Section 3: Mastering Call Options Trading – Complete Guide

Prerequisites: Before diving into call options, make sure you understand derivatives contracts fundamentals and have reviewed the options basics from Section 2.

Lecture 3.1: An Introduction to Call Options

As we covered in lecture 2.2, an option has 5 main parameters:

- The underlying asset

- The option type

- The expiry date

- The strike price

- The option price

In Course 3 we will be focusing specifically on the call option type. A call option gives the option buyer the right to buy the underlying asset, at the strike price, on the expiry date. As a call option is the right to buy the asset, we will also look at how buying a call option compares to buying the asset itself.

Related: Understanding Call vs Put Options

Understanding Call Option Buyers and Sellers

The buyer of a call option is purchasing the right to buy the underlying asset, at the strike price, on the expiry date. On the other side of the trade, the seller of the call option has an obligation to sell the underlying asset to the option buyer, should the option buyer choose to exercise their right.

Deep Dive: How Call Options Work in Practice

Traditional Markets vs Cryptocurrency Call Options

In Course 3 we will stick to call options in traditional markets, using examples where everything is denominated in US dollars. Then in Course 4, we will move on to cryptocurrency call options. This will allow you to first learn the basic mechanics of call options without the added complexity that cryptocurrencies and inverse contracts bring.

Preview: Bitcoin & Ethereum Call Options on Deribit

So, let’s begin in the next lecture with a simple example of how a company might use a call option.

Lecture 3.2: Simple Call Option Example

In this lecture we’ll look at how a company might use the purchase of a call option to make sure their business costs remain at an acceptable level.

The ABC Company Scenario

Suppose a company, let’s call them ABC, is building a facility for a new project. The new facility needs oil for one of its industrial processes, but the facility itself and the building that will be used to store the oil is not completed yet.

The profitability of the project will partially depend on how much they have to pay for the oil. The problem ABC has, is they are not ready to purchase the oil yet and won’t be until the 20th of June next year.

Current Situation:

- Current oil price: $40 a barrel

- Profitable threshold: Under $60 a barrel

- Project becomes unattractive: Above $60 a barrel

Creating a Call Option Agreement

What ABC would really love is a way to guarantee that they don’t have to pay more than $60 a barrel for the oil in June when they are ready to make the purchase. This could take the form of a legal agreement with another company that has oil to sell, let’s call this other company XYZ, that agrees to sell ABC the oil at no more than $55 per barrel on the 20th of June next year.

The Deal:

- XYZ agrees to sell oil at $55/barrel on June 20th

- ABC pays a $2/barrel premium (fee) to XYZ

- XYZ keeps this fee no matter what happens

This agreement between ABC and XYZ is essentially a call option.

Breaking Down the Option Parameters

In this example:

- Underlying asset: Oil

- Option type: Call option (right to buy)

- Expiry date: June 20th next year

- Strike price: $55 per barrel

- Option price: $2 per barrel

Learn More: The 5 Parameters of Options Contracts

Three Possible Scenarios

Scenario 1: Oil Price Decreases to $20/barrel

- Call option gives right to buy at $55

- Market price is $20, so buy from market instead

- Total cost: $20 + $2 premium = $22/barrel

- Result: Project profitable, option not exercised

Scenario 2: Oil Price Stays at $40/barrel

- Call option gives right to buy at $55

- Market price is $40, so buy from market instead

- Total cost: $40 + $2 premium = $42/barrel

- Result: Project profitable, option not exercised

Scenario 3: Oil Price Increases to $100/barrel

- Call option gives right to buy at $55

- Market price is $100, so exercise the option!

- Total cost: $55 + $2 premium = $57/barrel

- Result: Project still profitable, option saved the day!

Key Insight

Notice in Scenario 3 that if ABC had not purchased the $55 call option, the new price of oil of $100 would have made their whole project unprofitable. In scenarios 1 and 2, the call option was not needed in the end, but it only added a small $2 cost. In scenario 3 though, the call option was crucial to keeping the project profitable, saving them $43 per barrel!

This property of having a fixed cost but having the potential to pay off big, is what makes the buying of options so attractive in certain circumstances.

Real-World Application: Call Option Hedging Strategies

Lecture 3.3: Profit/Loss Calculations for Call Options

In this lecture we will work through examples of how to calculate the profit or loss of a call option position in dollars. For simplicity, we will ignore any trading fees initially.

Closing a Call Option Trade Early

When an option position is not held to expiry, but closed early, the profit and loss calculation is very simple:

Profit/Loss = Sell Price – Buy Price

This is true for both American and European options because we’re talking about closing a position by selling it to someone else, not about exercising the option.

