Common Models: CPA, RevShare, Hybrid – A Complete Guide and Comparison for Crypto Affiliates

Estimated reading time: 11 minutes

Key Takeaways

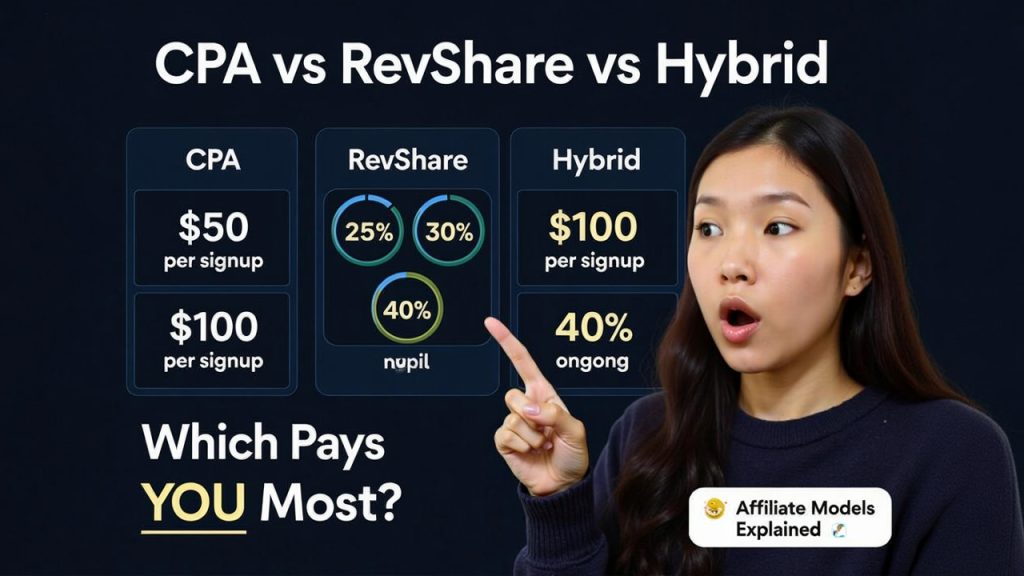

- The three main crypto affiliate commission models are CPA (Cost Per Acquisition), RevShare (Revenue Share), and Hybrid approaches.

- CPA provides predictable, immediate compensation—best for new affiliates, cash flow needs, short-term promotions, or simple tracking setups.

- RevShare offers uncapped long-term earnings but typically requires higher-quality, active user traffic, and has a longer payback period.

- A Hybrid balances both: guaranteeing an upfront payment and a piece of future user revenue for affiliates who want both stability and upside.

- Optimizing your affiliate model choice in 2025 depends on your traffic quality, volume, risk tolerance, and business maturity.

- Industry data reveals a shift to more flexible options, making understanding each structure vital to affiliate success.

Table of Contents

- Understanding Affiliate Commission Models in 2025

- Cost Per Acquisition (CPA) Model Explained

- When to Choose CPA Programs

- CPA Success Strategies

- Revenue Share (RevShare) Model Deep Dive

- FAQs

1. Understanding Affiliate Commission Models in 2025

The cryptocurrency affiliate landscape continues to mature in 2025, offering sophisticated commission structures that accommodate diverse traffic sources and marketing strategies. The three predominant models—CPA, RevShare, and Hybrid—each serve distinct purposes in an affiliate’s monetization toolkit. Recent industry data indicates that 47% of crypto platforms now offer multiple commission options, recognizing that affiliates require flexible compensation structures that align with their specific business models.

CPA remains the leading model for new affiliates, with 62% starting their crypto promotion journey with fixed-payment structures. Meanwhile, established affiliates increasingly gravitate toward RevShare arrangements, with 58% of high-volume partners preferring percentage-based commissions. The Hybrid model has gained significant traction, showing 34% year-over-year growth as platforms seek to attract quality traffic through balanced incentive structures.

Understanding the nuances of each model is no longer optional—it’s essential for optimizing promotional strategies and maximizing returns in an increasingly competitive market. Let’s examine each model in detail to determine which approach best serves your specific traffic quality, volume, and long-term objectives. For a foundational overview of how crypto affiliate programs operate and their core structures, see this comprehensive guide on crypto affiliate programs.

