Best Crypto Exchange 2025: The Complete Guide

Table of Contents

- 2025 Best Crypto Exchange Rankings

- What Is a Crypto Exchange and How Does It Work?

- Types of Crypto Exchanges: Centralized vs Decentralized

- Top 7 Best Crypto Exchanges 2025: Detailed Comparison

- Essential Trading Features on Modern Exchanges

- Exchange Fees Comparison: Finding the Lowest Costs

- Security and Regulation: Protecting Your Investments

- Common Risks and How to Avoid Them

- Latest Regulatory Updates: CFTC 2025 Changes

- Future Trends in Cryptocurrency Exchanges

- How to Choose the Best Exchange for You

- Frequently Asked Questions

The best crypto exchange is a digital platform that enables users to buy, sell, and trade cryptocurrencies for other digital assets or traditional fiat currencies. With over 600 active exchanges globally processing $2.3 trillion in annual trading volume, choosing the right platform has become crucial for both beginner and experienced crypto investors.

In 2025, the cryptocurrency exchange landscape has been revolutionized by recent CFTC regulatory clarity, allowing US traders access to previously restricted international platforms like Binance. Daily trading volumes now exceed $150 billion, with major exchanges like Coinbase, Binance, and Bybit offering increasingly sophisticated tools that bridge traditional finance with the decentralized digital asset ecosystem.

This comprehensive guide analyzes the best crypto exchanges of 2025, comparing security measures, fee structures, available features, and earning potential through affiliate programs. You’ll discover which platforms offer the lowest trading costs, strongest security protocols, and most profitable crypto affiliate opportunities for building additional income streams.

Whether you’re making your first cryptocurrency investment or optimizing your trading strategy, this expert analysis provides the insights necessary to select the best crypto exchange that aligns with your goals, risk tolerance, and geographic requirements in today’s rapidly evolving regulatory environment.

2025 Best Crypto Exchange Rankings {#best-crypto-exchange-2025}

Based on extensive testing, regulatory compliance analysis, and user experience evaluation, here are the best crypto exchanges for 2025:

🥇 #1 Best Overall: Binance

- Overall Score: 9.2/10

- Best For: Comprehensive trading ecosystem, lowest fees, highest liquidity

- Key Strength: 600+ trading pairs, 0.1% fees, $76B monthly volume

- Regulatory Status: CFTC clarity allows US access through FBOT registration

🥈 #2 Best for Beginners: Coinbase

- Overall Score: 8.8/10

- Best For: User-friendly interface, regulatory compliance, institutional trust

- Key Strength: Public company (NASDAQ: COIN), comprehensive insurance

- Trading Volume: $45B monthly, 100+ million verified users

🥉 #3 Best for Derivatives: Bybit

- Overall Score: 8.6/10

- Best For: Advanced derivatives trading, institutional-grade infrastructure

- Key Strength: 100x leverage, 100,000 TPS engine, copy trading

- Affiliate Program: Up to 60% commission sharing

🏆 #4 Best for Security: Kraken

- Overall Score: 8.4/10

- Best For: Never been hacked, transparent operations, proof-of-reserves

- Key Strength: 13+ years operation, comprehensive regulatory licenses

- Trading Options: 200+ assets, advanced order types, staking services

🔥 #5 Best Value: Crypto.com

- Overall Score: 8.2/10

- Best For: Competitive fees, comprehensive ecosystem, Visa card integration

- Key Strength: 300+ cryptocurrencies, cashback rewards, global accessibility

- Features: NFT marketplace, staking, DeFi integration

💎 #6 Rising Star: OKX

- Overall Score: 8.0/10

- Best For: Innovation, Web3 integration, competitive trading fees

- Key Strength: 400+ trading pairs, layer-2 integration, DEX features

- Volume: $32B monthly trading volume

🛡️ #7 Most Trusted: Gemini

- Overall Score: 7.8/10

- Best For: US regulatory compliance, institutional custody, security

- Key Strength: Winklevoss-founded, SOC 2 certified, FDIC-insured USD

- Focus: Security-first approach, educational resources

This comprehensive guide covers everything you need to know about crypto exchanges: their fundamental operations, types, security measures, fee structures, and how to choose the right platform for your trading needs. You’ll discover the key differences between centralized and decentralized exchanges, understand trading features like spot and futures trading, learn essential security practices, and explore how to potentially earn through crypto affiliate programs.

Whether you’re a beginner taking your first steps into cryptocurrency trading or an experienced investor seeking to optimize your exchange selection, this guide provides the knowledge and insights necessary to navigate the complex world of crypto exchanges safely and profitably.

What Is a Crypto Exchange and How Does It Work? {#what-is-crypto-exchange}

A crypto exchange is a digital marketplace that facilitates the buying, selling, and trading of cryptocurrencies using order matching algorithms and liquidity pools. These platforms operate 24/7, connecting buyers and sellers worldwide through sophisticated matching engines that execute trades in milliseconds.

Crypto exchanges function by maintaining order books that display current buy and sell orders for various cryptocurrency pairs. When a user places a market order, the exchange’s matching engine automatically pairs it with the best available opposing order, executing the trade at the current market price. The exchange earns revenue through trading fees, typically ranging from 0.1% to 1% per transaction, with additional income from listing fees, withdrawal fees, and premium services.

The operational infrastructure includes:

- Cold storage wallets for security (storing 90-95% of user funds offline)

- Hot wallets for immediate liquidity and trading operations

- Know Your Customer (KYC) verification systems for regulatory compliance

- Anti-Money Laundering (AML) compliance protocols

- Advanced trading engines processing 10,000 to 50,000 transactions per second during peak periods

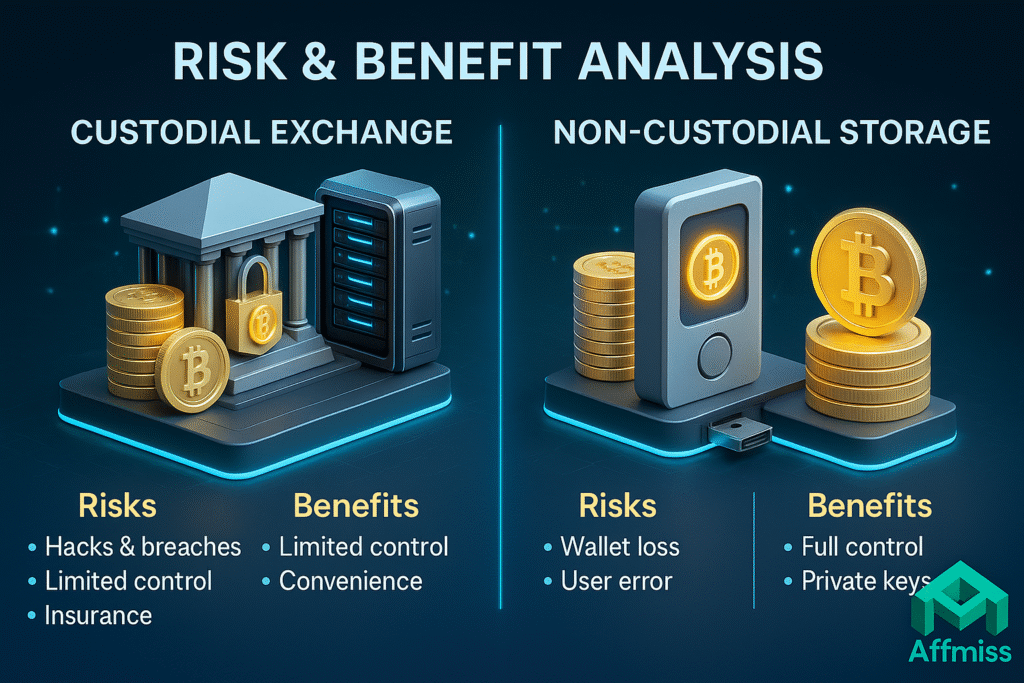

Exchange vs Wallet: Understanding the Key Differences

The distinction between cryptocurrency exchanges and wallets represents a fundamental concept every crypto user must understand. An exchange is a trading platform where you buy, sell, and trade cryptocurrencies, while a wallet is a storage solution for holding your digital assets securely.

