Crypto Staking Guide 2025: Earn Up to 20% APY Passive Income

Crypto staking allows you to earn passive income by locking cryptocurrency tokens to support blockchain networks. You can generate 3% to 20% annual returns by delegating tokens like Ethereum (ETH), Cardano (ADA), and Solana (SOL) through proven exchanges.

Over $50 billion worth of cryptocurrency is currently staked across major platforms. Professional traders use staking to generate consistent yields while supporting network security. This strategy eliminates the complexity of active trading while producing measurable income.

The global crypto staking market continues expanding as institutional investors recognize proof-of-stake as an energy-efficient alternative to mining. Major exchanges like Binance, Coinbase, and Kraken now offer simplified staking services with competitive rates.

Table of Contents

- What Is Crypto Staking?

- How Crypto Staking Works

- Best Crypto Staking Platforms 2025

- Top Cryptocurrencies for Staking

- Staking Rewards and APY Explained

- Types of Crypto Staking

- Staking Risks You Must Know

- Staking vs Other Investment Strategies

- Tax Implications of Staking Rewards

- Advanced Staking Strategies

- Common Staking Mistakes to Avoid

- Future of Crypto Staking

- FAQs

- Start Staking Today

What Is Crypto Staking?

Crypto staking is the process of locking cryptocurrency tokens to participate in blockchain network validation and earn rewards. You delegate your tokens to validators who process transactions and secure the network, receiving newly minted tokens as compensation.

Staking operates through proof-of-stake consensus mechanisms that replace energy-intensive mining. Networks like Ethereum, Cardano, and Polkadot use staking to maintain security while consuming 99% less energy than Bitcoin mining.

Your staked tokens remain in your control while generating passive income. Most staking arrangements allow you to withdraw your tokens after predetermined unbonding periods ranging from immediate to 28 days.

Key benefits of crypto staking include:

- Passive income generation: 3% to 20% annual returns

- Network participation: Support blockchain security and decentralization

- Environmental impact: Energy-efficient alternative to mining

- Compound growth: Automatic reinvestment of earned rewards

- Portfolio diversification: Yield generation beyond price appreciation

How Crypto Staking Works

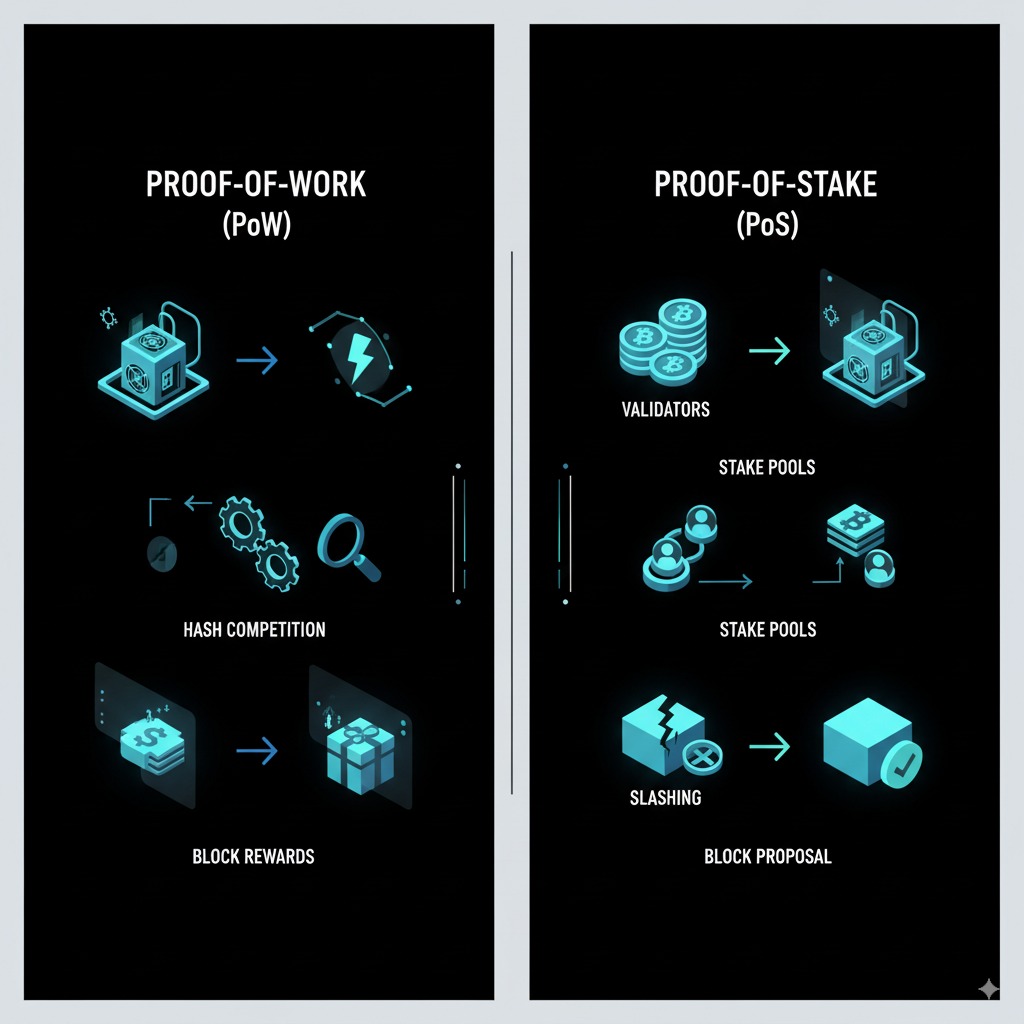

Proof-of-Stake Consensus Mechanism

Proof-of-stake networks select validators based on token ownership rather than computational power. Validators propose new blocks and confirm transactions, with selection probability proportional to their staked token amounts.

