Exchange vs Wallet Explained: A Comprehensive Guide to Crypto Storage Options

Estimated reading time: 11 minutes

- Discover the essential differences between crypto exchanges and wallets

- Learn about security, control, and practical considerations for storing digital assets

- Explore custodial vs. non-custodial wallets—and which is right for you

- Understand how exchanges and wallets function under the hood

- Get actionable tips for safe and effective crypto management

Table of Contents

- What is a Cryptocurrency Exchange?

- What is a Cryptocurrency Wallet?

- The Difference Between Exchanges and Wallets

- How Do Exchanges Function?

- How Do Wallets Function?

- Custodial vs Non-Custodial Wallets Explained

- FAQ

When entering the cryptocurrency world, one of the most fundamental decisions you’ll face involves understanding where and how to store your digital assets. The choice between using a cryptocurrency exchange versus a dedicated wallet represents more than just a storage preference—it determines your level of control, security, and accessibility to your funds. This comprehensive guide examines both options thoroughly, helping you make informed decisions that align with your specific needs and circumstances.

The distinction between exchanges and wallets often confuses newcomers, yet grasping this concept forms the foundation for safe cryptocurrency management. Each option serves distinct purposes within the broader digital asset ecosystem, offering unique advantages and trade-offs that can significantly impact your crypto journey.

For a gentle primer on wallets, exchanges, and fundamental concepts, see Introduction to Crypto.

What is a Cryptocurrency Exchange?

A cryptocurrency exchange functions as a digital marketplace where users buy, sell, and trade various cryptocurrencies. Think of it as the stock market for digital assets—a centralized platform that connects buyers and sellers while facilitating transactions at current market prices.

These platforms serve multiple roles within the crypto ecosystem. They provide order matching services, maintain liquidity pools, offer price discovery mechanisms, and handle the technical complexities of blockchain transactions. Most exchanges also offer additional services such as staking, lending, and futures trading to attract users seeking comprehensive financial services.

To dive deeper, check out Crypto Exchanges Explained.

