange Aggregation

Exchange aggregators combine liquidity from multiple decentralized exchanges to provide optimal pricing and execution for users. These systems automatically route trades through the most favorable venues while handling the technical complexity of multi-protocol interactions.

Advanced aggregation platforms consider factors including price impact, gas costs, and slippage when determining optimal trade routing. They provide unified interfaces accessing dozens of DEXs while maintaining the security benefits of decentralized trading.

Aggregation advantages:

- Superior pricing: Access to best available prices across all DEX venues

- Reduced gas costs: Optimized routing minimizing transaction fees

- Increased efficiency: Single interface accessing multiple decentralized protocols

- MEV protection: Advanced routing strategies avoiding maximal extractable value attacks

- Liquidity optimization: Access to deepest available liquidity pools

Web3 and Self-Custody Evolution

The future of crypto exchanges embraces self-custody principles through Web3 wallet integration and non-custodial trading solutions. Users maintain control over private keys while accessing professional trading tools and institutional-grade features previously available only through custodial platforms.

Non-custodial exchange architectures eliminate counterparty risk while providing advanced trading features including margin trading, derivatives, and complex order types. These systems combine security benefits of self-custody with convenience and functionality of centralized platforms.

Web3 integration features:

- Wallet-as-a-Service: Integrated self-custody solutions with exchange functionality

- Non-custodial trading: Advanced trading without surrendering asset custody

- Multi-signature security: Enhanced protection through distributed key management

- Cross-platform compatibility: Seamless integration with existing Web3 applications

- Decentralized identity: Self-sovereign identity management and verification

Self-Custody Trading Platforms

Emerging platforms enable sophisticated trading strategies while maintaining complete user control over assets through advanced cryptographic techniques. These systems use state channels, zero-knowledge proofs, and other technologies to provide centralized exchange functionality without custodial requirements.

Self-custody platforms address the fundamental trade-off between security and convenience by implementing innovative architectures that preserve user control while enabling complex trading features. These solutions appeal to institutional investors requiring fiduciary-grade custody standards.

Self-custody benefits:

- Eliminate counterparty risk: Users maintain complete control over assets

- Regulatory compliance: Meet institutional custody and fiduciary requirements

- Enhanced privacy: Transactions remain private without central intermediary monitoring

- Censorship resistance: Trading continues regardless of platform operational status

- Innovation acceleration: Programmable money enabling new financial products

Wallet Integration and User Experience

Modern exchanges integrate seamlessly with popular Web3 wallets including MetaMask, Ledger, and mobile wallets through standardized connection protocols. This integration eliminates the need for separate exchange accounts while providing familiar trading interfaces.

Advanced wallet integration supports features including transaction previewing, gas fee optimization, and bulk operations. Users access professional trading tools while maintaining wallet-level security and privacy controls.

Integration advantages:

- Familiar experience: Existing wallet workflows with enhanced trading functionality

- Enhanced security: Hardware wallet integration for institutional-grade protection

- Privacy preservation: Maintain pseudonymous trading without KYC requirements

- Cost optimization: Intelligent gas fee management and transaction batching

- Multi-chain support: Single wallet interface accessing multiple blockchain networks

Regulatory-Driven Innovation

The SEC’s Project Crypto and global regulatory frameworks are catalyzing exchange innovation through clear guidelines enabling on-chain securities trading and tokenized asset integration. Regulatory clarity encourages institutional participation while driving technological advancement in compliance and reporting systems.

Project Crypto aims to modernize securities rules for blockchain technology, enabling stocks and bonds to be tokenized and traded on-chain. This regulatory evolution transforms exchanges into comprehensive financial platforms supporting both traditional and digital asset trading.

Regulatory innovation drivers:

- On-chain securities trading: Tokenized stocks and bonds traded through blockchain infrastructure

- Automated compliance: Smart contracts implementing regulatory requirements automatically

- Real-time reporting: Blockchain-based transaction monitoring and regulatory reporting

- Cross-border frameworks: International coordination enabling global trading platforms

- Institutional participation: Clear rules encouraging bank and pension fund involvement

Compliance Automation and Smart Contracts

Automated compliance systems implement regulatory requirements through smart contracts and blockchain-based monitoring, reducing costs while improving accuracy. These systems automatically enforce trading limits, conduct surveillance, and generate regulatory reports without manual intervention.