The consensus process follows these steps:

- Token holders delegate stakes to validators

- Network algorithms select validators for block production

- Chosen validators process transactions and create blocks

- Other validators attest to block validity

- Rewards distribute to validators and delegators

Economic incentives encourage honest behavior. Validators who violate network rules face “slashing” penalties that destroy portions of staked tokens.

Validator Selection and Delegation

You can participate in staking without running validator nodes by delegating tokens to professional operators. Validators charge commission fees typically ranging from 0% to 20% for providing infrastructure and expertise.

Professional validators maintain:

- 99%+ uptime through redundant infrastructure

- Advanced security measures including hardware security modules

- Geographic distribution to prevent regional failures

- Transparent reporting on performance metrics

- Active participation in network governance

When selecting validators, evaluate these criteria:

- Historical uptime and performance records

- Commission rates and fee structures

- Security practices and operational transparency

- Community reputation and governance participation

- Financial stability and long-term sustainability

Best Crypto Staking Platforms 2025

Binance Staking Services

Binance operates the world’s largest crypto staking platform with over $8 billion in staked assets. The platform supports 60+ cryptocurrencies with flexible and locked staking options.

Binance staking features:

- Supported assets: 60+ cryptocurrencies including ETH, ADA, SOL, DOT

- Minimum amounts: 0.001 tokens for most cryptocurrencies

- Reward rates: 1% to 20% APY depending on asset and lock period

- Distribution: Daily reward payments with auto-compounding

- Flexibility: Instant redemption for flexible staking

Binance staking advantages:

- Highest liquidity and asset variety

- Competitive rates with transparent fee structure

- Advanced security including SAFU insurance fund

- Mobile app with full staking functionality

- 24/7 customer support in multiple languages

Coinbase Staking Platform

Coinbase provides regulated staking services for US-based investors with emphasis on security and compliance. The platform automatically stakes eligible cryptocurrencies with full insurance coverage.

Coinbase staking specifications:

- Asset coverage: 15+ major proof-of-stake cryptocurrencies

- Commission: 25% of earned rewards (industry standard)

- Insurance: FDIC protection for USD, private insurance for crypto

- Tax support: Form 1099-MISC generation for US taxpayers

- Regulation: Licensed under state money transmission laws

Why choose Coinbase for staking:

- Regulatory compliance and consumer protection

- Automatic staking without manual setup

- Institutional-grade security infrastructure

- Seamless integration with traditional banking

- Educational resources for blockchain beginners

Kraken Staking Infrastructure

Kraken operates enterprise-level staking infrastructure with 99.9% uptime across validator networks. The platform offers both traditional and flexible staking options with transparent reward calculations.

Kraken staking capabilities:

- Network coverage: 12+ proof-of-stake blockchain networks

- Reward frequency: Twice-weekly distribution schedule

- Minimum thresholds: $1 to $100 equivalent depending on asset

- Fee transparency: Clear commission disclosure and calculations

- Professional services: Institutional staking with custom terms

Kraken staking benefits:

- Professional validator operations with proven reliability

- Detailed performance metrics and transparent reporting

- Flexible staking with immediate liquidity options

- Advanced trading features integrated with staking rewards

- Strong regulatory compliance across multiple jurisdictions

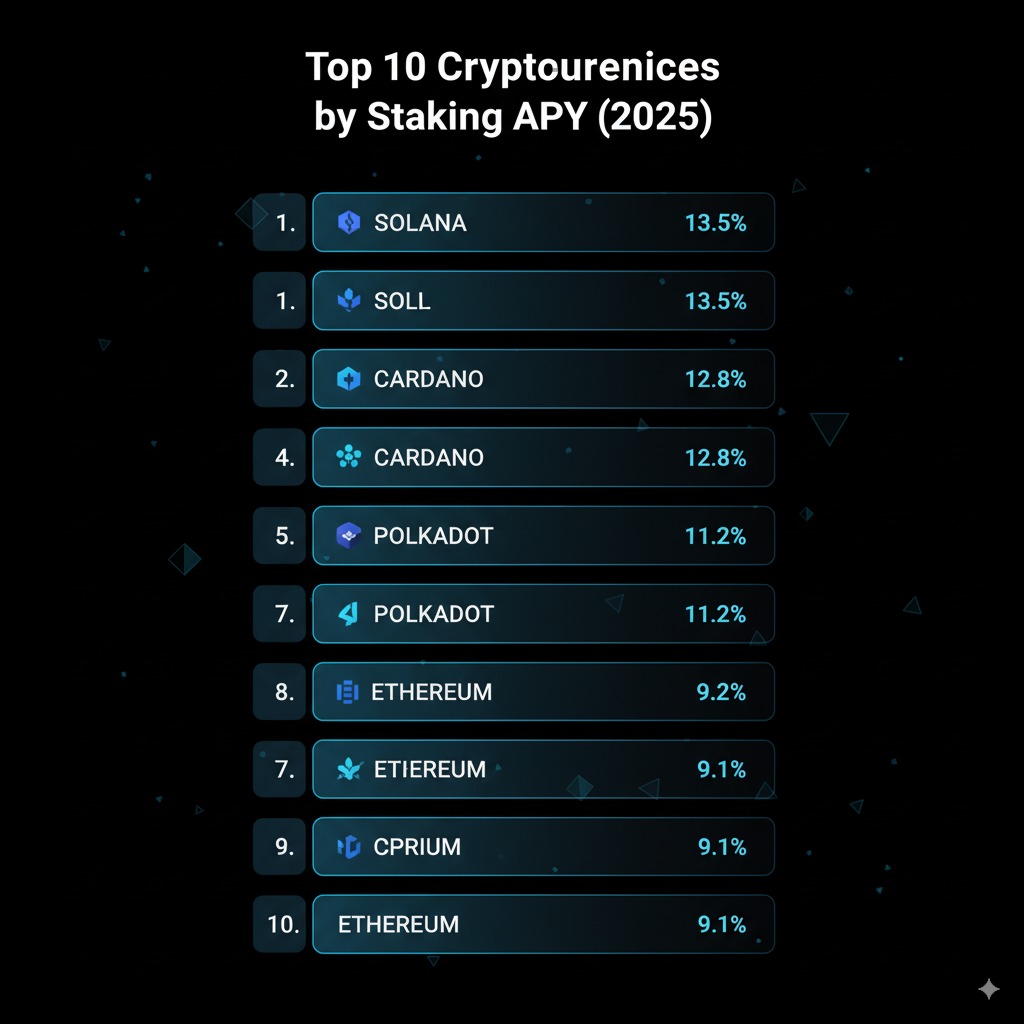

Top Cryptocurrencies for Staking

Ethereum (ETH) – 4.5% APY

Ethereum transitioned to proof-of-stake in September 2022, becoming the largest staking network by value. Over $50 billion in ETH is currently staked across validators and liquid staking protocols.

Ethereum staking details:

- Minimum requirement: 32 ETH for solo validation ($64,000+)

- Reward rate: 3.5% to 5.5% APY depending on network activity

- Lock-up period: Withdrawals enabled since Shanghai upgrade

- Slashing risk: 0.5% to 100% penalty for validator misconduct

- Liquid options: stETH, rETH enable DeFi participation while staking

Cardano (ADA) – 5.2% APY

Cardano’s Ouroboros protocol enables delegation without lock-up periods, making ADA attractive for flexible staking. The network distributes rewards every 5 days through epoch-based cycles.

Cardano staking features:

- Minimum stake: No minimum requirement, start with any amount

- Reward rate: 4.5% to 6% APY with consistent distribution

- Flexibility: Immediate unstaking without unbonding periods

- Pool selection: Choose from 3,000+ stake pool operators

- Treasury funding: Catalyst governance enables community project funding

Solana (SOL) – 7.8% APY

Solana combines high-performance blockchain technology with attractive staking rewards. The network processes 65,000+ transactions per second while maintaining energy efficiency.

Solana staking characteristics:

- Reward rate: 6.5% to 8.5% APY with epoch-based distribution

- Epoch duration: Approximately 2-3 days per reward cycle

- Validator choice: 1,500+ validators with varying commission rates

- Unstaking period: Immediate within current epoch cycle

- DeFi integration: Liquid staking through protocols like Marinade

Polkadot (DOT) – 12.5% APY

Polkadot’s nominated proof-of-stake system offers some of the highest staking rewards in crypto. The network enables interoperability between different blockchain projects.

Polkadot staking system:

- Reward rate: 10% to 14% APY through nominator rewards

- Minimum stake: 10 DOT minimum for nominator participation

- Unbonding period: 28 days for complete token withdrawal

- Validator limit: Nominate up to 16 validators simultaneously

- Governance rights: Participate in referenda and council elections

Other High-Yield Staking Options

| Cryptocurrency | APY Range | Min. Amount | Unbonding Period | Risk Level |

|---|---|---|---|---|

| Avalanche (AVAX) | 8-12% | 25 AVAX | 2-4 weeks | Medium |

| Cosmos (ATOM) | 10-15% | 0.1 ATOM | 21 days | Medium |

| Tezos (XTZ) | 5-7% | 1 XTZ | 3 weeks | Low |

| Algorand (ALGO) | 4-6% | 1 ALGO | Immediate | Low |

| Near Protocol (NEAR) | 8-11% | 1 NEAR | 36-48 hours | Medium |

Staking Rewards and APY Explained

Understanding APY vs APR

Annual Percentage Yield (APY) includes compound interest effects, while Annual Percentage Rate (APR) shows simple interest. Most staking platforms advertise APR figures that underestimate actual returns when rewards compound automatically.