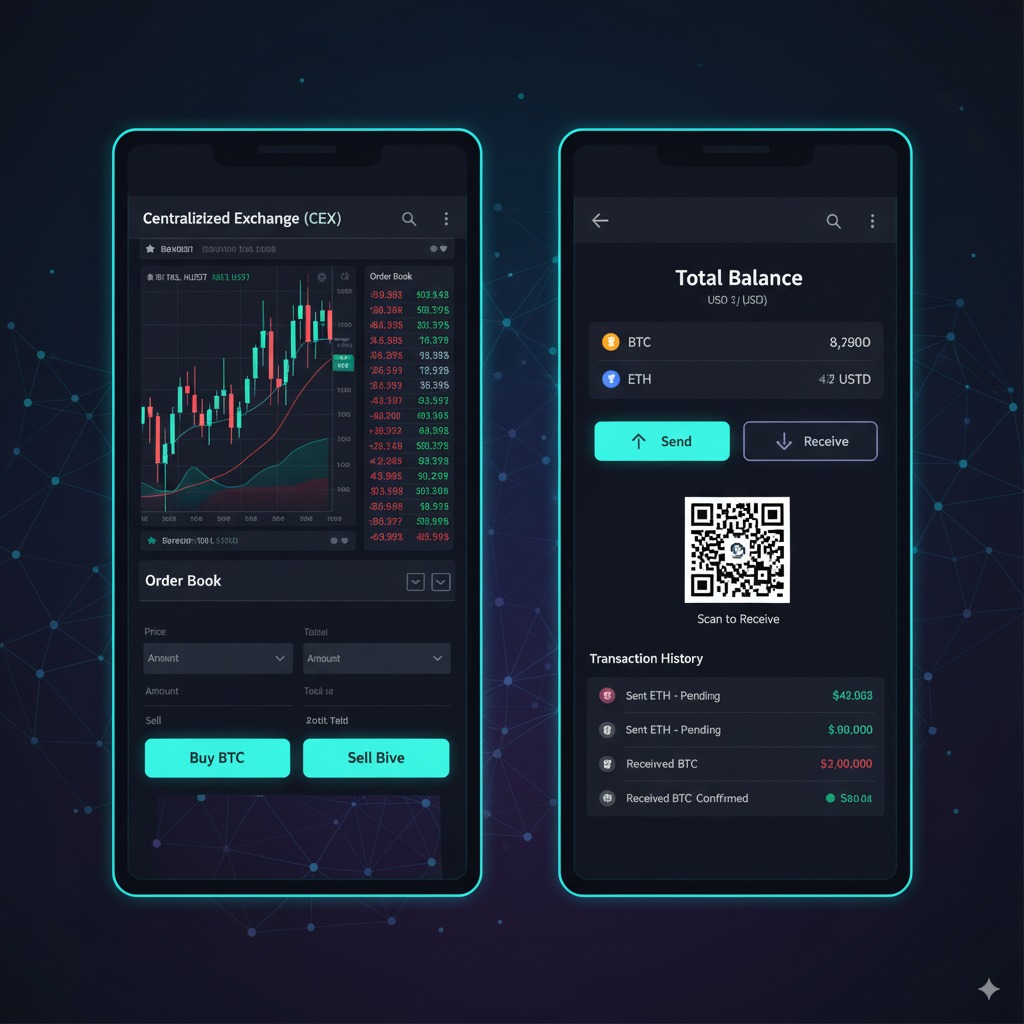

Cryptocurrency exchanges fall into two primary categories: centralized exchanges (CEXs) and decentralized exchanges (DEXs). Centralized exchanges like Binance, Coinbase, and Kraken operate as traditional companies with headquarters, regulatory oversight, and customer support teams. These platforms maintain custody of user funds and handle transaction processing internally. Decentralized exchanges such as Uniswap and PancakeSwap operate on blockchain networks without central authorities, allowing peer-to-peer trading through smart contracts.

“Centralized exchanges process over 95% of cryptocurrency trading volume globally, with platforms like Binance handling daily volumes exceeding $15 billion.” This massive scale demonstrates the critical role exchanges play in the crypto ecosystem, serving as the primary entry point for new users and the main venue for active trading.

For tips on choosing a trading venue, see Best Crypto Exchange 2025.

What is a Cryptocurrency Wallet?

A cryptocurrency wallet represents a software program or hardware device that stores the cryptographic keys needed to access and manage your digital assets on blockchain networks. Unlike traditional wallets that hold physical currency, crypto wallets don’t actually store cryptocurrencies—they store the private keys that prove ownership of funds recorded on distributed ledgers.

The wallet landscape encompasses several distinct types, each offering different security levels and user experiences:

- Hot wallets remain connected to the internet, providing convenient access for regular transactions. Popular examples: MetaMask, Trust Wallet, Exodus.

- Cold storage solutions (hardware wallets like Ledger and Trezor) keep private keys offline for maximum security. Paper wallets are another (less common) cold storage method.

- Software wallets on computers or mobile devices provide a compromise between convenience and security.

The wallet you choose ultimately depends on your security requirements, technical comfort level, and intended usage patterns.

For a detailed guide on protecting your funds, see Wallets & Security.

The Difference Between Exchanges and Wallets

| Aspect | Cryptocurrency Exchange | Cryptocurrency Wallet |

|---|---|---|

| Primary Purpose | Trading and buying/selling crypto | Storing and managing private keys |

| Control of Private Keys | Exchange controls keys (custodial) | User controls keys (non-custodial) |

| Security Model | Centralized security measures | Personal security responsibility |

| Transaction Speed | Internal transfers are instant | Network-dependent confirmation times |

| Trading Features | Built-in order books and trading pairs | Limited to basic send/receive functions |

| Regulatory Compliance | Subject to financial regulations | Generally unregulated usage |

| Recovery Options | Customer support assistance | Self-managed seed phrase recovery |

| Internet Dependency | Requires internet connection | Cold storage options available offline |

The fundamental difference lies in custody and control. Exchanges operate on a custodial model where the platform holds your private keys—similar to how traditional banks hold your money. This arrangement offers convenience and familiar customer service experiences but requires trusting a third party with your assets.