Exchanges maintain custody of your cryptocurrencies during trading, storing them in their own wallets for quick transaction processing. This custodial model enables instant trades, margin trading, and advanced order types but requires trust in the exchange’s security measures and financial stability.

Personal wallets give you complete control over your private keys and cryptocurrency holdings, following the principle “not your keys, not your crypto.” Hardware wallets like Ledger and Trezor provide maximum security for long-term storage, while software wallets offer convenience for regular transactions.

The main differences include:

- Custody control: Exchanges hold your keys vs. personal wallet ownership

- Functionality: Trading platform vs. storage solution

- Security responsibility: Shared with exchange vs. individual responsibility

- Access speed: Instant trading vs. transfer time for external wallets

Role of Exchanges in the Cryptocurrency Ecosystem

Cryptocurrency exchanges serve as the critical infrastructure connecting traditional financial systems with the decentralized digital asset ecosystem. They provide price discovery mechanisms, market liquidity, and standardized trading interfaces that have enabled mainstream cryptocurrency adoption.

Beyond basic trading functionality, modern exchanges offer comprehensive financial services including staking rewards, lending programs, savings accounts, derivatives trading, and even crypto affiliate opportunities for users to earn additional income through referrals.

These platforms also facilitate the transition from traditional finance to decentralized finance (DeFi) by providing fiat onramps, regulatory compliance frameworks, and user-friendly interfaces that abstract away the technical complexity of blockchain interactions.

Types of Crypto Exchanges: Centralized vs Decentralized {#types-crypto-exchanges}

Centralized Exchanges (CEX): Traditional Trading Platforms

Centralized exchanges are platforms operated by companies that maintain full control over user funds, trading operations, and platform governance. These exchanges hold customer cryptocurrencies in corporate-controlled wallets and facilitate trades through internal order books and matching engines.

Market Leaders and Statistics:

- Binance: $76 billion monthly volume, 120+ million users

- Coinbase: $45 billion monthly volume, 100+ million users

- Bybit: $38 billion monthly volume, 15+ million users

- OKX: $32 billion monthly volume, supporting 300+ cryptocurrencies

- Kraken: $28 billion monthly volume, regulated in multiple jurisdictions

Advantages of Centralized Exchanges:

- High liquidity and tight bid-ask spreads (typically <0.1% for major pairs)

- Advanced trading features: margin trading, futures, options, copy trading

- Fiat currency integration with bank transfers and credit card support

- Professional customer support and dispute resolution

- Insurance coverage for digital assets (up to $250,000 on some platforms)

- User-friendly interfaces suitable for beginners

Disadvantages:

- Custodial risk: users don’t control private keys

- Single points of failure susceptible to hacks or technical issues

- Regulatory restrictions and potential account freezing

- Higher fees compared to decentralized alternatives

- Required KYC/AML verification limiting privacy

Decentralized Exchanges (DEX): Peer-to-Peer Trading Networks

Decentralized exchanges operate on blockchain networks without central authorities, allowing users to trade directly from their personal wallets through smart contracts. DEX platforms like Uniswap, SushiSwap, and PancakeSwap have processed over $1.2 trillion in total trading volume since their launch.

How DEX Platforms Work: These platforms use Automated Market Maker (AMM) protocols instead of traditional order books, determining prices through mathematical formulas based on token supply ratios in liquidity pools. Users retain complete control of their private keys and funds throughout the entire trading process.

Popular DEX Platforms:

- Uniswap: Ethereum-based, $400+ billion total volume

- PancakeSwap: BSC-based, lower fees, yield farming

- SushiSwap: Multi-chain support, community governance

- 1inch: DEX aggregator, optimal price routing

- Curve Finance: Stablecoin trading specialization

DEX Advantages:

- No custodial risk: users maintain control of private keys

- Censorship resistance and global accessibility

- No KYC requirements for basic trading

- Transparency through open-source smart contracts

- Lower counterparty risk and elimination of exit scams

DEX Limitations:

- Higher transaction fees during network congestion ($5-50+ per trade)

- Limited trading pairs and lower liquidity for altcoins

- Technical complexity requiring wallet management knowledge

- No customer support for lost transactions or user errors

- Impermanent loss risks for liquidity providers

Hybrid Exchanges: Combining Centralized and Decentralized Benefits

Hybrid exchanges integrate features from both centralized and decentralized models, offering centralized user interfaces with decentralized fund custody. These platforms provide traditional exchange functionality while maintaining user control over private keys and cryptocurrency holdings.

Examples include Nash Exchange, IDEX, and Binance DEX, which attempt to capture the best of both worlds: CEX usability with DEX security. However, adoption remains limited as these platforms often inherit complexity from both models without fully solving the fundamental trade-offs.

Top 7 Best Crypto Exchanges 2025: Detailed Comparison {#top-crypto-exchanges-2025}

🥇 Binance: The Best Overall Crypto Exchange

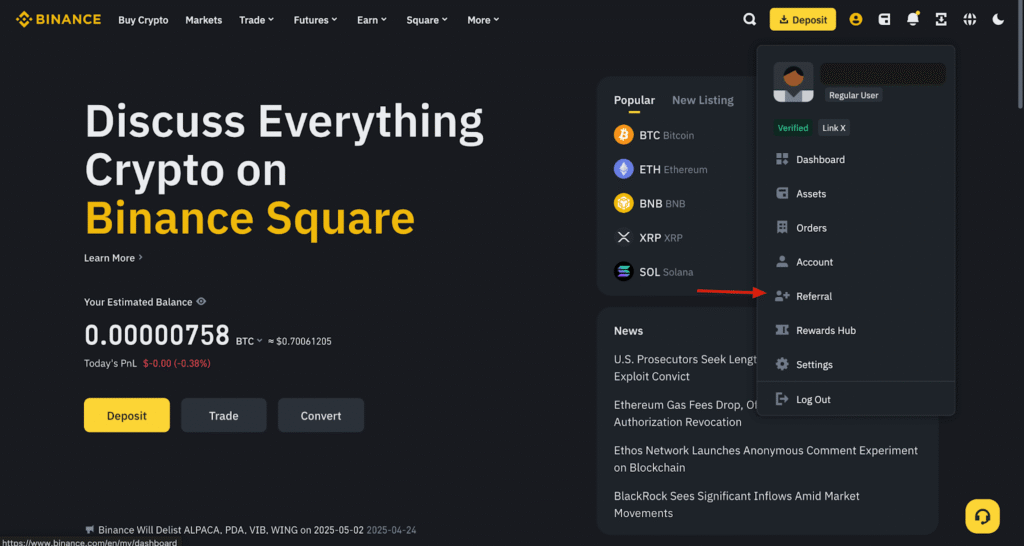

Binance dominates as the world’s largest cryptocurrency exchange with over 120 million registered users and $76 billion in monthly trading volume. Recent CFTC regulatory clarity has reopened US market access, making Binance the top choice for comprehensive cryptocurrency trading in 2025.

Why Binance is the Best Crypto Exchange:

- Lowest Trading Fees: 0.1% maker/taker, reduced to 0.075% with BNB

- Highest Liquidity: $10-15 billion daily volume across 600+ pairs

- Most Comprehensive Features: Spot, futures, options, copy trading, staking

- Best Affiliate Program: Up to 50% commission + volume bonuses

- Global Accessibility: 180+ countries with local currency support

Binance Key Statistics 2025:

- Monthly Volume: $76 billion (highest globally)

- Trading Pairs: 600+ (most comprehensive selection)

- Leverage: Up to 125x for futures trading

- Security: $1B SAFU fund, 95% cold storage

- Mobile App: 50+ million downloads, 4.5-star rating

Binance Affiliate Earning Potential: The Binance affiliate program offers the industry’s most lucrative commission structure with up to 50% revenue sharing. Top affiliates earn $50,000+ monthly through referral trading fees, making it ideal for content creators and crypto educators.