APY calculation with daily compounding: APY = (1 + APR/365)^365 – 1

Example: 10% APR with different compounding frequencies:

- No compounding: 10% annual return

- Monthly compounding: 10.47% APY

- Daily compounding: 10.52% APY

- Continuous compounding: 10.52% APY

Factors Affecting Staking Rewards

Staking rewards fluctuate based on network conditions, validator performance, and total staked supply. Understanding these variables helps you optimize reward generation.

Network-level factors:

- Total staked percentage: Higher participation reduces individual rewards

- Transaction activity: Network fees supplement base emission rewards

- Inflation rates: New token creation dilutes existing supply

- Protocol upgrades: Changes in consensus mechanisms affect reward distribution

- Market conditions: Token price volatility impacts fiat-denominated returns

Validator-specific factors:

- Uptime performance: Offline validators earn reduced rewards

- Commission rates: Validator fees directly reduce delegator returns

- Delegation amount: Larger stakes may receive preferential treatment

- Geographic location: Regional regulations affect validator operations

- Technical competence: Professional operators minimize slashing risks

Reward Distribution Schedules

Different networks distribute staking rewards on varying schedules, affecting compound growth rates. Understanding distribution timing helps optimize reinvestment strategies.

Common distribution patterns:

- Ethereum: Continuous balance updates every 12 seconds

- Cardano: Epoch-based rewards every 5 days

- Solana: Epoch rewards every 2-3 days

- Polkadot: Era-based distribution every 24 hours

- Cosmos: Block rewards with immediate delegation updates

Types of Crypto Staking

Exchange-Based Staking

Centralized exchanges offer simplified staking through managed services that eliminate technical complexity. You maintain exchange custody while earning rewards through automated validator selection.

Exchange staking advantages:

- One-click setup without technical knowledge

- Professional validator management and optimization

- Instant liquidity for most supported assets

- Integrated tax reporting and documentation

- Customer support for troubleshooting issues

Leading exchange staking platforms:

- Binance Staking: 60+ assets, flexible/locked options

- Coinbase Earn: 15+ assets, automatic staking

- Kraken Staking: 12+ networks, twice-weekly rewards

- OKX Earn: 100+ assets, flexible terms

- Gate.io Hodl & Earn: High-yield emerging projects

Native On-Chain Staking

Native staking provides direct blockchain participation through official network wallets. This approach offers maximum control and highest reward potential by eliminating intermediary fees.

Native staking benefits:

- Highest possible rewards without exchange fees

- Full control over private keys and validator selection

- Direct participation in network governance decisions

- No counterparty risk from exchange insolvency

- Access to advanced staking features and customization

Popular native staking wallets:

- Ethereum: MetaMask, Rocket Pool, Lido Protocol

- Cardano: Daedalus, Yoroi with stake pool selection

- Solana: Phantom, Solflare with validator delegation

- Polkadot: Polkadot.js with nominator functionality

- Cosmos: Keplr supporting multiple IBC networks

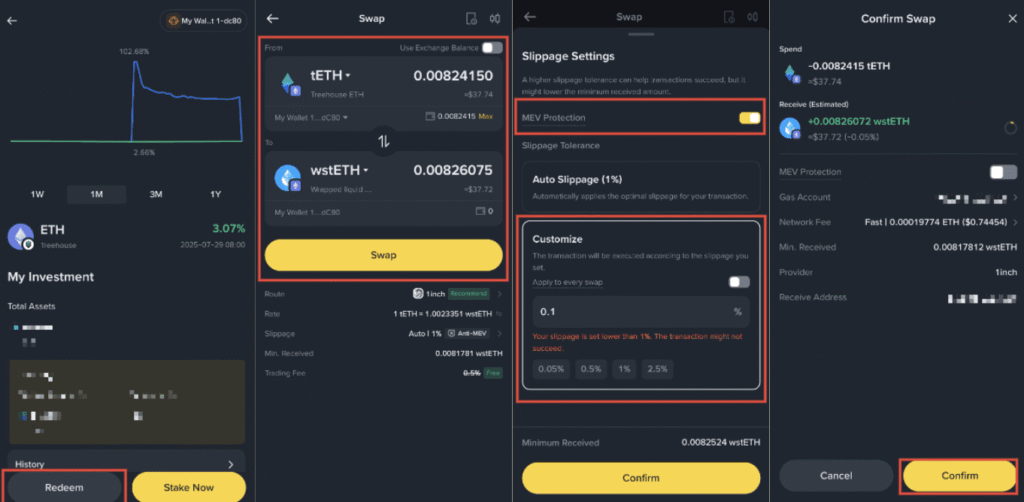

Liquid Staking Protocols

Liquid staking issues derivative tokens representing staked assets, enabling DeFi participation while earning rewards. This innovation solves traditional staking liquidity constraints.

