Deribit Exchange Review (2025): Is It the Best Crypto Derivatives Platform?

Executive Summary: Deribit at a Glance

Overall Rating: 4.6/5 ⭐⭐⭐⭐⭐

Deribit has established itself as the undisputed leader in cryptocurrency options trading, commanding over 80% market share and processing billions in daily volume. Since its 2016 launch, this Amsterdam-founded exchange has become the go-to platform for professional traders and institutions seeking sophisticated Bitcoin and Ethereum derivatives.

Quick Verdict:

Best for: Professional traders, options specialists, institutional investors, and advanced retail traders seeking deep liquidity in BTC/ETH derivatives.

Not ideal for: Complete beginners, spot-only traders, users in restricted jurisdictions (US, Canada), or those seeking diverse altcoin exposure.

Key Strengths: Dominant options market, competitive fee structure, robust security, advanced trading tools, institutional-grade infrastructure.

Notable Limitations: Limited to BTC/ETH only, no fiat support, restricted geographic availability, steep learning curve for beginners.

What Is Deribit? Platform Overview

Background and Company Information

Founded in June 2016 by entrepreneurs Johannes Jansen and Marius Jansen, Deribit emerged from Amsterdam’s fintech ecosystem with a laser focus on cryptocurrency derivatives. The platform launched when crypto derivatives were still nascent, establishing first-mover advantage in the options segment.

Corporate Structure:

- Legal Entity: Deribit (Panama) Ltd.

- Headquarters: Panama (operations), Netherlands (original founding)

- Regulatory Status: Self-regulated, not licensed by major financial authorities (SEC, FCA, etc.)

- Operational History: 8+ years without major security incidents or insolvency

While the lack of traditional financial regulation may concern some traders, Deribit’s longevity, market dominance, and transparent operations have built substantial trust within the crypto community. The platform serves global users except those from restricted jurisdictions.

Market Position and Volume Statistics

Deribit’s market position is nothing short of dominant in specific segments:

Options Trading: Controls 80-85% of the global crypto options market, with competitors collectively sharing the remainder. This near-monopoly status reflects both first-mover advantage and superior product execution.

Daily Trading Volume: Regularly processes $2-5 billion in daily derivatives volume, with spikes exceeding $10 billion during high volatility periods.

Open Interest: Maintains $5-10 billion in outstanding derivatives positions, indicating substantial institutional and professional participation.

User Base: Serves hundreds of thousands of registered accounts, though active trading accounts number in the tens of thousands—reflecting the platform’s professional orientation.

Competitive Landscape: Primary competitors include Binance (broader derivatives), Bybit (altcoin futures focus), CME (regulated institutional), and OKX (comprehensive crypto exchange). However, none match Deribit’s options liquidity or specialization.

Core Product Offerings

Deribit deliberately limits its product scope to achieve unmatched depth in specific markets:

Bitcoin (BTC) Derivatives:

- Perpetual futures contracts

- Weekly, monthly, and quarterly dated futures

- Daily, weekly, monthly, and quarterly options with numerous strike prices

Ethereum (ETH) Derivatives:

- Perpetual futures contracts

- Weekly, monthly, and quarterly dated futures

- Daily, weekly, monthly, and quarterly options with numerous strike prices

Settlement: All contracts settle in the underlying cryptocurrency (BTC or ETH), not USD or stablecoins. This eliminates counterparty risk from stablecoin issuers but requires traders to hold crypto collateral.

No Spot Trading: Unlike most exchanges, Deribit offers zero spot trading pairs. This focus allows resource concentration on derivatives infrastructure and liquidity.

Asset Limitation Rationale: By restricting offerings to BTC and ETH—the two most liquid and institutionally accepted cryptocurrencies—Deribit achieves:

- Maximum liquidity concentration

- Simplified risk management systems

- Reduced operational complexity

- Better institutional compliance profile

For traders seeking diverse altcoin derivatives, platforms like Binance or Bybit offer broader selection, though with less depth in any single market.

Deribit Fee Structure: Comprehensive Breakdown

Understanding Deribit’s fee structure is critical for calculating trading profitability and comparing against competitors.

Futures Trading Fees

Deribit employs a maker-taker model that incentivizes liquidity provision:

Standard Rates (Below 50 BTC 30-day volume):

- Maker Fee: -0.0001% (you receive a rebate)

- Taker Fee: 0.05%

Example Calculation:

- $100,000 futures position as taker: Pay $50 fee (0.05%)

- $100,000 futures position as maker: Receive $10 rebate (-0.0001%)

The negative maker fee means market makers are paid to provide liquidity, a powerful incentive that maintains tight spreads and deep order books.

Options Trading Fees

Options fee structure differs slightly due to pricing complexity:

Standard Rates:

- Maker Fee: 0.0003% of option notional value

- Taker Fee: 0.0003% of option notional value

Delivery Fee: 0.015% of intrinsic value at settlement/exercise

Example:

- Buy 1 BTC call option with $100,000 notional: $30 fee (0.0003%)

- Option expires in-the-money with $5,000 intrinsic value: $0.75 delivery fee (0.015%)

Options fees are symmetric between makers and takers because option pricing already reflects bid-ask spreads, and maker rebates would distort option pricing models.

