Bit Trading: How to Trade Bitcoin & Crypto Safely in 2025

A complete beginner-to-pro guide to Bit Trading: what it is, how it works, the safest way to buy Bitcoin, core strategies, common mistakes to avoid, and the best exchanges to start—curated for a global audience.

Start Bit Trading on Trusted Exchanges

Choose a regulated, high-liquidity exchange to buy or trade BTC. Availability varies by region.

Affiliate disclosure: We may earn a commission at no extra cost to you.

What Is Bit Trading?

Bit Trading is a colloquial way to say Bitcoin trading—and by extension, trading digital assets. In practice, people use “bit trading” to refer to buying and selling Bitcoin (BTC) and sometimes other cryptocurrencies for profit, hedging, or portfolio diversification.

Core ways to trade:

- Spot trading: Buy and hold BTC directly; sell when price rises or rebalance your portfolio.

- Perpetuals/futures: Speculate long/short with leverage. Higher risk; requires strict risk controls.

- Options: Buy/sell calls and puts to express directional or volatility views.

- Copy trading & bots: Automate or mirror strategies. Useful for learning, but monitor risk.

- DCA (Dollar-Cost Averaging): Schedule recurring buys to reduce timing risk.

Important: Crypto markets are volatile. This guide is for education only and is not financial advice.

How to Buy Bitcoin (Quick Start)

- Pick a reputable exchange. See our list in Where to Trade. Availability and features vary by region.

- Create and verify your account (KYC). Verification thresholds differ by platform and country.

- Deposit funds. Use bank transfer, card, or peer-to-peer (P2P) rails where supported.

- Place your order. Market orders execute instantly; limit orders let you choose your price.

- Secure your BTC. Keep on-exchange with strong 2FA, address whitelisting, and withdrawal protections—or move to a self-custody wallet you control.

Where to Trade: Best Exchanges for Bit Trading

Below are popular platforms used by global traders. We prioritize liquidity, product range, and security features. Compare terms and fees on each platform’s website before you trade.

Binance

- Deep spot & derivatives liquidity, wide asset coverage.

- Multiple order types, basic/advanced UIs, recurring buys.

- Security tools: 2FA, device management, withdrawal whitelist.

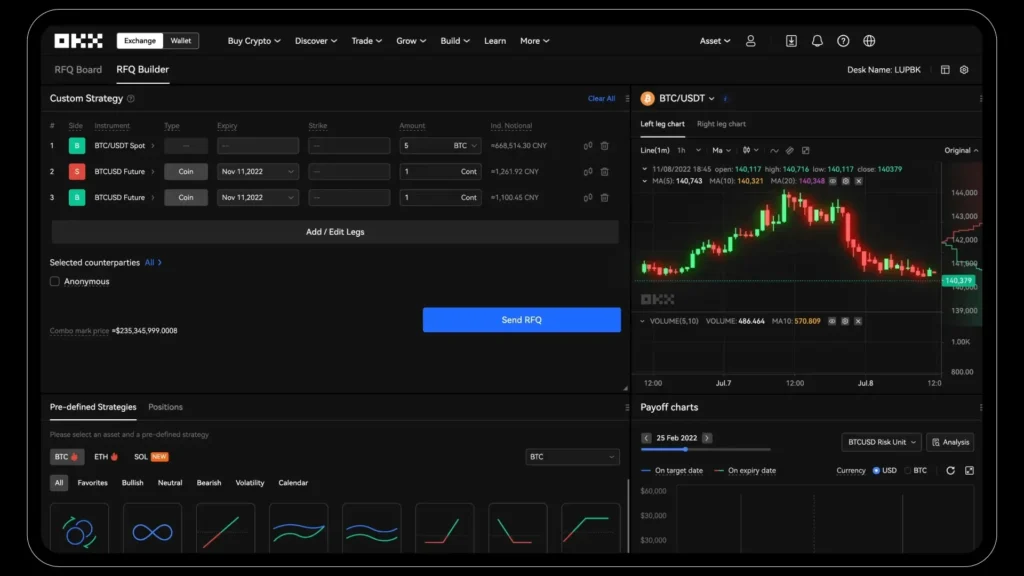

OKX

- Strong derivatives suite (perps, futures, options) + copy trading.