Advanced compliance platforms integrate with multiple jurisdictions’ requirements, automatically adapting to local regulations while maintaining consistent user experiences. They provide audit trails and real-time monitoring capabilities exceeding traditional compliance systems.

Automated compliance features:

- Smart contract enforcement: Automatic implementation of regulatory requirements

- Real-time monitoring: Continuous surveillance for suspicious activities and violations

- Multi-jurisdiction support: Adaptation to different regulatory frameworks automatically

- Audit trail generation: Immutable records supporting regulatory examinations

- Cost reduction: Automation reducing compliance expenses by 50-70%

Institutional Integration and Banking

Traditional financial institutions are integrating cryptocurrency trading capabilities through regulatory-compliant platforms and banking partnerships. This integration brings institutional-grade infrastructure and professional services to cryptocurrency markets.

Banking integration enables seamless fiat-crypto conversion, institutional custody services, and traditional finance product integration. These developments bridge the gap between traditional and digital asset markets while meeting institutional fiduciary requirements.

Institutional integration benefits:

- Professional infrastructure: Enterprise-grade trading and custody systems

- Banking relationships: Seamless fiat funding and conversion capabilities

- Fiduciary compliance: Meeting institutional investment and custody requirements

- Risk management: Institutional-grade portfolio and risk management tools

- Regulatory certainty: Clear compliance frameworks encouraging institutional adoption

Institutional Platform Development

Cryptocurrency exchanges are developing specialized institutional platforms offering advanced trading tools, custody services, and professional asset management capabilities. These platforms provide features including algorithmic trading, portfolio analytics, and institutional-grade security systems.

Institutional platforms integrate with traditional finance infrastructure including prime brokerage, custody banks, and fund administration services. They offer white-label solutions enabling banks and investment firms to provide cryptocurrency services under their own branding.

Institutional platform features:

- Prime brokerage services: Consolidated reporting and multi-venue execution

- Custody integration: Connection with traditional custody banks and service providers

- Professional analytics: Advanced portfolio and risk management tools

- White-label solutions: Branded platforms for traditional financial institutions

- Regulatory reporting: Automated compliance and regulatory reporting systems

- Multi-asset support: Integration of traditional and digital asset trading

Professional Trading Infrastructure

Enterprise-grade trading infrastructure provides institutional investors with the tools and connectivity required for large-scale cryptocurrency trading. These systems offer low-latency execution, advanced order types, and integration with existing trading workflows.

Professional platforms implement features including smart order routing, algorithmic trading, and risk management systems comparable to traditional equity and fixed-income markets. They provide the reliability and performance required for institutional-scale trading operations.

Infrastructure components:

- Low-latency connectivity: Sub-millisecond execution speeds through optimized infrastructure

- Advanced order types: Professional order management and execution algorithms

- Risk management: Real-time portfolio monitoring and automated risk controls

- Market data: Institutional-grade market data feeds and analytics platforms

- Integration capabilities: APIs and protocols connecting with existing trading systems

Custody and Asset Management

Institutional custody services provide secure asset storage and professional asset management capabilities meeting fiduciary and regulatory requirements. These services offer insurance coverage, segregated storage, and professional oversight of digital asset holdings.

Advanced custody platforms implement multi-signature security, hardware security modules, and professional key management procedures. They provide audit trails and reporting capabilities supporting institutional compliance and risk management requirements.

Custody service features:

- Segregated storage: Client assets separated from exchange operational funds

- Insurance coverage: Professional liability and asset protection insurance

- Multi-signature security: Distributed key management preventing single points of failure

- Audit trails: Comprehensive transaction logging and reporting capabilities

- Professional oversight: Experienced teams managing institutional digital asset custody

Zero-Fee and Gasless Trading

Revolutionary zero-fee trading models eliminate transaction costs through innovative business models including payment for order flow, maker rebates, and token-based incentives. These approaches democratize trading access while maintaining platform profitability through alternative revenue streams.