Volume-Based Fee Tiers

Active traders benefit from progressive fee reductions based on 30-day trailing volume:

| 30-Day Volume (BTC) | Futures Maker | Futures Taker | Options Maker/Taker |

|---|---|---|---|

| < 50 BTC | -0.0001% | 0.05% | 0.0003% |

| 50 – 250 BTC | -0.0002% | 0.045% | 0.00025% |

| 250 – 1,000 BTC | -0.0003% | 0.04% | 0.0002% |

| 1,000 – 5,000 BTC | -0.0004% | 0.035% | 0.00015% |

| > 5,000 BTC | -0.0005% | 0.03% | 0.0001% |

Note: Exact tier boundaries and percentages subject to change. Verify current rates on Deribit’s official fee schedule.

Volume Calculation: Based on combined BTC-equivalent volume across all instruments (futures + options), providing credit for diversified trading activity.

Market Maker Programs: Ultra-high-volume participants (10,000+ BTC monthly) can negotiate custom fee structures with even more favorable terms, plus dedicated support and infrastructure.

Funding Rates (Perpetual Futures)

Perpetual contracts include funding rate exchanges between long and short holders every 8 hours (00:00, 08:00, 16:00 UTC):

How It Works:

- Positive funding: Perpetual trading above spot → Longs pay shorts

- Negative funding: Perpetual trading below spot → Shorts pay longs

- Rate magnitude: Typically -0.05% to +0.05% per 8-hour period

Historical Patterns:

- Bull markets: Generally positive funding (long-biased market)

- Bear markets: Often negative funding (short-biased positioning)

- High volatility: Rates can spike beyond typical ranges

Strategic Implications: Funding creates opportunities and costs. Holding large perpetual positions for weeks can incur significant funding expenses or generate substantial income depending on market positioning and direction.

Deposit and Withdrawal Fees

Deposits: Completely free (zero fees from Deribit)

- You pay only blockchain network transaction fees when sending crypto

Withdrawals:

- Bitcoin: Dynamic fee based on network congestion, typically 0.0001 – 0.0005 BTC ($6-$40 at $60,000 BTC)

- Ethereum: Dynamic gas-based fee, typically 0.001 – 0.01 ETH ($3-$30 at $3,000 ETH)

Deribit adjusts withdrawal fees based on real-time blockchain conditions, ensuring timely confirmations without excessive costs. During periods of low network activity (often weekends), withdrawal fees decrease proportionally.

Withdrawal Processing:

- Most withdrawals processed within 30 minutes to 2 hours

- Large withdrawals may require manual review, adding time

- First-time addresses may face 24-hour security holds

Fee Comparison vs Competitors

Deribit vs Binance Futures:

- Deribit maker rebates: -0.0001% vs Binance: 0.02% (maker pays on Binance)

- Deribit taker: 0.05% vs Binance: 0.04%

- Verdict: Deribit better for makers; Binance slightly better for pure takers

Deribit vs Bybit:

- Deribit maker: -0.0001% vs Bybit: 0.01% (maker pays on Bybit)

- Deribit taker: 0.05% vs Bybit: 0.06%

- Verdict: Deribit superior on both maker and taker fees

Deribit vs CME Bitcoin Futures:

- Deribit: Percentage-based fees (0.05% taker)

- CME: Fixed per-contract fees (~$6-10 per contract)

- Verdict: Depends on trade size; CME potentially cheaper for very large institutional tickets

Bottom Line: Deribit offers highly competitive fees, especially for market makers and high-volume traders. The maker rebate structure is among the most generous in crypto derivatives.

Security and Safety: How Secure Is Deribit?

Security stands as a paramount concern for any cryptocurrency exchange. Deribit’s eight-year operational history without major hacks provides strong empirical evidence of robust security practices.

Cold Storage and Custody

Cold Wallet Storage: Deribit maintains over 95% of user funds in cold storage, meaning offline wallets inaccessible to internet-connected systems. This dramatically reduces attack surface for potential hackers.

Hot Wallet Management: Only funds required for immediate withdrawal processing and operational liquidity remain in hot wallets, typically representing less than 5% of total holdings.

Multi-Signature Architecture: Cold wallet withdrawals require multiple signature approvals from geographically distributed team members, preventing single points of failure or rogue insider actions.

Regular Audits: Deribit conducts periodic security audits by third-party cybersecurity firms, though unlike some competitors, detailed audit reports are not publicly published.

Account Security Features

Mandatory Two-Factor Authentication (2FA): All accounts must enable 2FA for trading and withdrawals. Supported methods include:

- Google Authenticator (TOTP)

- Authy (cloud-synced TOTP)

- Hardware security keys (YubiKey, FIDO2)

Withdrawal Whitelisting: Enable address whitelisting to restrict withdrawals only to pre-approved addresses, with 24-48 hour activation delays for new addresses preventing unauthorized emergency withdrawals.

Session Management:

- Configurable auto-logout after inactivity

- Device fingerprinting to detect unusual login patterns

- Email notifications for all logins, withdrawals, and security changes

IP Whitelisting: Advanced users can restrict account access to specific IP addresses, preventing access even if credentials are compromised.

