Fed Crypto: Unpacking the Federal Reserve’s Evolving Stance on Digital Assets

Estimated reading time: 11 minutes

Key Takeaways:

- The term “Fed crypto” refers to both regulatory oversight of digital assets by the Federal Reserve and ongoing research into a potential U.S. central bank digital currency (CBDC).

- Recent policy shifts removed some regulatory barriers for banks engaging with crypto, particularly around stablecoins.

- The Fed is taking a cautious approach to a digital dollar, prioritizing research, security, and legislative approval before any launch.

- These changes may make it easier for banks and ETFs to participate in crypto markets, but volatility and other risks remain high for investors.

- Staying informed about “Fed crypto” policy is now crucial for anyone investing in crypto or related ETFs.

Table of Contents

- What Exactly Is “Fed Crypto”? Demystifying the Terminology

- The Fed’s Regulatory U-Turn: A New Era for Crypto Banking?

- The Digital Dollar Dilemma: CBDC Development and Its Implications

- Market Impact Analysis: How Fed Crypto Policy Affects Your Investments

- Future Outlook: What’s Next for Fed Crypto Policy?

- Conclusion: Navigating the New Fed Crypto Landscape

- FAQs: Fed Crypto 2025

In the ever-shifting landscape of cryptocurrency regulation, few developments carry as much weight as the Federal Reserve’s approach to digital assets. From regulatory oversight to the potential issuance of a digital dollar, the Fed’s decisions ripple through markets, influencing everything from Bitcoin’s price to ETF performance. As we navigate 2025’s crypto landscape, understanding “Fed crypto” has become essential for investors, particularly those whose growth strategies depend on monetary policy dynamics and crypto-related ETFs.

If you are new to the world of digital assets, consider exploring foundational guides like What is Cryptocurrency? Beginner’s Guide to Digital Money (2025) and Digital Assets: Beginner’s Guide to Cryptocurrencies & Tokens (2025) for broader context as you read about Fed crypto developments.

But what exactly is happening with the Fed’s crypto strategy, and how should investors position themselves? Let’s dive into the Federal Reserve’s evolving relationship with digital assets and unpack what it means for your investment strategy.

What Exactly Is “Fed Crypto”? Demystifying the Terminology

Q: When people talk about “Fed crypto,” what are they actually referring to?

Despite what the term might suggest, “Fed crypto” isn’t a cryptocurrency issued by the Federal Reserve (at least not yet). Instead, it encompasses two distinct but related concepts:

- Regulatory Oversight: The Federal Reserve’s supervision of U.S. banks’ activities related to cryptocurrencies and stablecoins (often called “dollar tokens” in regulatory circles). Learn more about how these assets function in Types of Cryptocurrencies: A Complete Guide for Beginners (2025).

- Central Bank Digital Currency (CBDC): The Fed’s ongoing research and potential development of a “digital dollar” – a central bank-issued digital currency that would represent the U.S. dollar in the digital realm. For core blockchain technology principles that would underpin these innovations, see Blockchain Basics: Beginner’s Guide to How Blockchain Works (2025).

These dual aspects of Fed crypto policy create a complex framework that both constrains and potentially enhances the cryptocurrency ecosystem. Understanding this distinction is crucial for anyone tracking how monetary policy intersects with digital assets.

Q: How does Fed crypto policy differ from other crypto regulations?

While agencies like the SEC and CFTC focus primarily on market conduct, securities laws, and fraud prevention, the Federal Reserve’s concerns are anchored in banking stability, monetary policy transmission, and systemic risk. This creates a multi-layered regulatory environment where different agencies approach crypto from complementary but distinct angles.

For a comprehensive breakdown of regulations and compliance within the cryptocurrency space, refer to Regulations & Legal Aspects of Crypto Trading (2025).

The Fed’s unique position comes from its dual mandate of price stability and maximum employment, making its approach to crypto fundamentally different from other regulators. When the Fed shifts its stance, it affects not just compliance requirements but also the underlying economic conditions in which cryptocurrencies operate.

The Fed’s Regulatory U-Turn: A New Era for Crypto Banking?

Q: What major regulatory changes has the Fed made regarding cryptocurrencies?

In a significant policy shift, the Federal Reserve recently rescinded guidance that required state-chartered banks to notify regulators before engaging in crypto-asset activities. This change removes a substantial hurdle for banks looking to integrate cryptocurrency services into their operations.

