Bitcoin News Today: Market Analysis & Price Targets for October 16, 2025

Market Summary: Bitcoin Price Today Signals Stabilization

Bitcoin’s live price stands at $111,282.71 as of October 16, 2025, down 1.47% in the past 24 hours with a daily trading volume of $69 billion Bitcoin Price|BTC Live Chart, Market Cap and News Today. Despite the recent volatility, crypto markets are showing early signs of stabilization following last week’s dramatic crash.

Key Market Metrics (October 16, 2025)

- Bitcoin Price: $111,282 (-1.47% / 24h)

- 7-Day Performance: -0.08%

- Market Cap: $2.24 trillion

- All-Time High: $126,210 (October 6, 2025)

- Distance from ATH: -11%

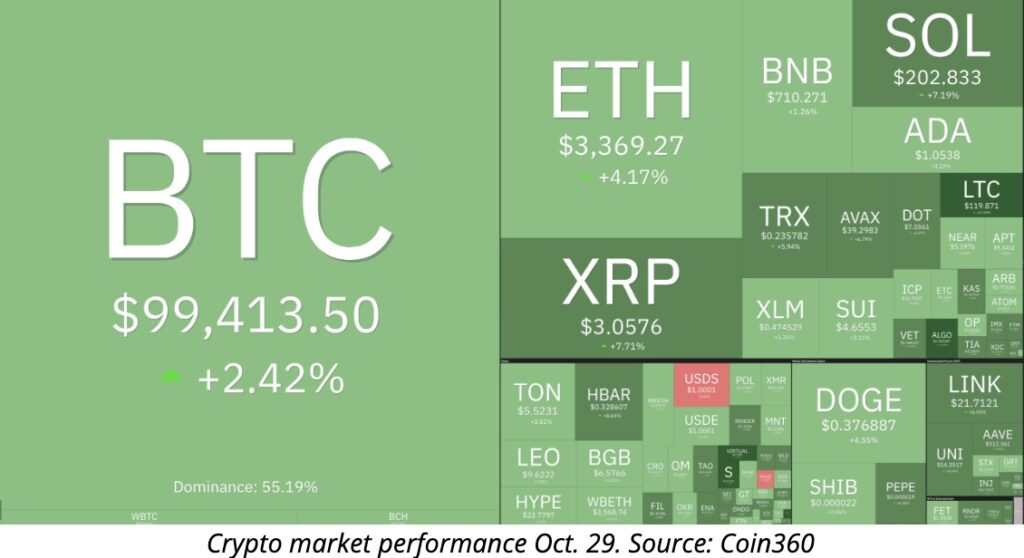

Crypto Market Drops Led By Major Coins

The cryptocurrency market experienced significant declines across major assets in the last 24 hours. Bitcoin fell 2.23%, Ethereum dropped 3.44%, XRP declined 3.8%, and Solana decreased 4.12% Bitcoin Price|BTC Live Chart, Market Cap and News Today, continuing the broader digital asset pullback following last week’s sharp liquidation event.

Major Cryptocurrency Performance

| Asset | 24h Change | Current Price |

|---|---|---|

| Bitcoin (BTC) | -2.23% | $111,282 |

| Ethereum (ETH) | -3.44% | $3,994 |

| XRP | -3.8% | $2.43 |

| Solana (SOL) | -4.12% | $196.89 |

Bearish Sentiment Persists For Bitcoin

Despite Federal Reserve Chair Powell signaling the end of quantitative tightening, BTC options markets continue to price in protection against further declines. Traders remain skeptical of an imminent bounce given heavy deleveraging and persistent macro pressures affecting risk assets.

What’s Driving the Bearish Mood?

- Ongoing Deleveraging: Last week’s $19 billion liquidation event continues to impact market psychology

- Macro Uncertainty: Trade tensions and US government shutdown concerns keep volatility elevated

- Technical Weakness: Bitcoin struggling to reclaim key resistance levels

Gold Hits Record High As Investors Seek Safety

While Bitcoin consolidates, gold has surged to unprecedented levels. Gold prices jumped above $4,200/oz, up 158% and marking a 14% monthly gain and 57% year-over-year increase. This flight to safety reflects US-China trade tensions and expectations for Federal Reserve rate cuts, with analysts predicting further gains toward $4,250 as the next resistance level.

XRP Finds Crucial Support Amid Volatility

After experiencing a brutal 45% collapse last week, XRP is showing signs of stabilization. XRP is currently holding at the $2.40-2.42 support level, with spot volumes rising 40%, pointing to institutional buying interest Bitcoin Price|BTC Live Chart, Market Cap and News Today. However, a break below this crucial support could trigger further decline toward $2.33.

Solana Volatility Outpaces Peers; Futures Volume Surges

Solana’s price action continues to demonstrate higher volatility compared to Bitcoin and Ethereum. While SOL dropped 4.12%, its futures volume jumped 57% on CME, significantly outpacing Bitcoin and Ethereum. This surge in futures activity signals heightened speculative interest, though short-term price action remains bearish.