Important: It is a common misconception that because European options cannot be exercised early, that European option traders are forced to hold their positions until expiry. This is not correct. On Deribit, all options are European, but you can still close positions anytime by reducing your position to zero.

Example 1: Closing Early

Let’s use the SLV silver ETF with a contract multiplier of 100.

Trade Details:

- Buy call option: Strike price $30, Premium $1.26

- A few days later: Option value rises to $5.00

- Close position by selling at $5.00

Profit Calculation (per share): $5.00 – $1.26 = $3.74 profit per share

Total Profit (100 shares): $3.74 × 100 = $374 profit

Alternative calculation:

- Bought for: $1.26 × 100 = $126

- Sold for: $5.00 × 100 = $500

- Profit: $500 – $126 = $374

Options Held to Expiry

At expiration, all extrinsic value from volatility and time is gone. We only need the strike price and delivery price at expiration.

Formula for calls with value at expiry:

(Price At Expiration - Strike Price - Premium Paid) × Contract Multiplier × Number Of Contracts

Example 2: Profit at Expiry

Given:

- Strike price: $30

- Premium paid: $1.26

- Price at expiration: $38

- Contract multiplier: 100

- Number of contracts: 1

Calculation: (38 – 30 – 1.26) × 100 × 1 = 6.74 × 100 = $674 profit

Example 3: Small Loss at Expiry

Given:

- Strike price: $30

- Premium paid: $1.26

- Price at expiration: $31

- Contract multiplier: 100

- Number of contracts: 1

Calculation: (31 – 30 – 1.26) × 100 × 1 = -0.26 × 100 = -$26 loss

Notice the price at expiration ($31) was above the strike price ($30), so the option had $1 of intrinsic value. However, since we paid $1.26 for the option, we still took a small loss.

Example 4: Maximum Loss

Given:

- Strike price: $30

- Premium paid: $1.26

- Price at expiration: $20 (below strike)

- Contract multiplier: 100

- Number of contracts: 1

Loss Calculation: Premium Paid × Contract Multiplier × Number Of Contracts 1.26 × 100 × 1 = $126 loss

Even though SLV dropped way below the strike price, the loss is limited to the premium paid. Even if SLV had dropped to zero, the loss would still only be $126. This fixed risk is one of the most attractive features of buying options.

Learn More: Risk Management with Call Options

Key Takeaways

- Buying a call option has fixed risk (maximum loss = premium paid)

- When closed early: Profit/Loss = Sell Price – Buy Price

- When held to expiry and in-the-money: Use the formula above

- The further above the strike price, the more profit you make

Lecture 3.4: Breakeven Points for Call Options

When a trader buys a call option, they hope the underlying price rises above their strike price. However, the strike price is not the breakeven point. The premium paid must be factored in.

Understanding Breakeven

In Example 3 from the previous lecture, we bought an SLV call option with a strike price of $30. It expired at $31 (above our strike), giving the option $1 of intrinsic value. However, we paid a $1.26 premium, resulting in a $0.26 loss.

Why? Because we needed SLV to reach $31.26 to break even, not just $30.

Breakeven Formula

Breakeven Point = Strike Price + Premium Paid

For our example: $30 + $1.26 = $31.26 breakeven

At this price point, the option expires with a value of $1.26, which exactly equals the premium paid. Income = Expense, therefore profit = $0.

Important: Use the per share premium, not the total premium paid.

More Examples

Example 1:

- Strike: $28, Premium: $1.62

- Breakeven: $28 + $1.62 = $29.62

Example 2:

- Strike: $23, Premium: $3.10

- Breakeven: $23 + $3.10 = $26.10

Buyer and Seller Share the Same Breakeven

The breakeven point for the seller of the call option is exactly the same as for the buyer. Both parties break even at the same underlying price (ignoring fees).

