Daily Crypto Market Summary – Daily Crypto News Update – August 26, 2025

In a volatile day for the cryptocurrency markets on August 26, 2025, the global crypto market capitalization dipped to around $3.8 trillion, reflecting a 2% decline amid widespread liquidations and macroeconomic pressures. Bitcoin led the downturn, briefly crashing below $110,000 in a flash event that wiped out nearly $200 billion in value across the sector, triggered by a massive whale sell-off. Ethereum and other altcoins followed suit, though some like XRP showed resilience with record futures open interest. This summary breaks down the key movements, news, and trends shaping the crypto landscape yesterday, helping traders and investors stay informed.

Whether you’re a beginner navigating crypto volatility or an experienced trader eyeing opportunities, understanding these daily shifts is crucial. Read on for detailed insights into major coins, market drivers, and what to watch next.

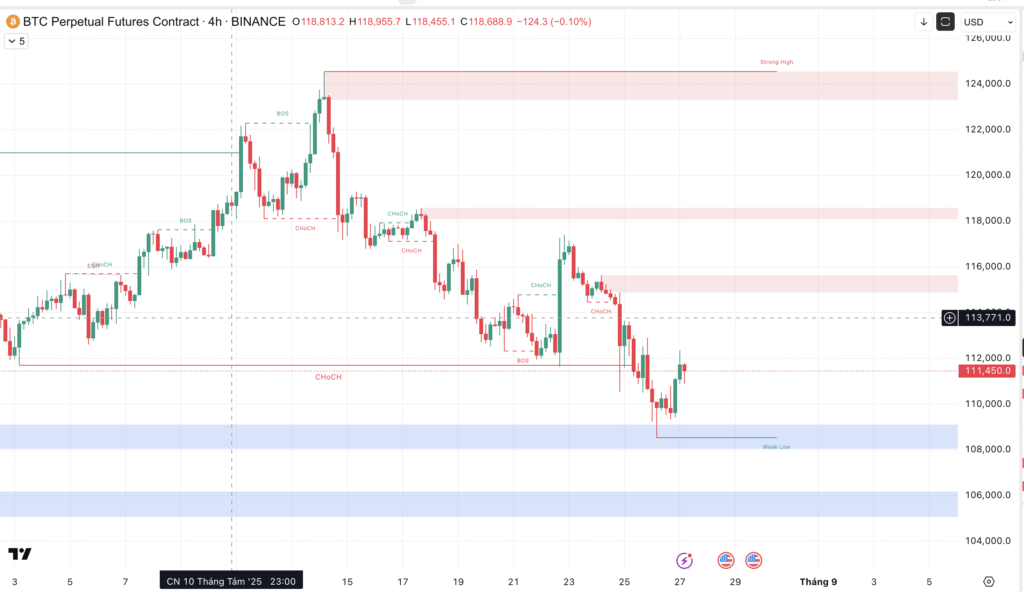

Bitcoin Sinks to Seven-Week Low Amid Fed Independence Concerns

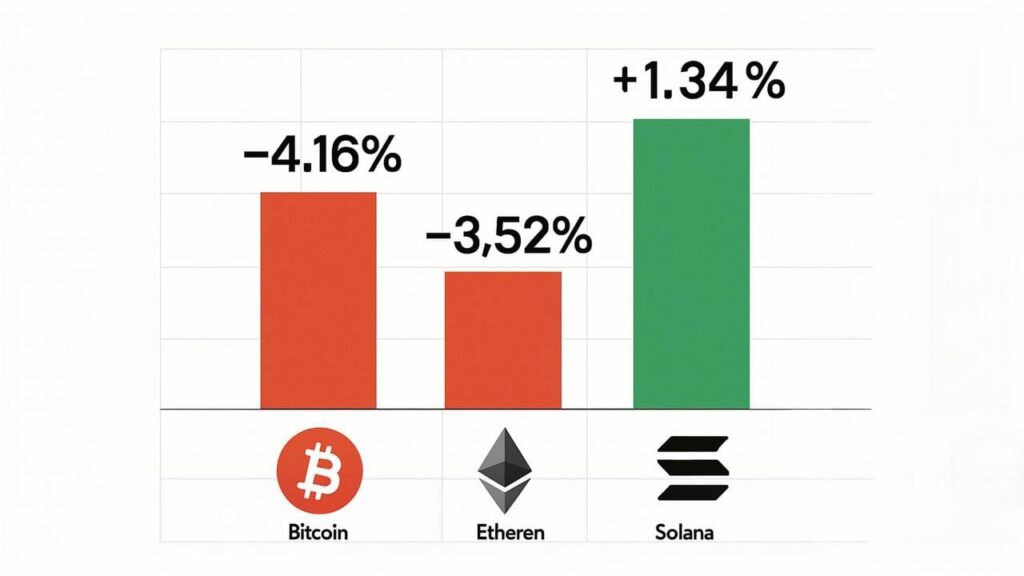

Bitcoin (BTC) experienced significant turbulence on August 26, falling 0.57% to close around $111,163 after touching lows near $110,000. The drop intensified market fears following President Trump’s abrupt firing of Fed Governor Lisa Cook, sparking concerns over political interference in the central bank and stoking risk aversion across crypto assets. A whale dumped 24,000 BTC, causing a sudden $4,000 price plunge and contributing to a flash crash that liquidated $940 million in positions sector-wide. By evening, BTC recovered slightly to $111,037, down 0.75% over 24 hours, with 7-day losses at -2.17%.