- Unified account margin modes, robust mobile app.

- Portfolio & risk tools for advanced users.

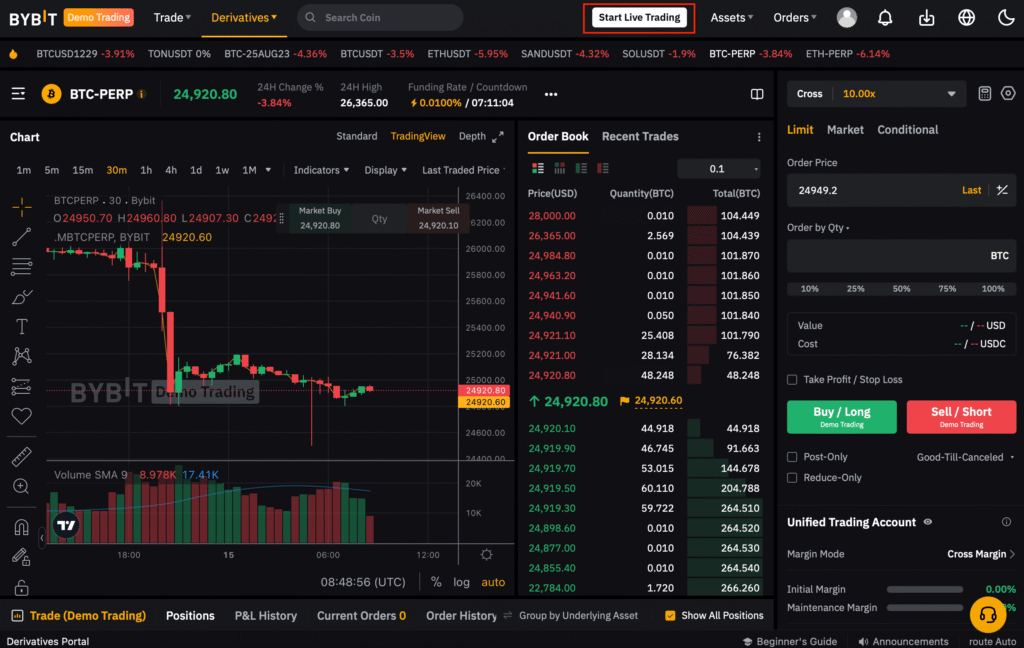

Bybit

- Perpetuals-focused with competitive liquidity.

- Grid & DCA bots; beginner-friendly spot interface.

- Good charting and order controls.

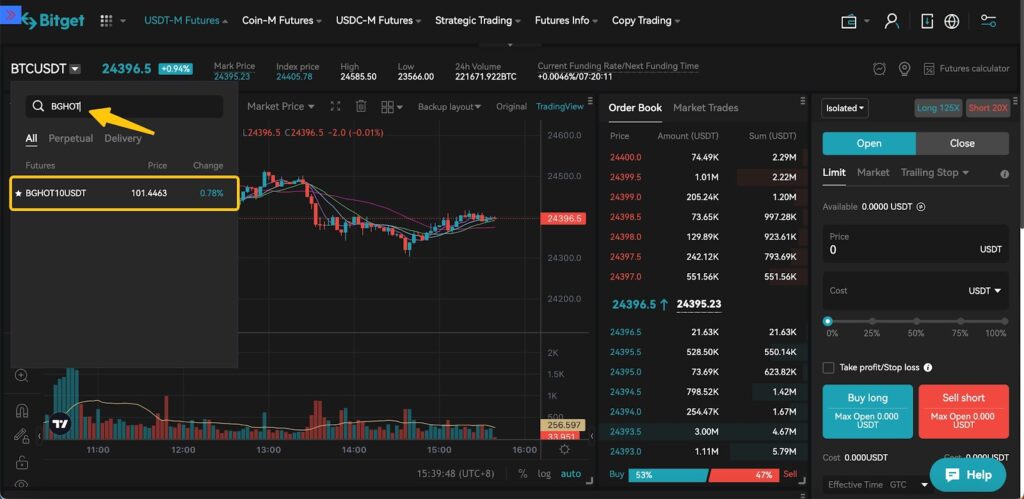

Bitget

- Popular for copy trading and bot automations.