Gasless transaction technologies enable users to trade without holding native blockchain tokens for fees. Layer-2 solutions and meta-transaction frameworks abstract gas costs while providing instant settlement and improved user experiences.

Zero-fee implementations:

- Payment for order flow: Revenue from market makers compensating for zero-fee trading

- Maker rebate programs: Liquidity providers receive payments exceeding taker fees

- Token incentives: Native exchange tokens subsidizing transaction costs

- Layer-2 optimization: Scaling solutions reducing transaction costs to near-zero

- Gasless transactions: Meta-transactions eliminating need for native token holdings

Layer-2 Solutions and Meta-Transactions

Layer-2 scaling solutions including state channels, rollups, and sidechains enable instant, low-cost trading without compromising security. These technologies process thousands of transactions per second while maintaining connection to underlying blockchain security.

Meta-transaction frameworks allow users to interact with exchanges without holding specific cryptocurrencies for gas fees. Exchanges sponsor transaction costs while providing seamless user experiences comparable to traditional financial applications.

Scaling benefits:

- Instant settlement: Sub-second transaction confirmation times

- Massive throughput: Processing thousands of transactions per second

- Cost reduction: Transaction fees reduced by 95%+ compared to mainnet

- Enhanced UX: Simplified user interfaces without gas management complexity

- Mainstream adoption: User experiences comparable to traditional applications

Alternative Revenue Models

Innovative revenue models enable exchanges to offer zero-fee trading while maintaining profitability through diversified income streams. These approaches include premium subscriptions, advanced analytics, and ecosystem token economics.

Successful zero-fee platforms generate revenue through payment for order flow, professional trading tools, lending services, and ecosystem development. They create sustainable business models while improving accessibility for retail traders.

Revenue diversification:

- Premium subscriptions: Advanced features and analytics for professional traders

- Order flow monetization: Revenue sharing with market makers and institutional traders

- Lending and staking: Interest income from asset utilization and delegation

- Ecosystem development: Token appreciation and transaction fee sharing

- Professional services: White-label platforms and institutional service offerings

Tokenized Assets and RWA Integration

Real-world asset tokenization brings traditional investments including real estate, commodities, and securities onto blockchain platforms through cryptocurrency exchanges. This integration expands trading opportunities while providing 24/7 access to traditionally illiquid assets.

Tokenized assets represent fractional ownership in real-world properties, commodities, art, and other valuable assets. Exchanges provide seamless trading of these tokens alongside traditional cryptocurrencies, creating unified marketplaces for all digital assets.

RWA tokenization benefits:

- Enhanced liquidity: 24/7 trading of traditionally illiquid assets

- Fractional ownership: Access to high-value assets through tokenized shares

- Global accessibility: International access to regional investment opportunities

- Reduced barriers: Lower minimum investments and simplified ownership transfer

- Price transparency: Real-time pricing and market depth for tokenized assets

Real Estate and Commodity Trading

Tokenized real estate platforms enable fractional ownership and trading of property investments through cryptocurrency exchanges. Investors access global real estate markets with minimum investments as low as $100, receiving proportional rental income and appreciation.

Commodity tokenization brings gold, silver, oil, and agricultural products to digital trading platforms. These tokens provide exposure to commodity price movements without physical storage requirements or complex logistics management.

Asset tokenization features:

- Fractional ownership: Access to expensive assets through tokenized shares

- Global diversification: International real estate and commodity exposure

- Passive income: Automated dividend and rental income distribution

- Instant liquidity: 24/7 trading without traditional settlement delays

- Reduced costs: Elimination of intermediaries and administrative overhead

Securities and Bond Integration

Blockchain-based securities trading enables stocks, bonds, and other financial instruments to be traded through cryptocurrency exchanges. This integration creates unified platforms supporting both traditional and digital asset trading.

Tokenized securities maintain regulatory compliance while providing enhanced settlement speed and reduced costs. They enable programmable features including automatic dividend distribution and governance participation through blockchain-based voting systems.