Analysts noted uncanny similarities to Q2 dips, with positive ETF inflows potentially signaling a rebound. However, the broader panic erased $100 billion from the crypto market in hours, highlighting ongoing vulnerability to macro events. For beginners, this underscores the importance of risk management—consider secure platforms like Binance for trading BTC with advanced tools.

Ethereum Cools After Record Highs, But Corporate Buying Supports Bulls

Ethereum (ETH) lost 0.50% to $4,578, following a 3.6% post-Fed drama plunge but sustaining interest from ETF and treasury buyers. Analysts call ETH “undervalued,” with year-end forecasts as high as $7,500 driven by attractive staking yields amid rising corporate treasuries. Large holder wallets (over 10,000 ETH) increased by 48 in August, signaling accumulation and potential market recovery.

Despite the dip, ETH’s on-chain activity remains robust, with Aave’s recent non-EVM expansion to Aptos boosting DeFi sentiment. If you’re exploring ETH staking or DeFi, platforms like OKX offer user-friendly tools for beginners.

Solana Bucks Trend as Risk Appetite Edges Back

Solana (SOL) surged 1.34% to $198.49, outperforming top coins in a cautious session. On-chain activity and robust trading volumes suggest traders rotating toward high-beta names, even as overall sentiment remains muted. Galaxy Digital and others are reportedly raising $1 billion for a dedicated Solana treasury, underscoring institutional interest.

This resilience positions SOL as a bright spot amid the downturn. For hands-on trading, check out Bybit for low-fee SOL perpetuals.

Gold Nears Critical $3,400 Amid Safe-Haven Flows; Copper Retreats

Gold hovered just below $3,400, up more than 2% over 30 days as US dollar weakness and Fed doubts kept demand intact. Technical analysts warn a sustained break above $3,400 could trigger a major bullish breakout.

Copper fell 0.15% to $4.46/lb, down over 20% for the month amid supply concerns and softer Chinese demand outweighing US policy support. Prices remain up 7% year-on-year.

Binance Coin Rises on Treasury Firm News

Binance Coin (BNB) added 1.95% after news that B Strategy will launch a $1B Nasdaq-listed BNB treasury firm, underscoring persistent institutional interest and ETF expansion in the sector.

Altcoin Market Pressured by Risk-Off Flows

Most major altcoins faced pressure, including XRP (-0.56%), Cardano (+0.5%), and Dogecoin (+0.45%), with mild rebounds following sharp initial drops. XRP hit a futures open interest record at CME, eyeing $3.70 next amid institutional flows. Meme and AI narratives shone, with annual gains over 20x, while L2 fell 20.7%.

For altcoin trading, Phemex provides a beginner-friendly spot for exploring high-potential tokens.

The Future Trends: What to Watch After August 26

As Q4 approaches, Bitcoin ETFs—the fastest-growing in history—could melt faces with renewed inflows. Regulatory shifts, like Japan’s crypto tax reform and Trump’s crypto treasury push, add bullish tailwinds, but whale activity and Nvidia earnings loom as potential catalysts. AI integration in crypto, via partnerships like Coinbase-Perplexity, may unlock further growth.

Frequently Asked Questions (FAQ) About August 26 Crypto Market

Why did Bitcoin crash on August 26, 2025?

A whale sell-off and Fed political concerns triggered a flash crash, liquidating $940M.

Is Ethereum undervalued right now?

Yes, with forecasts up to $7,500 by year-end due to staking yields and treasury buys.

What altcoins performed well?

Solana and XRP showed strength, with XRP hitting futures OI records.

For more on crypto basics, check our Introduction to Crypto or Crypto Trading for Beginners.

Conclusion: Navigate the Volatility with Informed Strategies

August 26, 2025, highlighted crypto’s sensitivity to whales, politics, and macros, with a 2% market dip but pockets of resilience in SOL and XRP. As recovery signs emerge—rising large holders and ETF momentum—stay vigilant. Ready to trade? Explore opportunities on Binance or OKX.

This article is for informational and educational purposes only, and is not investment advice. Please consult a financial expert before making any decisions related to crypto investments.