Copy Trading: Complete Guide for 2025

Updated on August 31, 2025 • Reading time: 16–20 minutes

Risk Notice: Copy trading does not guarantee profits. Performance varies, and past results do not predict future outcomes. Educational content only; this is not financial advice.

What Is Copy Trading?

Copy trading (social trading) lets you automatically mirror the trades of selected “leaders.” You keep custody on the exchange account you use, while allocations, entries, and exits follow the leader’s signals or positions according to rules you set (amount, max loss, stop following, etc.).

It complements basics like Spot Trading and advanced tools such as Margin Trading and Futures Trading inside the cluster Trading Features on Exchanges.

How Copy Trading Works

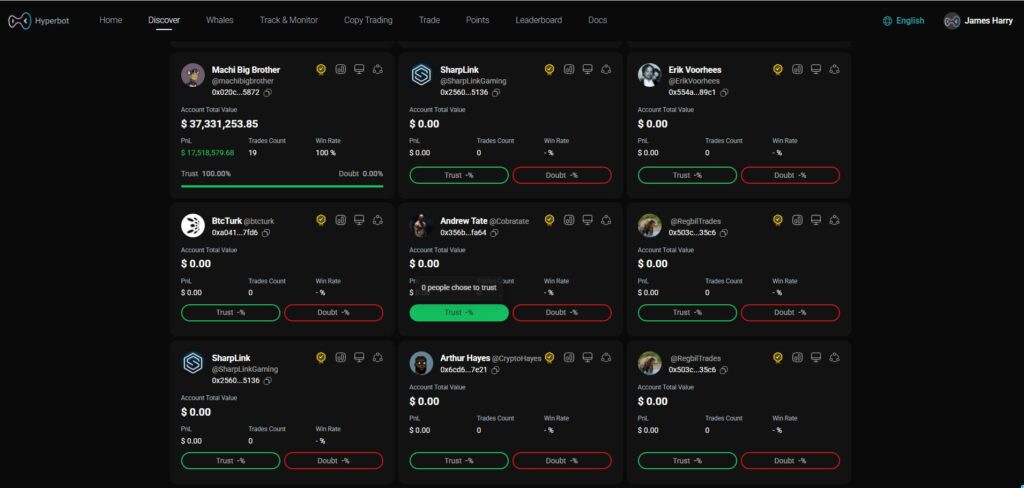

- Discover leaders: filter by win rate, profit factor, max drawdown, equity curve, sample size, and average holding time.

- Allocate capital: set fixed amount or percentage per leader; cap daily and per-trade risk.

- Sync trades: entries/exits auto-executed; you can pause, reduce allocation, or unfollow any time.

- Monitor performance: track equity curve, drawdowns, fees, slippage, and correlation across leaders.

- Adjust rules: update stops, max loss, or allocation when volatility or leader behavior changes.

Latency and Slippage

Follower fills can deviate from leader due to network latency, liquidity, or order type. Expect occasional slippage, especially on fast moves and illiquid pairs.

Pros and Cons

Pros

- Accessibility: beginners benefit from leader expertise and structured strategies.

- Diversification: allocate to multiple leaders, styles, and markets.

- Time-saving: rules-based following reduces manual monitoring.

Cons

- Tracking error: follower fills may lag or differ from leaders.

- Overfitting risk: great past performance can hide regime dependence.

- Fee drag: profit-share, subscription, and trading fees reduce net returns.

Where To Copy Trade (Platforms)

Select exchanges with transparent leader stats, clear fee rules, and strong risk controls. See our exchange deep-dives:

- Bybit Exchange Features — Join: Bybit (ref)

- OKX Exchange Benefits — Join: OKX (ref)

- Bitget — Join: Bitget (ref)

- BingX — Join: BingX (ref)

- MEXC — Join: MEXC (ref)

- Gate.io — Join: Gate.io (ref)

- KuCoin — Join: KuCoin (ref)

- WhiteBIT — Join: WhiteBIT (ref)

- Binance — Review: Read our Binance review • Start: Binance (ref)

Explore related concepts in the cluster hub: Trading Features on Exchanges.