Quick Reference: Call Option Breakeven Calculator

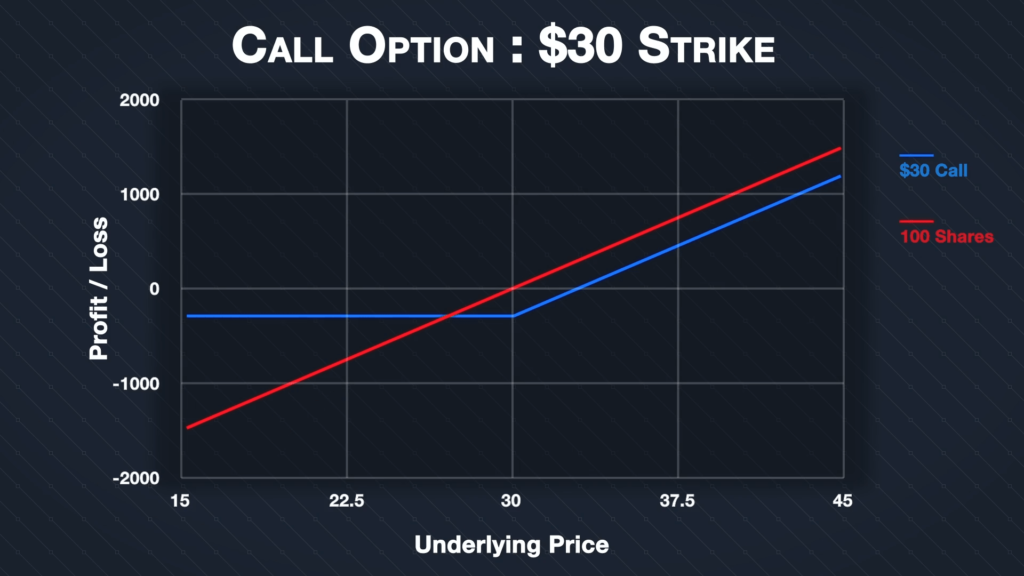

Lecture 3.5: Buying a Call vs Buying the Underlying

Buying a call option gives you the right to buy the underlying asset at the strike price on the expiry date. But why not just buy the underlying directly?

The two main reasons are:

- Fixed risk

- Considerably smaller initial outlay

Visual Comparison

Suppose a stock is trading at $30, with a call option (strike $30) priced at $3 per share.

Buying 100 Shares Directly:

- Cost: $3,000

- Profit potential: Unlimited to the upside

- Loss potential: Up to $3,000 if stock goes to zero

- Every $1 move = $100 profit or loss

Buying Call Option:

- Cost: $300 (100 shares × $3)

- Profit potential: Nearly unlimited (minus $300 premium)

- Loss potential: Limited to $300 premium

- Every $1 move above $30 = $100 profit (after premium)

The Crossover Point

These two positions have the same P/L at $27:

- Stock price of $30 – Premium of $3 = $27

Below $27: Call option is much better (limited loss) Above $27: Both profit, but shares profit slightly more

Lower Capital Requirement

To buy 100 shares at $30 each requires $3,000 (without leverage).

The call option only requires $300 – that’s 10 times less capital for similar upside exposure!

The Time Factor

The major disadvantage of call options is the inherent time limit. If price fails to increase before expiry, the option expires worthless and you must buy a new option (and pay a new premium) to regain exposure.

A stock holder can simply continue holding with no extra cost.

Time decay (Theta) is the rate at which options lose value over time. This is covered in detail in Section 8.

Strategy Guide: When to Choose Calls vs Spot

Summary

Buying the Underlying:

- Requires significant capital

- Potential for large losses

- No time limit

Buying Call Options:

- Requires less capital

- Fixed, limited risk

- Participates in upside moves

- Has expiration pressure

Call options are ideal for traders who want to limit risk while still participating in price increases, at the cost of paying a premium and having a time limit.

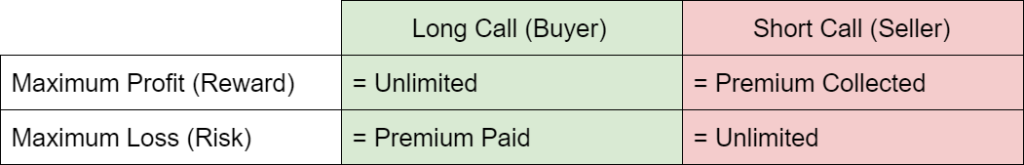

Lecture 3.6: Buying vs Selling Call Options

Every option trade has a buyer and a seller. Understanding both sides is crucial for success in options trading.

Zero-Sum Game

An option contract (excluding fees) is a zero-sum game:

- Buyer’s profit = Seller’s loss

- Buyer’s loss = Seller’s profit

P/L Chart Comparison

For a $30 strike call with $3 premium:

- Buyer’s P/L (blue line): Loss limited to $300, unlimited profit potential

- Seller’s P/L (red line): Profit limited to $300, unlimited loss potential

The charts are mirror images across the x-axis. Both share the same breakeven point.