If you are interested in how these changes impact crypto exchanges and the services they offer, Crypto Exchanges Explained: Beginner’s Guide (2025) provides an excellent primer on what exchanges are and the products now potentially accessible to users through regulated banks.

The Fed, alongside the FDIC and OCC, has also withdrawn earlier statements that expressed heightened concerns about crypto-related banking risks. This regulatory relaxation signals a more permissive approach, allowing banks to be supervised under standard procedures rather than facing crypto-specific barriers.

Q: Why did the Fed change its stance on crypto regulation?

- Market Maturation: As cryptocurrency markets have developed more robust risk management practices, the Fed’s risk assessment has evolved.

- Competitive Pressures: International developments in digital currency regulation have created pressure for the U.S. to maintain financial competitiveness.

- Innovation Support: The Fed has explicitly stated its aim to balance innovation with appropriate supervisory oversight, recognizing that overly restrictive policies could stifle beneficial financial technology advances.

This shift doesn’t represent a complete embrace of cryptocurrencies but rather a more nuanced approach that acknowledges both potential benefits and continued risks.

Q: What crypto activities can banks now engage in?

While the regulatory relaxation provides more flexibility, banks still face limitations on their crypto activities. Currently, the clearest path for banks involves stablecoin-related services, while questions remain about banks directly holding other types of crypto assets.

The Fed, OCC, and FDIC are reportedly developing additional guidance to address unresolved issues, particularly around banks holding non-stablecoin crypto assets. This evolving framework means banks can now more easily:

- Offer custody services for crypto assets

- Provide banking services to crypto companies

- Develop stablecoin-related products

- Explore blockchain-based settlement systems

If you want to understand the fundamentals of how exchanges and wallets differ for custody and storage strategies, visit Exchange vs Wallet Explained: A Comprehensive Guide to Crypto Storage Options.

The Digital Dollar Dilemma: CBDC Development and Its Implications

Q: How close is the U.S. to launching a digital dollar?

Despite extensive research, a U.S. central bank digital currency remains in the exploratory phase. The Federal Reserve has emphasized that any digital dollar would require thorough testing, piloting, and explicit Congressional authorization before launch.

Technical feasibility research, including collaborations with MIT through Project Hamilton, has advanced understanding of potential CBDC architectures. However, the Fed has clearly communicated that a digital dollar is not expected within the next two years.

For a broader perspective on digital money, see How Cryptocurrency Works: Beginner’s Guide to Digital Money.

This measured approach contrasts with more aggressive CBDC development in other countries, most notably China’s digital yuan, which has already seen significant real-world testing.