API Key Permissions: Granular API permission controls limit keys to specific functions (read-only, trading-only, no withdrawals), reducing damage from compromised API keys.

Insurance Fund and Risk Management

Insurance Fund Purpose: Deribit maintains a substantial insurance fund (typically several thousand BTC) to cover losses from liquidations that couldn’t be executed at bankruptcy price.

How It Works: When traders are liquidated, their positions close at the bankruptcy price. If market conditions prevent closing at this price (e.g., rapid price gaps), the insurance fund covers the shortfall, preventing socialized losses to profitable traders.

Fund Transparency: Insurance fund balances are publicly visible on Deribit’s website, allowing traders to assess the system’s resilience during extreme volatility.

Auto-Deleveraging (ADL): As a last resort if insurance funds are depleted, Deribit employs an auto-deleveraging system that closes profitable positions in order of leverage and profitability to cover losses. This is rare and typically only occurs during extreme black swan events.

Historical Security Track Record

No Major Hacks: Unlike many competitors (Binance, KuCoin, FTX), Deribit has never suffered a significant security breach resulting in user fund losses.

Operational Continuity: The platform has maintained consistent uptime even during 2017-2018 crypto boom/bust cycles and 2020-2021 extreme volatility.

Transparency During Issues: When technical issues occur, Deribit communicates promptly via social media and system status pages, maintaining user trust through transparency.

FTX Contagion Resistance: During the November 2022 FTX collapse that devastated the crypto industry, Deribit proved financially sound with no exposure to FTX or affiliated entities, demonstrating prudent risk management.

Regulatory Compliance and Legal Structure

Regulatory Status: Deribit operates without direct oversight from major financial regulators (SEC, FCA, MAS, etc.). The platform is registered in Panama, which offers limited regulatory requirements.

Know Your Customer (KYC):

- Basic accounts: No KYC required, allowing pseudonymous trading with withdrawal limits

- Verified accounts: Optional KYC increases withdrawal limits and unlocks advanced features

- KYC verification: Requires government ID, proof of address, and selfie

Anti-Money Laundering (AML): Deribit implements blockchain analysis to detect suspicious transaction patterns and maintains compliance with international AML standards despite limited regulatory oversight.

Geographic Restrictions: Deribit blocks users from several jurisdictions including:

- United States

- Canada

- Crimea, Cuba, Iran, Syria, North Korea (OFAC sanctioned regions)

- Other jurisdictions as required by evolving regulations

Jurisdiction Shopping Debate: Critics argue offshore registration avoids accountability. Supporters note that unclear US crypto regulations make domestic operations impractical, and market forces (reputation, user trust) provide strong security incentives even without formal oversight.

Security Best Practices for Users

While Deribit provides robust infrastructure security, users must implement personal security hygiene:

Essential practices:

- Use unique, complex passwords (minimum 16 characters, password manager recommended)

- Enable hardware 2FA (YubiKey superior to app-based 2FA)

- Activate withdrawal whitelisting with all addresses you’ll need

- Never share API keys or grant full withdrawal permissions to third parties

- Verify URLs carefully to avoid phishing sites (bookmark official site)

- Keep devices secure with updated antivirus and operating systems

- Use separate email for exchange accounts (not reused elsewhere)

- Store 2FA backup codes securely offline

Red flags indicating potential compromise:

- Unexpected login notifications

- Withdrawal attempts you didn’t initiate

- API keys created without your action

- 2FA settings changes

If you detect suspicious activity, immediately change passwords, revoke all API keys, contact support, and consider withdrawing funds to secure personal wallets.

Trading Features and Platform Capabilities

Deribit’s feature set caters specifically to professional and institutional traders, offering sophisticated tools that may overwhelm beginners but empower experienced participants.

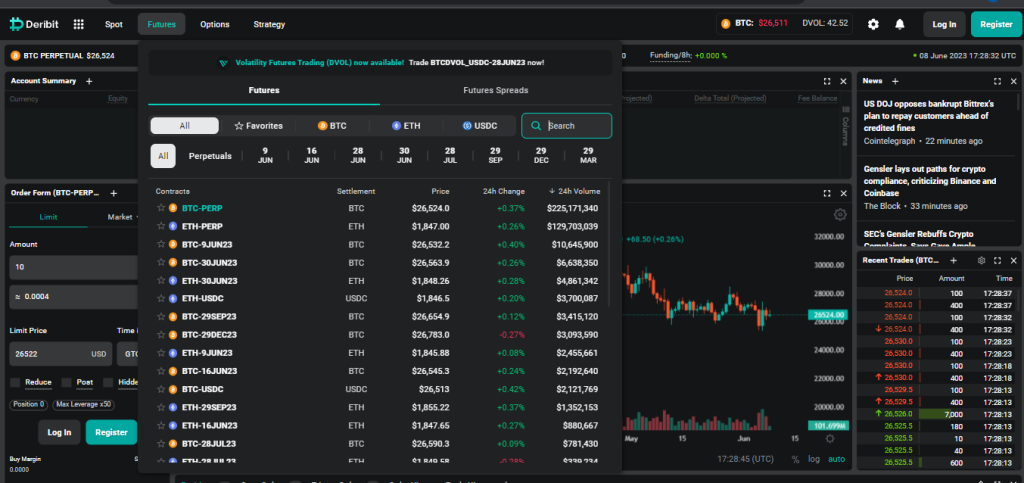

Trading Interface and Usability

Web Platform: Fully-featured browser-based interface requiring no downloads. The layout emphasizes information density, providing extensive data at a glance while maintaining reasonable organization.