- Spot & futures with risk features for newer users.

- Learning center for strategy basics.

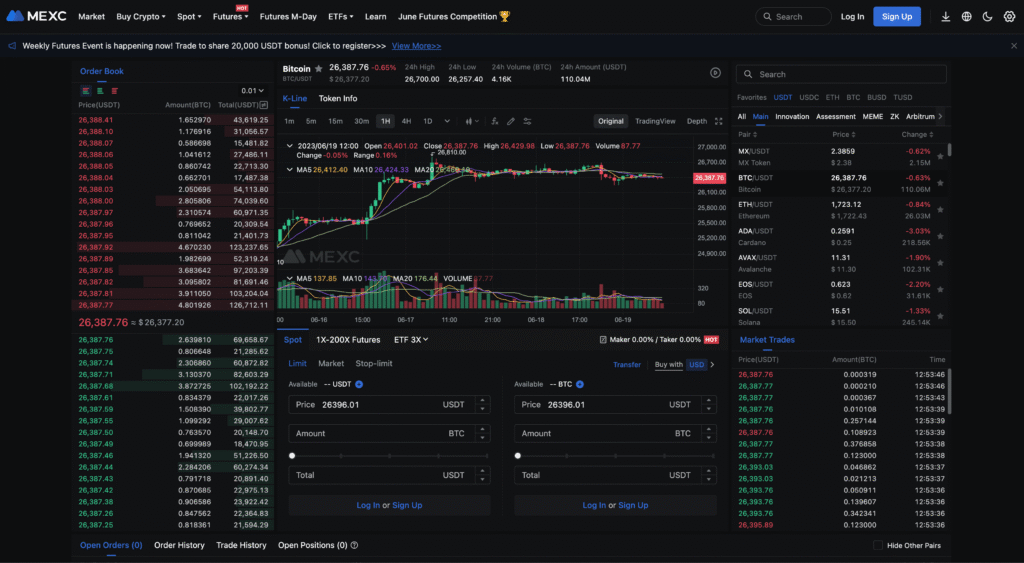

MEXC

- Wide coin selection; active derivatives markets.

- Recurring buys and bot strategies supported.

- Useful for altcoin discovery.

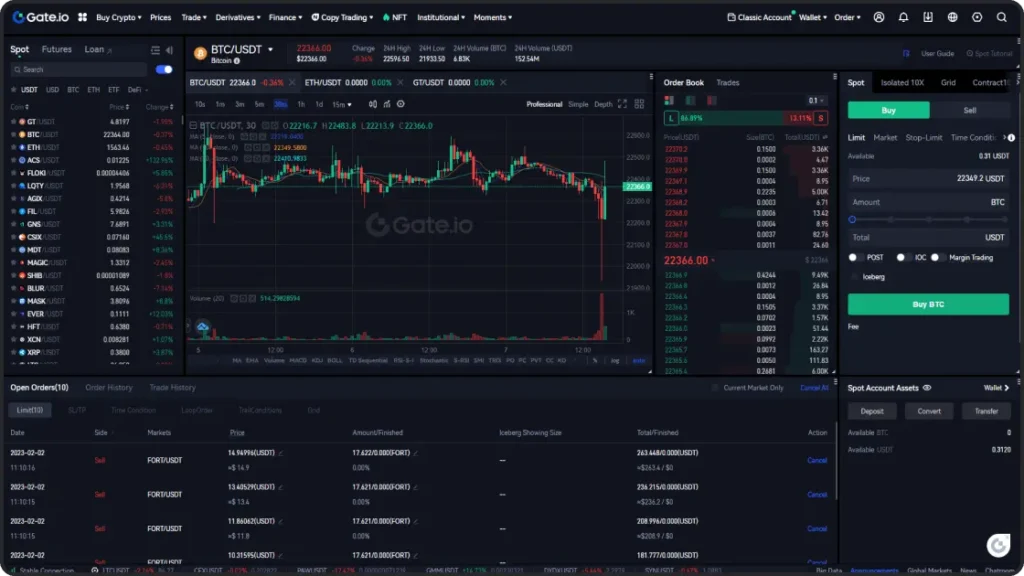

Gate.io

- Large spot market coverage with niche pairs.