Liquid staking mechanics:

- Deposit tokens into liquid staking protocol

- Receive liquid staking tokens (LSTs) representing staked assets

- Use LSTs in DeFi applications while earning staking rewards

- Redeem LSTs for original tokens plus accumulated rewards

Major liquid staking protocols:

- Lido Finance (stETH): $20+ billion TVL, Ethereum focus

- Rocket Pool (rETH): Decentralized Ethereum staking

- Ankr (ankrETH): Multi-chain liquid staking solutions

- StakeWise (sETH2): Ethereum staking with dual tokens

- Marinade (mSOL): Solana liquid staking platform

Staking Risks You Must Know

Slashing Risk Management

Slashing penalties automatically destroy staked tokens when validators violate network rules. Penalty severity ranges from 0.5% to 100% depending on misconduct type and network design.

Common slashing triggers:

- Extended validator downtime exceeding network thresholds

- Double-signing blocks during consensus participation

- Contradictory attestations or equivocation events

- Long-range attacks on blockchain history

- Correlated failures across multiple validators

Slashing mitigation strategies:

- Distribute stakes across multiple independent validators

- Research validator track records and security practices

- Monitor validator performance through network explorers

- Consider slashing insurance where available

- Maintain diversified staking portfolio across networks

Smart Contract and Platform Risks

Liquid staking protocols and exchanges introduce technical vulnerabilities beyond native staking exposure. Smart contract bugs, exchange hacks, and governance attacks can impact staked assets.

Platform risk categories:

- Smart contract vulnerabilities: Code exploits enabling unauthorized withdrawals

- Exchange insolvency: Platform bankruptcy affecting customer funds

- Regulatory restrictions: Government actions limiting platform operations

- Governance attacks: Malicious proposals altering protocol parameters

- Liquidity crises: Inability to exit positions during market stress

Risk mitigation approaches:

- Use audited protocols with established track records

- Diversify across multiple platforms and staking methods

- Monitor platform health indicators and community sentiment

- Maintain emergency liquidity reserves outside staking positions

- Consider insurance products where available

Market Volatility Impact

Cryptocurrency price volatility affects total returns measured in fiat currency terms. Token price declines can offset staking rewards during bear market conditions.

Volatility considerations:

- Staking rewards cannot protect against asset price depreciation

- High-yield staking often correlates with higher price volatility

- Bear markets may reduce network activity and reward generation

- Forced selling during emergencies may occur at unfavorable prices

- Tax implications of reward income persist regardless of price movements

Volatility management strategies:

- Focus on long-term accumulation rather than short-term price movements

- Use dollar-cost averaging for new staking positions

- Consider hedging strategies for large staking positions

- Maintain diversified portfolio across multiple asset classes

- Establish clear investment timeline and exit strategies

Staking vs Other Investment Strategies

Staking vs Traditional Savings

Crypto staking typically provides 3% to 20% returns compared to 0.1% to 2% for traditional bank deposits. However, staking involves cryptocurrency volatility and regulatory uncertainties.

Comparison factors:

| Factor | Crypto Staking | Bank Savings |

|---|---|---|

| Yield Potential | 3-20% APY | 0.1-2% APY |

| Principal Risk | High volatility | FDIC insured |

| Liquidity | Varies by network | Instant access |

| Regulatory Status | Evolving framework | Established laws |

| Tax Treatment | Income tax on rewards | Interest income |

Staking vs DeFi Lending

Decentralized lending protocols offer variable yields ranging from 1% to 30% based on market demand. DeFi lending provides higher potential returns but requires active management and technical expertise.

Strategy comparison:

- Yield variability: DeFi rates fluctuate daily, staking rewards remain stable

- Risk profile: Smart contract risks vs validator slashing risks

- Management intensity: DeFi requires active monitoring, staking is passive

- Liquidity access: DeFi offers instant withdrawal, staking has unbonding periods

- Technical complexity: DeFi demands advanced knowledge, staking is beginner-friendly

Staking vs Active Trading

Successful trading can generate higher returns than staking but requires significant expertise and time investment. Staking provides predictable passive income suitable for long-term wealth building.

Performance considerations:

- Time commitment: Trading demands full-time attention, staking is passive

- Success probability: 80% of traders lose money, staking provides consistent yields

- Stress levels: Trading involves emotional pressure, staking reduces anxiety

- Transaction costs: Frequent trading fees erode profits, staking has minimal costs

- Tax efficiency: Trading triggers frequent taxable events, staking is simpler

Tax Implications of Staking Rewards

United States Tax Treatment

The IRS treats staking rewards as taxable income at fair market value on receipt dates. You must report reward income annually while tracking cost basis for future capital gains calculations.

US tax requirements:

- Income recognition: Rewards taxed when received or claimed

- Fair market value: Token prices at receipt establish income amounts

- Cost basis tracking: Received tokens basis for capital gains calculations

- Estimated payments: Quarterly payments required for substantial income

- Record keeping: Detailed logs supporting tax return preparation

Tax optimization strategies:

- Time reward claims during lower income years

- Offset staking income with cryptocurrency capital losses

- Consider tax-advantaged accounts where permitted

- Document all staking-related expenses for potential deductions

- Consult tax professionals for comprehensive planning

International Tax Obligations

Tax treatment varies significantly across jurisdictions, with some countries offering favorable staking taxation. Research local requirements before beginning staking activities.