Interface Components:

- Real-time order book with color-coded depth visualization

- TradingView charts integrated natively with full indicator library

- Order entry panel with multiple order types and one-click trading

- Position management showing real-time P&L, margin, and Greeks

- Trade history and execution reports

Customization: Layouts are fully customizable with draggable panels, multiple color schemes (including dark mode), and saved workspace configurations.

Learning Curve: The interface assumes trading knowledge and familiarity with derivatives concepts. Complete beginners will face steep initial learning, though experienced traders appreciate the efficiency.

Mobile Experience: Deribit offers mobile-optimized web access and dedicated mobile apps (iOS, Android) providing core functionality including:

- Position monitoring

- Order placement and modification

- Basic charting and market data

- Account management

Mobile apps are functional but lack the comprehensive features of desktop interfaces. Professional traders typically use mobile for monitoring rather than primary execution.

Order Types and Execution

Standard Order Types:

Market Orders: Execute immediately at best available price, guaranteeing fill but not price. Use for urgent entries/exits when execution certainty outweighs price precision.

Limit Orders: Specify exact price, only executing if market reaches your level. Provides price control but no guarantee of execution. These create maker orders if they don’t immediately match.

Stop-Market Orders: Trigger a market order when price reaches stop level. Used for stop-losses and breakout entries.

Stop-Limit Orders: Trigger a limit order when stop price is reached. Combines stop functionality with limit price control, though risks non-execution if price gaps beyond limit.

Advanced Order Types:

Fill-or-Kill (FOK): Execute entire order immediately or cancel completely. Prevents partial fills for strategies requiring specific position sizes.

Immediate-or-Cancel (IOC): Execute whatever quantity is available immediately, canceling the remainder. Useful for gauging available liquidity without leaving resting orders.

Post-Only: Ensures orders only execute as maker (earning rebates), canceling if they would take liquidity. Ideal for market makers and fee-sensitive strategies.

Reduce-Only: Orders that can only reduce existing positions, not increase exposure. Useful for implementing stops that won’t accidentally flip position direction.

Combination Orders: Multi-leg strategies (spreads, combos) executed atomically, ensuring all legs fill together or none fill.

Options Trading Capabilities

Deribit’s options suite stands as its defining feature, offering capabilities unmatched in the crypto space:

Strike Price Selection: Extensive strike ladders spanning realistic price ranges, with strikes typically spaced at:

- 5% intervals for near-term expirations

- 10% intervals for distant expirations

- Additional strikes added based on demand

Expiration Variety:

- Daily options: Near-term hedging and speculation

- Weekly options: Short-term strategies with weekly settlement

- Monthly options: Standard monthly cycle (last Friday of month)

- Quarterly options: March, June, September, December expirations

Greeks Display: Real-time calculation of Delta, Gamma, Theta, Vega, and Rho for all positions, enabling sophisticated risk management.

Implied Volatility Analytics:

- Volatility smile visualization showing IV across strikes

- Historical volatility comparisons

- Volatility surface 3D rendering (advanced traders)

Strategy Builder: Tools for constructing multi-leg strategies including:

- Vertical spreads (bull/bear)

- Calendar spreads

- Straddles and strangles

- Iron condors and butterflies

- Custom ratio strategies

Option Exercise: American-style options can be exercised any time before expiration. European-style options (more common on Deribit) exercise automatically at expiration if in-the-money.

Settlement Mechanics: Cash-settled in the underlying cryptocurrency based on settlement index price calculated from multiple spot exchanges, preventing manipulation.

Leverage and Margin System

Maximum Leverage:

- Futures: Up to 50x leverage

- Options: Up to 20x leverage (for sellers; buyers pay full premium)

Margin Calculation: Deribit uses a sophisticated portfolio margining system that considers correlations between positions, offering capital efficiency for diversified portfolios.

Initial vs Maintenance Margin:

- Initial margin: Required to open new positions

- Maintenance margin: Minimum to keep positions open (typically 50-60% of initial)

Cross Margin vs Isolated Margin:

- Cross margin (default): All positions share collateral, maximizing capital efficiency but risking entire balance

- Isolated margin: Positions have separate collateral allocations, limiting risk to designated amounts

Margin Calls and Liquidation:

- Warning notifications: Alerts when approaching liquidation thresholds

- Partial liquidation: System may close only portion of positions to restore margin compliance

- Full liquidation: If equity drops too quickly, entire position closes at mark price

Mark Price Protection: Unlike some competitors, Deribit liquidates based on mark price (derived from spot index) rather than last traded price, preventing manipulation-based liquidations during volatile periods.