Bitcoin Price Analysis: Key Levels to Watch

Critical Support Zones

- Primary Support: $110,000 – $111,000

- Secondary Support: $105,000

- Major Support: $100,000 psychological level

Resistance Levels

- Immediate Resistance: $115,500

- Key Resistance: $117,800 – $118,000

- Major Breakout Level: $120,500

If Bitcoin manages to sustain above $115,500 and reclaim the $117,800-$118,000 resistance band, the price could target $120,500 first and potentially $123,000 by mid-October Bitcoin Price Prediction 2025, 2026- 2030: Can BTC Rally to $130K?.

Bitcoin Target: Expert Price Predictions

Short-Term Outlook (October 2025)

Bitcoin is projected to reach $121,633 by the end of October 2025, representing a 6.64% increase from current levels Bitcoin Price Prediction , BTC Price Prediction , Price Prediction 2025 | Bitget. This recovery scenario depends on:

- Sustained support above $112,500

- Positive Federal Reserve policy signals

- Stabilization of geopolitical tensions

- Continued institutional ETF inflows

Medium-Term Targets (Q4 2025)

Bitcoin price prediction for December 2025 remains bullish, with BTC eyeing the $130,000-$135,000 zone amid strong ETF inflows and year-end optimism Bitcoin Price Prediction 2025, 2026- 2030: Can BTC Rally to $130K?.

Long-Term Vision (2025-2026)

A selection of 7 expert analysts unanimously predict Bitcoin prices around $200,000 by late 2025, citing strong fundamentals and institutional adoption Bitcoin (BTC) Price Prediction 2025 2026 2027 – 2030 – InvestingHaven.

Macro & Fed News Move Risk Assets

Powell’s recent dovish tone sent bond yields lower and stoked rate cut hopes, but the anticipated relief rally in crypto markets failed to materialize. Trade war rhetoric and the ongoing US government shutdown are keeping volatility elevated, preventing sustained risk-on positioning.

Federal Reserve Impact

The market awaits the Fed’s October 28-29 meeting for clarity on:

- Rate cut trajectory

- Quantitative tightening timeline

- Economic growth projections

- Inflation expectations

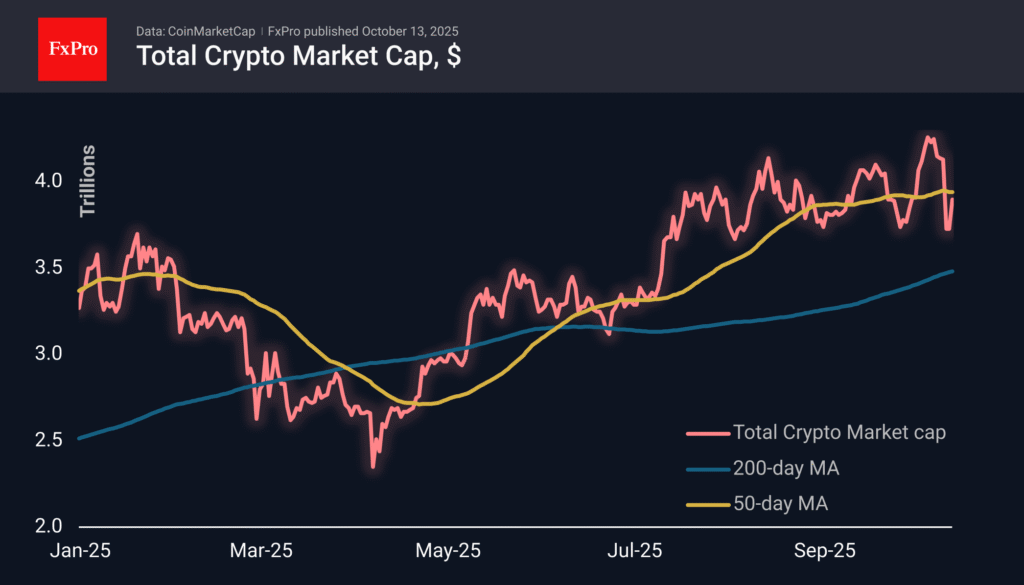

Crypto Volumes Slump But Open Interest Hits All-Time High

While trading activity cooled significantly, falling 17.5% in September to $8.12 trillion, open interest in crypto derivatives rose to a record high. This divergence indicates investors are positioning for large future moves, despite reduced day-to-day trading activity.

What This Means:

- Lower volumes suggest consolidation phase

- Record open interest shows conviction in directional bets

- Market preparing for significant volatility ahead

Equities Rise On Bank Earnings Despite Global Market Jitters

US stocks held firm on blockbuster banking sector results, with the S&P 500 remaining near key resistance levels. However, persistent trade uncertainty and skittish risk sentiment continue to weigh on broader market performance, indirectly affecting cryptocurrency valuations.

Where to Buy Bitcoin Today: Top Platforms

If you’re looking to capitalize on the current Bitcoin price dip, choosing a secure and reliable platform is essential:

Recommended Exchanges for October 2025

- Deribit – Advanced options and futures trading

- Binance – Highest liquidity and comprehensive features

- Coinbase – Best for beginners with intuitive interface

- OKX – Competitive fees with professional tools

- Bybit – Excellent derivatives platform

Safety Reminder: Always use two-factor authentication and consider hardware wallets for long-term holdings.

