Lecture 1.1: Welcome to Cryptocurrency Options Trading

Your Journey to Options Mastery Starts Here

Welcome to the most comprehensive cryptocurrency options course available today. Whether you’re a complete beginner or an experienced trader looking to expand into crypto derivatives, this course will transform you into a confident options trader on Deribit – the world’s leading cryptocurrency options exchange.

📖 New to options trading? Read our complete guide: How to Trade Options on Deribit: Complete Guide 2025 for a comprehensive overview before diving into this lecture series.

🚀 Ready to start? Open your Deribit account now

What Makes This Course Different?

This isn’t just another theoretical finance course. This is a practical, hands-on guide created by the experts at Deribit, the platform that handles over 85% of global crypto options volume. You’ll learn directly from the exchange that invented the modern cryptocurrency options market.

Who This Course Is Perfect For:

📈 Traditional Options Traders

- Transitioning from stock/forex options to crypto

- Understanding inverse contracts and crypto-specific mechanics

- Learning Bitcoin/Ethereum as collateral (not just USD)

- See detailed comparison guide

🎯 Experienced Crypto Traders

- Currently trading spot or futures

- Want to add options strategies to their toolkit

- Ready to unlock advanced profit opportunities

- Learn the 4-step process

🌟 Motivated Beginners

- Little to no derivatives experience

- Eager to learn professional trading techniques

- Committed to mastering a high-value skill

- Start with the basics

💼 Portfolio Managers

- Need sophisticated hedging strategies

- Managing substantial crypto holdings

- Seeking to generate additional yield

The Knowledge Gap We’re Solving

Challenge 1: The Crypto Options Learning Curve

Traditional options traders face a unique challenge when entering cryptocurrency markets. The inverse contracts used on platforms like Deribit operate with different mathematics than the linear contracts found in traditional markets.

Key Differences:

- Collateral: Bitcoin/Ethereum instead of USD

- Contract Structure: Inverse vs. linear mechanics

- Settlement: Crypto-denominated outcomes

- Volatility: 24/7 markets with higher volatility

Challenge 2: The Derivatives Knowledge Barrier

Most crypto traders are comfortable with spot trading, but options introduce concepts like:

- Strike prices and expiration dates

- Call vs. Put options

- The Greeks (Delta, Gamma, Theta, Vega)

- Implied volatility

- Multi-leg strategies

This course bridges both gaps completely.

💡 Pro Tip: Before continuing, bookmark our comprehensive options trading guide for quick reference throughout your learning journey.

Your Complete Learning Pathway

🏗️ Foundation Building (Weeks 1-2)

Module 1: Derivatives Fundamentals

- What are derivatives and why they matter

- The difference between futures and options

- Risk and reward profiles

- How options fit into your trading strategy

Module 2: Options Basics

- Call options: Your bullish instrument

- Put options: Your bearish tool

- Strike prices explained

- Expiration dates and time decay

- Intrinsic vs. extrinsic value

What you’ll achieve: Solid understanding of options terminology and mechanics

📚 Supplementary Reading: How to Choose the Right Strike Price and Expiration

📚 Access Full Course on Deribit

📊 Contract Mastery (Weeks 3-4)

Module 3: Dollar-Denominated Options

- Linear contract mechanics

- USD settlement process

- Profit/loss calculations

- When to use dollar-denominated contracts

Module 4: Bitcoin-Denominated Options

- Inverse contract mathematics

- BTC/ETH as collateral

- Unique advantages of crypto-denominated options

- Real-world trade examples

What you’ll achieve: Complete confidence in both contract types

🧮 Pricing and Greeks (Weeks 5-6)

Module 5: Option Pricing Models

- The Black-Scholes-Merton model explained

- Implied volatility deep dive

- How market makers price options

- Using volatility to your advantage

Module 6: The Greeks Unveiled

Delta: Price sensitivity

- Understanding directional risk

- Delta hedging strategies

- Practical delta applications

Theta: Time decay

- How theta works against buyers

- Using theta to your advantage as a seller

- Managing theta risk

Vega: Volatility exposure

- Trading implied volatility

- Volatility skew and smile

- Vega-neutral strategies

Gamma: Delta acceleration

- Gamma risk management

- Gamma scalping techniques

- Position gamma monitoring

What you’ll achieve: Professional-level understanding of option pricing

🎯 Strategy Implementation (Weeks 7-10)