Securities tokenization advantages:

- Faster settlement: Instant trade settlement compared to T+2 traditional timing

- Global access: International trading without geographic restrictions

- Programmable features: Automated dividend payments and corporate actions

- Reduced costs: Elimination of intermediaries reducing transaction expenses

- Enhanced compliance: Blockchain-based audit trails and regulatory reporting

Exchange Super-Apps and Ecosystems

Leading exchanges are evolving into comprehensive financial super-apps offering trading, payments, lending, staking, NFT marketplaces, and lifestyle services within unified platforms. These ecosystems provide everything users need for digital asset interaction and financial management.

Super-app development includes features like crypto-backed payment cards, travel booking, e-commerce integration, and social trading. Exchanges become central hubs for digital lifestyle and financial services extending far beyond traditional trading functionality.

Super-app features:

- Integrated payments: Crypto payment cards and merchant acceptance networks

- Lifestyle services: Travel booking, e-commerce, and entertainment platform integration

- Social trading: Community features enabling strategy sharing and copy trading

- Educational content: Comprehensive learning platforms and certification programs

- Professional services: Tax reporting, accounting, and portfolio management tools

Native Token Ecosystems

Exchange native tokens power comprehensive ecosystems providing governance rights, fee discounts, staking rewards, and access to exclusive features. These tokens create network effects and user loyalty while generating sustainable revenue streams.

Advanced tokenomics include governance voting, revenue sharing, and ecosystem development funding. Token holders participate in platform decision-making while receiving benefits proportional to their holdings and engagement levels.

Token ecosystem benefits:

- Governance participation: Community voting on platform development and policies

- Revenue sharing: Token holders receive portions of exchange fee revenue

- Exclusive features: Premium access to new products and services

- Staking rewards: Earn additional tokens through platform participation

- Network effects: Increased utility driving token demand and platform growth

Community and Social Features

Social trading features enable users to follow successful traders, copy strategies, and participate in community-driven investment opportunities. These systems combine social media functionality with professional trading tools and performance analytics.

Advanced social features include strategy marketplaces, performance leaderboards, and educational content creation. Users build reputations through consistent performance while monetizing their trading expertise through subscription and revenue-sharing models.

Social trading capabilities:

- Strategy copying: Automated replication of successful trader portfolios

- Performance tracking: Transparent analytics and historical performance data

- Community interaction: Discussion forums and strategy sharing platforms

- Content monetization: Revenue opportunities for successful traders and educators

- Reputation systems: Trust scores and verification for community leaders

Layer-2 and Scaling Solutions

Layer-2 scaling solutions are transforming cryptocurrency exchanges by enabling instant transactions, massive throughput, and near-zero fees while maintaining underlying blockchain security. These technologies process millions of transactions daily while reducing costs by over 95%.

Major scaling approaches include state channels, optimistic rollups, zero-knowledge rollups, and hybrid solutions combining multiple technologies. Exchanges implement these solutions to provide user experiences comparable to traditional financial applications while maintaining decentralization benefits.

Scaling solution types:

- State channels: Instant bilateral transactions with periodic blockchain settlement

- Optimistic rollups: High-throughput processing with fraud-proof security guarantees

- Zero-knowledge rollups: Privacy-preserving scaling with cryptographic security proofs

- Hybrid solutions: Combined approaches optimizing for specific use cases and requirements

- Interoperability bridges: Cross-layer communication and asset transfer mechanisms

Performance and User Experience Improvements

Layer-2 implementations provide sub-second transaction confirmation, eliminate network congestion, and enable complex smart contract interactions previously impossible on main chains. Users experience instant trading, seamless deposits/withdrawals, and sophisticated DeFi functionality.

Enhanced user experiences include batch transactions, predictable fees, and MEV protection. These improvements make cryptocurrency trading accessible to mainstream users expecting traditional application responsiveness and reliability.

Performance enhancements:

- Sub-second confirmation: Instant transaction processing and confirmation

- Predictable costs: Fixed or near-zero transaction fees regardless of network congestion

- Batch processing: Multiple operations combined into single transactions

- MEV protection: Shielding users from maximal extractable value exploitation

- Seamless integration: Transparent scaling without requiring user technical knowledge

Cross-Layer Interoperability

Advanced interoperability protocols enable seamless asset movement and trading across multiple Layer-2 networks and main chains. Users access liquidity and features from different scaling solutions without manual bridging or complex technical procedures.