Selling Call Options: Key Characteristics

Fixed Profit

- Maximum profit = Premium collected

- Achieved when price stays below strike at expiry

- In our example: $300 maximum profit

Unlimited Risk

- Losses are theoretically unlimited

- Can lose far more than premium collected

- Critical: You could lose everything in your account

Time is Your Friend

- Every day that passes, the option loses value

- If price stays flat or goes down, seller profits

- “If nothing happens, the seller is benefiting”

Margin Requirements

When Buying:

- Pay premium upfront

- Maximum loss = premium paid

- No additional capital needed

When Selling:

- Must maintain margin in account

- Broker requires funds to cover potential losses

- May face margin call if price moves significantly against you

- Position could be forcibly closed at a loss

Naked Options Warning

Selling a naked option means selling with no other position covering it – no hedge against the undefined risk.

Recommendation for beginners: Stick to buying options or use defined-risk strategies. Avoid selling naked options until you:

- Fully understand the risks

- Are comfortable with the margin system

- Have practiced on paper trading accounts

Advanced: Covered Call Strategy

Summary

Buying a Call:

- Bet that price will increase

- Limited risk, unlimited profit potential

- Pay premium upfront

- Time works against you

Selling a Call:

- Bet that price will NOT increase significantly

- Limited profit, unlimited risk

- Collect premium upfront

- Time works for you

- Requires margin management

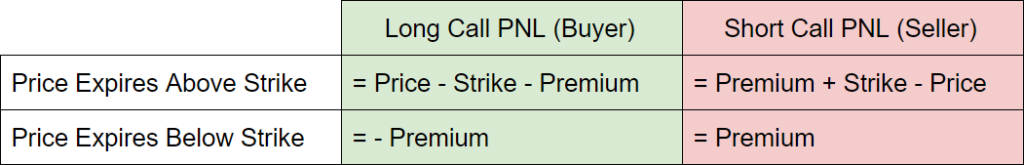

Lecture 3.7: Maximum Profit/Loss of Call Options

Understanding the maximum profit and loss of your position is essential before placing any trade.

Formulas for Call Option P/L

When call expires in-the-money:

Buyer’s P/L: = Price – Strike – Premium

Seller’s P/L: = Premium + Strike – Price

When call expires out-of-the-money:

Buyer’s P/L: = -Premium (maximum loss)

Seller’s P/L: = Premium (maximum profit)

Example Calculation

Given:

- Strike: $50

- Premium: $4

- Price at expiry: $70

Buyer’s P/L: = 70 – 50 – 4 = $16 profit

Seller’s P/L: = 4 + 50 – 70 = -$16 loss

Maximum Profit and Loss Table

| Position | Maximum Profit | Maximum Loss |

|---|---|---|

| Call Buyer | Unlimited/Undefined | Premium Paid (Fixed) |

| Call Seller | Premium Collected (Fixed) | Unlimited/Undefined |

Key Insights

For Call Buyers:

- Profit increases $1 for every $1 the underlying rises above strike

- Maximum loss occurs when price is below strike at expiry

- Risk is fixed and known before entering the trade

For Call Sellers:

- Profit is capped at premium collected

- Loss increases $1 for every $1 the underlying rises above strike

- Risk is unlimited – could exceed account balance

Critical Risk Management

Always be aware of:

- Whether your position has fixed or undefined risk

- Which direction you have risk in

- Your maximum potential loss

This becomes even more important when combining multiple options into spreads and strategies (covered in later sections).