Bitcoin Analysis: Technical Indicators

Moving Average Analysis

Bitcoin’s current price of $112,164 shows a 1% increase from 24 hours ago but remains 9% down from the $122,910 level recorded one week ago Bitcoin Price, BTC Price, Live Charts, and Marketcap: bitcoin price, bitcoin price usd, bitcoin.

Key Technical Signals:

- 50-day MA: Bearish crossover

- 200-day MA: Providing long-term support

- RSI: Neutral zone (45-55)

- MACD: Showing bearish divergence

On-Chain Metrics

Declining exchange balances have reached their lowest levels since 2019, pointing to an intensifying supply crunch that could fuel the next leg higher Bitcoin Price Prediction 2025, 2026- 2030: Can BTC Rally to $130K?.

Bullish On-Chain Indicators:

- Exchange outflows accelerating

- Whale accumulation increasing

- Long-term holder supply growing

- Mining difficulty maintaining strength

Investment Strategy: Should You Buy Bitcoin Now?

Bull Case Arguments

- Historic Valuation: Trading 11% below all-time high presents attractive entry

- Institutional Support: ETF-driven inflows remain strong, with sustained accumulation patterns visible Bitcoin Price Prediction 2025, 2026- 2030: Can BTC Rally to $130K?

- Supply Dynamics: Fixed 21 million supply cap with increasing scarcity

- Technical Setup: Potential double-bottom formation at $110K-$112K range

Bear Case Considerations

- Macro Headwinds: Trade tensions and political uncertainty

- Technical Weakness: Failed breakout attempts above $120K

- Leverage Overhang: Market still recovering from $19B liquidation

- Competitive Pressure: Gold attracting safe-haven flows

Balanced Approach

For conservative investors:

- Dollar-cost averaging into positions

- Target allocation: 2-5% of portfolio

- Time horizon: Minimum 6-12 months

- Risk management: Use stop-losses below $105K

What’s Next for Bitcoin?

Upcoming Catalysts

October 28-29, 2025: Federal Reserve FOMC meeting

- Rate decision announcement

- Economic projections update

- Powell’s press conference

November 2025: Key technical breakout window

- Potential retest of $130K

- Alt season trigger levels

- Q4 institutional allocation period

Scenarios Analysis

Bullish Scenario (60% probability)

- Break above $118K triggers momentum

- Target $123K-$125K by month-end

- Year-end rally toward $135K-$150K

Neutral Scenario (30% probability)

- Consolidation between $108K-$118K

- Sideways action through October

- Breakout delayed to November

Bearish Scenario (10% probability)

- Break below $105K support

- Retest $95K-$100K zone

- Extended consolidation into Q1 2026

Expert Insights: Market Outlook

Bitcoin is entering its next bullish window between mid-October and early 2026, consistent with long-term cycle analysis, with improving market structure and investor sentiment supporting continued upside momentum Bitcoin (BTC) Price Prediction 2025 2026 2027 – 2030 – InvestingHaven.

Key Takeaways from Analysts

- Short-term volatility expected but long-term structure remains bullish

- Support above $112K critical for maintaining recovery trajectory

- $120K breakout level will determine momentum for remainder of 2025

- Institutional flows remain the primary driver of sustained uptrend

Risk Management for Today’s Market

Essential Trading Rules

- Never invest more than you can afford to lose

- Avoid excessive leverage during volatile periods

- Use stop-loss orders to protect capital

- Diversify across major cryptocurrencies

- Keep majority holdings in cold storage

Position Sizing Guidelines

- Aggressive traders: 5-10% portfolio allocation

- Moderate investors: 2-5% allocation

- Conservative approach: 1-2% allocation

Conclusion: Bitcoin Outlook for October 2025

Bitcoin’s current consolidation near $111,000 represents a critical juncture for the cryptocurrency market. While short-term bearish sentiment persists due to macro uncertainties and recent liquidation events, the long-term fundamental picture remains constructive.

With Bitcoin above its 200-day EMA and RSI reset, the setup favors stabilization over breakdown unless the $104K level gives way Bitcoin Price Prediction 2025, 2026- 2030: Can BTC Rally to $130K?. A sustained reclaim of the $112,500-$113,500 range would signal the resumption of the uptrend toward $120K and beyond.

For investors with conviction in Bitcoin’s long-term value proposition, the current price levels may present an attractive accumulation opportunity, particularly for those employing dollar-cost averaging strategies.

Take Action: Start Trading Bitcoin Today

Ready to position yourself for Bitcoin’s next move? Open your free Deribit account to access professional-grade trading tools with institutional security.

Related Articles

- Best Cryptocurrency Exchanges 2025: Complete Platform Guide

- Crypto Trading for Beginners: Master the Fundamentals

- Bitcoin Advantages: Why BTC Leads the Market

- Technical Analysis for Beginners: Essential Guide

Disclaimer: This article provides market analysis and educational information only. It does not constitute financial advice. Cryptocurrency investments carry substantial risk of loss. Always conduct thorough research and consult qualified financial advisors before making investment decisions.