- Variety of trading bots and portfolio tools.

- Flexible order types for active traders.

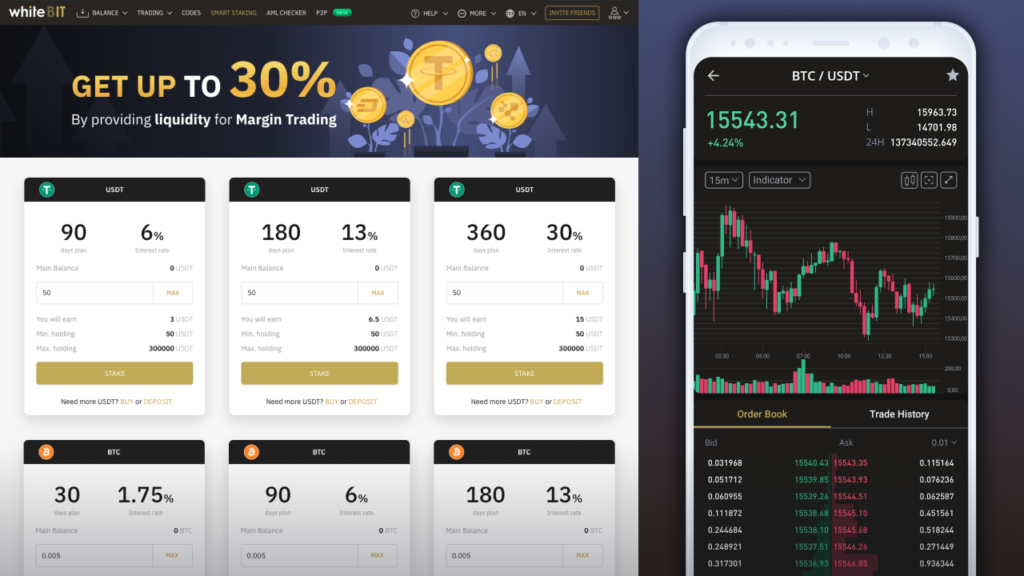

WhiteBIT

- Focus on compliance-first operations.

- Spot and margin products; straightforward UI.

- Security-first defaults for new users.

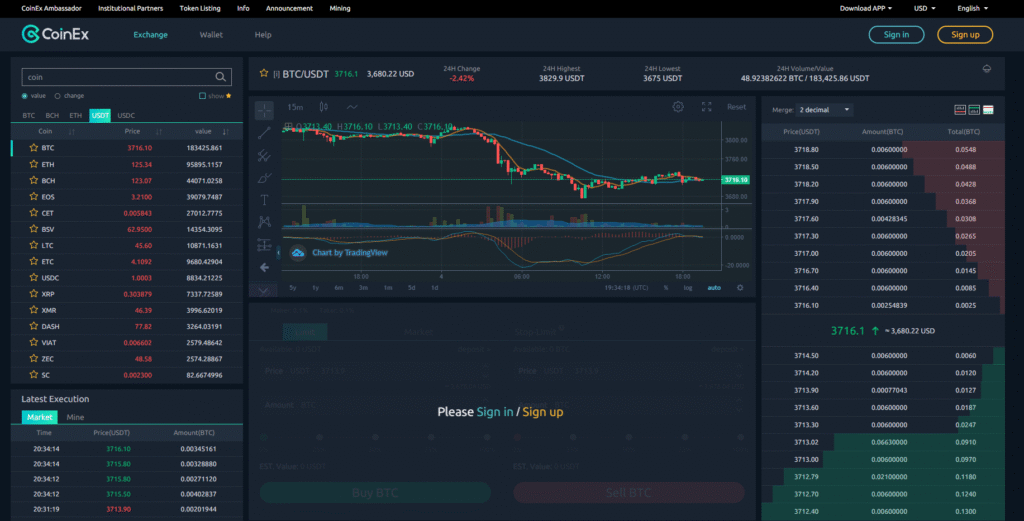

CoinEx

- Diverse spot pairs and derivatives.