Risk Tools: Position Risk Calculator

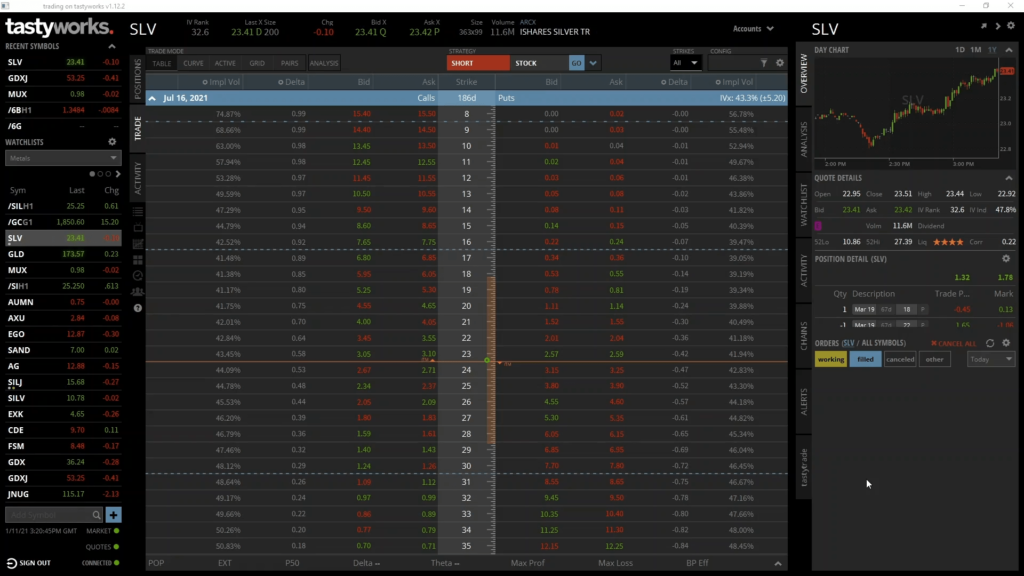

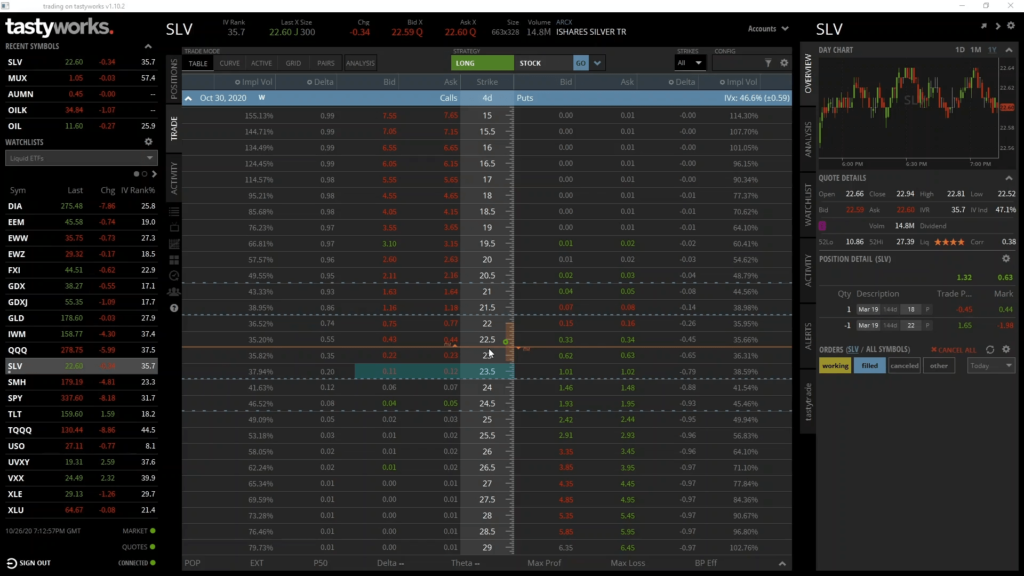

Lecture 3.8: Trade Example – Buying a Call Option (Long)

It’s time to put theory into practice with a real trade example. We’ll buy a call option on Tastyworks, analyze potential outcomes, let it expire, and review the results.

The Setup

Instrument: SLV (silver ETF)

- Tracks spot silver price closely

- Good liquidity

- Contract multiplier: 100

- Accessible for traders of all sizes

Current Market (Monday, October 26, 2020):

- SLV trading at $22.62

- Recent highs around $23.50

- Our view: Price will break through $23.50 this week

Our Trade:

- Buy call option

- Expiry: Friday, October 30th (4 days)

- Strike price: $23.50

- Premium: $0.12 per share ($12 total)