Module 7: Directional Strategies

Bullish Strategies:

- Long calls for maximum leverage

- Bull call spreads for controlled risk

- Covered calls for income generation

- See covered call strategy example

Bearish Strategies:

- Long puts for downside profit

- Bear put spreads

- Protective puts for portfolio insurance

- Learn protective put mechanics

Neutral Strategies:

- Iron condors for range-bound markets

- Straddles and strangles for volatility plays

- Calendar spreads for time decay profits

- Master iron condor strategy

Module 8: Volatility Trading

- Identifying high vs. low IV environments

- Buying volatility before major events

- Selling volatility in stable markets

- IV rank and percentile analysis

What you’ll achieve: A complete arsenal of proven strategies

💻 Platform Mastery (Weeks 11-12)

Module 9: Live Trading Examples

You’ll watch over-the-shoulder as we:

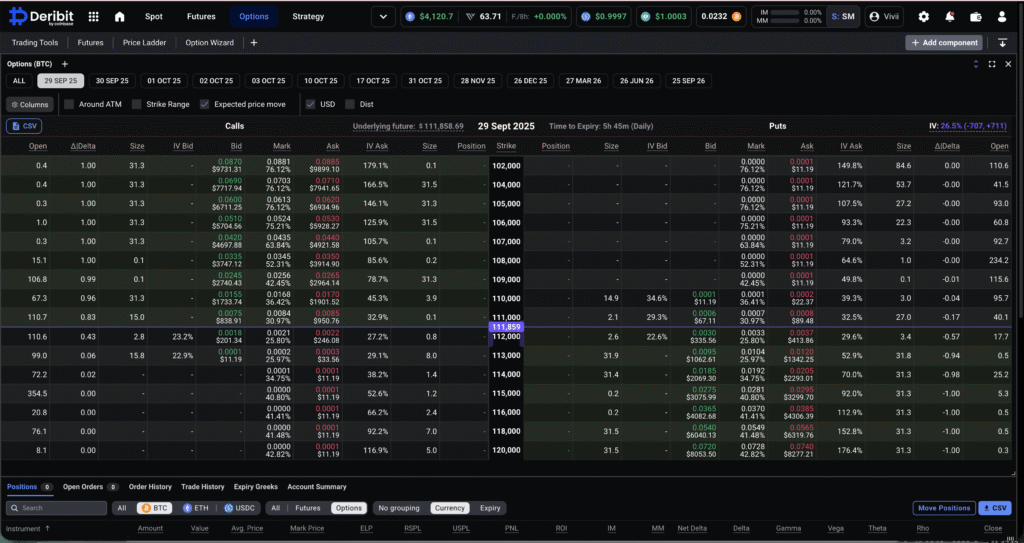

- Navigate the Deribit options chain

- Analyze market conditions

- Select optimal strikes and expirations

- Enter orders with precision

- Manage positions through expiration

- Close trades for maximum profit

Module 10: Order Types and Execution

- Market vs. limit orders

- Stop-loss placement

- Take-profit automation

- Advanced order types

- Execution best practices

What you’ll achieve: Confidence to place real trades immediately

What Makes Deribit Options Unique?

🏆 Industry Leadership

- 85% market share in crypto options

- $2.5B+ daily volume

- Most liquid options market globally

- Tightest spreads in the industry

🔧 Advanced Tools

- Professional-grade trading interface

- Real-time Greeks calculations

- Volatility charts and analysis

- Portfolio margin system

- Mobile app for trading anywhere

🛡️ Institutional Security

- 99% cold storage of user funds

- $50M insurance fund

- SOC 2 Type II certified

- Regular security audits

💰 Competitive Fees

- Makers: 0.02% (earn rebates!)

