Crypto Trading for Beginners: The Complete 2025 Guide

New to crypto trading? This all‑in‑one guide shows you how to start safely and confidently — from choosing a beginner‑friendly exchange and setting up a secure wallet to learning basic strategies, technical analysis, and risk management. Built by Affmiss.com – Crypto & AI Affiliate Hub, it’s designed for global beginners in 2025.

1) What is Crypto Trading?

Crypto trading is the practice of buying and selling digital assets (such as Bitcoin, Ethereum, or stablecoins like USDT/USDC) to generate profit. Unlike traditional markets, crypto trades 24/7 and is accessible globally with small amounts. Beginners typically start with spot trading before exploring margin or futures.

- Spot trading: Buy/sell the underlying asset at current market price.

- Margin trading: Borrow funds to increase position size (higher risk — avoid at the start).

- Futures trading: Trade contracts to speculate on future price moves (advanced).

2) How Crypto & Trading Work (for Beginners)

Cryptocurrencies live on blockchains — distributed databases that are transparent and tamper‑resistant. You interact with crypto through a wallet (which holds your private keys) and a trading venue (usually an exchange). Each trade is an agreement between a buyer and a seller, matched via an order book or an automated market maker (AMM).

- Blockchain: Public ledger that records transactions.

- Keys: Public address (for receiving), private key/seed (for control). Keep private keys secret.

- Order book vs AMM: Order books match bids/asks; AMMs use liquidity pools and algorithms.

3) Market Venues: CEX vs DEX

You can trade on centralized exchanges (CEX) or decentralized exchanges (DEX).

- CEX: Account‑based, KYC, fiat on‑ramps, order books, customer support (e.g., Binance, Coinbase).

- DEX: Wallet‑based, no KYC, AMMs, self‑custody, but no fiat on‑ramps and slippage can be higher.

Beginners usually start with CEX for easier onboarding, better fiat deposits, and clearer fee structures.

4) Choosing a Beginner-Friendly Exchange (Comparison)

Your exchange is your gateway. Evaluate fees, asset coverage, liquidity, app quality, and regional access. Here’s a quick comparison:

| Exchange | Typical Beginner Fees | Strengths | Considerations | Sign-up |

|---|---|---|---|---|

| Binance | Low spot fees; VIP tiers | Largest liquidity, many coins, robust tools | Regional availability varies | Join Binance |

| Bybit | Competitive spot & futures fees | Beginner‑friendly UI; excellent derivatives | Lower spot depth vs. Binance | Join Bybit |

| OKX | Low fees; volume discounts | Balanced spot & futures; feature‑rich | Interface dense at first | Join OKX |

| Coinbase | Higher retail fees | Trusted brand; simplest onboarding | Fees higher than peers | Join Coinbase |

| KuCoin | Low fees; token discounts | Many altcoins; community‑driven | Licensing varies by region | Join KuCoin |

5) Step 1: Create Your Exchange Account

- Pick an exchange:

Binance,

Bybit,

OKX,

Coinbase,

KuCoin - Sign up with email → verify.

- Complete KYC to raise limits.

- Enable Two‑Factor Authentication (2FA).

- Deposit a small amount to practice ($50–100).

6) Step 2: Set Up a Wallet & Core Security

A wallet holds your private keys. Start with a hot wallet (e.g., MetaMask, Trust Wallet) for small amounts, and consider a hardware wallet (Ledger/Trezor) for long‑term storage.

- Back up your seed phrase offline.

- Enable 2FA on exchange + wallet if supported.

- Whitelist withdrawal addresses and set anti‑phishing code.

7) Step 3: Master Basic Trading Concepts

- Order types: Market, Limit, Stop‑Loss — see Order Types Explained.

- Trading pairs: Example pairs BTC/USDT, ETH/USDC (base vs quote asset).

- Maker vs taker: Placing a limit order adds liquidity (maker), hitting market price takes liquidity (taker) — fees differ.

- Liquidity & slippage: Deeper markets = better fills and fewer surprises.

- Fees: Check spot maker/taker tiers; small differences matter long‑term.

8) Step 4: Technical Analysis for Beginners

Technical Analysis (TA) gives you a structured way to read price action. Start with the essentials and keep it lightweight.

- Candlesticks: opens, closes, wicks, body size, and momentum.

- Support & Resistance: where buyers/sellers repeatedly react.

- RSI (14): overbought/oversold context, divergences.

- MACD: momentum shifts, signal crossovers.

- Moving averages (SMA/EMA): trend filters and dynamic support/resistance.

- Trendlines: connecting swing highs/lows for structure.

9) Step 5: Starter Strategies That Actually Work

Choose one simple, rules‑based strategy and practice it consistently before trying others.

- Spot + DCA (Dollar‑Cost Averaging): Buy small amounts over time to smooth entries.

- Trend‑Following with MA: Only trade in the direction of the 50/200 MA trend; exit on breaks.

- Breakout‑Pullback: Wait for a clean break above resistance, then enter on the first pullback with tight risk.

- News‑Aware Swing: Focus on major assets; use daily structure; manage risk strictly.

Avoid high leverage early. It magnifies both gains and losses and can quickly wipe beginners.

10) Risk Management & Psychology

Protecting capital is priority #1. Use written rules and risk caps so you can trade another day.

- Risk per trade: 0.5–2% of account balance; size positions so a stop‑loss respects this cap.

