Basics of Crypto Exchanges – Complete Beginner’s Guide 2025

Cryptocurrency exchanges are the gateway to the world of digital assets. They enable you to buy, sell, and trade Bitcoin, Ethereum, and thousands of altcoins. If you are new to crypto, mastering the basics of exchanges is the first step before diving deeper into Crypto Trading for Beginners.

This guide explores what crypto exchanges are, how they work, their different types, key features, risks, and how to choose the right one in 2025.

What Is a Cryptocurrency Exchange?

A cryptocurrency exchange is a marketplace where users can trade cryptocurrencies for fiat currencies or other digital assets. Much like stock markets, they provide liquidity and price discovery but operate globally and online.

Major exchanges in 2025 include:

- Binance – leading by trading volume.

- Coinbase – U.S.-based and beginner-friendly.

- Bybit – popular for derivatives and futures.

- OKX – advanced tools and global reach.

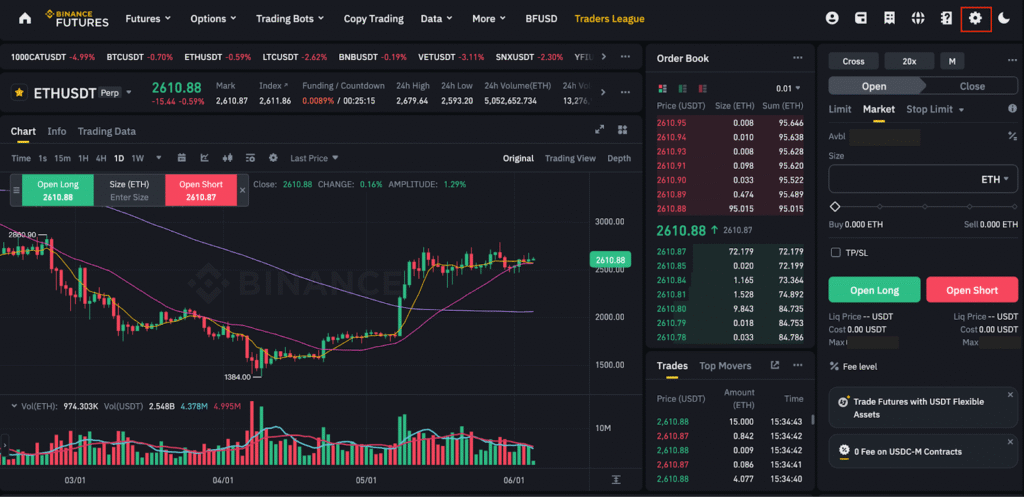

How Do Crypto Exchanges Work?

Crypto exchanges act as intermediaries matching buyers and sellers. Here’s the process:

- Account creation & KYC – Users register and verify identity.

- Deposits – Fund accounts via fiat or crypto.

- Trading – Orders are matched through the order book.

- Storage – Assets held in hot wallets or withdrawn to private wallets.

- Withdrawals – Cash out to fiat or transfer to other wallets.

Types of Crypto Exchanges

Centralized Exchanges (CEX)

CEXs are operated by companies that hold custody of user funds.

Examples: Binance, Bybit, Coinbase.

Pros: High liquidity, easy-to-use apps, fiat gateways.

Cons: Hacking risk, compliance requirements.

Decentralized Exchanges (DEX)

DEXs use smart contracts to facilitate peer-to-peer trades.

Examples: Uniswap, PancakeSwap.

Pros: Privacy, self-custody, no KYC.

Cons: Lower liquidity, more complex for beginners.

Hybrid Exchanges

A mix of CEX liquidity and DEX self-custody.

Example: Qurrex.

Key Features of Crypto Exchanges

- Wide range of trading pairs: BTC/USDT, ETH/USDC.

- Order types: market, limit, stop-loss.

- Liquidity: vital for smooth trades.

- Security measures: cold storage, 2FA, proof-of-reserves.

- Regulation: licensed exchanges inspire more trust.

- Mobile apps: essential for trading on the go.

Pros and Cons of Using Crypto Exchanges

Pros:

- Easy access to cryptocurrencies.

- High liquidity and fast trades.

- Advanced tools (margin, futures, staking).

- Beginner-friendly support.

Cons:

- Centralized risk (CEX hacks).

- Withdrawal and trading fees.

- KYC requirements (privacy concerns).

- Exposure to regulatory crackdowns.

How to Choose the Right Crypto Exchange

When choosing an exchange, consider:

- Fees – Maker/taker fees, withdrawal costs.

- Security – Cold storage, audits, proof-of-reserves.

- Supported assets – Number of listed coins/tokens.

- Liquidity – More liquidity = better pricing.

- Regulation – Licensed exchanges in your region.

- User interface – Friendly design for beginners.

- Customer support – Multilingual, 24/7 service.

Comparison Table: Top Exchanges 2025

| Exchange | Trading Fees | Assets Supported | Security | Best For |

|---|---|---|---|---|

| Binance | 0.1% | 350+ | High | Spot & futures traders |

| Coinbase | 0.25% | 250+ | High | U.S. beginners |

| Bybit | 0.1% | 300+ | High | Futures specialists |

| OKX | 0.08% | 400+ | High | Global advanced users |

Risks of Using Crypto Exchanges

- Hacks & breaches – Mt. Gox, FTX collapse examples.

- Regulation – Shifts differ by region.

- Volatility – Sudden market swings.

- Custodial risk – Funds frozen if an exchange fails.

Risk management tips:

- Enable 2FA and use strong passwords.

- Store long-term assets in cold wallets.

- Stick to trusted exchanges only.

Future of Crypto Exchanges (2025 and Beyond)

- Cross-chain trading – seamless swaps across blockchains.

- AI dashboards – smarter portfolio management.

- Regulatory clarity – global compliance.

- Institutional adoption – hedge funds, banks entering the space.

FAQs – Basics of Crypto Exchanges

What is a crypto exchange?

A platform where you can buy, sell, and trade digital assets.

Is it safe to use a crypto exchange?

Yes, but stick to regulated and secure platforms.

Which is better: CEX or DEX?

CEX is beginner-friendly, DEX offers self-custody and privacy.

How much are trading fees?

Typically 0.05%–0.25% depending on the exchange.

Can I trade without KYC?

Yes, on DEXs or CEXs with limited withdrawals.

Conclusion

Crypto exchanges are the foundation of digital trading. By understanding their types, features, risks, and how to choose the right one, you can confidently begin your journey.

👉 Start with reputable platforms today: Binance, Bybit, OKX, and Coinbase.

Also explore related topics: Margin Trading and Copy Trading to expand your knowledge.