- Takers: 0.05%

- No hidden costs

- Volume discounts available

📊 Complete Platform Review: Why Deribit Dominates Crypto Options Market

🎯 Experience These Features on Deribit

Real Success Stories from Our Students

“I started this course with zero options knowledge. Three months later, I’m generating 8% monthly returns using covered call strategies on my Bitcoin holdings.” – Marcus T., Professional Trader

“As a traditional equity options trader, the inverse contract mechanics confused me initially. This course broke it down perfectly. Now I trade crypto options exclusively.” – Sarah L., Former Stock Trader

“The live trading examples were invaluable. Seeing real trades from start to finish gave me the confidence to start trading with real money.” – David K., Crypto Investor

Your Investment in This Course

Time Commitment

- Video content: 12+ hours of comprehensive lessons

- Practice exercises: 20+ hours hands-on learning

- Total duration: 8-12 weeks at your own pace

- Lifetime access: Review materials anytime

What’s Included

- ✅ 50+ video lectures with HD quality

- ✅ Downloadable study materials and cheat sheets

- ✅ Live trading examples with real money

- ✅ Interactive quizzes and assessments

- ✅ Options strategy templates

- ✅ Risk management frameworks

- ✅ Access to exclusive trading community

- ✅ Regular content updates

- ✅ Certificate of completion

Expected ROI

- Knowledge value: $10,000+ in traditional education

- Earning potential: 5-20% monthly returns possible

- Risk reduction: Avoid costly beginner mistakes

- Time savings: Years of trial-and-error condensed

Prerequisites and Expectations

What You Need to Start:

✅ Recommended:

- Basic understanding of cryptocurrency (Bitcoin, Ethereum)

- Any trading experience (even stock/forex helps)

- Familiarity with candlestick charts

- Basic math skills

❌ Not Required:

- Advanced mathematics knowledge

- Prior derivatives experience

- Large trading capital (start with $100)

- Programming or technical skills

What We Expect from You:

- Commitment: Complete all lectures and exercises

- Practice: Paper trade before using real money

- Patience: Master fundamentals before advanced strategies

- Discipline: Follow risk management rules strictly

- Curiosity: Ask questions and engage with material

Course Structure and Learning Philosophy

Our Teaching Approach

1. Concept Introduction

- Clear explanation of new concepts

- Real-world analogies

- Visual aids and diagrams

2. Theoretical Foundation

- Mathematical principles explained simply

- Why things work the way they do

- Building intuition, not just memorization

3. Practical Application

- Live trading demonstrations

- Step-by-step walkthroughs

- Common pitfalls and how to avoid them

4. Mastery Through Repetition

- Multiple examples of each concept

- Practice exercises

- Quiz assessments

Learning Resources

Video Lectures:

- Professional production quality

- Clear audio and visuals

- Pause, rewind, and review anytime

- Downloadable for offline viewing

Written Materials:

- Comprehensive study guides

- Quick reference cards

- Strategy cheat sheets

- Options terminology glossary

Interactive Elements:

- Live trading simulations

- Risk calculator tools

- Strategy backtesting exercises

- Community discussion forums

🎓 Begin Your Options Education Today

Why Options? Why Now?

The Options Advantage

1. Directional Flexibility

- Profit when prices rise (calls)

- Profit when prices fall (puts)

- Profit when prices stay flat (neutral strategies)

2. Defined Risk

- Know your maximum loss before entering trade

- No liquidation nightmares

- Sleep better with controlled exposure

3. Leverage Without Liquidation

- Control large positions with small capital

- No margin calls on bought options

- Asymmetric risk/reward profiles

4. Income Generation

- Collect premium by selling options

- Generate yield on existing holdings

- Create monthly cash flow

5. Portfolio Protection

- Hedge against market crashes

- Insurance for your crypto holdings

- Reduce portfolio volatility

The Cryptocurrency Options Opportunity

Market Growth:

- Crypto options volume grew 500% in 2024

- Increasing institutional adoption

- Still early compared to traditional markets

Volatility Edge:

- Higher volatility = higher premiums

- More profit opportunities daily

- 24/7 markets = no overnight gaps

Innovation Leader:

- Crypto derivatives leading financial innovation

- New strategies emerging constantly

- First-mover advantage available

What You’ll Be Able to Do After This Course

Trading Capabilities

✅ Analyze any options chain and identify opportunities ✅ Select optimal strike prices and expiration dates ✅ Execute trades with proper order types ✅ Manage positions through their lifecycle ✅ Calculate profit/loss for any strategy ✅ Understand how Greeks affect your positions ✅ Implement 20+ different options strategies ✅ Trade volatility effectively ✅ Hedge portfolios against downside risk ✅ Generate consistent income through options selling

Knowledge Mastery

✅ Explain options concepts to others ✅ Identify market conditions suitable for each strategy ✅ Recognize profitable opportunities quickly ✅ Avoid common beginner mistakes ✅ Adapt strategies to changing market conditions ✅ Combine multiple strategies for complex positions ✅ Read and interpret volatility indicators ✅ Navigate Deribit platform with confidence

Your Next Steps

Step 1: Get Prepared (Today)

- Open your Deribit account (2 minutes)

- Complete KYC verification

- Familiarize yourself with platform interface

- Join Deribit community channels

- 📖 Read: Complete setup guide

Step 2: Begin Learning (This Week)

- Watch Lecture 1.2: Options Fundamentals

- Complete the introductory quiz

- Review glossary of key terms

- Set up your practice trading account

- 📖 Study: Options strategy basics

Step 3: Practice (Week 2)

- Paper trade simple strategies

- Track your hypothetical trades

- Ask questions in community forums

- Review mistakes and learnings

- 📖 Reference: Risk management tips

Step 4: Go Live (Week 3-4)

- Start with small positions ($20-50)

- Focus on one strategy initially

- Keep detailed trading journal

- Gradually increase position sizes

- 📖 Learn: Position sizing guide

Special Bonuses for Course Students

🎁 Exclusive Benefits

Bonus #1: Options Strategy Library

- 25+ pre-built strategy templates

- Risk/reward calculators

- Position sizing guides

Bonus #2: Weekly Market Analysis

- Professional volatility reports

- Strategy recommendations

- Market outlook and opportunities

Bonus #3: VIP Community Access

- Private Discord/Telegram group

- Connect with fellow traders

- Monthly live Q&A sessions

- Direct support channel

Bonus #4: Advanced Tools

- Greeks calculator spreadsheet

- Volatility tracking dashboard

- Trade journal template

- Performance analytics tools

Total Value: $2,000+ in bonuses included FREE

Final Thoughts Before We Begin

Options trading is a skill, not luck. Like any valuable skill, it requires:

- Education: Understanding the fundamentals (this course)

- Practice: Paper trading and small live trades

- Experience: Learning from both wins and losses

- Discipline: Following your trading plan consistently

This course provides the education. Your commitment provides the rest.

The cryptocurrency options market is still in its early stages. The opportunities available today won’t last forever. As more traders enter this space and liquidity increases, profit margins will compress.

The best time to learn was yesterday. The second best time is right now.

🎯 Complete Resource Hub: Access our master guide to options trading alongside this course for the ultimate learning experience.

Are You Ready?

By the end of this course, you’ll possess knowledge that took professional traders years to acquire. You’ll understand instruments that intimidate 99% of crypto traders. You’ll have strategies that can generate income in any market condition.

But none of that matters if you don’t take action.

🚀 START YOUR OPTIONS JOURNEY NOW – OPEN DERIBIT ACCOUNT

Course Navigation

📚 Recommended Reading Order:

- Complete Options Trading Guide – Read first for overview

- Lecture 1.1 – This introduction (you are here)

- Lecture 1.2 – What Are Derivatives? (continue below)

Next Lecture: 1.2 – What Are Derivatives?

Up Next You’ll Learn:

- The definition and purpose of derivatives

- How options differ from futures

- The role of derivatives in modern markets

- Why derivatives are essential trading tools

Estimated Time: 15 minutes

🔗 Related Resources:

Remember: Trading involves risk. Never invest more than you can afford to lose. This educational content does not constitute financial advice. Always do your own research and consider consulting with a financial advisor.

🎓 Your options mastery journey starts with a single click. Let’s begin!