Cross-layer architectures aggregate liquidity from multiple networks while providing unified interfaces. These systems automatically route transactions through optimal paths considering costs, speed, and security requirements.

Interoperability benefits:

- Liquidity aggregation: Combined order books across multiple scaling networks

- Optimal routing: Automatic selection of best execution paths

- Unified interfaces: Single platform accessing multiple Layer-2 ecosystems

- Cost optimization: Dynamic routing minimizing transaction expenses

- Feature access: Comprehensive functionality across different scaling solutions

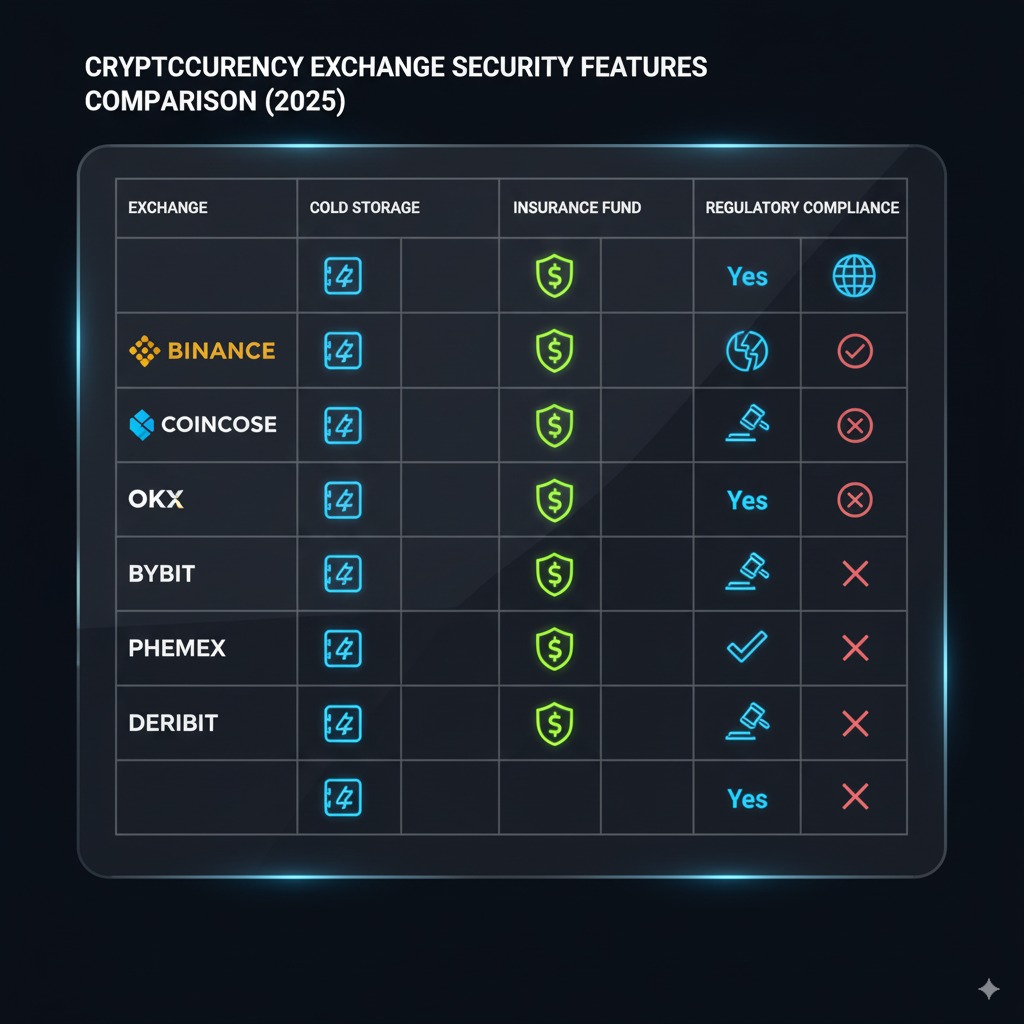

Security and Privacy Innovations

Next-generation security technologies including zero-knowledge proofs, multi-party computation, and quantum-resistant cryptography are enhancing exchange security while preserving user privacy. These innovations protect against emerging threats while enabling regulatory compliance.