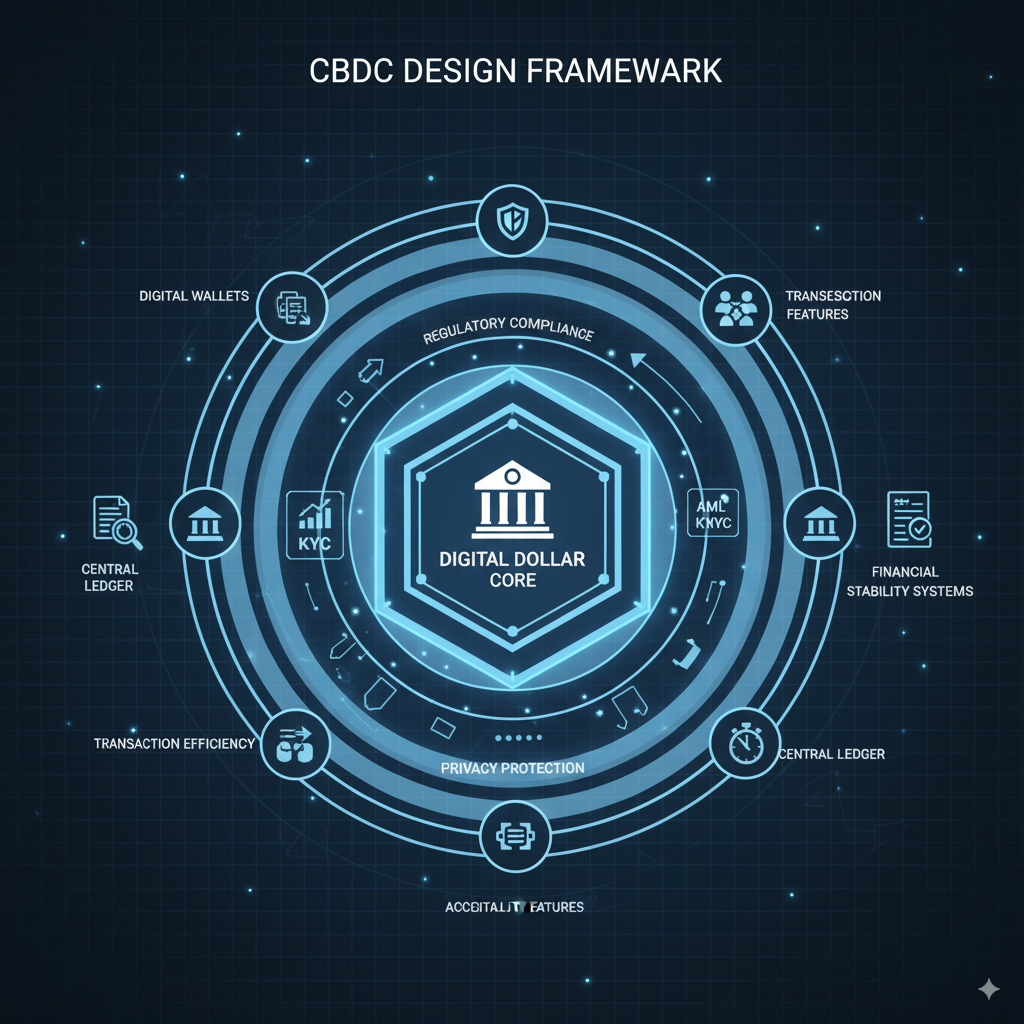

Q: What would a digital dollar look like if implemented?

While specific design choices remain undecided, the Fed has outlined several core priorities for any potential digital dollar:

- Privacy Protection: Balancing transaction privacy with necessary compliance requirements

- Regulatory Compliance: Ensuring adherence to anti-money laundering laws and sanctions

- Financial Stability: Preventing disruption to existing banking and payment systems

- Efficiency: Creating a system that improves upon current payment rails

- Accessibility: Ensuring broad access across different socioeconomic groups

The resulting CBDC would likely operate alongside (rather than replacing) physical cash and existing electronic payment systems, providing a federally-backed digital alternative that combines the security of central bank money with the convenience of digital transactions.

For those interested in the technical backbone of CBDCs and other blockchain-based assets, Distributed Ledger Technology (DLT): What It Is, How It Works, and Why It Matters in 2025 offers essential insights.

Q: What concerns does the Fed have about launching a CBDC?

- Banking Disruption: A digital dollar could potentially reduce bank deposits if consumers shift funds to CBDC holdings

- Financial Stability Risks: During periods of stress, rapid shifts from bank deposits to a CBDC could amplify banking system volatility

- Monetary Policy Transmission: Changes to the banking system could affect how monetary policy decisions impact the broader economy

- Operational Resilience: Ensuring a CBDC system can withstand cyber attacks and operational failures

- Privacy and Surveillance Concerns: Balancing transaction monitoring with appropriate privacy protections

These concerns explain the Fed’s cautious approach and emphasis on thorough research before any implementation decisions. You can read more about crypto investment risks and market volatility in Risks of Crypto Investment: What Beginners Must Know in 2025 and Volatility in Crypto: Why Prices Swing Wildly in 2025.

Market Impact Analysis: How Fed Crypto Policy Affects Your Investments

Q: How do these Fed policies impact cryptocurrency markets and ETFs?

The Fed’s more permissive regulatory stance creates several investment implications:

- Banking Integration: Easier bank participation in crypto activities could accelerate institutional adoption, potentially benefiting established cryptocurrencies and related ETFs.

For a deeper comparison of crypto exchanges that stand to benefit from regulatory clarity, see Top Crypto Exchanges 2025: Complete Comparison Guide. - Stablecoin Growth: The regulatory clarification around stablecoins could drive expansion in this sector, benefiting projects with strong regulatory compliance frameworks.

- ETF Dynamics: Crypto ETFs may see reduced regulatory risk premiums as the banking system’s integration with digital assets becomes more straightforward. This could potentially narrow the gap between crypto ETF performance and underlying asset performance.

- Volatility Effects: As traditional financial institutions increase their crypto exposure, we may see decreased volatility in major cryptocurrencies as liquidity deepens and market structures mature. If you’re curious why volatility matters so much in crypto, see Volatility in Crypto: Why Prices Swing Wildly in 2025.

For investors in crypto-related ETFs, these developments suggest potentially smoother institutional adoption curves and reduced regulatory headwinds, though market-specific risks remain significant.