Wallets, particularly non-custodial varieties, place complete control in your hands. You hold the private keys and bear full responsibility for security measures. This approach aligns with cryptocurrency’s core principle of self-sovereignty but demands higher technical knowledge and security awareness.

The trade-off between convenience and control represents the central tension in crypto storage decisions. Exchanges excel at providing seamless trading experiences with customer support safety nets, while wallets offer ultimate control with corresponding responsibility burdens.

For a broader perspective on the nature of money, see Crypto vs Fiat Money.

How Do Exchanges Function?

Cryptocurrency exchanges operate through sophisticated order matching systems that connect buyers and sellers at agreed-upon prices. When you place a buy order for Bitcoin at $45,000, the exchange’s matching engine searches for corresponding sell orders at or below that price, executing trades when matches occur.

The process begins when users deposit funds into exchange accounts through bank transfers, credit cards, or cryptocurrency transfers. These deposits create internal account balances that the exchange tracks through centralized databases rather than individual blockchain transactions. This system enables rapid trading without waiting for blockchain confirmations between each trade.

For a thorough breakdown of these mechanisms, visit How Does a Crypto Exchange Work.

Market makers and takers form the trading ecosystem’s backbone. Market makers provide liquidity by placing limit orders that sit in order books, while takers execute immediate trades against existing orders. Exchanges incentivize market makers through reduced fee structures.

KYC and AML procedures represent crucial operational components. These regulatory requirements mandate identity verification, transaction monitoring, and suspicious activity reporting. While burdensome for some, they enable exchanges to operate legally and build trust with institutions.

Exchange revenue primarily comes from trading fees (typically 0.1% to 1% per trade). Additional income streams include listing fees, premium services, staking rewards, and margin interest.

To see how these costs affect users, check the Crypto Exchange Fees Guide.

How Do Wallets Function?