2. Cost Per Acquisition (CPA) Model Explained

Cost Per Acquisition represents the most straightforward commission structure in crypto affiliate marketing. Under this model, affiliates receive a fixed payment for each qualified user acquisition, typically when a referred visitor completes a specific action such as registration, email verification, deposit, or trade execution. The defined payout occurs regardless of the user’s subsequent platform activity or lifetime value.

In the cryptocurrency sector, CPA rates vary substantially based on several factors: the required conversion action, geographic region, platform reputation, and market position. Current market rates for crypto exchanges range from $70-150 for funded accounts in tier-one markets (North America, Western Europe, Australia) to $25-80 in emerging markets. For more specialized crypto services such as lending platforms or derivatives exchanges, CPA rates typically range from $100-300 per qualified acquisition, reflecting the higher average customer value in these segments.

CPA structures in crypto typically follow one of three frameworks:

- Single-action CPA: Payment for a specific completed action (e.g., $100 for a verified account with minimum deposit)

- Multi-step CPA: Graduated payments for progressive actions (e.g., $30 for registration, $70 additional upon first deposit)

- Threshold-based CPA: Fixed payment when referred users reach specific activity levels (e.g., $150 when user completes $1,000 in trading volume)

The CPA model proves particularly valuable for affiliates with high-converting traffic who prefer predictable, immediate compensation without the complexity of tracking long-term user value. Platforms like Binance and KuCoin offer competitive CPA rates ($100-150 per funded account) for affiliates who can deliver quality traffic with high conversion potential. For more information and a detailed comparison of payment models in crypto affiliate marketing, see this breakdown of CPA, CPL, and RevShare differences.

However, the CPA structure creates an inherent limitation—compensation caps regardless of referred user value. An affiliate receives the same payment whether the acquired user generates $200 or $20,000 in transaction fees. This ceiling effect represents the primary trade-off between immediate revenue certainty and long-term earning potential.

2.1 When to Choose CPA Programs

CPA programs align perfectly with specific affiliate scenarios where immediate revenue generation and predictable income take priority. Consider pursuing CPA arrangements under these circumstances:

- New affiliate operations – When establishing revenue history and baseline performance metrics are immediate priorities, CPA provides verifiable results and cash flow for reinvestment.

- Limited analytics capability – Operations without sophisticated lifetime value tracking benefit from CPA’s straightforward attribution mechanism.

- High-converting traffic sources – Content sites, comparison platforms, and educational resources with strong conversion records achieve optimal results with fixed-payment structures.

- Diversified traffic portfolio – Affiliates promoting multiple crypto platforms simultaneously can maintain consistent revenue across varying conversion rates.

- Short-term promotional campaigns – Time-limited marketing initiatives benefit from immediate performance measurement and compensation.

- Cash flow requirements – Business models requiring predictable monthly income benefit from CPA’s consistent payment structure rather than the variable returns of percentage-based models.

CPA programs particularly suit affiliates in emerging market development phases, where establishing baseline performance takes precedence over maximizing individual user value. The model provides essential stability during growth phases while market positioning and conversion optimization remain works in progress.

For more context on the CPA model and how it sits within commission structures in crypto, see this explanation of crypto affiliate program models.

2.2 CPA Success Strategies

Maximizing CPA program performance requires strategic optimization throughout the conversion funnel. Implement these proven techniques to enhance acquisition rates and commission earnings:

- Traffic pre-qualification – Develop content addressing specific user intent signals that align with conversion actions. Educational resources explaining complex crypto concepts (like staking or futures trading) demonstrate higher conversion rates than general cryptocurrency traffic.

- Geographic targeting refinement – Focus promotional efforts on regions with optimal conversion-to-cost ratios. While tier-one markets offer higher CPA rates, competition intensity may reduce ROI compared to emerging markets with growing crypto adoption.

- Conversion path optimization – Minimize friction between initial click and required conversion action. Analyze abandonment points along the registration-to-deposit journey and develop content addressing specific conversion barriers.

- Platform alignment – Select crypto platforms with intuitive onboarding processes and reasonable qualification thresholds. Conversion rates typically decrease 14% for each additional step in the verification process.