Q: Does this make cryptocurrency a safer investment?

While regulatory clarity generally reduces certain risks, crypto investments remain highly speculative. The Fed’s policy shift doesn’t eliminate fundamental concerns about:

- Volatility: Crypto assets continue to experience dramatic price swings (Volatility in Crypto: Why Prices Swing Wildly in 2025)

- Technology Risks: Smart contract vulnerabilities and other technical failures remain concerns—in-depth info in What Are Smart Contracts? A Beginner’s Guide for August 2025

- Regulatory Uncertainty: Other agencies like the SEC continue to pursue enforcement actions (Regulations & Legal Aspects of Crypto Trading (2025))

- Market Manipulation: Concerns about market manipulation persist despite improved market structures

Investors should view the Fed’s evolving stance as just one factor in a comprehensive risk assessment rather than a wholesale endorsement of crypto assets as safe investments.

Future Outlook: What’s Next for Fed Crypto Policy?

Q: What developments should investors watch for in Fed crypto policy?

Several key indicators will signal the Fed’s future direction on crypto policy:

- Additional Banking Guidance: Forthcoming guidelines from banking regulators about permitted crypto activities beyond stablecoins will clarify institutional participation boundaries.

- CBDC Development Milestones: Technical progress reports and policy position papers on digital dollar research will indicate implementation timelines.

- International Coordination: The Fed’s participation in international CBDC forums and standards development will reveal how U.S. approaches align with global developments.

- Congressional Actions: Legislative developments related to stablecoins and CBDCs could accelerate or constrain the Fed’s options.

For investors whose strategies depend on monetary policy dynamics, monitoring the intersection of traditional Fed communications with these crypto-specific developments provides crucial context. To see how exchanges are innovating for the future, check out Future of Crypto Exchanges 2025: AI, DeFi & Web3 Evolution.

Q: How might a potential digital dollar affect cryptocurrency investments?

Potential Challenges:

- Competition with certain stablecoin use cases

- Increased regulatory scrutiny of the entire digital asset ecosystem

- Potential advantages for CBDC-compatible projects over competitors

Potential Opportunities:

- Legitimization of digital assets as a concept

- New infrastructure needs for CBDC interoperability

- Clearer regulatory boundaries for compliant projects

The balance of these factors would depend significantly on specific design choices and implementation timelines for any digital dollar.

Conclusion: Navigating the New Fed Crypto Landscape

The Federal Reserve’s approach to cryptocurrency represents a careful balancing act between supporting innovation and managing financial stability risks. Recent policy shifts signal a more nuanced understanding of digital assets rather than a complete embrace or rejection.

For investors whose growth strategies depend on monetary policy and ETF performance, these developments create a more favorable institutional environment while leaving fundamental crypto investment risks largely unchanged. The potential development of a digital dollar remains a longer-term consideration that could significantly reshape market dynamics when and if implemented.

As we navigate this evolving landscape, the most successful investment strategies will likely be those that remain adaptable to regulatory developments while maintaining appropriate risk management for crypto’s inherent volatility. The Fed’s evolving approach provides more room for financial innovation, but navigating this space still requires careful assessment of both traditional financial risks and crypto-specific challenges.

To start or optimize your cryptocurrency journey, compare trusted exchanges that operate within the evolving regulatory landscape, such as Binance, Coinbase, Bybit, and OKX.

The “Fed crypto” story continues to unfold, and for investors watching this space, staying informed about both monetary policy and digital asset developments has never been more important.

FAQs: Fed Crypto 2025

- What is “Fed crypto” in one sentence?

“Fed crypto” refers to the Federal Reserve’s regulatory oversight of digital asset banking and its research into a potential U.S. digital dollar (CBDC). - Has the Fed approved banks to hold cryptocurrency directly?

No, direct bank custody and holding of non-stablecoin crypto assets remains restricted, with further guidance expected soon. - When could a digital dollar launch in the U.S.?

Not before 2026; Congressional authorization, public input, and further technical testing will all be required first. - Will a CBDC replace physical cash?

Unlikely—CBDC implementation is intended as an addition to, rather than a substitute for, physical cash and current electronic funds. - Does Fed crypto policy make crypto investments “safe”?

No, crypto assets remain highly volatile and speculative even with greater regulatory clarity. - Where can I learn more about the basics?

Start with What is Cryptocurrency? Beginner’s Guide and Digital Assets Guide for the essentials before diving deeper into “Fed crypto.”