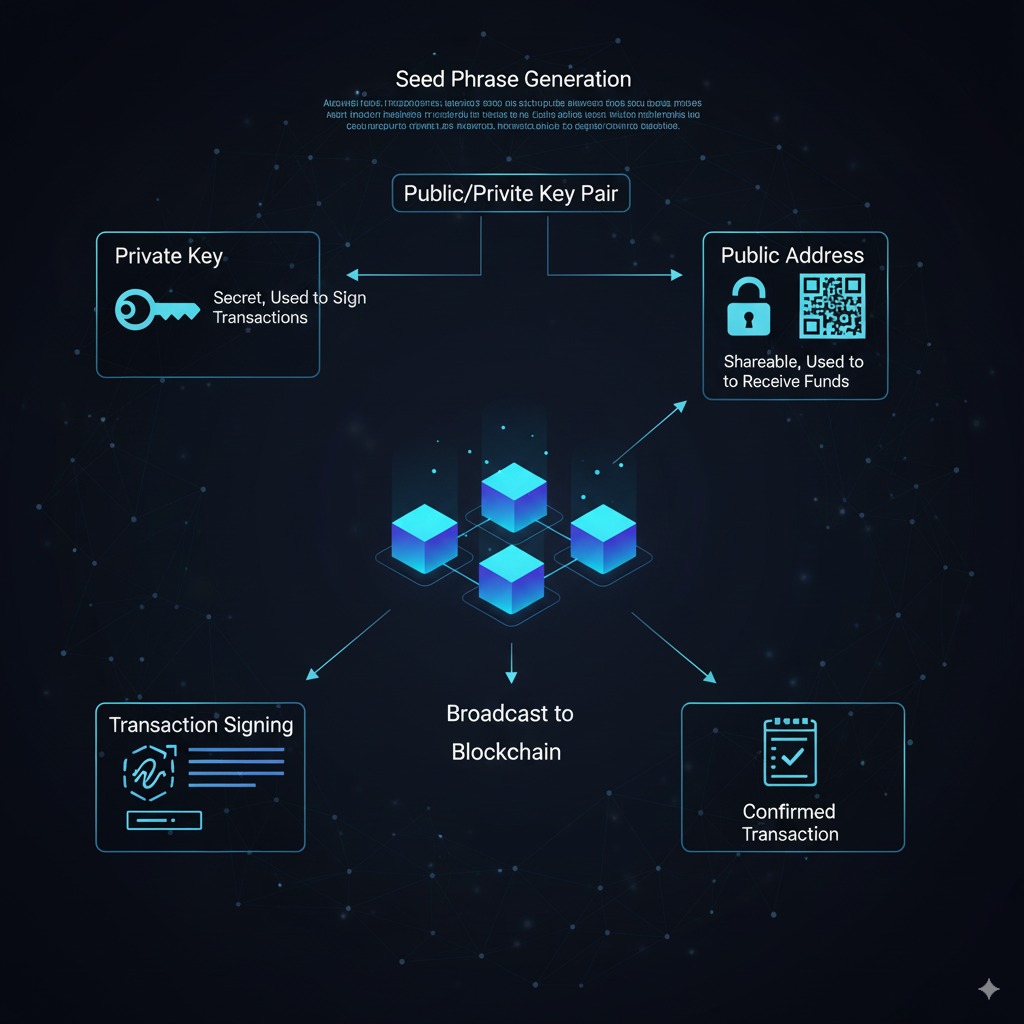

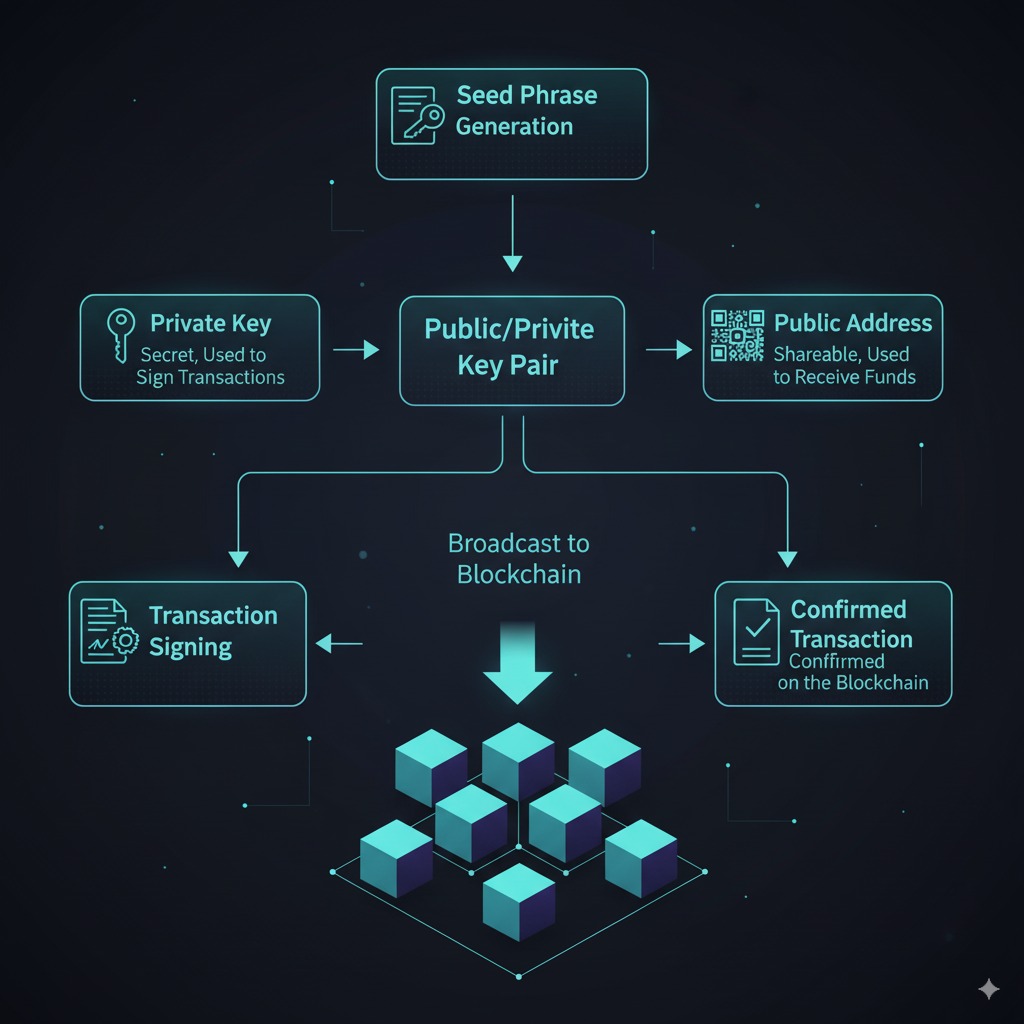

Cryptocurrency wallets function by managing pairs of cryptographic keys—public keys (addresses) and private keys (for spending). When someone sends crypto to your wallet, they’re assigning ownership on the blockchain to your public address.

Transaction signing is at the heart of wallet operations. When you send funds, your wallet signs the transaction with your private key (without ever exposing it), creating a digital signature verifiable by the entire network. The signed transaction broadcasts for confirmation and addition to the blockchain.

Seed phrases (usually 12 or 24 words) allow for easy backup and recovery of all your private keys through standardized algorithms—so secure storage of your seed phrase is critical (lose it and your funds are gone forever).

Most modern wallets are hierarchical deterministic (HD), supporting multiple cryptocurrencies and generating new addresses for added privacy on each transaction.

Wallets integrate with blockchain networks in several ways:

- Full node (max privacy/security, high setup)

- Light clients (convenient, trust some third-party nodes)

- Web/service wallets (easy but less control/privacy)

For a clear, visual introduction, see How Cryptocurrency Works.

Custodial vs Non-Custodial Wallets Explained

The custodial versus non-custodial distinction represents one of the most important concepts in cryptocurrency storage. This classification determines who controls the private keys that govern access to your digital assets, shaping security, responsibility, and user experience.

| Feature | Custodial Wallets | Non-Custodial Wallets |

|---|---|---|

| Private Key Control | Service provider holds keys | User holds keys |

| Account Recovery | Customer support assistance | Self-managed seed phrase only |

| Transaction Authorization | Platform may require approval | Direct user authorization |

| Regulatory Oversight | Subject to financial regulations | Generally unregulated |

| Security Responsibility | Platform handles security measures | User responsible for security |

| Access Requirements | Account credentials needed | Private keys/seed phrase needed |