API Trading and Automation

Professional and algorithmic traders rely heavily on Deribit’s robust API infrastructure:

API Options:

- WebSocket API: Real-time streaming data and ultra-low latency order execution

- REST API: Standard request-response for account management, historical data, and less time-sensitive operations

API Features:

- Comprehensive documentation with examples in Python, JavaScript, and other languages

- Sandbox environment for testing without live funds

- Rate limiting: Generous limits for most use cases, with higher limits for verified accounts

- Granular permissions: Limit API keys to specific functions (read-only, trade-only, etc.)

Common API Use Cases:

- Market making with automated quote management

- Statistical arbitrage and algorithmic strategies

- Automated portfolio rebalancing and hedging

- High-frequency trading (HFT) strategies

- Custom risk monitoring and alerting systems

Community and Third-Party Tools: Active developer community has created numerous open-source libraries, trading bots, and analytical tools integrating with Deribit’s APIs.

Testnet for Risk-Free Practice

Deribit Testnet (test.deribit.com) provides a complete production replica with simulated funds:

Testnet Benefits:

- Practice all platform features without financial risk

- Test trading strategies and risk management

- Learn interface and order types

- Develop and test algorithmic strategies

- Request free testnet BTC/ETH to simulate various capital levels

Limitations: Testnet liquidity and pricing don’t perfectly mirror live markets, and psychological dynamics differ without real capital at risk. However, testnet remains invaluable for familiarization and strategy development.

Recommended Approach: Spend at least 1-2 weeks on testnet before depositing significant real capital, ensuring comfort with interface mechanics and liquidation risks.

Pros and Cons: Balanced Assessment

Advantages of Trading on Deribit

Market-Leading Options Liquidity ⭐⭐⭐⭐⭐

Deribit’s 80%+ options market share translates directly to trading advantages. Tight bid-ask spreads, immediate execution of substantial orders, and ability to implement complex multi-leg strategies all stem from unmatched liquidity depth. No competitor comes close in crypto options.

Competitive and Transparent Fee Structure ⭐⭐⭐⭐⭐

The maker rebate model and volume-based tiers reward active traders. Compared to competitors, Deribit’s fees rank among the lowest, particularly for makers and high-volume participants. Fee transparency eliminates hidden costs common on some platforms.

Institutional-Grade Security ⭐⭐⭐⭐⭐

Eight-year track record without major security incidents speaks volumes. 95%+ cold storage, mandatory 2FA, withdrawal whitelisting, and substantial insurance fund provide multiple security layers. While no platform is 100% safe, Deribit’s record inspires confidence.

Sophisticated Professional Tools ⭐⭐⭐⭐⭐

Advanced order types, comprehensive Greeks analytics, portfolio margining, robust APIs, and TradingView integration create a professional-grade ecosystem. The platform doesn’t dumb down features for mass appeal, instead optimizing for sophisticated users.

Focus and Specialization ⭐⭐⭐⭐

By concentrating exclusively on BTC/ETH derivatives, Deribit achieves unmatched product depth. This focus enables better risk management, deeper liquidity, and superior user experience compared to exchanges spreading resources across dozens of assets.

Reliable Infrastructure ⭐⭐⭐⭐

Sub-millisecond latency, high-capacity matching engine handling 1M+ transactions per second, and consistent uptime even during extreme volatility demonstrate robust technical infrastructure critical for derivatives trading.

No Mandatory KYC (With Limitations) ⭐⭐⭐⭐

Basic trading available without identity verification appeals to privacy-conscious users. While withdrawal limits apply, many traders appreciate the option to maintain pseudonymity.

Disadvantages and Limitations

Limited to BTC and ETH Only ⭐

Traders seeking exposure to altcoin derivatives must use alternative platforms. While BTC/ETH represent the majority of institutional interest, retail traders often want broader asset selection.

No Spot Trading ⭐

The absence of spot markets means users must maintain balances elsewhere for converting between cryptocurrencies or acquiring initial crypto. This adds friction compared to all-in-one platforms.

No Fiat Support ⭐⭐

Crypto-only deposits and withdrawals require users to already own cryptocurrency. New participants must use separate fiat on-ramps, adding steps and potential fees.

Steep Learning Curve ⭐⭐

The professional-oriented interface and derivatives complexity create significant barriers for beginners. Users without prior derivatives experience may struggle initially, though resources and testnet help.

Geographic Restrictions ⭐⭐

US, Canadian, and other restricted jurisdiction residents cannot legally access the platform. This eliminates a substantial potential user base and forces residents to seek alternative venues.

Limited Regulatory Oversight ⭐⭐

Operating without major financial authority supervision creates both opportunity (fewer restrictions) and risk (less recourse if problems occur). This concerns some institutional participants requiring regulated venues.

Customer Support Responsiveness ⭐⭐

While Deribit offers email support and comprehensive documentation, response times can extend to 24-48 hours during high-demand periods. No phone support or instant live chat frustrates users needing urgent assistance.

Mobile App Limitations ⭐⭐

Mobile applications lack the full feature set of desktop interfaces. Professional traders typically find mobile apps insufficient for primary trading, useful only for monitoring.

Overall Assessment: Who Should Use Deribit?