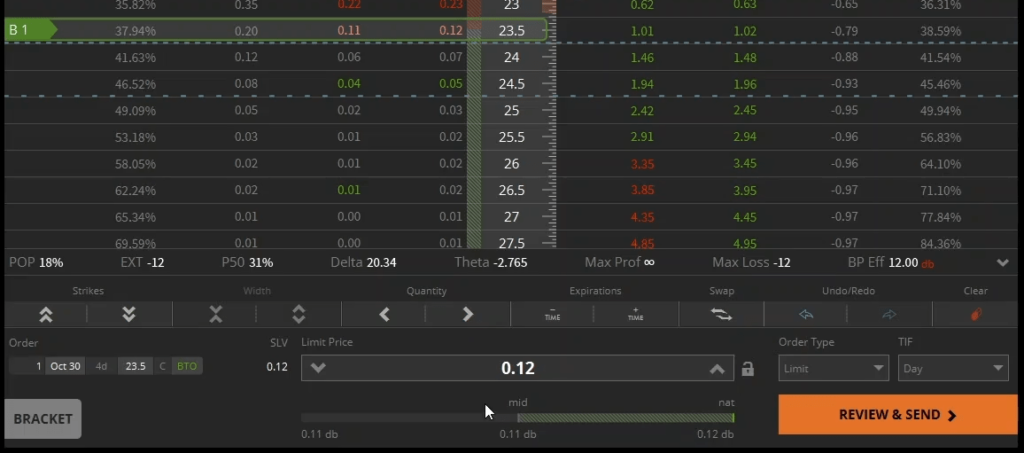

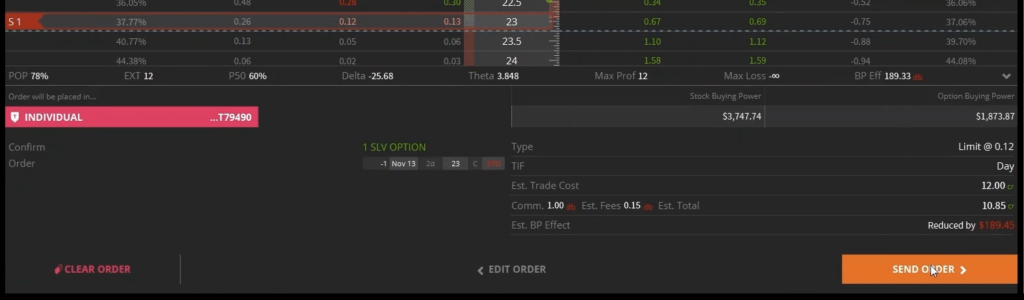

Placing the Trade

Option Chain Details:

- Strike prices in center column

- Calls on the left, puts on the right

- Bid: $0.11 (price to sell)

- Ask: $0.12 (price to buy)

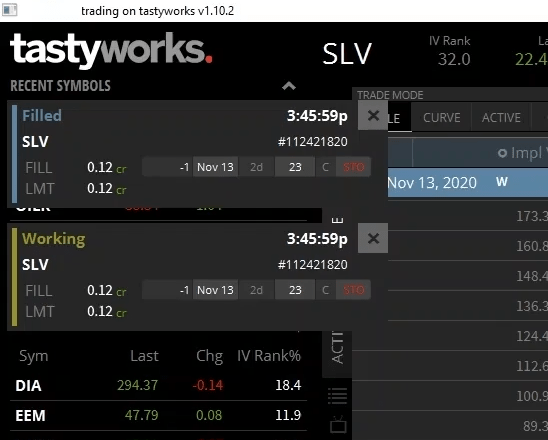

Order Execution:

- Click ask price ($0.12) to populate order form

- 1 contract, Oct 30 expiry, 4 days remaining

- Strike: $23.50, Type: Call (C)

- BTO (Buy To Open) in green

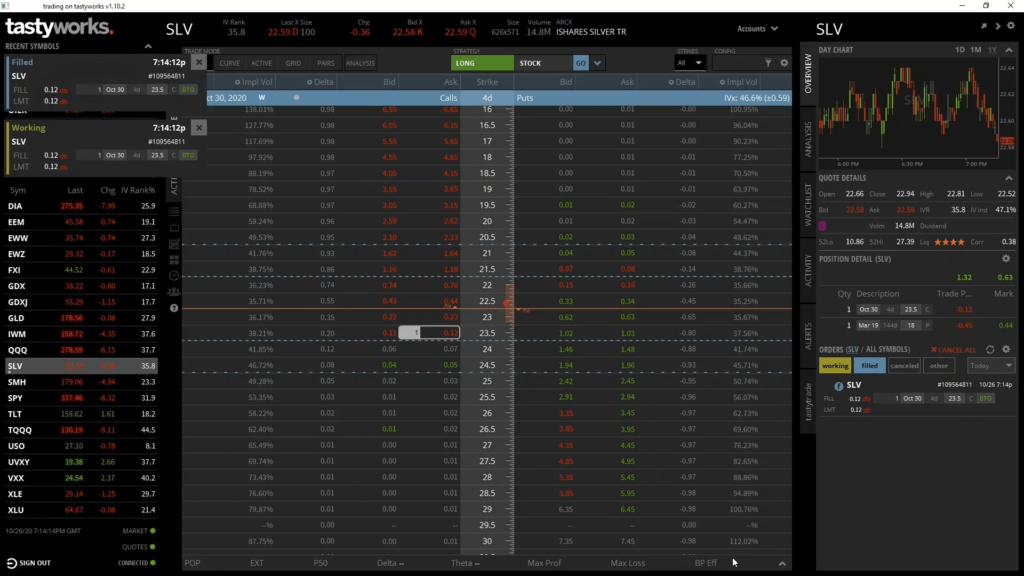

- Review & Send → Order filled immediately

Total Cost:

- Premium: $0.12 × 100 = $12.00

- Fees: $1.14

- Total: $13.14

Potential Outcomes Analysis

Maximum Loss:

- Limited to premium + fees = $13.14

- Occurs if SLV is below $23.50 at expiry

Breakeven Point:

- Strike + Premium + Fees per share

- $23.50 + $0.1314 = $23.6314

Profit Example (if SLV reaches $24.75):

- (24.75 – 23.50 – 0.1314) × 100 × 1

- = $1.1186 × 100

- = $111.86 profit

What Actually Happened

Price Action:

- Monday: Entry at $22.62

- Tuesday: Slight move up

- Wednesday: Gapped down hard

- Thursday-Friday: Small recovery

- Expiry price: $22.00

Result:

- Price below strike ($23.50)

- Option expired worthless

- Loss: $13.14 (maximum possible loss)

Comparison to Buying Stock

If we had bought 100 shares instead:

- Cost: $22.62 × 100 = $2,262

- End price: $22.00 × 100 = $2,200

- Loss: $62 (plus fees)

Call Option Advantage:

- Lost only $13.14 vs $62

- Required 80x less capital ($13.14 vs $1,131 with 2x leverage)

- Limited risk protected us from the larger loss

Key Lesson: Even in a losing trade, the call option’s fixed risk meant we lost significantly less money while tying up minimal capital.

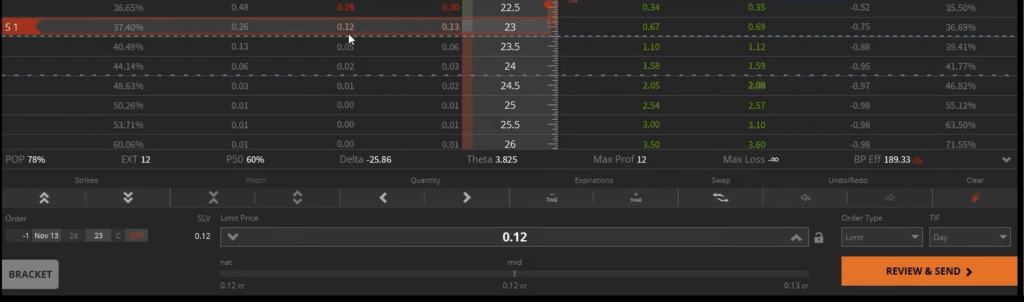

Lecture 3.9: Trade Example – Selling a Call Option (Short)

In this example, we’ll sell a call option and analyze the trade from the seller’s perspective.

The Setup

Instrument: SLV (silver ETF) again Current Market (Wednesday, November 11, 2020):

- SLV trading at $22.48

- Our view: Price will stall here, stay under $23

- Timeframe: 2 days until Friday

Our Trade:

- Sell call option

- Expiry: Friday, November 13th (2 days)

- Strike price: $23.00

- Premium: $0.12 per share

Placing the Sell Order

Option Chain:

- Bid: $0.12 (price we can sell for)

- Ask: $0.13

- We’re interested in the bid price since we’re selling

Order Details:

- Click bid price ($0.12)

- -1 contracts (negative = short position)

- Nov 13 expiry, 2d remaining

- Strike: $23, Type: Call (C)

- STO (Sell To Open) in red

Key Difference – Margin: When buying: capital needed = premium + fees When selling: much higher capital requirement due to margin

- Undefined loss potential requires holding extra funds

- Could face margin call if price moves against us

Total Credit:

- Premium: $0.12 × 100 = $12.00

- Fees: $1.15

- Net Credit: $10.85

Potential Outcomes Analysis

Maximum Profit:

- Limited to net credit = $10.85

- Achieved if SLV stays below $23 at expiry

Breakeven Point:

- $23.00 + $0.1085 = $23.1085

- Above this = loss

- Below this = profit

Loss Example (if SLV reaches $24.30):

- (0.1085 + 23 – 24.30) × 100 × 1

- = -1.1915 × 100

- = -$119.15 loss

Note: As the seller, our loss increases $1 for every $1 SLV rises above $23.