Global tax variations:

- Germany: Tax-free after 1-year holding period

- Portugal: No tax on crypto gains for individual investors

- Singapore: Generally tax-free for individual trading activities

- Australia: Capital gains or business income depending on circumstances

- Canada: 50% of gains included in taxable income

Cross-border considerations:

- US citizens: Worldwide income taxation regardless of residence

- FATCA reporting: Foreign account disclosure requirements

- Double taxation treaties: Potential relief from multiple jurisdictions

- Withholding taxes: Platform deductions in operating countries

- Transfer pricing: Related party transaction documentation

Advanced Staking Strategies

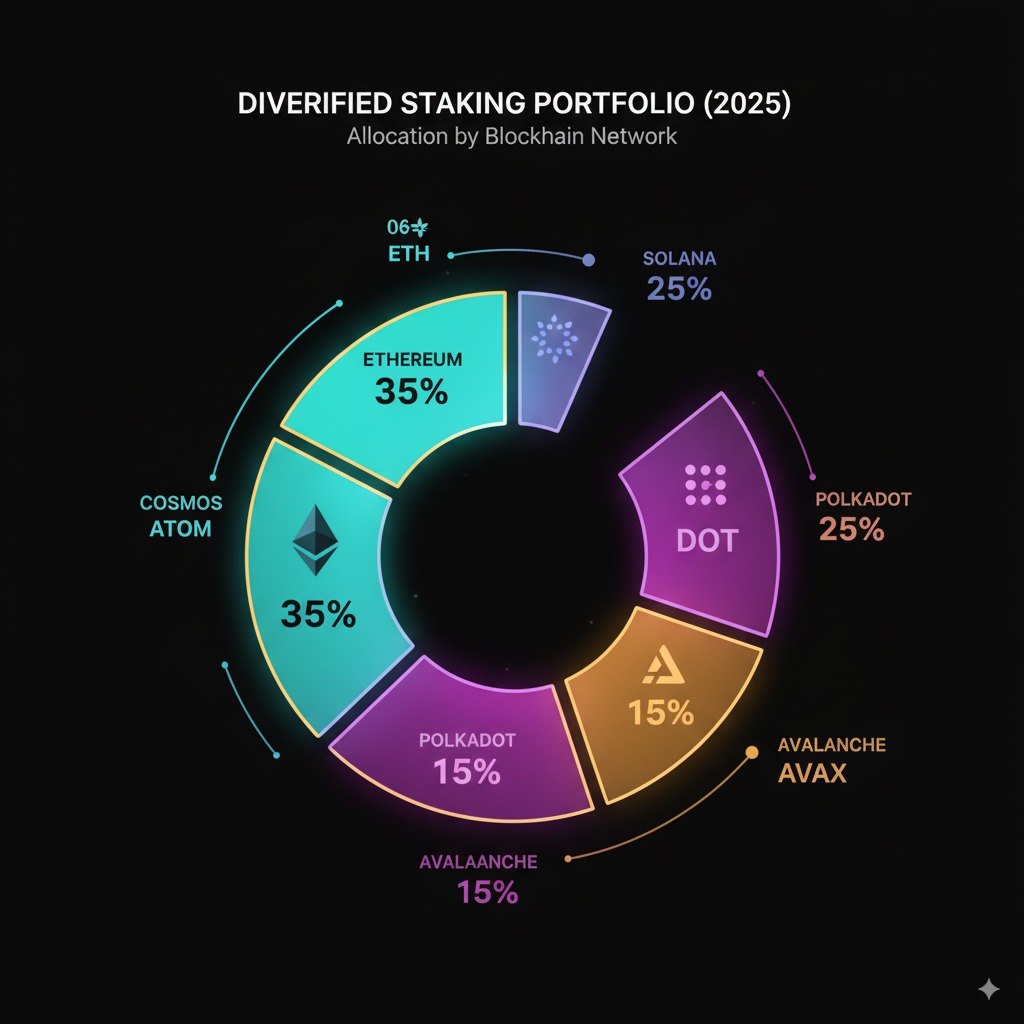

Multi-Network Portfolio Diversification

Professional stakers diversify across multiple blockchain networks to optimize risk-adjusted returns. Strategic allocation balances yield potential against network-specific risks and correlations.

Portfolio construction principles:

- Network maturity: Balance established protocols with emerging opportunities

- Correlation analysis: Minimize exposure to similar technical architectures

- Yield optimization: Target 8-12% blended returns across portfolio

- Liquidity management: Maintain 20-30% in liquid staking derivatives

- Rebalancing schedule: Quarterly adjustments based on performance metrics

Sample diversified staking portfolio:

- 40% Ethereum (ETH): Stable, liquid, established network

- 20% Cardano (ADA): Academic approach, no lock-up periods

- 15% Solana (SOL): High performance, growing ecosystem

- 10% Polkadot (DOT): Interoperability focus, high yields

- 10% Cosmos (ATOM): Interchain connectivity, governance participation

- 5% Emerging protocols: Higher risk/reward opportunities

Yield Farming with Liquid Staking Tokens

Liquid staking tokens enable simultaneous staking rewards and DeFi yield generation. This strategy compounds returns by deploying staking derivatives in lending, farming, and trading protocols.