Ideal User Profiles:

✅ Professional derivatives traders seeking maximum liquidity and sophisticated tools ✅ Options specialists requiring comprehensive strike/expiration selection and Greeks analytics ✅ Institutional participants (hedge funds, market makers, proprietary trading firms) ✅ Experienced retail traders comfortable with derivatives concepts and risk management ✅ Algorithmic traders leveraging robust APIs for automated strategies ✅ Bitcoin/Ethereum focused traders who don’t need altcoin exposure

Not Recommended For:

❌ Complete beginners without derivatives knowledge (start with spot trading elsewhere) ❌ Casual/occasional traders who find the interface overwhelming ❌ Altcoin enthusiasts wanting diverse cryptocurrency selection ❌ US/Canadian residents (geographic restrictions apply) ❌ Traders requiring fiat on-ramps within the same platform ❌ Those needing immediate customer support (response times can lag)

How to Get Started on Deribit: Step-by-Step Guide

Ready to begin trading on Deribit? Follow this comprehensive setup process:

Step 1: Account Registration

Visit the official registration page: Create your Deribit account →

Required Information:

- Email address: Use a secure, dedicated email for financial accounts

- Username: Choose carefully—this cannot be changed later

- Password: Minimum 12 characters with uppercase, lowercase, numbers, symbols

- Country: Select your country of residence for compliance

Email Verification: Check your inbox for the confirmation email and click the activation link. Check spam folders if not received within 5 minutes.

Security Note: Immediately after registration, you’ll be prompted to enable 2FA. Do not skip this step—it’s critical for account security.

Step 2: Enable Two-Factor Authentication

Supported 2FA Methods:

Google Authenticator (recommended for most users):

- Download Google Authenticator app (iOS/Android)

- Scan the QR code displayed on Deribit

- Enter the 6-digit code to confirm activation

- CRITICAL: Save backup codes in secure offline location

Authy (cloud-synced alternative):

- Similar setup to Google Authenticator

- Offers cloud backup and multi-device sync

- Convenient but slightly less secure than fully offline 2FA

Hardware Security Keys (maximum security):

- YubiKey or FIDO2-compatible devices

- Physical key required for login and sensitive operations

- Best security but risks lockout if key is lost

Backup Code Storage: Store 2FA backup codes in:

- Password manager (encrypted)

- Physical paper in secure location

- Split across multiple secure storage methods

Never:

- Screenshot backup codes (can be compromised if device hacked)

- Email backup codes to yourself

- Store in cloud storage without encryption

Step 3: Additional Security Configuration

Withdrawal Whitelisting:

- Navigate to Security Settings

- Add approved withdrawal addresses for BTC/ETH

- Configure 24-48 hour activation delay for new addresses

- Confirm via email when adding addresses

IP Whitelisting (optional, for consistent location traders):

- Add your static IP addresses or ranges

- Prevents access even with correct credentials from other locations

- Use cautiously if you trade while traveling

Session Settings:

- Configure automatic logout after inactivity (recommend 30-60 minutes)

- Enable login notifications via email

- Review login history regularly for suspicious activity

Step 4: Deposit Cryptocurrency

Deribit accepts only cryptocurrency deposits (no fiat). If you don’t already own crypto, you’ll need to:

- Purchase BTC or ETH from a fiat on-ramp (Coinbase, Kraken, Gemini, etc.)

- Transfer to your personal wallet (optional but recommended)

- Send to your Deribit deposit address

Deposit Process:

- Navigate to Wallet section in Deribit dashboard

- Select Deposit and choose cryptocurrency (BTC or ETH)

- Copy your unique deposit address or scan QR code

- CRITICAL: Verify the address carefully (malware can replace addresses)

- Send a small test transaction first (0.001 BTC or 0.01 ETH)

- Wait for confirmations (1-3 for BTC, 12-30 for ETH)

- Once test succeeds, send remaining funds

Deposit Considerations:

- No deposit fees from Deribit (you pay only blockchain network fees)

- Minimum deposit: ~0.0001 BTC or 0.001 ETH (though higher amounts recommended)

- Deposit times: 30 minutes to 2 hours depending on network congestion

- Always send BTC to BTC addresses and ETH to ETH addresses (cross-chain sends are irreversibly lost)

Step 5: Optional KYC Verification

Why Verify?

- Higher withdrawal limits: Dramatically increased daily/monthly caps

- Enhanced features: Access to subaccounts and institutional tools

- Account recovery: Easier support if you lose 2FA access

- Compliance: Required for very large accounts

Verification Requirements:

- Government-issued photo ID (passport, driver’s license, national ID)

- Proof of address (utility bill, bank statement, government mail within 90 days)

- Selfie holding ID document

Verification Timeline: Typically 24-48 hours for standard applications; longer during high-demand periods.

Decision Factors: If you plan to trade with modest capital (<$50,000 equivalent) and withdrawal limits don’t constrain you, KYC is optional. Larger traders and those wanting maximum flexibility should verify.

Step 6: Explore the Testnet

Before risking real capital, spend time on Deribit Testnet:

Testnet Activities:

- Familiarize yourself with interface layout

- Practice placing different order types

- Test liquidation scenarios with high leverage

- Develop and refine trading strategies

- Understand how Greeks change with price movements

- Experiment with API connections if relevant

Testnet Limitations: Remember that testnet doesn’t replicate real trading psychology or exact market conditions, but it’s invaluable for mechanical familiarization.