- Risk‑Reward (RR): Target 1:2+ so winners outweigh losers.

- Max daily loss: Stop trading after a set drawdown (e.g., 3R) to avoid tilt.

- Journal: Track setups, entries, exits, emotions; review weekly.

- Discipline: Avoid FOMO/FUD; wait for your setup, not your feelings.

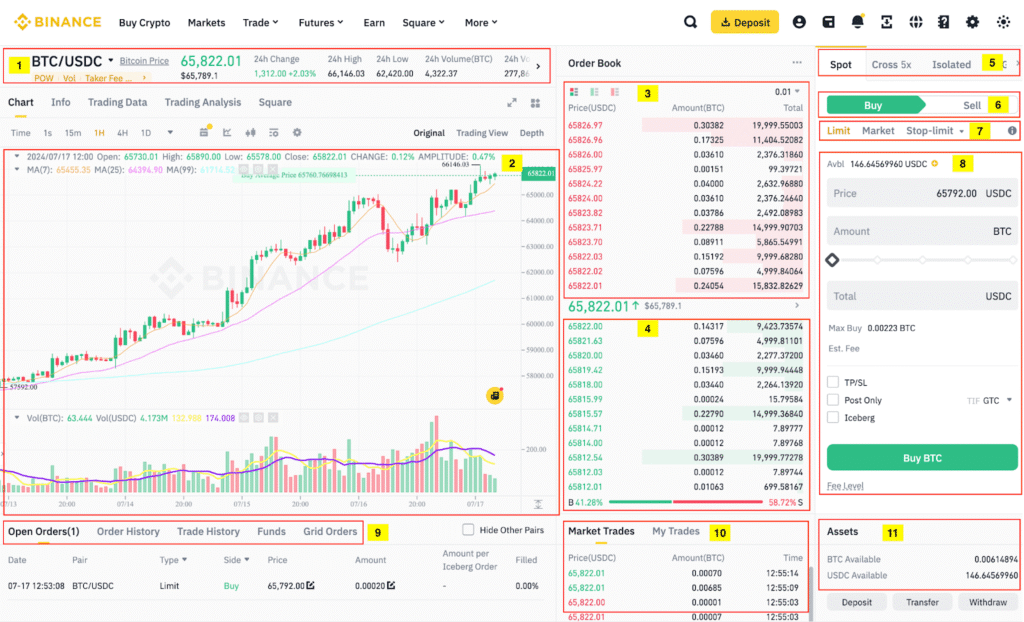

11) Your First Spot Trade: A Step-by-Step Tutorial

- Open an account:

Binance or

Coinbase (simple UIs).

For futures later:

Bybit,

OKX. - KYC + 2FA: Verify identity and enable two‑factor authentication.

- Deposit: Bank card, bank transfer, or P2P (fees and availability vary by region).

- Choose a pair: Start with BTC/USDT or ETH/USDC.

- Place a Limit order: Define entry price; set a stop‑loss below your invalidation level.

- Size the position: Use 1% risk per trade; compute quantity so stop equals 1% account risk.

- Take profit plan: Pre‑plan partial exits (e.g., scale out at 1R, 2R).

- Log the trade: Write your rationale and emotions; review weekly.

12) Common Beginner Mistakes (and Fixes)

| Mistake | Why It Hurts | Fix |

|---|---|---|

| No written plan | Emotional trades, inconsistency | Define entry, stop, target, risk %, and review weekly |

| Using high leverage early | Magnifies losses, liquidation risk | Start spot only; add leverage later with strict caps |

| Ignoring fees/slippage | Erodes profit, worse fills | Use limit orders; prefer deep‑liquidity pairs |

| No security hygiene | Account/asset compromise | Enable 2FA, use whitelists, secure seed offline |

| Chasing hype | Buy tops, panic sell bottoms | Wait for setups that fit your plan; avoid FOMO |

13) Mini Glossary: 20 Words You’ll See on Day One

Altcoin, AMM, Ask, Base/Quote, Bid, Candlestick, Cold wallet, DCA, DEX, Gas fee, KYC, Liquidity, Maker/Taker, Order book, P2P, Private key, Slippage, Spot, Spread, Stablecoin.

14) Resources & Next Steps

- Introduction to Crypto (Hub)

- Blockchain Basics

- Crypto Exchanges (Hub) → Binance, OKX, Bybit, Coinbase

- Wallets & Security (Hub) → MetaMask, Trust Wallet, Hardware Wallets

- Technical Analysis for Beginners (Hub) → Candlesticks, Support & Resistance, RSI, MACD

- Risk Management & Psychology

- Common Beginner Mistakes

15) FAQ

How much money do I need to start?

As little as $10–50 on most exchanges. Start small while you learn execution and risk.

Which exchange is best for beginners?

Coinbase for simplicity; Binance for lower fees and deep liquidity. Choose based on your region and goals.

Is crypto trading safe?

Crypto is volatile. Reduce risk by using reputable exchanges, enabling 2FA, and keeping long‑term funds in a hardware wallet.

Should I trade or invest?

Start with long‑term investing (DCA) in major assets; move to active trading once you have a plan and consistent journaled results.

Do I need a wallet to trade?

No for CEX (your account has a hosted wallet). Yes for DEX. Regardless, use a personal wallet for long‑term storage.

How do I avoid scams?

Never share your seed phrase, verify URLs, use withdrawal whitelists, and ignore unsolicited messages promising guaranteed profits.