Key Statistics:

- 600+ trading pairs across spot, futures, and options markets

- Trading fees: 0.1% maker/taker, reduced to 0.075% with BNB

- Daily volume: $10-15 billion during typical market conditions

- Supported countries: 180+ jurisdictions with varying service levels

- Mobile app: 50+ million downloads across iOS and Android

Trading Features:

- Advanced spot trading with 200+ cryptocurrency pairs

- Futures trading with up to 125x leverage on major cryptocurrencies

- Options trading for sophisticated risk management strategies

- Copy trading functionality following successful traders

- Binance Smart Chain integration for DeFi access

- NFT marketplace and launchpad for new token sales

Revenue Opportunities: Binance offers one of the industry’s most lucrative affiliate programs, providing up to 50% commission sharing on trading fees plus additional bonuses for high-volume referrals. The program includes real-time tracking, multiple promotional materials, and dedicated account management for top affiliates.

Security Measures:

- Secure Asset Fund for Users (SAFU) with $1 billion insurance

- Two-factor authentication and device whitelisting

- Advanced risk management and anti-phishing systems

- Cold storage for 95% of user funds with multi-signature wallets

Coinbase: The Leading Regulated Exchange in the United States

🥈 Coinbase: Best Crypto Exchange for Beginners

Coinbase ranks as the best crypto exchange for newcomers with its user-friendly interface, comprehensive educational resources, and unmatched regulatory compliance. As a publicly-traded company (NASDAQ: COIN), Coinbase provides institutional-grade security that has attracted over 100 million verified users worldwide.

Why Coinbase Excels for Beginners:

- Intuitive Design: Simplified interface with clear buy/sell buttons

- Educational Hub: Coinbase Learn offers free crypto courses with rewards

- Regulatory Trust: First crypto exchange to go public, full US compliance

- Insurance Protection: FDIC-insured USD deposits, comprehensive crypto insurance

- Mobile Excellence: Top-rated apps for iOS and Android

Coinbase Platform Options:

- Coinbase: Beginner-friendly with higher fees (0.5-4.5%)

- Coinbase Advanced: Lower fees (0.5%) with professional tools

- Coinbase Prime: Institutional services for large organizations

- Coinbase Wallet: Non-custodial wallet supporting DeFi protocols

Coinbase vs Competitors: While Coinbase charges higher fees than Binance, its regulatory compliance, educational resources, and beginner-focused features make it the best crypto exchange for new investors prioritizing security and simplicity over cost optimization.

🥉 Bybit: Best Crypto Exchange for Derivatives Trading

Bybit specializes as the best crypto exchange for advanced derivatives trading with institutional-grade infrastructure processing 100,000 transactions per second. The platform’s focus on futures, perpetuals, and options has attracted over 15 million users seeking professional trading capabilities.

Bybit Advanced Features:

- Ultra-Fast Execution: 100,000 TPS with <5ms latency

- High Leverage: Up to 100x for major cryptocurrency pairs

- Copy Trading: Follow successful traders automatically

- Unified Accounts: Cross-margin and isolated margin modes

- API Integration: Professional algorithmic trading support

Bybit Affiliate Advantages: The Bybit affiliate program offers up to 60% commission sharing with additional performance bonuses, making it highly attractive for trading educators and derivative specialists.

Platform Overview:

- Coinbase: Simplified interface for beginners with higher fees

- Coinbase Pro: Advanced trading platform with professional tools

- Coinbase Prime: Institutional services for large organizations

- Coinbase Wallet: Non-custodial wallet supporting DeFi protocols

Supported Assets: Over 200 cryptocurrencies including Bitcoin, Ethereum, and emerging altcoins. Coinbase maintains strict listing standards, often resulting in price premiums when new tokens are added to the platform.

Fee Structure:

- Coinbase: 0.5% to 4.5% depending on payment method and transaction size

- Coinbase Pro: 0.5% maker/taker fees with volume-based discounts

- Institutional: Custom pricing for high-volume traders

Regulatory Compliance: Coinbase maintains comprehensive insurance coverage for digital assets, follows SOC 2 Type 2 certification standards, and conducts regular third-party security audits. The platform’s regulatory approach has enabled partnerships with major financial institutions and government agencies.

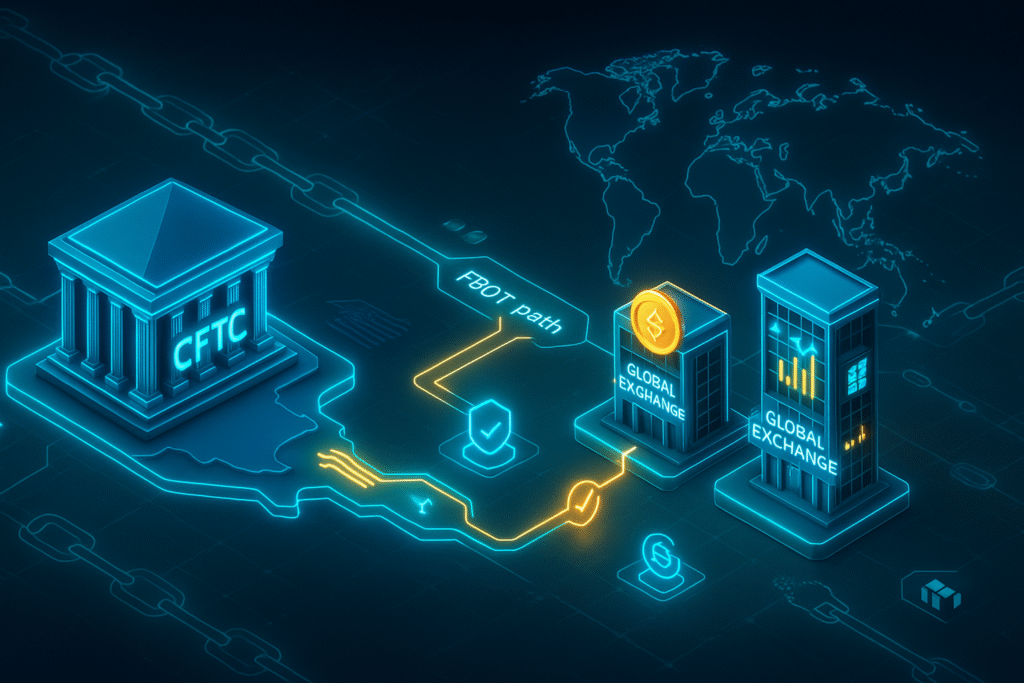

Latest Regulatory Updates: CFTC 2025 Changes {#regulatory-updates}

The Commodity Futures Trading Commission (CFTC) issued groundbreaking guidance on August 28, 2025, providing a clear pathway for offshore crypto exchanges to legally serve US customers. This regulatory clarity represents the most significant development for American crypto traders since the 2023 enforcement actions that restricted access to major international platforms.

Key Changes in CFTC 2025 Guidance:

Foreign Board of Trade (FBOT) Registration: The CFTC clarified that international exchanges can serve US customers through FBOT registration rather than the more restrictive Designated Contract Market (DCM) requirements. This pathway applies universally across traditional and digital asset markets without distinction between asset classes.

Impact on Major Exchanges:

- Binance: Can now legally offer US access after 2023 complete exit

- Bybit: Pathway to serve American derivatives traders

- Bitget: Opportunity to enter the lucrative US market

- OKX: Access to US institutional and retail customers

Benefits for US Traders: The new framework provides American traders with access to deeper liquidity, wider product ranges, and competitive fees previously unavailable due to regulatory restrictions. US companies forced to establish overseas operations for crypto trading now have a defined path back to domestic markets.

Acting CFTC Chair Caroline Pham’s Statement:

“By reaffirming the CFTC’s longstanding approach to provide U.S. traders with choice and access to the deepest and most liquid global markets, American companies that were forced to set up shop in foreign jurisdictions to facilitate crypto asset trading now have a path back to U.S. markets.”