Yield farming strategies:

- Stake ETH to receive stETH from Lido Finance

- Provide stETH liquidity on Curve Finance

- Stake Curve LP tokens for additional CRV rewards

- Use earned CRV in governance voting for boost multipliers

Risk management for yield farming:

- Monitor protocol health and TVL changes

- Understand impermanent loss risks in liquidity provision

- Track governance token emissions and sustainability

- Maintain diversification across protocols and strategies

- Set clear exit criteria for risk management

Institutional Staking Solutions

Large investors utilize specialized infrastructure for professional staking operations. Enterprise solutions address custody, compliance, and fiduciary requirements for institutional participation.

Institutional staking services:

- Validator operation: Professional node management with enterprise security

- Custody integration: Seamless connection with institutional custody providers

- Compliance monitoring: Automated regulatory reporting and audit trails

- Risk analytics: Portfolio-level risk assessment and concentration monitoring

- Performance attribution: Detailed validator selection and network analysis

Leading institutional providers:

- Coinbase Institutional: Regulated US staking services

- BitGo: Custody-integrated staking solutions

- Anchorage Digital: Federally chartered digital asset bank

- Fireblocks: Infrastructure for institutional DeFi participation

- Staked.us: Professional validator services and consulting

Common Staking Mistakes to Avoid

Choosing Validators Based Only on Commission Rates

Selecting validators solely on low commission rates ignores critical performance factors. Poor validators with low fees often have higher slashing risks and reduced uptime affecting total returns.

Comprehensive validator evaluation criteria:

- Historical performance: 99%+ uptime over extended periods

- Security practices: Multi-signature keys and geographic distribution

- Community involvement: Active governance participation and transparency

- Technical competence: Proven ability to upgrade and maintain infrastructure

- Financial sustainability: Adequate resources for long-term operations

Red flags to avoid:

- New validators without proven track records

- Extremely low commission rates that may indicate poor service quality

- Validators with recent slashing events or downtime

- Operators without transparent communication channels

- Concentrated validator sets controlled by single entities

Ignoring Lock-Up Periods and Liquidity Needs

Failing to understand unbonding periods can create liquidity constraints during emergencies or market opportunities. Different networks have varying withdrawal timelines affecting portfolio flexibility.

Unbonding period examples:

- Ethereum: Immediate for liquid staking, queue-based for validators

- Cardano: No unbonding period, immediate unstaking available

- Polkadot: 28-day unbonding period for complete withdrawal

- Cosmos: 21-day unbonding with gradual token release

- Solana: Immediate unstaking within current epoch cycles

Liquidity management strategies:

- Maintain 25-30% portfolio allocation outside staking for flexibility

- Use liquid staking derivatives for immediate liquidity access

- Stagger unbonding periods across different networks and validators

- Consider partial position exits rather than complete withdrawals

- Plan staking timeline based on personal financial requirements

Concentration Risk in Single Networks or Platforms

Concentrating staking activities creates unnecessary risks that diversification easily mitigates. Professional portfolios distribute exposure across networks, validators, and platforms.

Diversification best practices:

- Network diversification: Stake across 5-8 different blockchain protocols

- Validator distribution: Use 3-5 validators per network when possible

- Platform allocation: Balance exchange convenience with self-custody control

- Geographic spread: Validators across different regulatory jurisdictions

- Correlation management: Avoid validators sharing infrastructure or operators

Risk concentration examples to avoid:

- 100% allocation to single cryptocurrency or network

- All stakes delegated to validators from same operator

- Exclusive reliance on single exchange for staking services

- Geographic concentration in single regulatory jurisdiction

- Correlation between staking and other portfolio holdings

Future of Crypto Staking

Ethereum Scaling and Staking Evolution

Ethereum’s continued development will reshape the staking landscape through lower barriers and enhanced functionality. Future upgrades may reduce validator requirements and improve withdrawal flexibility.

Anticipated Ethereum developments:

- Lower validator thresholds: Potential reduction from 32 ETH minimum

- Improved withdrawal systems: Enhanced liquidity for staked positions

- MEV redistribution: Fairer distribution of maximal extractable value

- Sharding implementation: Increased network capacity affecting rewards

- Layer 2 integration: Staking services on scaling solutions

Impact on staking ecosystem:

- Increased retail participation through lower entry barriers

- Enhanced competition among liquid staking providers

- Integration with traditional financial service providers

- Regulatory clarity enabling institutional adoption

- Innovation in staking derivatives and financial products

Cross-Chain Interoperability and Shared Security

Interoperability protocols enable shared security models allowing multiple chains to benefit from established validator sets. This evolution reduces operational complexity while maintaining decentralization.