Recommended Testnet Duration: Minimum 1-2 weeks of active testnet trading before committing significant real capital.

Step 7: Start Trading Conservatively

Initial Trading Recommendations:

Start small: Begin with 1-5% of your total crypto holdings to test the platform with real stakes while limiting risk.

Use low leverage: 2-5x maximum initially, regardless of what platform allows. Master position management before scaling leverage.

Focus on liquid instruments: Trade high-volume weekly or monthly futures and options initially, avoiding esoteric products until experienced.

Implement strict risk management: Never risk more than 1-2% of capital per trade; always use stop-losses.

Keep a trading journal: Document every trade including rationale, emotions, and outcomes for continuous improvement.

Gradual scaling: Only increase position sizes and leverage after demonstrating consistent profitability over several weeks or months.

Frequently Asked Questions

Is Deribit safe and legitimate?

Yes, Deribit is a legitimate cryptocurrency derivatives exchange with an eight-year operational history and no major security breaches. The platform employs industry-leading security practices including 95%+ cold storage, mandatory 2FA, withdrawal whitelisting, and substantial insurance funds.

However, like all crypto exchanges, Deribit is not regulated by traditional financial authorities and lacks government insurance (no FDIC equivalent). Users should employ personal security best practices and only deposit funds they can afford to lose.

The platform’s market dominance, deep liquidity, and transparent operations have built substantial trust within the professional trading community.

Can US citizens trade on Deribit?

No. Deribit explicitly restricts access from the United States due to uncertain US regulatory treatment of cryptocurrency derivatives. The platform employs IP blocking and requires attestation of non-US residency during registration.

US persons seeking derivatives exposure should explore:

- CME Bitcoin/Ethereum futures (regulated, cash-settled)

- US-based exchanges like Coinbase (limited derivatives offerings)

- Offshore platforms accepting US users (though these often face regulatory risk)

Attempting to circumvent geographic restrictions using VPNs or false attestations violates Deribit’s terms of service and may result in account closure and fund withholding.

What is the minimum deposit on Deribit?

There is no official minimum deposit, though practical minimums depend on your trading objectives:

Minimum for platform testing: 0.001-0.01 BTC ($60-$600) allows experiencing interface and placing very small positions

Comfortable trading minimum: 0.1 BTC (~$6,000) enables meaningful position sizing with proper leverage and risk management

Professional trading minimum: 1+ BTC ($60,000+) provides flexibility for diversified strategies without excessive leverage

Starting with smaller amounts helps you learn platform mechanics and test strategies before committing substantial capital. However, very small accounts (<$1,000) will struggle to implement proper risk management given minimum position sizes.

How do Deribit’s fees compare to competitors?

Deribit offers highly competitive fees, particularly for market makers and high-volume traders:

Futures Fees:

- Deribit maker: -0.0001% (rebate) vs Binance: 0.02% (pay) vs Bybit: 0.01% (pay)

- Deribit taker: 0.05% vs Binance: 0.04% vs Bybit: 0.06%

Options Fees:

- Deribit: 0.0003% both sides vs Binance: 0.03% (significantly higher)

- Competitors generally have minimal options liquidity, making fee comparison less relevant than execution quality

Volume Discounts: All platforms offer volume-based fee reductions. Deribit’s maker rebates increase with volume, providing strong incentives for active traders.

Overall Verdict: Deribit’s fees rank among the most competitive in crypto derivatives, especially for makers and options traders.

What happens if I get liquidated?

Liquidation occurs when your account equity falls below maintenance margin requirements. Deribit’s liquidation process:

- Warning notifications: Platform displays alerts as you approach liquidation thresholds

- Liquidation execution: If equity drops below maintenance margin, the liquidation engine activates:

- Positions close at mark price (not last price) to prevent manipulation

- System attempts to minimize market impact

- Partial liquidation: May close only portion of position if this restores margin compliance

- Insurance fund: If liquidation cannot occur at bankruptcy price due to market gaps, the insurance fund absorbs losses, protecting other users from socialized losses

- Auto-deleveraging (rare): Only if insurance fund is depleted during extreme events, profitable opposite positions are closed in order of leverage and profitability

Preventing Liquidation:

- Use conservative leverage (2-10x rather than maximum 50x)

- Monitor margin usage and add collateral before reaching critical levels

- Set stop-losses well before liquidation price

- Reduce position sizes during high volatility

Liquidation Penalties: You lose your margin on liquidated positions. Additionally, Deribit charges a small liquidation fee. The primary cost is the forced position closure at unfavorable prices.

Does Deribit offer customer support?

Yes, but with limitations:

Support Channels:

- Email support: primary@deribit.com for general inquiries

- Comprehensive documentation: Extensive help center and user guides

- Social media: Active on Twitter (@DeribitExchange) for platform updates

- Community: Telegram channel for user discussions (unofficial support)

Response Times: Typically 24-48 hours for email inquiries, longer during high-demand periods. Urgent security issues may receive faster response.