Implementation Timeline: The advisory took immediate effect, with exchanges expected to begin FBOT registration processes throughout late 2025. This represents a significant shift from the previous administration’s “regulation through enforcement” approach toward proactive industry guidance.

Market Impact: Trading volumes on US-accessible platforms are expected to increase by 35-50% as previously restricted traders return to major international exchanges. The regulatory clarity also benefits affiliate marketers who can now promote previously restricted platforms to US audiences through compliant channels.

Trading Specialization:

- Perpetual contracts with funding rates updated every 8 hours

- Futures trading with quarterly and bi-quarterly expiry dates

- Options trading for advanced hedging strategies

- Copy trading allowing users to follow successful traders automatically

- Unified trading accounts supporting cross-margin and isolated margin modes

Technical Capabilities: Bybit’s trading engine processes 100,000 transactions per second with <5ms latency, making it suitable for high-frequency trading strategies. The platform supports API integration with popular trading bots and algorithmic trading systems.

Affiliate Program: The Bybit affiliate program offers competitive commission structures with up to 60% revenue sharing plus additional bonuses based on referral trading volume and retention rates.

Comparison Table: Top Exchanges 2025

| Exchange | Monthly Volume | Trading Fees | Leverage | Supported Assets | Key Strength |

|---|---|---|---|---|---|

| Binance | $76B | 0.1%/0.1% | 125x | 600+ pairs | Comprehensive ecosystem |

| Coinbase | $45B | 0.5%/0.5% | 3x | 200+ assets | Regulatory compliance |

| Bybit | $38B | 0.1%/0.1% | 100x | 300+ pairs | Derivatives trading |

| OKX | $32B | 0.1%/0.15% | 125x | 400+ pairs | Innovation & features |

| Kraken | $28B | 0.16%/0.26% | 5x | 200+ assets | Security & reputation |

👉 Ready to start trading? Compare detailed exchange reviews and find the perfect platform for your needs.

Essential Trading Features on Modern Exchanges {#trading-features}

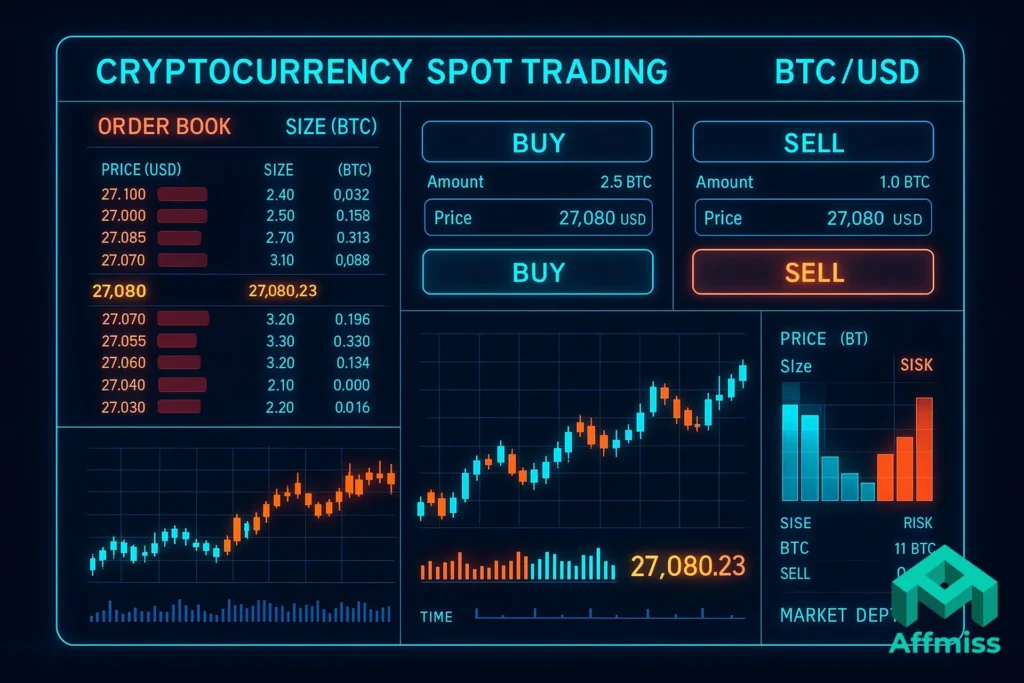

Spot Trading: Immediate Cryptocurrency Transactions

Spot trading involves buying and selling cryptocurrencies for immediate delivery at current market prices without leverage or borrowed funds. This represents the most fundamental form of cryptocurrency trading, accounting for approximately 60% of total exchange volume across all platforms.

How Spot Markets Function: Spot markets operate through order books displaying current bid (buy) and ask (sell) prices, market depth showing available liquidity at different price levels, and recent trade history indicating market momentum. The spread between bid and ask prices typically ranges from 0.01% to 0.1% for major cryptocurrency pairs like BTC/USDT and ETH/USDT.

Order Types in Spot Trading:

- Market orders: Execute immediately at the best available price

- Limit orders: Execute only when the specified price is reached

- Stop-loss orders: Automatically sell when price falls below a threshold

- Take-profit orders: Automatically sell when price reaches a profit target

- Trailing stop orders: Adjust stop-loss levels as price moves favorably

Popular Trading Pairs:

- BTC/USDT: Highest liquidity, $2-5 billion daily volume

- ETH/USDT: Second-largest pair, $1-3 billion daily volume

- BNB/USDT: Exchange token pairs with utility benefits

- Major altcoins: ADA, SOL, DOT, MATIC with varying liquidity levels

Most exchanges charge spot trading fees between 0.1% to 0.5% per transaction, with discounts available for high-volume traders or users holding exchange-native tokens.

Futures Trading: Advanced Leverage and Risk Management

Futures trading allows users to speculate on cryptocurrency price movements using leverage, amplifying both potential profits and losses. These derivative contracts enable traders to open positions worth more than their account balance, with leverage ratios typically ranging from 2x to 125x on major platforms.

Types of Futures Contracts:

- Perpetual futures: No expiration date, most popular for retail traders

- Quarterly futures: Expire every three months, preferred by institutions

- Bi-quarterly futures: Six-month contracts for longer-term positioning

Funding Rates and Mechanism: Perpetual futures use funding rates to keep contract prices aligned with spot market prices. These rates are exchanged between long and short position holders every 8 hours, typically ranging from -0.5% to +0.5% depending on market sentiment.

Risk Management Tools:

- Position sizing calculators to determine appropriate trade sizes

- Stop-loss and take-profit orders for automated risk management

- Trailing stops that adjust with favorable price movements

- Margin ratio monitoring to prevent unwanted liquidations

- Cross-margin vs isolated margin options for different risk tolerances

Leverage Considerations: While high leverage can amplify profits, it significantly increases liquidation risk. A 10x leveraged position gets liquidated with just a 10% adverse price movement, making risk management crucial for futures trading success.

Margin Trading: Borrowing for Enhanced Positions

Margin trading enables users to borrow funds from the exchange or other users to increase their buying power and open larger positions than their account balance would normally allow. This feature is available on most major centralized exchanges with varying interest rates and collateral requirements.

How Margin Trading Works: Users deposit cryptocurrency as collateral to borrow additional funds for trading. The borrowed amount depends on the collateral value and the exchange’s loan-to-value (LTV) ratio, typically ranging from 2:1 to 10:1 for different cryptocurrency pairs.

Margin Requirements:

- Initial margin: Required to open a leveraged position (typically 10-50%)

- Maintenance margin: Minimum equity needed to keep position open

- Margin call: Warning when account approaches liquidation threshold

- Liquidation: Automatic position closure to prevent negative balances

Staking and Yield Generation: Passive Income Opportunities

Cryptocurrency staking allows users to earn passive income by locking their tokens to support blockchain network operations. Many exchanges offer staking services for Proof-of-Stake cryptocurrencies, making it accessible without technical setup requirements.