Interoperability developments:

- Cosmos Hub shared security: Multiple zones secured by ATOM validators

- Polkadot parachain slots: Shared security through relay chain validators

- Avalanche subnets: Customizable validation and consensus mechanisms

- Ethereum restaking: Shared security for Layer 2 and middleware protocols

- Cross-chain bridges: Secure asset transfers between staking networks

Benefits of shared security models:

- Reduced validator operational costs through economies of scale

- Enhanced security for smaller networks through established validator sets

- Simplified user experience across multiple blockchain applications

- Improved capital efficiency for stakers across network ecosystems

- Innovation in cross-chain financial products and derivatives

Institutional Adoption and Regulatory Clarity

Traditional financial institutions increasingly integrate crypto staking into standard investment products. This institutional adoption brings professional infrastructure and regulatory compliance.

Institutional integration trends:

- Bank staking services: Major banks offering crypto staking products

- Pension fund allocation: Institutional investors adding staking strategies

- Insurance product development: Professional liability and slashing coverage

- ETF integration: Staking yields in exchange-traded fund structures

- Custody evolution: Traditional custodians adding staking capabilities

Regulatory framework development:

- SEC guidance: Clear rules for staking service providers

- CFTC oversight: Commodity treatment for major staking assets

- Banking integration: Regulatory approval for traditional bank participation

- Tax clarification: Comprehensive guidance on staking income treatment

- International coordination: Harmonized approaches across jurisdictions

Frequently Asked Questions

What is crypto staking and how does it work?

Crypto staking involves locking cryptocurrency tokens to participate in blockchain network validation and earn rewards. You delegate tokens to validators who secure the network, receiving newly minted tokens as compensation for supporting network operations.

How much can I earn from crypto staking?

Staking rewards typically range from 3% to 20% annually depending on the cryptocurrency and network conditions. Ethereum offers 3-5% APY, while newer networks like Cosmos and Polkadot provide 10-15% returns with higher risk profiles.

Is crypto staking safe?

Crypto staking involves risks including slashing penalties, smart contract vulnerabilities, and market volatility. However, established networks and professional validators minimize these risks through proven security practices and insurance mechanisms.

Can I lose money staking crypto?

Yes, you can lose money through slashing penalties, exchange failures, or cryptocurrency price declines. Slashing can destroy 0.5-100% of staked tokens depending on validator misconduct, while market volatility affects total portfolio value.

What is the difference between staking and mining?

Staking uses token ownership for network consensus while mining relies on computational power. Staking consumes 99% less energy than mining while providing similar network security through economic incentives rather than electricity costs.

How do I choose the best staking platform?

Evaluate platforms based on supported assets, reward rates, security measures, and regulatory compliance. Binance offers the widest selection, while Coinbase provides regulatory certainty for US investors.

Are staking rewards taxable?

Yes, most jurisdictions treat staking rewards as taxable income at fair market value on receipt dates. You must track reward values for tax reporting while establishing cost basis for future capital gains calculations.

What is liquid staking and should I use it?

Liquid staking provides derivative tokens representing staked assets, enabling DeFi participation while earning rewards. This approach offers flexibility but introduces smart contract risks and typically slightly lower yields than native staking.

How long are my tokens locked when staking?

Lock-up periods vary by network, ranging from immediate withdrawal to 28-day unbonding periods. Ethereum liquid staking offers instant liquidity, while Polkadot requires 28 days for complete token withdrawal after unstaking.

Can I stake with small amounts of cryptocurrency?

Yes, most exchanges enable staking with minimal amounts starting from $1-10 equivalent. Native staking often requires larger minimums like 32 ETH ($64,000+) for Ethereum validators, making exchange staking accessible for smaller investors.

Start Staking Today

Begin your crypto staking journey by choosing a reputable platform and starting with established cryptocurrencies. Focus on learning fundamentals while building experience with smaller amounts before expanding your staking portfolio.

Recommended next steps:

- Open account with Binance for comprehensive staking options

- Start with Ethereum or Cardano for stable, established networks

- Begin with flexible staking to understand mechanics before committing to locked terms

- Research validator options if considering native staking approaches

- Track performance and learn while gradually increasing position sizes

Key takeaways for successful staking:

- Diversify across multiple networks and validators for risk management

- Understand tax implications and maintain detailed records

- Monitor validator performance and network developments regularly

- Balance yield optimization with risk tolerance and liquidity needs

- Consider professional advice for substantial staking operations

The crypto staking landscape continues evolving with new opportunities and improved infrastructure. Start with established platforms and proven strategies while staying informed about technological developments and regulatory changes affecting the staking ecosystem.

Ready to earn passive income through crypto staking? Sign up with Binance today and start generating yields on your cryptocurrency holdings while supporting blockchain network security and decentralization.

Disclaimer: Cryptocurrency staking involves substantial risk of loss and may not be suitable for all investors. Staking rewards are not guaranteed and fluctuate based on network conditions, validator performance, and market factors. Past performance does not indicate future results.

Risk Warning: Staked tokens may be subject to slashing penalties, lock-up periods, smart contract vulnerabilities, and market volatility that can result in partial or total loss of principal. Regulatory changes may affect staking availability and taxation.

Educational Purpose: This content is for informational purposes only and does not constitute investment, financial, or tax advice. Consult qualified professionals before making investment decisions. Always conduct your own research and understand the risks before participating in cryptocurrency staking activities.