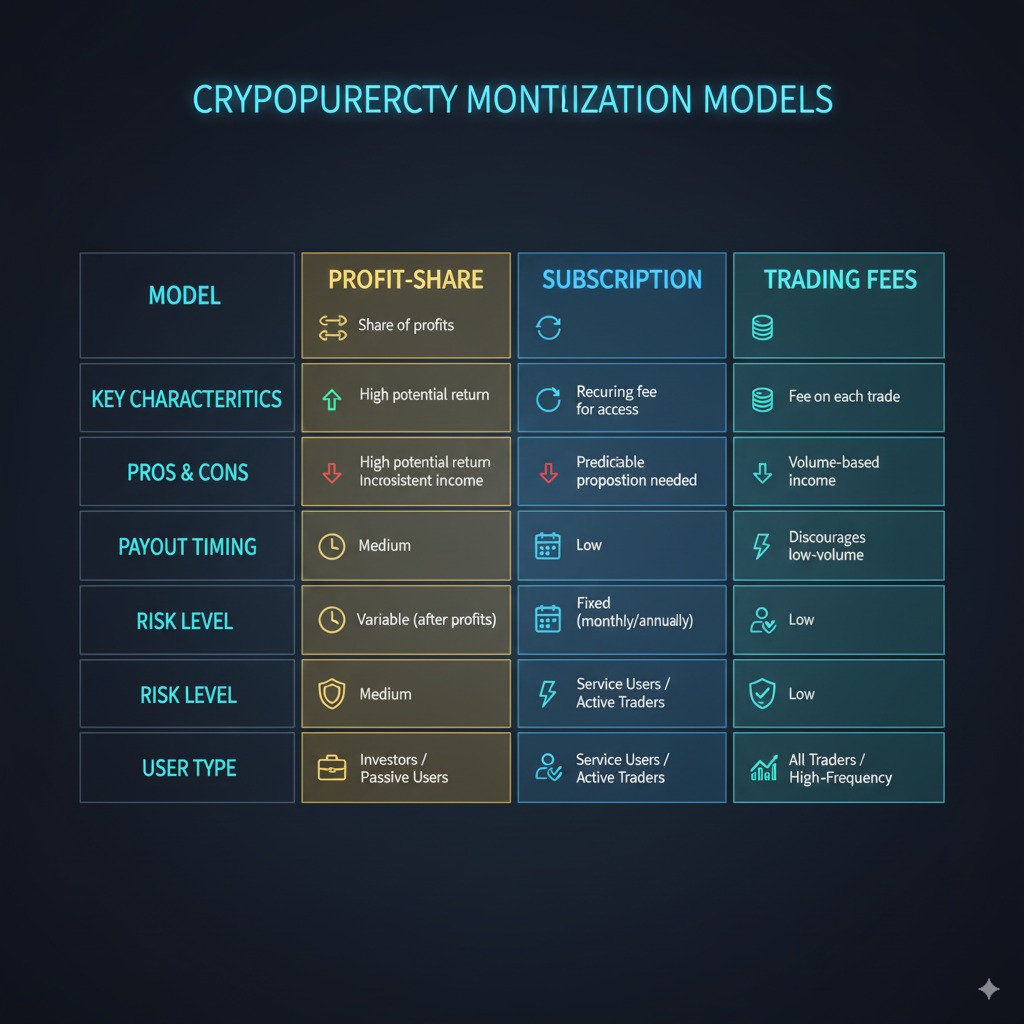

Fees and Cost Models

Expect three layers of cost: trading fees (maker/taker), copy-trading fees (profit share or subscription), and withdrawal/network fees. Review terms carefully—fee drag compounds over time.

| Cost Type | How It Works | Impact | What To Check |

|---|---|---|---|

| Profit Share | Percentage of follower profits paid to leader/platform | Reduces net PnL | High-water mark, calculation period, caps |

| Subscription | Fixed fee per period to follow a leader | Can hurt if performance stagnates | Refund policy, renewal rules |

| Trading Fees | Maker/taker on each executed order | Higher with frequent trading | VIP tiers, token discounts |