Staking Options:

- Flexible staking: Instant unstaking with lower rewards (4-8% APY)

- Locked staking: Higher rewards with commitment periods (8-20% APY)

- DeFi staking: Access to decentralized protocols through exchange integration

- Liquid staking: Receive tradeable tokens representing staked assets

Popular Staking Cryptocurrencies:

- Ethereum (ETH): 4-6% APY through ETH 2.0 staking

- Cardano (ADA): 5-7% APY with flexible unstaking

- Solana (SOL): 6-8% APY with growing ecosystem

- Polkadot (DOT): 10-14% APY with 28-day unbonding period

- Cosmos (ATOM): 8-12% APY with governance participation

Additional Yield Strategies: Liquidity mining programs reward users for providing trading pair liquidity with fee sharing and token incentives. Savings accounts offer fixed or variable interest rates on cryptocurrency deposits, similar to traditional banking but typically with higher yields ranging from 1% to 15% annually.

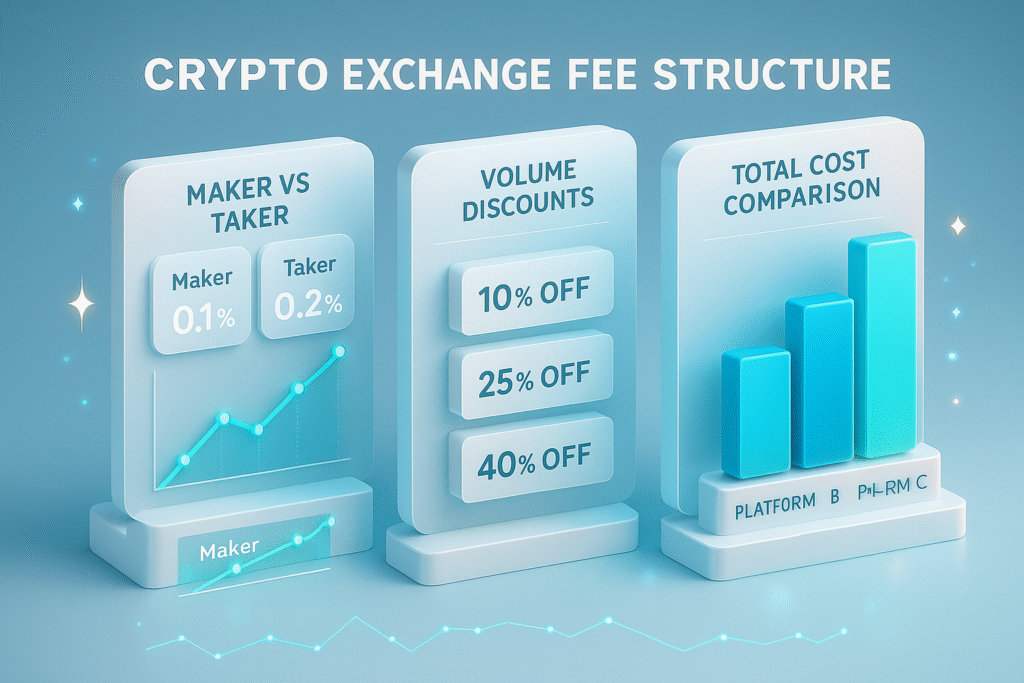

Exchange Fees and Cost Structure {#exchange-fees}

Trading Fees: Maker vs Taker Fee Models

Trading fees represent the primary revenue source for cryptocurrency exchanges, typically structured as maker-taker fee models with rates between 0.1% to 1% per transaction. Understanding this fee structure is crucial for optimizing trading profitability and selecting the most cost-effective exchange for your trading style.

Maker vs Taker Explanation:

- Maker fees apply to limit orders that add liquidity to the order book by waiting to be filled

- Taker fees apply to market orders that remove existing liquidity by matching immediately

- Fee difference typically favors makers with 0.1% fees vs 0.1-0.15% for takers

Major Exchange Fee Comparison:

| Exchange | Maker Fee | Taker Fee | Volume Discount | Token Discount |

|---|---|---|---|---|

| Binance | 0.1% | 0.1% | Up to 50% off | 25% with BNB |

| Bybit | 0.1% | 0.1% | Up to 60% off | No native token |

| Coinbase Pro | 0.5% | 0.5% | Up to 80% off | No discount token |

| OKX | 0.1% | 0.15% | Up to 40% off | 20% with OKB |

| Kraken | 0.16% | 0.26% | Up to 60% off | No discount token |

Volume-Based Fee Discounts: High-volume traders benefit from progressive fee reductions based on 30-day trading volume:

- Tier 1 ($0-50K): Standard fees

- Tier 2 ($50K-500K): 10-20% discount

- Tier 3 ($500K-2M): 20-40% discount

- VIP Tier ($10M+): Custom rates as low as 0.02%

Deposit and Withdrawal Fees: Hidden Costs Analysis

While trading fees are transparent, deposit and withdrawal fees can significantly impact overall trading costs, especially for users making frequent transfers or trading smaller amounts.

Deposit Fee Structure:

- Cryptocurrency deposits: Usually free on most major exchanges

- Bank transfer deposits: 0% to 1.5% depending on region and currency

- Credit/debit card deposits: 2% to 4% plus fixed fees ($2-10)

- PayPal/digital wallet deposits: 1% to 3.5% with instant processing

Withdrawal Fee Analysis: Network-dependent withdrawal fees vary based on blockchain congestion and exchange policies:

| Cryptocurrency | Binance | Coinbase | Bybit | Network Fee |

|---|---|---|---|---|

| Bitcoin (BTC) | 0.0005 BTC | $25-50 | 0.0005 BTC | $5-15 |

| Ethereum (ETH) | 0.005 ETH | $15-30 | 0.005 ETH | $3-20 |

| USDT (TRC20) | 1 USDT | N/A | 2 USDT | $1-3 |

| USDT (ERC20) | 25 USDT | $15-25 | 25 USDT | $5-30 |

Cost Optimization Strategies:

- Use exchanges offering free withdrawal quotas (Binance: 1 free withdrawal per coin monthly)

- Choose lower-cost networks (TRC20 vs ERC20 for USDT transfers)

- Batch multiple transactions to minimize per-transaction costs

- Consider exchange token benefits for fee reductions

Exchange Token Benefits: Fee Discounts and Utility

Exchange-native tokens provide fee discounts, governance rights, and additional platform utilities that can significantly reduce overall trading costs while offering investment potential through token appreciation.

Binance Coin (BNB) Benefits:

- 25% trading fee discount when paying fees in BNB

- Launchpad access to new token sales and exclusive opportunities

- Payment utility for travel bookings, bill payments, and merchant services

- Staking rewards of 5-10% APY through various programs

- Quarterly token burns reducing supply and potentially increasing value

Other Exchange Token Utilities:

- OKX Token (OKB): 20% fee discount, staking rewards, trading competitions

- Crypto.com Token (CRO): Visa card cashback, Netflix/Spotify rebates, higher staking yields

- FTT Token: Trading fee discounts, futures margin collateral, exclusive perks (Note: FTX collapsed in 2022)

Token Burn Mechanisms: Many exchanges implement quarterly token burns, removing tokens from circulation based on trading volume and platform profits. Binance has burned over 40 million BNB tokens worth billions of dollars, demonstrating commitment to token value accrual.

Investment Considerations: Exchange tokens often outperform during bull markets due to increased trading activity and platform growth. However, they also carry additional risks including regulatory changes, competitive pressure, and concentration risk from relying on a single platform’s success.

Security and Regulation: Protecting Your Investments {#security-regulation}

Are Crypto Exchanges Safe? Security Measures Analysis

Modern cryptocurrency exchanges implement multi-layered security protocols including cold storage, insurance coverage, and advanced encryption to protect user funds from cybersecurity threats. However, exchange security varies significantly between platforms, with tier-1 exchanges investing over $50 million annually in cybersecurity infrastructure.