Advanced privacy features allow exchanges to provide compliance reporting and audit capabilities without compromising user transaction privacy. Zero-knowledge systems prove regulatory compliance without revealing sensitive trading information.

Security innovation areas:

- Zero-knowledge proofs: Privacy-preserving compliance and identity verification

- Multi-party computation: Distributed key management without single points of failure

- Quantum-resistant cryptography: Protection against future quantum computing threats

- Biometric authentication: Advanced user verification and access control systems

- Decentralized identity: Self-sovereign identity management and verification

Privacy-Preserving Compliance

Zero-knowledge compliance systems enable exchanges to meet regulatory requirements while protecting user privacy through cryptographic proofs. These systems verify identity and transaction legitimacy without revealing sensitive information to authorities or third parties.

Advanced privacy architectures separate compliance verification from transaction monitoring, enabling audit capabilities while preserving user anonymity. These systems address regulatory requirements without compromising the privacy benefits of cryptocurrency usage.

Privacy-preserving features:

- Anonymous compliance: Regulatory verification without identity disclosure

- Selective disclosure: Granular control over information sharing with authorities

- Encrypted audit trails: Compliance records accessible only to authorized parties

- Private reporting: Regulatory submissions without compromising user privacy

- Decentralized verification: Distributed compliance checking without central authorities

Advanced Authentication and Access Control

Next-generation authentication systems combine biometrics, hardware security modules, and behavioral analysis to provide seamless security without compromising user experience. These systems adapt to user behavior patterns while detecting anomalous activities.

Multi-factor authentication evolves beyond traditional 2FA to include continuous authentication, risk-based access controls, and contextual security measures. These systems balance security requirements with user convenience through intelligent automation.

Authentication innovations:

- Biometric integration: Fingerprint, facial, and voice recognition for seamless access

- Behavioral analysis: Continuous monitoring of user patterns and anomaly detection

- Risk-based controls: Dynamic security requirements based on transaction risk levels

- Hardware security: Integration with security keys and trusted hardware platforms

- Contextual authentication: Location, device, and timing-based security adaptations

Mobile-First and Accessibility

Mobile-first design principles are transforming cryptocurrency exchanges into accessible platforms optimized for smartphone usage and global accessibility. These platforms provide full trading functionality through intuitive mobile interfaces designed for on-the-go trading and portfolio management.

Accessibility improvements include multi-language support, offline functionality, low-bandwidth optimization, and assistive technology integration. These features expand cryptocurrency access to emerging markets and users with connectivity or disability constraints.

Mobile optimization features:

- Native mobile apps: Full-featured applications optimized for iOS and Android platforms

- Offline capability: Limited functionality during network connectivity interruptions

- Low-bandwidth modes: Optimized interfaces for slow or expensive internet connections

- Voice control: Hands-free trading and portfolio management through voice commands

- Accessibility compliance: Support for screen readers and assistive technologies

Emerging Market Adoption

Cryptocurrency exchanges are developing specialized features for emerging markets including local payment integration, simplified KYC procedures, and educational resources. These initiatives expand access to financial services through cryptocurrency platforms.

Emerging market features include support for local currencies, alternative verification methods, and culturally appropriate user interfaces. Exchanges partner with local financial institutions and mobile network operators to provide seamless access.

Emerging market adaptations:

- Local payment methods: Integration with regional payment systems and mobile money

- Simplified verification: Alternative KYC procedures for users without traditional documentation

- Educational resources: Comprehensive learning materials in local languages

- Community support: Local customer service and community engagement programs

- Partnership networks: Collaboration with regional financial institutions and service providers

Accessibility and Inclusion

Universal design principles ensure cryptocurrency trading accessibility for users with disabilities, limited technical knowledge, and diverse cultural backgrounds. These initiatives promote financial inclusion through technology accessibility.

Accessibility features include screen reader compatibility, high-contrast modes, simplified interfaces, and comprehensive help systems. These improvements ensure cryptocurrency benefits reach diverse global populations regardless of technical expertise or physical capabilities.