- Simple trading layout suitable for beginners.

- Automation-friendly tools.

Bit Trading Strategies (Beginner → Advanced)

1) DCA (Dollar-Cost Averaging)

Set a fixed amount and buy BTC at regular intervals. It reduces timing risk and is psychologically easier to sustain.

2) Swing Trading

Trade multi-day or multi-week moves using trendlines, support/resistance, and indicators like RSI or moving averages.

3) Range Trading

Identify price ranges and buy near support, sell near resistance. Avoid overtrading in choppy markets.

4) Perpetuals/Futures (Advanced)

Trade with leverage for amplified gains/losses. Use isolated margin, stop-losses, and position sizing. Treat leverage as a tool, not a shortcut.

5) Options (Advanced)

Use calls and puts to express bullish/bearish or volatility views. Strategies like covered calls and protective puts can manage risk.

6) Copy Trading & Bots

Automate entry/exit rules. Backtest and monitor drawdowns; never “set and forget.”

Risk Management & Security for Bit Trading

- Risk per trade: Many experienced traders risk a small portion of capital per idea (e.g., 0.5%–2%). Adjust to your tolerance.

- Stop-loss & take-profit: Predefine exits; avoid emotional decisions.

- Diversification: Avoid concentration in a single asset or strategy.

- Security basics: Enable 2FA, device confirmation, address whitelisting, and withdrawal restrictions.

- Custody choice: On-exchange with strict security vs. self-custody (hardware/software wallets). Self-custody requires managing seed phrases securely.

- Phishing protection: Bookmark official domains; verify emails and URLs; beware of unsolicited “support.”

Taxes & Compliance

Tax treatment of crypto varies widely by jurisdiction. Keep accurate records of trades, deposits/withdrawals, and costs. Consult a licensed professional in your country before filing.

Common Bit Trading Mistakes to Avoid

- Overusing leverage without a defined risk plan.

- Chasing pumps or overtrading during high volatility.

- Leaving large balances on-exchange without security controls.

- Ignoring fees, slippage, and liquidity when sizing positions.

- No written trading plan or journal.

Tools & Resources

- Charting: Built-in exchange charts + advanced platforms.

- Screeners: Filter coins by volume, volatility, or trend strength.

- Portfolio trackers: Consolidate holdings; export tax-ready reports.

- Education hubs: Exchange academies, trading glossaries, risk tutorials.

FAQ

Is “Bit Trading” the same as Bitcoin trading?

Yes—people often use “bit trading” to mean trading Bitcoin. Many extend it to broader crypto trading.

Do I need KYC to trade?

Most centralized exchanges require identity verification for deposits, withdrawals, or higher limits. Rules vary by region.

How much money should I start with?

Only what you can afford to risk. Start small, learn mechanics, and scale gradually.

Can I use leverage as a beginner?

It’s not recommended. Learn spot first; practice risk management before considering leveraged products.

What’s the safest way to hold BTC?

Strengthen exchange account security or use reputable self-custody. Never share seed phrases; store backups offline.

HowTo: Buy Bitcoin on an Exchange

- Choose an exchange

- Create an account and complete KYC

- Deposit fiat or stablecoins

- Place a market or limit order for BTC

- Secure your BTC (2FA / self-custody)

Note: Features and payment rails differ by country. Availability varies by region.

Image Suggestions

- Featured Image: “A clean, minimalist candlestick chart of BTC/USD with subtle grid, modern fintech style, depth of field, 16:9”.

- In-article: “Step-by-step flow showing account → KYC → deposit → buy BTC → secure wallet, flat UI icons, white background”.

- Security Visual: “Hardware wallet on desk with 2FA phone lock screen, high-key lighting”.