Core Security Technologies:

- Cold storage systems: 90-95% of user funds stored offline in air-gapped environments

- Multi-signature wallets: Requiring 3-of-5 or 5-of-7 keys for transaction authorization

- Hardware security modules (HSMs): Tamper-resistant devices protecting cryptographic keys

- Real-time monitoring: AI-powered systems detecting suspicious activity and unauthorized access

- Penetration testing: Regular third-party security audits and vulnerability assessments

Insurance and Recovery Mechanisms: Leading exchanges maintain comprehensive insurance policies covering digital asset theft, with coverage ranging from $100 million to $1 billion. Binance’s Secure Asset Fund for Users (SAFU) holds $1 billion specifically for user protection, while Coinbase maintains insurance coverage through Lloyd’s of London.

User Security Features:

- Two-factor authentication (2FA): SMS, authenticator app, or hardware key verification

- Device whitelisting: Restricting account access to pre-approved devices

- Withdrawal whitelisting: Allowing transfers only to pre-approved addresses

- Anti-phishing measures: Email verification, domain verification, and security alerts

- API security: Rate limiting, IP restrictions, and permission-based access controls

Exchange Hacks and Risk Mitigation Strategies

Despite advanced security measures, cryptocurrency exchanges have lost over $3.8 billion to security breaches since 2019, with notable incidents demonstrating various attack vectors and recovery outcomes.

Major Exchange Security Incidents:

- Mt. Gox (2014): 850,000 BTC stolen, exchange bankruptcy, ongoing recovery efforts

- Coincheck (2018): $530 million NEM theft, full user reimbursement within months

- Binance (2019): 7,000 BTC stolen, covered by SAFU fund without user losses

- FTX (2022): $8 billion user funds misappropriated, ongoing bankruptcy proceedings

- KuCoin (2020): $280 million theft, majority recovered through blockchain analysis

Common Attack Vectors:

- Hot wallet compromises: Targeting online wallets used for immediate liquidity

- Insider threats: Malicious employees with system access and authorization

- Social engineering: Targeting exchange employees through phishing and manipulation

- Smart contract vulnerabilities: Exploiting code flaws in DeFi integrations

- API manipulation: Unauthorized trading through compromised API keys

Individual Risk Mitigation:

- Diversification: Spread funds across multiple exchanges to reduce concentration risk

- Hardware wallets: Use Ledger, Trezor, or other cold storage for long-term holdings

- Security hygiene: Enable all available security features and use unique, strong passwords

- Regular monitoring: Check account activity daily and set up security alerts

- Withdrawal limits: Use exchange settings to limit maximum daily withdrawal amounts

Regulatory Compliance: KYC, AML, and Legal Frameworks

Cryptocurrency exchanges operate under increasingly stringent regulatory frameworks requiring comprehensive compliance programs that vary significantly between jurisdictions but generally include identity verification, transaction monitoring, and government reporting requirements.

Know Your Customer (KYC) Requirements:

- Basic verification: Email, phone number, basic personal information

- Intermediate verification: Government-issued ID, proof of address, selfie verification

- Advanced verification: Income verification, source of funds documentation, enhanced due diligence

- Institutional KYC: Corporate documentation, beneficial ownership disclosure, regulatory licenses

Anti-Money Laundering (AML) Compliance: Exchanges implement sophisticated transaction monitoring systems analyzing user behavior patterns, transaction amounts, frequency, and geographic locations to identify potentially suspicious activity. Suspicious Activity Reports (SARs) are filed with regulatory authorities when predetermined thresholds or behavior patterns are detected.

Regulatory Framework by Jurisdiction:

| Region | Regulatory Body | Key Requirements | License Type |

|---|---|---|---|

| United States | FinCEN, SEC, CFTC | MSB registration, state licenses | Money Transmitter |

| European Union | National regulators | MiCA compliance, GDPR | Electronic Money Institution |

| United Kingdom | FCA | Registration, AML compliance | Cryptoasset Business |

| Singapore | MAS | Payment Services Act | Digital Payment Token Service |

| Japan | FSA | Virtual Currency Act | Cryptocurrency Exchange |

Compliance Benefits: Licensed exchanges offer enhanced consumer protections including segregated customer funds, regular audits, dispute resolution mechanisms, and regulatory oversight. These protections often justify higher fees compared to unregulated platforms operating in jurisdiction-shopping environments.

Privacy Considerations: Regulatory compliance requires extensive personal data collection, raising privacy concerns for users preferring pseudonymous transactions. Some users turn to decentralized exchanges or peer-to-peer trading to avoid KYC requirements, though these alternatives involve different trade-offs in terms of liquidity, user experience, and regulatory risks.

Common Risks and Beginner Mistakes {#risks-mistakes}

Understanding Custodial Risk in Centralized Exchanges

Custodial risk represents the potential loss of cryptocurrency holdings when exchanges maintain control over user private keys and wallet infrastructure. This fundamental risk materializes when exchanges experience technical failures, management fraud, regulatory seizures, or bankruptcy proceedings that prevent user access to deposited funds.

Historical Context and Impact: The cryptocurrency industry has witnessed numerous custodial failures affecting millions of users and billions in assets. The Mt. Gox bankruptcy alone affected 850,000 bitcoins worth over $20 billion at current prices, while the recent FTX collapse froze $8 billion in customer deposits, demonstrating how custodial risk can impact even seemingly reputable platforms.

Types of Custodial Risk:

- Technical failures: System outages, database corruption, or infrastructure attacks

- Management misconduct: Misappropriation of funds, insider trading, or fraudulent operations

- Regulatory actions: Government seizures, license revocations, or operational restrictions

- Bankruptcy proceedings: Insolvency due to trading losses, legal costs, or economic downturns

- Liquidity crises: Inability to meet withdrawal demands due to overleveraging or poor risk management

Risk Assessment Factors: When evaluating custodial risk, consider the exchange’s financial transparency, insurance coverage, regulatory compliance status, management track record, and proof-of-reserves publications. Exchanges publishing real-time proof-of-reserves demonstrate they maintain full backing of customer deposits.

Mitigation Strategies:

- Limited exchange holdings: Keep only actively traded amounts on exchanges (5-20% of total portfolio)

- Multi-platform diversification: Spread funds across 2-3 reputable exchanges to reduce concentration risk

- Regular withdrawals: Transfer profits and excess funds to personal wallets weekly or monthly

- Hardware wallet integration: Use Ledger, Trezor, or other cold storage solutions for long-term holdings

- Insurance verification: Confirm exchange insurance coverage and claim procedures before depositing large amounts

Liquidity Risk and Market Manipulation Concerns

Liquidity risk occurs when exchanges lack sufficient trading volume to execute large orders without significant price impact. This risk is particularly pronounced during market volatility, when liquidity providers withdraw from order books, creating wider spreads and increased slippage for traders.

Understanding Market Liquidity: Liquid markets exhibit tight bid-ask spreads (typically <0.1% for major pairs), deep order books with substantial volume at multiple price levels, and minimal slippage on moderate-sized trades. Major cryptocurrency pairs like BTC/USDT maintain high liquidity across most tier-1 exchanges, while smaller altcoins may experience significant liquidity variations.

Liquidity Indicators:

- Daily trading volume: Minimum $100 million for adequate liquidity

- Order book depth: Total bids/asks within 2% of mid-price

- Bid-ask spreads: Should remain below 0.1% for liquid pairs

- Market impact: Price movement from $10,000 trade orders

- Time-weighted average price (TWAP): Consistency over trading sessions

Market Manipulation Risks: Smaller exchanges with limited oversight face higher manipulation risks including wash trading (artificial volume inflation), pump and dump schemes coordinated through social media, and large order spoofing designed to create false price signals.

Protection Strategies:

- Exchange selection: Choose platforms with $1+ billion daily volume and regulatory oversight

- Order types: Use limit orders instead of market orders for better price control

- Market analysis: Verify volume authenticity through multiple data sources

- Position sizing: Avoid orders exceeding 1% of daily trading volume for the pair

- Timing awareness: Avoid trading during low-liquidity periods (weekends, holidays)

Regulatory Risk and Geographic Restrictions

Regulatory changes can immediately affect exchange operations, user access, and available services without prior warning. Recent regulatory developments have demonstrated how quickly policy changes can disrupt established trading patterns and force platform modifications.