| Typical Examples | Exchange wallets, PayPal crypto | MetaMask, hardware wallets |

Custodial wallets operate similarly to traditional bank accounts. The service provider manages private keys, handles security, and often has customer support.

This model appeals to users who want a familiar financial experience and don’t want the stress of safeguarding keys.

However, custodial solutions introduce counterparty risk—the possibility that the service provider might suffer technical failures, regulatory clampdowns, or even hacks. Famous incidents like Mt. Gox’s collapse resulted in multi-billion-dollar losses, teaching hard lessons in the risks of centralization.

Non-custodial wallets put you firmly in the driver’s seat. “Not your keys, not your coins” is a famous saying in crypto for good reason—holding your private keys means your crypto is always under your personal control, but it also means you are solely responsible for security and recovery.

For in-depth beginner advice, don’t miss Wallets & Security.

FAQ

A: It depends on your needs. For frequent trading or active investing, exchanges offer convenience. For long-term storage or maximum security, a non-custodial wallet is safer. Experts often recommend transferring any funds you don’t plan to trade soon to a wallet where you control the keys.

A: The main risk is loss of funds due to hacks, platform insolvency, withdrawal freezes, or regulatory actions—since you do not control the private keys on the exchange. Read about mitigating these risks in Crypto Exchanges Explained.

A: Hot wallets are connected to the internet (greater convenience but increased risk); cold wallets (like hardware wallets) are offline and far more secure for storage.

A: Wallets provide more privacy than exchanges (no identity required for creation), but most public blockchains are transparent, so transactions can often be tracked. For more, see How Cryptocurrency Works.

A: Most wallets generate a recovery seed phrase—write it down and keep it secure (never online). This phrase is your only recovery option for non-custodial wallets. For security tips, see Wallets & Security.