No Live Chat or Phone Support: Unlike some competitors, Deribit doesn’t offer instant messaging or phone support, which frustrates users needing immediate assistance.

Quality: When responses arrive, they’re generally thorough and technical, reflecting the platform’s professional orientation.

For critical issues (account lockout, suspected security breach), contacting via multiple channels simultaneously (email + Twitter DM) may accelerate response.

Can I trade Deribit on mobile?

Yes, Deribit offers mobile-optimized web access and dedicated mobile apps for iOS and Android.

Mobile App Features:

- View positions and real-time P&L

- Place and modify orders (market, limit, stop orders)

- Basic charting and market data

- Account and security management

- Price alerts and notifications

Limitations: Mobile apps lack advanced features available on desktop:

- Simplified charting (not full TradingView)

- Limited order type options

- Reduced customization

- No advanced options analytics

Recommended Use: Mobile apps work well for monitoring positions and quick order management while away from desk. Professional traders typically use desktop/laptop for primary trading and analysis, with mobile serving as a monitoring supplement.

How long do withdrawals take?

Withdrawal Processing Times:

Bitcoin withdrawals: Typically 30 minutes to 2 hours from request to blockchain broadcast, then 1-3 confirmations for completion

Ethereum withdrawals: Usually 1-4 hours for processing, then 12-30 confirmations for completion

Factors Affecting Speed:

- First-time addresses: 24-hour security hold may apply

- Large amounts: May require manual review, adding time

- Network congestion: Blockchain confirmation times vary with network activity

- Withdrawal whitelisting: Pre-approved addresses process faster

Best Practices:

- Whitelist frequently-used addresses to avoid delays

- Withdraw during low network activity (often weekends) for lower fees and faster confirmations

- Be patient with first withdrawals—security delays protect your funds

Emergency Withdrawals: If you need immediate access to funds, plan ahead. Deribit’s security-focused approach means same-day withdrawals aren’t always guaranteed, especially for new addresses or very large amounts.

Final Verdict: Should You Trade on Deribit?

Overall Rating: 4.6/5 ⭐⭐⭐⭐⭐

Deribit has earned its position as the premier cryptocurrency derivatives platform through focused execution, deep liquidity, competitive fees, and robust security. The platform’s 80%+ options market share reflects genuine competitive advantages rather than marketing hype.

Who Should Choose Deribit?

Strongly Recommended For:

✅ Options traders seeking the deepest liquidity and most comprehensive crypto options market globally

✅ Professional derivatives traders requiring institutional-grade tools, low latency, and sophisticated order types

✅ High-volume traders benefiting from maker rebates and aggressive volume-based fee tiers

✅ Market makers and arbitrageurs leveraging APIs for automated strategies

✅ Experienced traders comfortable with derivatives mechanics and risk management

✅ Bitcoin/Ethereum specialists who don’t require broader altcoin exposure

Who Should Look Elsewhere?

❌ Complete beginners without derivatives knowledge (start with spot trading on user-friendly platforms like Coinbase or Kraken)

❌ US/Canadian residents (legally restricted from platform access)

❌ Altcoin derivatives traders seeking exposure beyond BTC/ETH (try Binance or Bybit)

❌ Casual traders overwhelmed by professional-oriented interface complexity

❌ Those requiring fiat on-ramps within the same platform

❌ Traders needing immediate customer support (response times can lag)

The Bottom Line

If you’re a sophisticated trader focusing on Bitcoin and Ethereum derivatives, especially options, Deribit represents the clear best choice in the crypto market. The platform’s specialization creates tangible advantages in liquidity, execution quality, and professional tooling that competitors cannot match.

However, this specialization comes with tradeoffs. Beginners will face steep learning curves, altcoin enthusiasts will find limited selection, and regulatory concerns may affect some users.

For the target professional audience, Deribit excels where it matters most: execution quality, fee competitiveness, security, and comprehensive product depth. The platform’s eight-year track record and consistent innovation suggest continued leadership in crypto derivatives trading.

Ready to Get Started?

Open your Deribit account now →

Remember to:

- ✅ Enable 2FA immediately after registration

- ✅ Start with testnet to learn platform mechanics

- ✅ Begin with conservative position sizes and leverage

- ✅ Implement strict risk management from day one

- ✅ Continue educating yourself on derivatives strategies

Additional Resources

Explore Related Content:

- Deribit Beginner’s Guide: Comprehensive introduction to derivatives trading on Deribit

- Official Deribit Documentation: https://docs.deribit.com

- Deribit Testnet: https://test.deribit.com (practice with simulated funds)

Disclaimer: Cryptocurrency derivatives trading involves substantial risk of loss and is not suitable for all investors. This review provides educational information and does not constitute financial advice. Trading with leverage can result in losses exceeding your initial investment. Always conduct thorough research, understand the risks, and consider consulting with qualified financial advisors before trading derivatives. Deribit is not available to residents of certain jurisdictions including the United States and Canada.

Affiliate Disclosure: This review contains affiliate links. If you register through our links, we may receive compensation at no additional cost to you. This does not influence our editorial independence or the objectivity of this review, which is based on thorough research and analysis of Deribit’s actual platform features, fees, and performance.