What Actually Happened

Price Action:

- Wednesday: Entry at $22.48

- Friday morning: Gapped up above $23 (briefly worried!)

- Friday close: Settled back to $22.91

Result:

- Price below strike ($23.00)

- Option expired worthless

- Profit: $10.85 (maximum possible profit)

Comparison to Selling Stock

If we had shorted 100 shares instead:

- Sold at: $22.48 × 100 = $2,248

- Buy back at: $22.91 × 100 = $2,291

- Loss: $43 (plus fees)

Call Option Advantage:

- Made $10.85 profit vs -$43 loss

- Price moved against us (increased), but we still won

- Time decay worked in our favor

Key Lesson: As a call seller, you profit when price stays below your strike, even if it moves up slightly. The short duration (2 days) and small price movement meant time decay outweighed the directional move.

Section 3 Summary: Call Options Mastery

Congratulations! You’ve completed Section 3 and now understand call options comprehensively.

What You’ve Learned

Lecture 3.1: Call option basics – rights, obligations, and parameters Lecture 3.2: Real-world hedging example with company ABC Lecture 3.3: Profit/loss calculations for closed and expired positions Lecture 3.4: Breakeven point calculations Lecture 3.5: Comparing calls to buying the underlying Lecture 3.6: Understanding both sides: buying vs selling Lecture 3.7: Maximum profit and loss analysis Lecture 3.8: Live buying example with real results Lecture 3.9: Live selling example with real results

Key Concepts to Remember

Buying Call Options:

- Fixed risk (premium paid)

- Unlimited profit potential

- Requires less capital

- Benefits from price increases

- Time decay works against you

- Ideal for limited-risk directional bets

Selling Call Options:

- Fixed profit (premium collected)

- Unlimited risk

- Requires margin

- Benefits from price staying below strike

- Time decay works for you

- Suitable for experienced traders only

Critical Formulas

Breakeven: Strike + Premium Paid

Buyer P/L (in-the-money): Price – Strike – Premium

Maximum Loss (buyer): Premium Paid

Maximum Profit (seller): Premium Collected

Next Steps

Immediate Actions:

- Review the two trade examples until comfortable with the process

- Practice calculating P/L and breakeven on paper

- Consider paper trading to build confidence

- Open your Deribit account to access crypto options

Coming Up:

- Section 4: Cryptocurrency call options on Deribit

- Section 5: Put options (bearish strategies)

- Section 6: Advanced multi-leg strategies

Additional Resources

Related Guides:

- Complete Options Trading Guide

- Call Options Strategies Library

- Risk Management Framework

- Covered Call Strategy

Trading Tools:

- Options Calculator

- P/L Visualizer

- Breakeven Calculator

- Greeks Dashboard

Frequently Asked Questions About Call Options

Q: What’s the maximum I can lose buying a call option? A: The maximum loss is limited to the premium you paid for the option, plus any trading fees. This is a fixed amount known before you enter the trade.

Q: Can I sell a call option before expiry? A: Yes! Both American and European style options can be sold before expiry to close your position. You’re not forced to hold until expiration.

Q: When should I buy a call option instead of buying the stock? A: Buy call options when you want limited, defined risk and don’t want to tie up large amounts of capital. Call options are ideal for speculative trades or when capital is limited.

Q: Is selling call options too risky for beginners? A: Selling naked call options has unlimited risk and requires margin management. Beginners should stick to buying options or use defined-risk strategies like covered calls or spreads.

Q: How do I choose the right strike price? A: Consider your outlook and risk tolerance. Lower strikes (ITM) have higher success probability but cost more. Higher strikes (OTM) cost less but need larger price moves to profit.

Q: What happens if I don’t close my position before expiry? A: If your call is in-the-money at expiry, it will be automatically exercised (or cash settled, depending on the contract type). If it’s out-of-the-money, it expires worthless.

Q: Can I trade call options on cryptocurrencies? A: Yes! Deribit offers Bitcoin and Ethereum call options. Learn how to trade crypto options.

Q: How much capital do I need to start trading call options? A: You can start with as little as $100-500. The SLV examples in our live trades only required $13-14 per position. Start small while learning.

Course Navigation

Previous Section: Section 2 – Laying the Foundations

Current Section: Section 3 – Call Options (Complete)

Next Section: Section 4 – Cryptocurrency Call Options

Continue your learning: Proceed to Section 4

Remember: Options trading involves risk. Never invest more than you can afford to lose. This educational content does not constitute financial advice. Always practice with paper trading before using real capital.

Ready to apply what you’ve learned? Start trading options on Deribit