Inclusion initiatives:

- Disability support: Full compatibility with assistive technologies and accessibility standards

- Language diversity: Multi-language interfaces and customer support capabilities

- Simplified interfaces: Beginner-friendly modes reducing complexity for new users

- Educational integration: Built-in tutorials and learning resources for skill development

- Cultural adaptation: Regionally appropriate design and functionality considerations

Predictions for 2025-2030

The cryptocurrency exchange landscape will undergo fundamental transformation through AI automation, regulatory integration, and technological convergence creating unified financial platforms. These changes will reshape how individuals and institutions interact with digital and traditional assets.

Short-Term Predictions (2025-2026)

AI-powered trading will become standard across major exchanges, with automated strategies handling over 60% of retail trading volume by late 2025. Machine learning systems will provide personalized investment advice and risk management comparable to professional financial advisors.

Zero-fee trading models will expand significantly as exchanges implement sophisticated revenue diversification strategies. Payment for order flow, premium subscriptions, and ecosystem tokens will sustain platform operations while eliminating barriers for retail traders.

2025-2026 developments:

- AI ubiquity: Automated trading and advisory services standard across platforms

- Zero-fee expansion: Fee-free trading available on most major exchanges

- Cross-chain maturity: Seamless multi-blockchain trading becomes routine

- Regulatory clarity: Comprehensive frameworks enabling institutional participation

- DeFi integration: Traditional exchanges offering comprehensive DeFi access

Medium-Term Evolution (2027-2028)

Exchange super-apps will consolidate multiple financial services including banking, payments, investing, and lifestyle services into unified platforms. Users will manage comprehensive financial lives through cryptocurrency-native applications.

Tokenized asset trading will expand dramatically as regulatory frameworks enable stocks, bonds, real estate, and commodities to trade alongside cryptocurrencies. This integration will create unified markets for all asset classes through blockchain infrastructure.

2027-2028 transformations:

- Super-app dominance: Comprehensive financial services through unified platforms

- Asset tokenization: Traditional assets routinely traded as blockchain tokens

- Institutional mainstream: Banks and pension funds operating native crypto trading desks

- Global interoperability: Seamless cross-border trading without regulatory friction

- Privacy integration: Zero-knowledge compliance systems protecting user privacy

Long-Term Vision (2029-2030)

Cryptocurrency exchanges will evolve into comprehensive financial operating systems powering the global digital economy. These platforms will integrate with central bank digital currencies, provide programmable money services, and enable new economic models previously impossible.

Traditional distinction between cryptocurrency and traditional assets will disappear as all financial instruments operate through blockchain infrastructure. Exchanges will become the foundational infrastructure for programmable finance and autonomous economic systems.

2029-2030 vision:

- Financial operating systems: Exchanges as core infrastructure for digital economy

- CBDC integration: Central bank digital currencies trading alongside cryptocurrencies

- Programmable money: Smart contracts automating complex financial relationships

- Autonomous finance: AI-managed portfolios and algorithmic investment strategies

- Global unification: Single platforms serving worldwide markets without barriers

Frequently Asked Questions

How will AI change crypto trading for regular users?

AI will democratize professional trading strategies by providing retail users with institutional-grade tools including automated portfolio management, risk assessment, and market analysis. By 2025, AI-powered trading bots will execute trades, rebalance portfolios, and provide personalized investment advice comparable to human financial advisors.

What is cross-chain trading and why does it matter?

Cross-chain trading enables seamless asset exchange across different blockchain networks without manual bridging or multiple exchange accounts. This technology eliminates friction while providing access to diverse ecosystems including Ethereum DeFi, Solana NFTs, and Polygon gaming applications through single interfaces.

Will traditional exchanges replace banks?

Cryptocurrency exchanges are evolving into comprehensive financial platforms offering banking services, but they will likely partner with traditional banks rather than replace them entirely. Hybrid models combining exchange innovation with banking infrastructure will serve different market segments.

How will regulations affect exchange innovation?

Clear regulatory frameworks like the SEC’s Project Crypto will accelerate innovation by enabling new features including tokenized securities trading, institutional custody, and programmable compliance systems. Regulatory clarity encourages investment and development in exchange infrastructure.

What are the risks of using AI-powered trading?

AI trading risks include algorithmic failures, market manipulation, over-optimization, and loss of user control over investment decisions. However, these risks decrease as systems mature and regulatory frameworks develop around algorithmic trading oversight.