- Negotiation leverage – Utilize traffic quality metrics to secure improved terms. Platforms value traffic with above-average deposit rates and demonstrable user quality, often offering 15-30% rate premiums for proven performance.

- A/B testing implementation – Continuously test promotional messaging, call-to-action elements, and landing page selections to identify highest-converting combinations for specific audience segments.

Implement comprehensive attribution tracking to identify traffic sources and content types generating qualified conversions rather than just clicks. This performance data creates leverage for future CPA rate negotiations while identifying the most valuable components of your affiliate operation.

3. Revenue Share (RevShare) Model Deep Dive

The Revenue Share model establishes a fundamentally different relationship between affiliate and crypto platform, creating an ongoing partnership tied directly to referred user lifetime value. Unlike CPA’s one-time payment, RevShare provides the affiliate with a percentage of revenue generated from each referred user’s activity for a specified duration—often ranging from one year to perpetuity in competitive markets.

In cryptocurrency platforms, RevShare typically applies to transaction fees, spread revenue, or other monetization mechanisms. Current industry standards offer base commission rates ranging from 20% to 50% of generated revenue, with variations based on traffic volume, user quality, and competitive positioning. Top-tier affiliates with substantial traffic volume can secure premium rates up to 70% through direct negotiation.

The RevShare model creates mathematical relationships between platform economics and affiliate compensation. For instance, on an exchange with 0.1% trading fees, an affiliate with 40% RevShare earns 0.04% of all transaction volume from referred users. If referred traders generate $1,000,000 monthly volume, the affiliate earns $400—significantly exceeding typical CPA values for active traders.

RevShare structures in crypto typically follow three frameworks:

- Flat percentage: Consistent revenue percentage regardless of volume (e.g., 30% of all fees generated)

- Tiered performance: Increasing percentages based on referred user activity (e.g., 25% base rate, increasing to 40% for high-volume users)

- Volume-based scaling: Percentage increases with total referred user volume (e.g., 30% for first $100,000, 40% for $100,001-$500,000)

The RevShare model particularly benefits affiliates promoting platforms with high user retention and significant transaction potential. Crypto derivatives exchanges like ByBit and BitMEX offer compelling RevShare arrangements (30-50%) for affiliates who can deliver active traders, as futures and margin trading generate substantial recurring fee revenue. For in-depth affiliate program reviews by exchange and best practices on maximizing revenue from RevShare, visit this Binance RevShare guide and the Bybit Affiliate Program 2025 review.

The primary strength of RevShare—unlimited earning potential—is counterbalanced by delayed gratification. While CPA provides immediate payment, RevShare compensation builds gradually, often requiring months to exceed equivalent CPA values. This timing difference creates the fundamental decision point for affiliate strategy selection.

For a deeper comparison of RevShare, hybrid, and CPA models with sample payout calculations, see this detailed guide on affiliate payment models.

FAQs

What is CPA in crypto affiliate marketing?

CPA (Cost Per Acquisition) means the affiliate gets a fixed one-time payment for each new user who meets the platform’s requirements—such as registering and funding an account. It’s preferred by affiliates seeking fast, predictable payouts. Learn more at this overview of crypto affiliate models.

How does RevShare differ from CPA?

RevShare pays affiliates a percentage of actual revenue generated by each referred user—usually from trading fees—over a set period or for the user’s lifetime. This model has unlimited earning potential but typically slower, less predictable payouts.

What is a Hybrid affiliate model in crypto?

The Hybrid model combines an upfront CPA payment with an ongoing (often lower) RevShare percentage. For example, affiliates might receive a small fixed payout per account plus a share of future trading fees, balancing early cash flow and long-term income. More on hybrids: hybrid vs CPA vs RevShare comparison.

Which model is best for new crypto affiliates?

Most beginners prefer CPA because it’s simple, provides quick returns, and doesn’t require complex analytics. As you accumulate more data and start attracting high-value users, transitioning to RevShare or Hybrid can potentially maximize your total earnings.

How do I choose the right affiliate model?

Your choice depends on your traffic quality, quantity, user lifetime value, and risk appetite. If you want upfront certainty, use CPA. If your audience includes high-activity, loyal crypto traders, RevShare or Hybrid often offers a bigger upside. Use tools and stats—see this affiliate program guide—to model your likely outcomes.