How To Choose Leaders (Data-Driven)

Evaluate leaders with objective, multi-metric criteria. Favor consistency and robust sample sizes over eye-catching monthly returns.

| Metric | What It Tells You | Red Flags |

|---|---|---|

| Max Drawdown (MDD) | Worst peak-to-trough loss | Large single-month or repeated deep MDDs |

| Profit Factor | Gross wins ÷ gross losses | PF inflated by tiny sample or one-off wins |

| Win Rate | Percent of winning trades | High WR with poor R:R or huge MDD |

| Average Hold | Strategy speed and fee sensitivity | Very short holds + high fees → fee drag |

| Sample Size | Statistical confidence | < Sufficient trades / months to trust |

| Correlation | Overlap between leaders | Clustering multiple leaders with same style |

Practical filter: consistent equity curve, controlled drawdown, adequate sample size, and transparent, repeatable process.

Risk Management for Followers

- Allocation caps: set max per leader and per trade; avoid oversized bets.

- Hard loss limits: daily and per-trade caps; auto-pause on breach.

- Diversification: 2–4 uncorrelated leaders; avoid style concentration.

- Unfollow triggers: breach of drawdown, behavior drift, or rule violations.

- Audit latency/slippage: compare leader vs follower fills periodically.

- Journal: record changes to allocations, reasons, and outcomes.

Common Mistakes and How To Avoid Them

- Chasing recent returns: prioritize long-term consistency over one hot month.

- No loss limits: allocations without daily/per-trade caps invite large drawdowns.

- Over-correlation: picking leaders with the same strategy amplifies risk.

- Ignoring fees: profit-share + trading fees can erode edge.

- Emotional toggling: panic pausing at lows then re-following at highs.

Copy Trading vs. Spot, Margin, and Futures

| Feature | Copy Trading | Spot | Margin | Futures |

|---|---|---|---|---|

| Who Decides | Leader (you follow rules) | You | You (with borrowed funds) | You (derivatives, leverage) |

| Main Costs | Profit share / subscription + trading fees | Trading + withdrawal | Interest + trading | Funding (perps) + trading |

| Complexity | Low–Medium (setup rules) | Low | Medium–High | High |

| Key Risk | Leader behavior & correlation | Market direction only | Liquidation + interest | Liquidation + funding |

Security, Compliance, and Availability

Check regional availability and derivative rules before enabling copy trading. Prioritize exchanges with strong custody, risk controls, and transparency. Always enable 2FA, anti-phishing codes, and withdrawal allowlists.

Explore more in our exchange reviews: Binance Review, Bybit Features, OKX Benefits, Coinbase Explained.

Getting Started: A Safe Path

- Filter leaders using objective metrics (MDD, PF, WR, sample size) and check equity curve stability.

- Allocate small first with strict per-trade/daily loss caps and a pause rule.

- Diversify across 2–4 uncorrelated leaders; avoid clustering.

- Review monthly (not daily) to avoid emotional toggling; rotate slowly if necessary.

- Journal allocations, reasons, and outcomes; iterate rules quarterly.

Quick access:

- Bybit (ref): Start on Bybit

- OKX (ref): Start on OKX

- Binance (ref): Start on Binance

FAQs

Is Copy Trading Profitable?

It can be, but outcomes vary widely. Focus on leader consistency, drawdown control, and fee impact. Use strict allocation and loss limits.

How Much Should I Allocate?

Start small. Cap per-leader allocation and set daily/per-trade loss limits. Scale only after stable results over a meaningful sample size.

What Metrics Matter Most?

Max drawdown, profit factor, win rate, sample size, average holding time, and correlation with your other leaders.

Can I Stop Following Anytime?

Yes. You can pause or unfollow, and adjust allocation or risk settings at any time according to platform rules.

Do Fees Make a Big Difference?

Yes. Profit-share or subscriptions plus trading fees compound over time. Always include fees in your net-return calculation.