Will self-custody replace centralized exchanges?

Self-custody solutions will coexist with centralized exchanges, offering users choice between convenience and control. Web3-native platforms will provide sophisticated trading features while maintaining user asset custody, appealing to security-conscious traders.

How will zero-fee trading affect exchange business models?

Zero-fee trading drives revenue diversification toward premium services, payment for order flow, lending, staking, and ecosystem tokens. Successful exchanges will build comprehensive service offerings beyond simple trading functionality.

What role will stablecoins play in future exchanges?

Stablecoins will become the primary trading pair and settlement currency, replacing volatile cryptocurrencies for most trading activities. Crypto staking of yield-generating stablecoins will provide passive income while maintaining price stability.

How will mobile usage change crypto trading?

Mobile-first design will make cryptocurrency trading as accessible as social media, with voice commands, simplified interfaces, and offline capabilities. Emerging markets will drive mobile adoption through smartphone-native trading experiences.

What happens to exchange fees in the future?

Traditional trading fees will largely disappear for retail users, replaced by premium service subscriptions and institutional fee structures. As covered in our crypto exchange fees analysis, platforms will monetize through value-added services rather than per-transaction charges.

Prepare for the Future

The future of cryptocurrency exchanges presents unprecedented opportunities for traders, investors, and financial institutions willing to embrace technological innovation and regulatory evolution. Success requires understanding emerging trends while adapting to rapidly changing market dynamics.

Strategic preparation recommendations:

For Individual Traders:

- Embrace AI tools: Learn to use automated trading and analytics platforms effectively

- Diversify platforms: Maintain accounts across multiple exchanges with different specializations

- Develop skills: Understand DeFi, cross-chain trading, and self-custody principles

- Stay informed: Follow regulatory developments and technological innovations regularly

- Risk management: Implement systematic approaches to portfolio and operational risk

For Institutions:

- Regulatory compliance: Establish frameworks for digital asset trading and custody

- Technology investment: Build or partner for institutional-grade crypto infrastructure

- Staff development: Train teams on blockchain technology and digital asset management

- Strategic partnerships: Collaborate with established cryptocurrency exchanges and service providers

- Pilot programs: Implement controlled testing of cryptocurrency trading and services

For Exchanges and Platforms:

- Technology integration: Invest in AI, cross-chain, and scaling solution development

- Regulatory preparation: Build compliance systems for evolving regulatory frameworks

- User experience focus: Prioritize mobile, accessibility, and simplified user interfaces

- Ecosystem development: Create comprehensive platforms beyond traditional trading

- Security advancement: Implement next-generation security and privacy technologies

Key preparation areas:

- Education and training: Develop cryptocurrency and blockchain expertise systematically

- Infrastructure planning: Prepare for increased transaction volumes and new asset types

- Regulatory monitoring: Track developing compliance requirements across jurisdictions

- Partnership evaluation: Identify collaboration opportunities with traditional finance and technology providers

- Innovation adoption: Systematically evaluate and implement emerging technologies

The cryptocurrency exchange evolution represents one of the most significant financial technology transformations since the internet’s emergence. Organizations and individuals positioning themselves appropriately will benefit from unprecedented opportunities in the emerging digital financial system.

Ready to explore the future of crypto trading? Start with established platforms like Binance for comprehensive features, Coinbase for regulatory compliance, or specialized platforms focusing on specific innovations like AI trading or DeFi integration.

Stay ahead of exchange evolution by understanding crypto exchange security measures, exploring advanced futures trading capabilities, and following the complete crypto exchange guide for optimal platform selection.

Disclaimer: Cryptocurrency trading involves substantial risk of loss and may not be suitable for all investors. Future predictions are speculative and based on current trends that may change due to technological, regulatory, or market developments.

Risk Warning: Emerging technologies including AI trading, cross-chain protocols, and DeFi integration carry additional risks including technical failures, smart contract vulnerabilities, and regulatory uncertainties. Never invest more than you can afford to lose.

Educational Purpose: This content provides educational information about potential future developments and does not constitute investment, technology, or legal advice. Consult qualified professionals before making decisions regarding cryptocurrency investments or platform selection.