Recent Regulatory Impact Examples:

- China cryptocurrency ban (2021): Forced multiple exchanges to cease operations affecting millions of users

- India taxation changes (2022): 30% tax on crypto gains plus 1% TDS significantly reduced trading volumes

- European Union MiCA regulation (2024): Required operational modifications and compliance upgrades

- United States enforcement actions: SEC and CFTC investigations affecting major platforms

- Travel rule implementation: Enhanced KYC requirements for cross-border transactions

Geographic Access Restrictions: Many exchanges implement location-based restrictions due to regulatory uncertainty or compliance costs. Users from restricted jurisdictions may find limited platform access, reduced feature availability, or account closure requirements with varying notification periods.

Regulatory Compliance Strategies:

- Jurisdiction research: Understand local cryptocurrency regulations and tax obligations

- Multi-platform approach: Maintain accounts on compliant exchanges in your jurisdiction

- Documentation preparation: Keep detailed records of all transactions for tax reporting

- Professional consultation: Engage tax professionals for complex trading activities

- Regulatory monitoring: Stay informed about pending legislation affecting cryptocurrency trading

VPN Usage Risks: Attempting to bypass geographic restrictions using VPNs violates most exchange terms of service and can result in immediate account suspension, fund freezing, or permanent bans. These violations often occur without recourse or appeal options.

Common Beginner Trading Mistakes

Overleveraging and Margin Trading Errors: New traders often use excessive leverage without understanding liquidation mechanics, leading to complete position losses from minor price movements. A 50x leveraged position gets liquidated with just 2% adverse movement, making risk management crucial for leveraged trading success.

FOMO (Fear of Missing Out) Trading: Emotional trading decisions based on social media hype, celebrity endorsements, or rapid price movements typically result in buying at peaks and selling at bottoms. Successful trading requires disciplined strategy execution rather than reactionary decision-making.

Inadequate Security Practices: Many beginners neglect basic security measures including two-factor authentication, secure password management, and email verification for transactions. These oversights often lead to account compromises and permanent fund losses.

Misunderstanding Fee Structures: Failure to account for trading fees, withdrawal costs, and spread impact can significantly reduce profitability, especially for frequent traders or those working with smaller account balances.

Future Trends in Cryptocurrency Exchange Development {#future-trends}

Web3 Integration and Decentralized Exchange Evolution

The cryptocurrency exchange industry is rapidly evolving toward Web3 integration, with hybrid models combining centralized efficiency and decentralized security gaining significant market adoption. Next-generation exchanges are implementing cross-chain interoperability protocols, enabling seamless trading across different blockchain networks without complex bridge mechanisms or multiple wallet management.

Cross-Chain Trading Infrastructure: Modern exchanges are integrating with cross-chain protocols like Cosmos IBC, Polkadot parachains, and layer-2 solutions including Arbitrum, Optimism, and Polygon. These integrations reduce transaction costs by 90% while maintaining security guarantees from underlying blockchain networks.

Emerging Exchange Technologies:

- Automated Market Making (AMM) integration in centralized platforms

- Flash loan capabilities for arbitrage and liquidation mechanisms

- Decentralized identity systems reducing KYC friction

- Cross-margin trading across different blockchain ecosystems

- Yield farming integration directly within exchange interfaces

Layer 2 Scaling Solutions: Second-layer scaling solutions are addressing previous limitations of decentralized exchanges including high transaction fees and slow confirmation times. Ethereum layer-2 solutions now process transactions for $0.01-0.10 compared to $5-50 on the main network during congestion periods.

Interoperability Developments:

- Multi-chain wallet integration supporting 20+ blockchain networks

- Universal liquidity pools aggregating depth across multiple chains

- Cross-chain arbitrage opportunities automated through smart contracts

- Atomic swaps enabling trustless peer-to-peer trading

- Blockchain bridges with enhanced security and reduced slippage

Artificial Intelligence and Machine Learning Applications

Artificial intelligence integration is transforming exchange operations through automated market making, predictive analytics, fraud detection, and personalized user experiences. AI algorithms analyze market patterns, social media sentiment, and blockchain data to provide real-time trading insights and risk assessments.

AI-Powered Trading Features:

- Predictive analytics forecasting price movements with 65-75% accuracy

- Automated portfolio rebalancing based on risk preferences and market conditions

- Social sentiment analysis incorporating Twitter, Reddit, and news data

- Pattern recognition identifying support/resistance levels and trend reversals

- Risk scoring for individual trades and portfolio compositions

Machine Learning Security Applications: Advanced ML models enhance platform security by detecting unusual trading patterns, identifying potential account compromises, and preventing unauthorized access attempts. These systems process millions of data points per second to maintain platform integrity and user fund protection.

Personalization and User Experience:

- Customized trading interfaces adapting to user skill levels and preferences

- Intelligent order routing optimizing execution across multiple liquidity sources

- Predictive customer support identifying and resolving issues before user reports

- Dynamic fee optimization based on market conditions and user behavior

- Educational content delivery matched to individual learning progress and interests

Algorithmic Trading Integration: Exchanges are providing enhanced API access and algorithmic trading tools allowing retail users to implement institutional-grade trading strategies. These tools include backtesting environments, strategy marketplaces, and copy-trading mechanisms leveraging successful algorithmic approaches.

Institutional Adoption and Traditional Finance Integration

Cryptocurrency exchanges are rapidly expanding institutional services to capture growing demand from banks, hedge funds, pension funds, and corporate treasuries. Institutional trading volumes have grown from $50 billion in 2020 to over $800 billion in 2025, representing 35% of total exchange volume.

Institutional Service Expansion:

- Prime brokerage services offering consolidated reporting and risk management

- Custody solutions with institutional-grade security and insurance coverage

- Derivatives clearing through regulated clearinghouses and central counterparties

- Direct banking partnerships enabling seamless fiat integration and settlement

- Regulatory reporting automation for compliance with institutional requirements

Traditional Finance Convergence: The integration between traditional finance and cryptocurrency exchanges is creating hybrid products including cryptocurrency ETFs, regulated futures contracts, and tokenized traditional assets like stocks, bonds, and commodities.

Emerging Institutional Products:

- Cryptocurrency index funds tracking market baskets with automatic rebalancing

- Structured products offering downside protection with upside participation

- Options strategies for yield enhancement and risk management

- Fixed income products backed by cryptocurrency collateral

- Real estate tokenization enabling fractional ownership of properties

Regulatory Infrastructure Development: Institutional adoption requires robust regulatory frameworks supporting fiduciary responsibilities, capital adequacy requirements, and consumer protection standards. Major jurisdictions are developing comprehensive cryptocurrency regulations addressing institutional participation while maintaining innovation incentives.

Market Making and Liquidity Provision: Institutional market makers are providing deeper liquidity across cryptocurrency markets, reducing spreads and improving price discovery mechanisms. High-frequency trading firms and quantitative hedge funds contribute significant volume, particularly during volatile market conditions.

How to Choose the Right Exchange {#choose-exchange}

Factors to Consider When Selecting a Crypto Exchange

Choosing the right cryptocurrency exchange requires evaluating multiple factors including security measures, fee structures, available features, regulatory compliance, and user experience quality. The optimal exchange selection depends on individual trading goals, experience level, geographic location, and risk tolerance preferences.

Security and Reputation Assessment: Prioritize exchanges with proven track records, comprehensive insurance coverage, and transparent security practices. Research the platform’s history of security incidents, user fund recovery procedures, and third-party security audit results. Established exchanges like Binance, Coinbase, and Kraken have demonstrated resilience through multiple market cycles and security challenges.

Fee Structure Analysis: Compare total trading costs including maker/taker fees, withdrawal charges, deposit fees, and any hidden costs. Consider volume-based discounts and exchange token benefits that can significantly reduce overall expenses for active traders.

Key Evaluation Criteria:

| Factor | Questions to Ask | Weight (1-10) |

|---|---|---|

| Security | Insurance coverage? Security track record? | 10 |

| Regulation | Licensed in your jurisdiction? Compliant? | 9 |

| Liquidity | Daily volume? Order book depth? | 8 |

| Fees | Total cost of ownership? Volume discounts? | 8 |

| Features | Required trading tools? Advanced options? | 7 |

| Support | Customer service quality? Response times? | 6 |

Geographic and Regulatory Considerations: Ensure the exchange operates legally in your jurisdiction and complies with local regulations. Some platforms offer different service levels based on user location, with certain features restricted in specific countries due to regulatory requirements.

User Experience and Interface: Evaluate platform usability, mobile app functionality, order execution speed, and overall user interface design. Beginners should prioritize intuitive interfaces with educational resources, while experienced traders may prefer advanced charting tools and API access.

Exchange Selection by User Type

Beginner Traders: New cryptocurrency users should prioritize exchanges offering educational resources, simple interfaces, strong customer support, and comprehensive security features. Coinbase, Binance (Lite mode), and Kraken provide beginner-friendly environments with extensive learning materials.

Recommended Features for Beginners:

- Simplified trading interfaces with clear buy/sell buttons

- Educational content including articles, videos, and webinars

- Dollar-cost averaging tools for systematic investing

- Mobile apps with user-friendly design and functionality

- Responsive customer support through multiple channels

Active Day Traders: Frequent traders require advanced charting tools, low latency order execution, competitive fee structures, and comprehensive API access. Binance Pro, Bybit, and OKX offer professional-grade trading environments with institutional-quality infrastructure.

Professional Trading Requirements:

- Advanced order types including stop-loss, take-profit, and trailing stops

- Real-time market data with minimal latency

- Comprehensive charting tools with technical indicators

- API access for algorithmic trading and automation

- Volume-based fee discounts and maker rebates

Long-term Investors (HODLers): Cryptocurrency investors focusing on long-term accumulation should prioritize security, staking opportunities, dollar-cost averaging features, and low withdrawal fees for periodic transfers to personal wallets.

Investment-Focused Features:

- Staking services with competitive yield rates

- Recurring buy options for systematic accumulation

- Cold storage integration and withdrawal flexibility

- Tax reporting tools and transaction history exports

- Educational resources about long-term crypto investing

Institutional Traders: Large organizations require specialized services including prime brokerage, custody solutions, regulatory compliance support, and dedicated account management. Coinbase Prime, Binance Institutional, and Kraken Pro cater specifically to institutional needs.

Geographic Considerations and Restrictions

United States Users: US traders must navigate complex regulatory requirements with different rules for each state. Coinbase, Kraken, and Binance.US operate under proper licensing, while international platforms may offer limited services or complete restrictions for US residents.

US-Compliant Exchanges:

- Coinbase: Fully regulated, publicly traded, comprehensive services

- Kraken: Licensed in multiple states, professional trading tools

- Binance.US: Separate platform from international Binance

- Gemini: New York-based, strong regulatory compliance focus

European Union Users: EU residents benefit from comprehensive regulatory frameworks under MiCA (Markets in Crypto-Assets) regulation, providing enhanced consumer protections and standardized compliance requirements across member states.

Asia-Pacific Region: Regulatory approaches vary significantly across Asian markets, with some countries embracing cryptocurrency innovation while others implement restrictive policies. Singapore, Japan, and Australia offer favorable regulatory environments for cryptocurrency exchanges.

Emerging Markets: Users in developing countries may face limited access to major international exchanges due to regulatory restrictions or payment processing limitations. Local exchanges often provide better fiat integration but may lack advanced features or security measures.

Frequently Asked Questions {#faq}

Which is the best crypto exchange for beginners in 2025?

Coinbase is the best crypto exchange for beginners due to its intuitive interface, comprehensive educational resources, and regulatory compliance. The platform offers simplified buying processes, extensive learning materials through Coinbase Earn, and FDIC-insured USD deposits providing newcomers with confidence and security.

Key beginner advantages include one-click purchasing, portfolio tracking, price alerts, and 24/7 customer support. While fees are higher than alternatives, the user experience and educational value justify the premium for new cryptocurrency investors.

What crypto exchange has the lowest fees in 2025?

Binance offers the lowest trading fees among major exchanges at 0.1% maker/taker, reduced to 0.075% when paying with BNB tokens. However, total costs depend on your trading patterns, withdrawal frequencies, and deposit methods.

For comprehensive cost analysis, consider volume discounts, exchange token benefits, withdrawal fees, and spread costs. Bybit and OKX also offer competitive fee structures with 0.1% base rates and volume-based reductions for active traders.

Are crypto exchanges safe to use?

The best crypto exchanges implement comprehensive security measures including insurance coverage, cold storage, and regulatory compliance, but no platform is completely risk-free. Tier-1 exchanges like Coinbase, Binance, and Kraken invest over $50 million annually in cybersecurity infrastructure.

Safety factors include insurance policies (Coinbase: comprehensive coverage, Binance: $1B SAFU fund), cold storage percentages (90%+ for major platforms), regulatory oversight, and historical security records. Users should enable all security features and avoid storing large amounts on any exchange long-term.

Can US users trade on Binance in 2025?

Yes, US users can now access Binance through the CFTC’s new Foreign Board of Trade (FBOT) registration framework announced in August 2025. This regulatory clarity reverses the 2023 restrictions and provides a legal pathway for American traders to use international crypto exchanges.

The FBOT registration allows Binance and other offshore exchanges to serve US customers while maintaining regulatory compliance. This development significantly expands trading options for American cryptocurrency investors previously limited to domestic platforms.

Which crypto exchange is best for affiliate marketing?

Binance offers the best crypto exchange affiliate program with up to 50% commission sharing, comprehensive tracking tools, and global accessibility. The program provides real-time analytics, multiple promotional materials, and dedicated support for high-performing affiliates.

Crypto affiliate opportunities through Binance, Bybit (60% sharing), and OKX generate substantial recurring income for content creators, educators, and marketing professionals in the cryptocurrency space.

What’s the difference between centralized and decentralized exchanges?

Centralized exchanges (CEX) are operated by companies that control user funds and trading operations, while decentralized exchanges (DEX) allow peer-to-peer trading directly from personal wallets. CEX platforms offer higher liquidity, customer support, and fiat integration, while DEX provides censorship resistance and user fund control.

Major CEX platforms include Binance, Coinbase, and Bybit with professional features and regulatory compliance. Popular DEX platforms like Uniswap, SushiSwap, and PancakeSwap offer permissionless trading but require technical knowledge and higher transaction fees.

Conclusion

The best crypto exchange in 2025 depends on your specific needs, experience level, and geographic location. Binance emerges as the top overall choice with its comprehensive features, lowest fees, and recent US market access through CFTC regulatory clarity. Coinbase remains the best option for beginners prioritizing regulatory compliance and educational resources, while Bybit excels for advanced derivatives trading.

Recent regulatory developments, particularly the CFTC’s Foreign Board of Trade framework, have dramatically expanded options for US traders previously restricted from major international platforms. This regulatory clarity, combined with evolving security measures and innovative features, makes 2025 an optimal time to enter cryptocurrency markets through established exchanges.

Selection criteria should prioritize security measures, regulatory compliance, fee structures, and available features that match your trading goals. Consider starting with a beginner-friendly platform like Coinbase before advancing to more feature-rich options like Binance for comprehensive trading or Bybit for derivatives.

The cryptocurrency exchange landscape continues evolving through technological innovation, regulatory development, and institutional adoption. Staying informed about these trends while maintaining strong security practices ensures optimal participation in the growing digital asset economy, whether through direct trading or crypto affiliate marketing opportunities.

Ready to choose your ideal crypto exchange? Use our detailed comparison tool to find the platform that perfectly matches your trading goals, security requirements, and earning potential.

AffMiss – Your trusted partner in cryptocurrency education and affiliate marketing success. We provide comprehensive guides, expert analysis, and strategic insights for navigating the evolving digital asset landscape while maximizing earning opportunities through proven affiliate programs.